Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The deep tech market is expected to reach USD 714.6 billion by 2031, growing at a remarkable compound annual growth rate (CAGR) of 48.2%. As organizations accelerate the adoption of transformative technologies like artificial intelligence (AI), automation, quantum computing, and cybersecurity, investor confidence continues to surge, thereby fueling record funding levels and innovation momentum. In this guide, you’ll explore the most impactful deep tech trends, strategic insights, and innovative companies poised to shape the future of your organization.

Executive Summary

- Why Deep Tech Now – Explosive VC funding, new market creation, climate action, geopolitical priorities, and workforce shifts are accelerating deep techs’ adoption across industries.

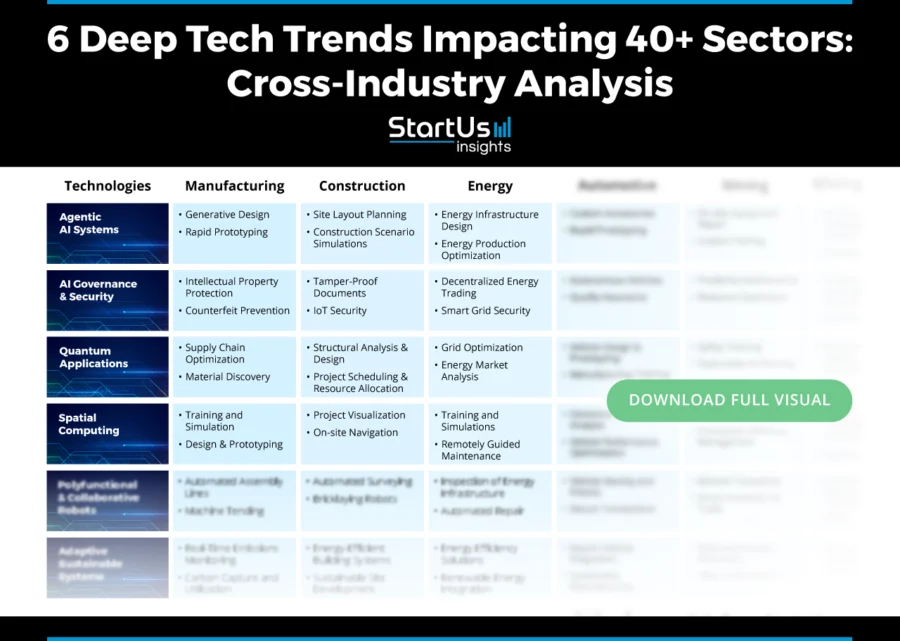

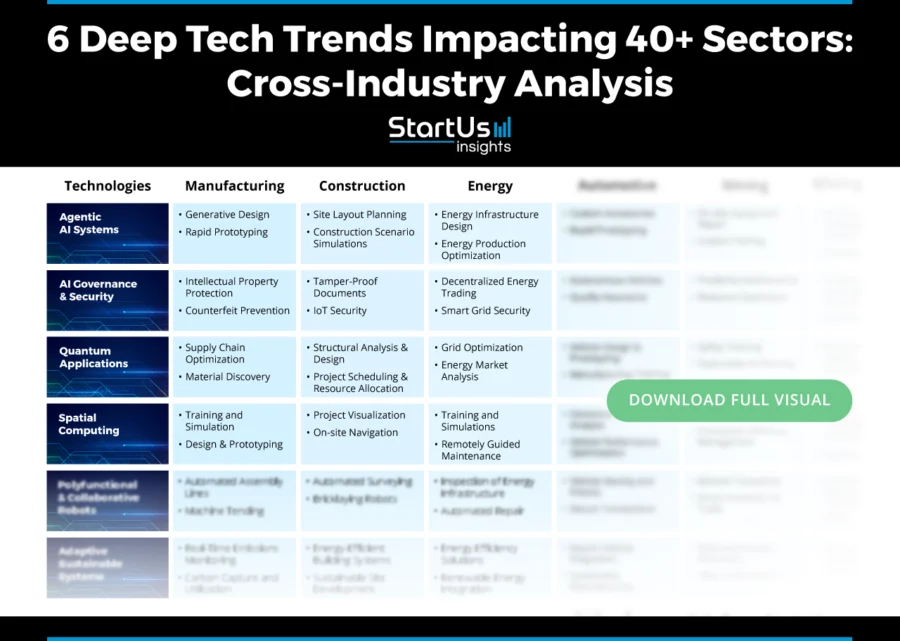

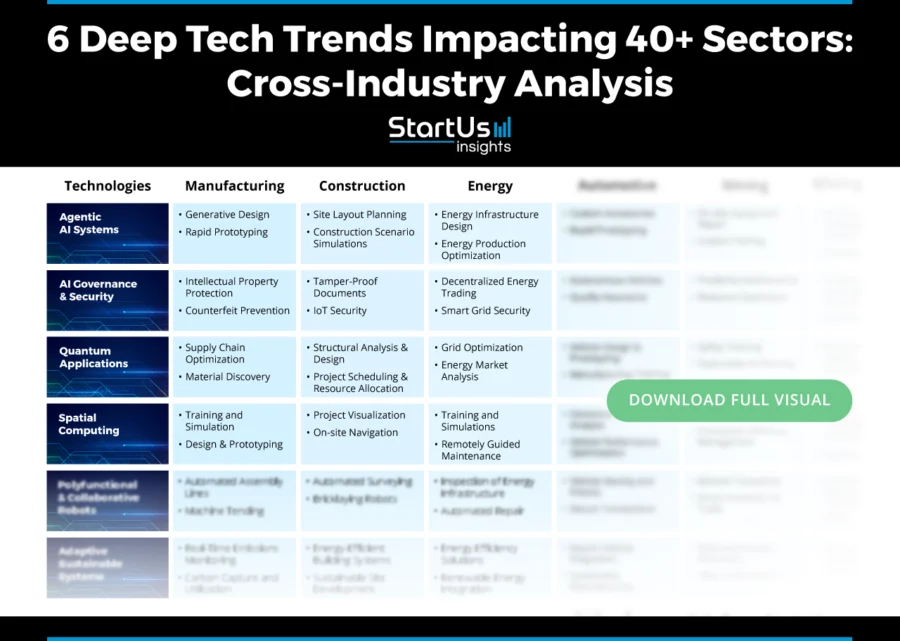

- Deep Tech Market Landscape – With a projected CAGR of 48.2%, the deep tech market is scaling rapidly, led by AI, quantum, and biotech. The US and Europe dominate funding, while ROI outpaces traditional tech despite higher upfront costs.

- Top 10+ Deep Tech Trends in 2025

- Agentic AI Systems

- AI Governance & Security

- Commercial Quantum Applications

- Quantum Machine Learning

- Post-Quantum Cryptography

- Spatial Computing

- Metabolomics & Novel Therapeutics

- Polyfunctional & Collaborative Robots

- Adaptive Sustainable Systems

- Advanced Earth Observation (EO)

- Space-Based Manufacturing & Energy

How Do We Research and Where is This Data From?

We reviewed 3100+ industry innovation reports to extract key insights and construct a comprehensive guide for integrating AI in agricultural operations. To increase accuracy, we cross-validated this information with external industry sources.

Additionally, we leveraged the StartUs Insights Discovery Platform – an AI and Big Data-powered innovation intelligence tool covering over 7 million startups and more than 20K+ technologies & trends worldwide to:

- Confirm our findings using the Trend Intelligence feature.

- Gather market statistics for each technology.

Why Deep Tech Now?

Competitive Edge

Venture capital investment in generative AI nearly doubled to USD 45 billion in 2024, signaling a massive shift in where innovation is happening. AI startups are commanding premium valuations, with some trading at revenue multiples as high as 70x.

Generative AI alone could add USD 2.6 to USD 4.4 trillion annually to the global economy, boosting productivity across sectors like banking, high tech, and life sciences.

New Market

Spatial computing, agentic AI, and quantum computing are enabling new markets in healthcare, education, and entertainment. For example, AI-driven drug discovery and personalized medicine are accelerating treatment development in biotech.

Sustainability

AI is projected to help reduce 3 to 6 gigatonnes of CO2-equivalent emissions annually by 2035 through optimizing power, food, and mobility systems. Deep tech startups are pioneering renewable energy, carbon capture, and sustainable supply chains, directly addressing climate and resource challenges.

Geopolitical Stakes

Deep tech leadership is now a strategic priority for governments, directly tied to national security and economic power. Europe, for example, doubled its investment in novel AI to USD 3 billion in 2024, recognizing that mastery in AI, quantum computing, and advanced hardware will shape future global power dynamics.

Workforce Transformation

Demand for AI, machine learning, and data skills is surging. Machine learning mentions in job postings doubled from 7% to 14% in 2025. The European Deep Tech Talent Initiative aims to skill, upskill, and reskill 1 million people in deep tech by the end of 2025 to close the skills gap.

Data analyst roles, enhanced by AI tools, are growing rapidly, with salaries increasing and a projected 23% job market growth by 2032.

Deep Tech Market Overview 2025

Market Scope:

- Key Segments: AI/ML, IoT & Edge Computing, Quantum Computing, Biotechnology, Advanced Materials

- Applications: Healthcare, autonomous vehicles, defense, energy, and smart manufacturing

Projected Market Growth

From USD 41 billion in 2024, the deep tech market is going to reach USD 714.6 billion with a 48.2% CAGR.

Source: Industry Arc

Top Countries for Investment

- US: 25 000+ startups and USD 449B funding (2015 to 2025)

- China: 6100+ startups, USD 94.4B funding.

- India: 3600+ startups, USD 850M funding (2023).

- Europe: 44% of tech investments in deep tech (2023)

Leading Investors

- VC Firms: Atlantic Bridge Ventures, SOSV (USD 1.5B AUM), Walden Catalyst (quantum computing).

- Sectors Focus: AI, robotics, biotech, quantum.

Top Industries by Investment

- AI/ML: Gen AI companies worldwide raised USD 56 billion from venture capitalists (VCs) last year.

- Defense Tech: USD 3 billion VC funding in 2024 (e.g., Anduril).

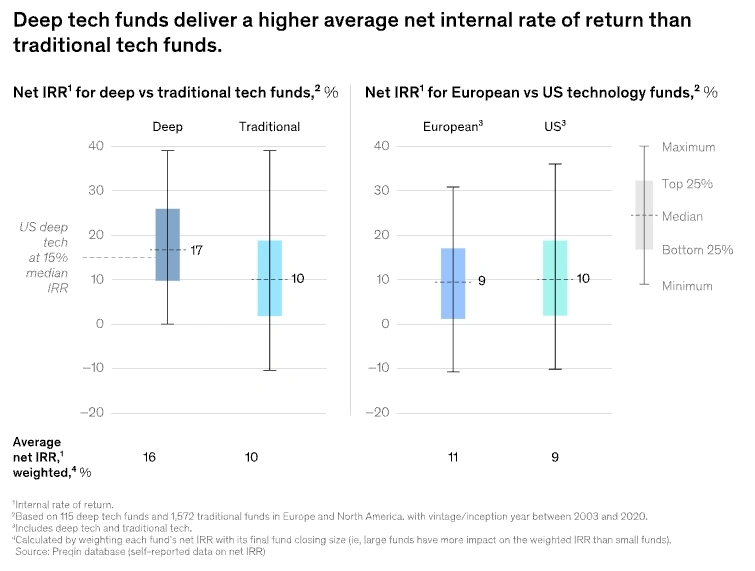

ROI & Costs

Source: McKinsey

- Costs: Initial funding is 40% higher than traditional tech, but better capital efficiency is due to non-dilutive grants.

Top FAQs Leaders Ask on Deep Tech Trends

1. How can we keep up with the speed of deep tech advancements?

- Build a “tech-radar” loop that makes continuous scanning non-negotiable.

- Create a cross-functional deep-tech task force.

- Tap venture/accelerator partnerships for early-stage pilots.

2. What are the most impactful deep tech trends for our industry?

- Generative & Agentic AI: Adds USD 2.6 to USD 4.4 trillion to the global economy yearly by automating content, code, and decisions.

- Spatial & Edge Computing: 75% of enterprise data will be created/processed at the edge, cutting latency for AI inference.

- Quantum-Safe Security: Quantum computers threaten today’s encryption; migration windows are shrinking.

3. What’s the best way to recruit and retain deep tech talent?

- Adopt skills-first hiring (credentials optional).

- Launch enterprise-wide upskilling programs in AI, quantum, and robotics.

- Elevate employer brand via OSS, thought leadership & marquee projects.

Top 10+ Deep Tech Trends to Watch [2025-2030]

You may also like:

1. Agentic AI Systems

Agentic AI is autonomous software that leverages advanced large language models (LLMs), orchestration frameworks, and continuous learning loops to plan, act, and self-improve for performing high-level goals.

Strategic Payoff

- Labor-Hour Cuts: Enterprises report up to a 40% reduction in manual effort for routine and repetitive tasks.

- Faster Decision Cycles: ServiceNow shows 52% faster case resolution once agents handle data gathering and first-pass triage.

- Cost & Revenue Impact: Operational costs fall while revenue opportunities rise due to improved efficiency, accuracy, and customer engagement

Market Momentum

a. Market Growth

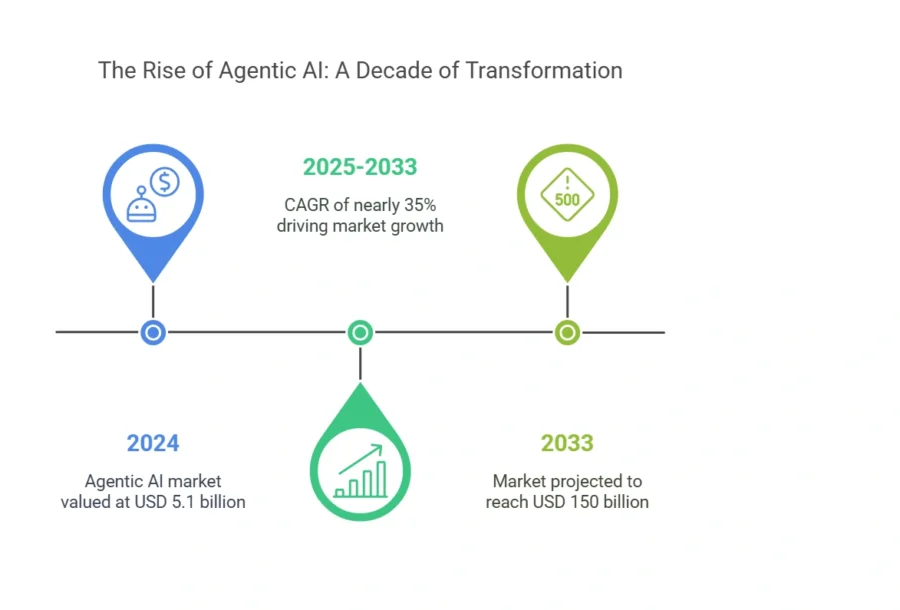

The global agentic AI market is anticipated to reach USD 150 billion by 2033 with a CAGR of nearly 35%.

Source: Data Intelo

b. Investment Landscape

The European market has been particularly active, with 65 AI agent deals in Q1 2025, raising EUR 1 billion and tracking to exceed the EUR 1.7 billion raised in 2024. Leading venture capital firms:

- Coatue Ventures: Led WisdomAI’s USD 23 million seed round.

- General Catalyst: Led Portia AI’s GBP 4.4 million funding round.

- Lightspeed India: Participated in Composio’s USD 24 million Series A round.

- Accel: Participated in H COMPANY‘s USD 220 million seed round.

c. Enterprise Adoption of Agentic AI

- Deloitte predicts that 25% of companies using generative AI are expected to launch agentic AI pilots or proofs of concept in 2025.

- Adoption projected to reach 50% by 2027.

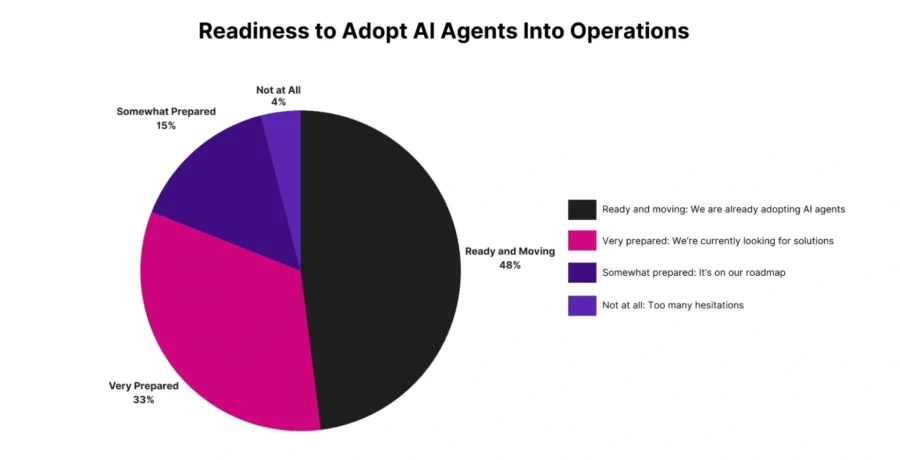

- 48% of enterprises are already adopting agentic solutions, with an additional 33% actively exploring them.

Source: Forum

d. Sector Penetration

- Finance: AI agents conduct KYC checks, fraud triage, and portfolio rebalancing (e.g., SymphonyAI, ServiceNow Financial Crime Agents).

- Healthcare: Streamlines patient management, diagnostics, and appointment scheduling.

- Retail: Enhances personalized recommendations, customer service, and inventory management.

- IT and Manufacturing: Optimizes workflows, automates support, and improves supply chain operations.

Real World Example

Decidr & CareerOne Transforms Recruitment with Agentic AI

CareerOne has collaborated with Decidr to deploy autonomous, task-specialist AI agents that maintain human oversight. CareerOne achieved an eightfold increase in candidate-job match rates, a 65% rise in candidate onboarding, and processed over 500 000 applications. This integration shifted the recruitment focus from volume to precision and enhanced both efficiency and the quality of hires.

2. AI Governance and Security

AI governance and security encompass the frameworks, policies, and tools required to ensure that AI systems are transparent, ethical, secure, and compliant with regulatory and societal expectations.

Strategic Payoff

- Risk Mitigation: Strengthens organizational safeguards by reducing legal, financial, and reputational exposure from non-compliant or biased AI systems.

- Trust and Transparency: Improves public and stakeholder confidence through explanation, fairness, and oversight.

- Operational Resilience: Proactively addresses vulnerabilities from adversarial attacks, data breaches, and unintended AI behaviors.

Market Momentum

a. Market Growth

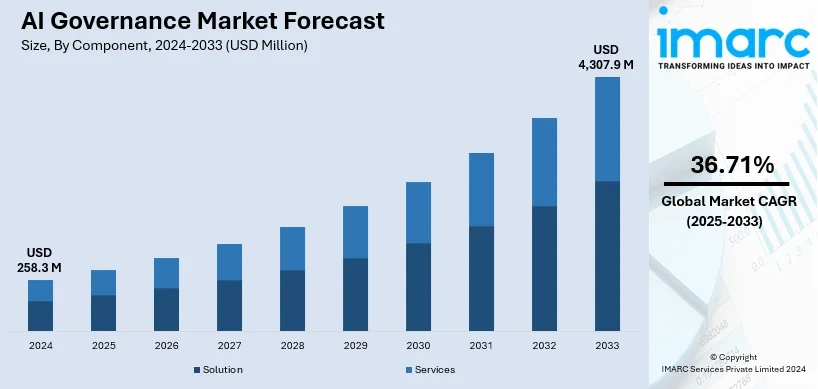

The AI governance market is projected to grow to USD 4.3 billion by 2033 at a CAGR of 36.7%. North America leads with over 33% market share, followed by Asia-Pacific.

Source: imarc

b. Investment Landscape

AI startups raised over USD 100 billion in venture capital, with significant funding directed toward governance, compliance, and risk-focused solutions. Notable startups securing funding for AI security and governance solutions:

- Acuvity secured USD 9 million in seed funding to improve its AI security and governance platform.

- Monitaur raised USD 6 million in Series A to expand its governance software.

- Government Grants: Programs like the US Department of Defense’s AI initiative and the EU’s Horizon 2020 Cybersecurity Grant offer non-dilutive funding for AI cybersecurity startups.

c. Enterprise Adoption of AI Governance and Security

- 27% of organizations plan to test AI for security.

- 32% of finance firms have established an AI committee or governance group, with 12% of those adopting a formal AI risk management framework.

d. Sector Penetration

- Finance: Governance ensures compliance with DORA, the EU AI Act, and risk management protocols for fraud detection and auditability.

- Healthcare: Governs patient data use, mitigates bias in diagnostics, and supports compliance with medical AI regulations.

- Government: Uses governance to ensure fairness, transparency, and ethical AI deployment in public services.

Real World Example

IBM’s watsonx.governance is an AI governance platform that enables organizations to manage the lifecycle of AI models responsibly. It offers tools for automating governance processes, monitoring model performance, and ensuring compliance with evolving regulations.

The platform includes lifecycle governance, risk management, compliance management, and integration capabilities. watsonx.governance helps organizations scale AI responsibly, ensuring models are trustworthy, compliant, and aligned with business objectives.

3. Commercial Quantum Applications

Commercial quantum applications mark the transition of quantum computing, sensing, and communication technologies from research labs to real-world business scenarios.

Strategic Payoff

- Breakthrough Problem-Solving: Quantum tools offer solutions in logistics, drug discovery, financial modeling, and material design.

- Competitive Differentiation: Early adopters benefit from faster simulations, better optimizations, and enhanced cybersecurity.

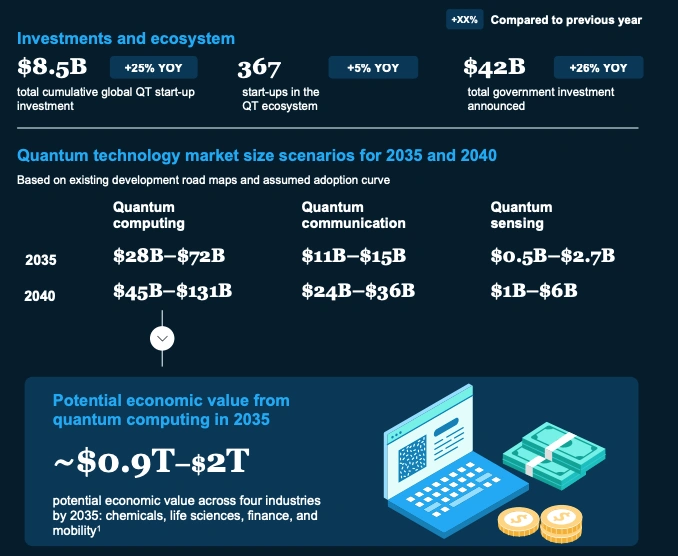

- Economic Value: Potential commercial quantum value is expected to be between USD 0.9 trillion and USD 2 trillion by 2035.

Source: Mckinsey

Market Momentum

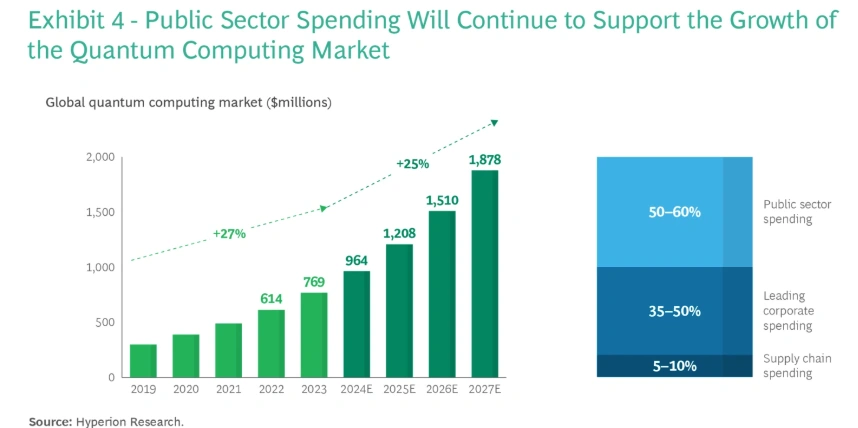

a. Market Growth

- Valued at USD 1 billion in 2025, the global quantum computing market is forecasted to grow at a 30% CAGR, reaching USD 15 billion by 2033.

- Startup investors poured in USD 8.5 billion, and governments committed USD 42 billion to the sector by 2024. Over 367 quantum tech startups are active globally.

b. Investment Landscape

The commercial quantum sector rebounded with USD 2.6 billion in startup funding and marked a 58% increase over last year. Governments continue to lead the charge with over USD 42 billion committed globally, with new initiatives emerging from Germany, the UK, South Korea, India, and Australia.

The majority of VC investment is concentrated in quantum hardware and software companies. Notable recent rounds:

- Quantum Circuits raised USD 26.5 million in an extended Series B round.

- PsiQuantum secured AUD 940 million in government-backed funding.

- Origin Quantum raised USD 148 million in Series B led by state-backed investors.

- IQM continues to draw large-scale VC interest as a key quantum hardware player.

c. Enterprise Adoption of Commercial Quantum Applications

- 21% of organizations currently use or plan to deploy quantum technologies within the next 12–18 months.

- Over 100 Fortune 500 companies are running quantum proof-of-concept projects, with a combined investment of approximately USD 300 million.

Source: BCG

d. Sector Penetration

- Finance: Quantum algorithms support portfolio optimization, market risk analysis, and cryptographic resilience.

- Healthcare & Life Sciences: Used in drug discovery, genomics, and quantum sensing for advanced diagnostics.

- Chemicals & Materials: Simulations accelerate the discovery of new compounds and materials with targeted properties.

- Defense & Aerospace: Quantum sensors support GPS-free navigation, infrastructure inspection, and secure communication.

Real World Example

Terra Quantum launched TQ42 Studio in closed beta to simplify quantum AI development through a no-code interface. The platform empowers users to build and deploy quantum-enhanced AI models by integrating hybrid quantum-classical algorithms.

Early enterprise testers reported accelerated development cycles and reduced costs, with use cases ranging from quantum portfolio optimization to advanced drug discovery simulations. TQ42 Studio positions Terra Quantum to democratize access to commercial quantum applications across industries.

4. Quantum Machine Learning

Quantum machine learning (QML) integrates the principles of quantum computing with machine learning algorithms to address data processing challenges. It leverages quantum properties such as entanglement and superposition to enhance pattern recognition, accelerate computations, and enable insights in complex or sparse data environments.

Strategic Payoff

- Breakthrough Performance: QML reduces data and energy requirements by encoding information more efficiently.

- Reduced Training Times for Machine Learning Models: QML decreases the time required to train complex machine learning models for quicker deployment.

- Competitive Advantage: Enterprises adopting QML early gain speed, accuracy, and problem-solving capacity that reshape operational strategies.

Market Momentum

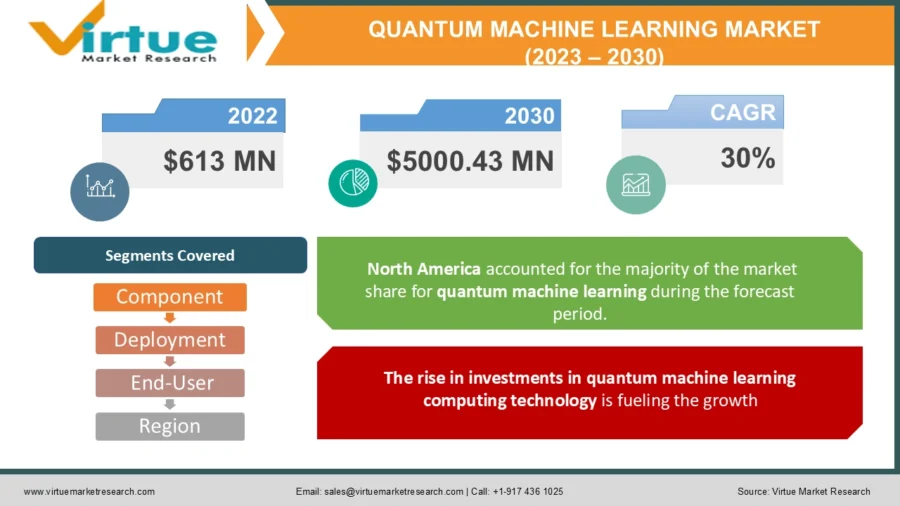

a. Market Growth

The market for quantum machine learning is projected to reach USD 5 billion by 2030 with a CAGR of 30%.

Source: Virtue Market Research

b. Investment Landscape

Investor confidence in quantum startups, including those focused on QML, surged in Q2 2024, with the sector attracting USD 1.9 billion from venture capitalists. Notable recent rounds:

- Q-CTRL raised a USD 27.4 million Series B extension.

- Quanfluence secured USD 2 million in seed funding led by pi Ventures. The company is developing photonics-based quantum technologies.

- QunaSys raised JPY 1.7 billion in a Series B2 round to focus on chemistry and material simulation via QML.

- HQS Quantum Simulations obtains EUR 2.3 million in seed funding to advance quantum simulation software for industrial applications.

c. Enterprise Adoption of Quantum Machine Learning

- Volkswagen and BMW are using QML for traffic flow optimization, car design, and materials research.

- 25% of organizations report integrating quantum machine learning solutions as of mid-last year.

- JPMorgan and Goldman Sachs are piloting QML in portfolio optimization and risk modeling.

d. Sector Penetration

- Finance: QML algorithms enable advanced fraud detection, risk forecasting, and investment optimization.

- Healthcare & Life Sciences: Personalized medicine, genomics analysis, and clinical trials benefit from quantum processing of biological data.

- Climate Science & Chemistry: QML accelerates complex simulations for weather models and molecular research.

Real World Example

QC Ware developed an algorithm that outperformed classical machine learning models in both training speed and prediction accuracy. The algorithm was tested on financial datasets for fraud detection and credit scoring.

This hybrid quantum-classical system delivered a 30% improvement in accuracy while dramatically reducing training time. This implementation highlights the practical potential of QML to drive measurable performance gains in real-world financial applications.

ProteinQure, a Canada-based biotech startup, develops a computational platform that combines biophysical models with machine learning and quantum computing to design novel protein therapeutics. By integrating experimental data and assays, ProteinQure predicts protein structures and functions more efficiently.

5. Post-Quantum Cryptography

Post-quantum cryptography (PQC) employs advanced mathematical techniques like lattice-based, code-based, and hash-based cryptography to protect data against potential threats from quantum computers.

The National Institute of Standards and Technology (NIST) finalized three key standards for long-term security, such as FIPS 203 (CRYSTALS-Kyber) for secure key exchange, FIPS 204 (CRYSTALS-Dilithium) for digital signatures, and FIPS 205 (SPHINCS+) for stateless hash-based signatures.

Strategic Payoff

- Mitigates Quantum Threats: Prevents “harvest now, decrypt later” attacks by securing sensitive data such as IP, financial records, and government files.

- Compliance-Driven Security: Aligns with global mandates like NIST, EU directives, and emerging cybersecurity frameworks to avoid regulatory penalties.

- Infrastructure Resilience: Ensures future-proof encryption for critical systems in finance, healthcare, and national defense.

Market Momentum

a. Market Growth

The global PQC market is projected to grow to USD 7.82 billion by 2030, with a CAGR of 37.6%. North America leads with 37% market share, driven by financial and defense sector adoption.

Source: Grand View Research

b. Investment Landscape

- Government Support: USD 42 billion committed globally to quantum technologies, with PQC R&D a major beneficiary.

- Enterprise Spending: AI and quantum security budgets increased by 15.1% YoY in 2025, as PQC becomes a boardroom priority.

- Focus Areas: Hybrid quantum-classical cryptography, quantum key distribution (QKD), and cloud-native PQC infrastructure.

c. Enterprise Adoption of PQC

- 50% of US federal IT leaders are developing strategies to accelerate their transition to PQC.

- 35% of organizations are in the process of defining plans and budgets for PQC readiness.

d. Sector Penetration

- Finance: Quantum-safe payment systems, fraud-proof authentication, and compliance-grade transaction encryption.

- Healthcare: Securing EMRs and genomic data from long-term decryption risks.

- Government & Defense: Safeguarding classified communications and critical infrastructure from quantum espionage.

- Telecom & Energy: Implementing quantum-resistant protocols across IoT, 5G, and smart grids.

Real-World Examples

Versa Networks is proactively addressing the emerging threats posed by quantum computing by integrating post-quantum cryptography into its security solutions. Recognizing the potential vulnerabilities of traditional encryption methods in the face of quantum advancements, Versa is embedding quantum-resistant algorithms into its secure access service edge (SASE) and SD-WAN platforms.

6. Spatial Computing

Spatial computing combines AI, computer vision, and extended reality (XR) to create immersive, responsive digital environments that integrate seamlessly with the physical world. This improves enterprise productivity, training, and customer engagement.

Strategic Payoff

- Enhanced Productivity: Real-time 3D simulations and digital twins optimize workflows in manufacturing, logistics, and healthcare.

- Immersive Experiences: Transforms how users engage in retail, gaming, and education through lifelike environments and spatial interaction.

- Operational Efficiency: Enable remote monitoring, predictive maintenance, and real-time decision-making

- Future-Proofing: Lays the groundwork for smart city development, autonomous systems, and next-gen spatial interfaces.

Market Momentum

a. Market Growth

The spatial computing market is projected to surge to USD 945.8 billion by 2033, growing at a CAGR of 21.7%. North America holds 31.4% of the market.

Source: Business Research Insights

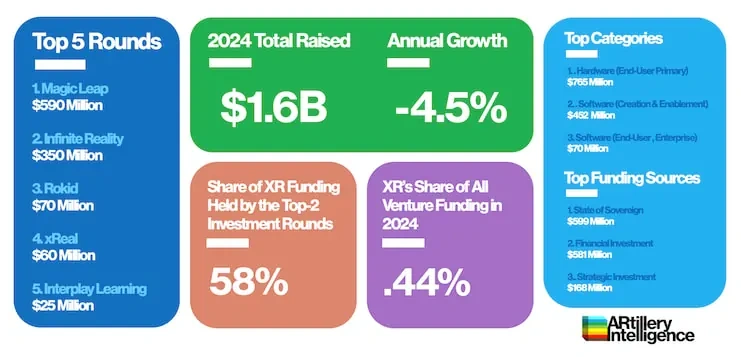

b. Investment Landscape

Private investors deployed USD 1.62 billion into AR/VR startups last year. ARtillery Intelligence forecasted funding of USD 1.34 billion for 2025, but the domain has already acquired USD 3 billion in strategic rounds.

Source: AR Insider

For instance, Riceberg Ventures launched a USD 20 million fund in 2025 to support deep tech startups in India, including those advancing spatial computing solutions.

Even the European Union opened EUR 140 million Digital Europe in 2025 includes EUR 27 million for “digital-skills academies on quantum, AI, and virtual worlds” that widened the talent pipeline for spatial computing.

c. Enterprise Adoption

- The global market for smart glasses reached approximately 678 600 units in 2023 and is projected to grow to 13 million units by 2030 (CAGR of 53%), with enterprise deployments such as Vuzix and RealWear leading the way.

- General Electric (GE) has reported a 34% increase in productivity per worker after equipping technicians with AR glasses for real-time information access.

d. Sector Penetration

- Healthcare – Holds a 16% market share, leveraging spatial computing for surgery planning, rehabilitation, and patient engagement.

- Retail – Sees a 25% growth in adoption, driven by AR-powered virtual try-ons and immersive shopping experiences.

- Industrial Training – Experiences a 40% increase in spatial computing spend, particularly for safety simulations and real-time digital twin environments.

Real World Examples

Apple’s Vision Pro brings spatial computing to the enterprise through a standalone mixed-reality headset powered by visionOS and the M2 + R1 chips. It delivers an ultra-high-resolution 3D display system, eye and hand tracking, and spatial audio for immersive experiences without external controllers.

The device allows professionals to create infinite virtual screens, manipulate 3D objects with precision, and overlay live data or instructions in physical environments.

7. Metabolomics and Novel Therapeutics

Metabolomics is the large-scale study of small molecules (metabolites) within cells, biofluids, tissues, or organisms. By integrating AI and advanced analytics, metabolomics enables high-resolution insights into disease biology, drug response, and biomarker discovery.

Strategic Payoff

- Precision Medicine: Enables treatment personalization by identifying individual metabolic fingerprints that improve outcomes and minimize side effects.

- Accelerated Drug Discovery: Streamlines therapeutic development by pinpointing metabolic biomarkers for diseases like cancer and Parkinson’s.

- Cost Efficiency: AI-driven metabolomic analysis reduces R&D cycles and costs by predicting drug efficacy earlier in the development pipeline.

Market Momentum

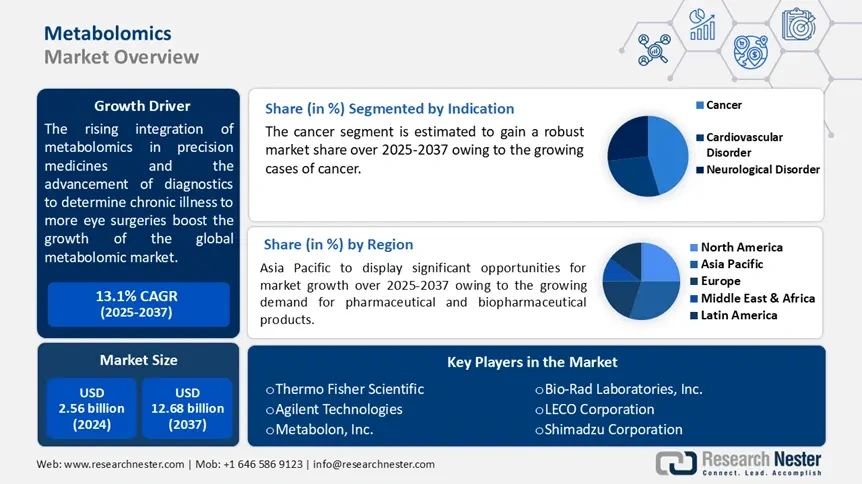

a. Market Growth:

The global metabolomics market is projected to grow to USD 12.68 billion by 2037, with a CAGR of 13.1%. North America is expected to dominate the global market with a 39.8% share, followed by Asia Pacific with a 26.2% share in 2025.

Source: Research Nester

b. Investment Landscape

Hundreds of millions of dollars have been raised in the past 18 months, led by Enveda’s USD 130 million Series C. Also, Sinopia Biosciences received USD 2.0 million in funding from The Michael J. Fox Foundation for Parkinson’s disease therapeutics.

Some industry leaders, like Metabolon and Thermo Fisher Scientific, control the tools and services market to support pharmaceutical and academic research.

Government Funding:

- NIH Common Fund & disease-area grants continue to bankroll oncology and neuro-metabolomics work.

- India’s USD 20 million initiative dedicated to national metabolomics infrastructure

c. Enterprise Adoption of Metabolomics

Adoption of metabolomics is expanding rapidly across pharma, healthcare, and biotech.

- Pharmaceuticals: High adoption for target identification, drug response modeling, and toxicity prediction.

- Healthcare: Moderate uptake for non-invasive diagnostics, including breath- and urine-based biomarker profiling.

- Biotech Startups: Rapid deployment of AI-driven tools for rare disease research and orphan drug development.

d. Sector Penetration

- Oncology: Many metabolomics studies target cancer biomarker identification and early diagnosis.

- Neurology: Metabolite signatures are advancing treatments for Parkinson’s and Alzheimer’s.

- Nutrigenomics: Consumers and providers seek personalized nutrition based on metabolic profiling.

Real-world Examples

Akero Therapeutics is advancing MASH Treatment through metabolomics

Akero Therapeutics is developing a new treatment for MASH (a serious liver disease) by studying how a natural protein called FGF21 affects metabolism. Their main drug, efruxifermin (EFX), is a modified version of FGF21 designed to treat MASH.

In a Phase 2b trial, 39% of patients with advanced liver scarring (F4 stage) showed improvement after 96 weeks of EFX treatment, compared to only 15% in the placebo group. These strong results have moved the drug into Phase 3 trials, showing promise as a potential breakthrough treatment for MASH.

8. Polyfunctional and Collaborative Robots

Polyfunctional robots are advanced, modular systems equipped with AI-driven adaptability and multi-sensor integration that allow them to execute tasks, such as inspection, assembly, and logistics, without manual reprogramming. Collaborative robots, or cobots, on the other hand, safely interact with humans in shared workspaces through responsive designs, force-limiting joints, and contextual awareness.

Strategic Payoff:

- Cost Efficiency & Labor Optimization: Polyfunctional robots reduce labor costs. For instance, OnRobot shows a 35% reduction in labor costs.

- Scalability: Modular, plug-and-play architectures allow rapid adaptation to evolving workflows.

- Safety & Precision: Cobots lower workplace injury rates by up to 30% to 70% while delivering high precision in tasks like welding, surgical assistance, and material handling.

Market Momentum

a. Market Growth

The global cobot market value is projected to reach USD 5.8 billion by 2030, with a CAGR of 22-25% between 2025 and 2035. Similarly, the polyfunctional robots market is going to reach USD 21 billion by 2032 with a CAGR of 11.5%.

b. Investment Landscape

Robotics startups raised over USD 4.2 billion last year. Notably, collaborative robotics secured a USD 100 million Series B in April 2024, bringing its total to USD 140 million within two years. VC funds are prioritizing workplace automation, surgical robotics, and robot software platforms.

Enterprises like Amazon, Google, and KDDI are increasing direct investments and deployment of polyfunctional and collaborative robots in logistics, manufacturing, and inspection operations.

c. Enterprise Adoption of Robotics

Polyfunctional robots are used for assembly, welding, painting, inspection (manufacturing), surgery and patient care (healthcare), and sorting and packaging (logistics)

The global annual unit shipments of robots exceed 35 000.

d. Sector Penetration

- Automotive: Cobots are deployed for vehicle assembly, painting, and battery system handling.

- Food & Beverage: 36% of processing units now integrate collaborative robots into their packaging and labeling lines.

- Defense: Polyfunctional robots like Modular Advanced Armed Robotic System (MAARS) are used for hazardous missions such as bomb defusal and remote surveillance.

Real World Examples

Tesla’s Optimus handles welding/assembly

Tesla’s manufacturing strategy produces low-cost electric vehicles. The company adopts simplified molded body parts and a parallel assembly method known as the “Unboxed Process” to speed up production and cut costs.

A key part of this shift is the use of polyfunctional collaborative robots, like the Optimus Gen 2 humanoid robot, which can handle multiple tasks across assembly lines and quality checks. These versatile cobots work safely alongside humans and support Tesla in reducing factory size and making EVs more affordable.

Amazon has introduced Vulcan, an AI-powered warehouse robot designed to assist human workers by performing delicate picking and stowing tasks. Equipped with force sensors and a suction-equipped arm guided by an AI-powered camera, Vulcan handles approximately 75% of items in Amazon’s warehouses.

By taking over physically demanding tasks, Vulcan aims to reduce worker strain and improve safety while working collaboratively alongside employees.

9. Adaptive Sustainable Systems

Adaptive sustainable systems are cyber-physical infrastructures that span buildings, grids, data centers, vehicles, and robotics and combine real-time sensing, AI control, renewable generation, and reconfigurable materials to automatically balance performance, cost, and environmental impact in response to changing internal or external conditions.

Strategic Payoff

- Enhanced Performance: Accelerate mission-critical computing using metamaterial-enhanced chips.

- Regulatory Compliance: Meet global energy efficiency and cybersecurity mandates under frameworks like the EU AI Act and NIST PQC standards.

Market Momentum

a. Market Growth

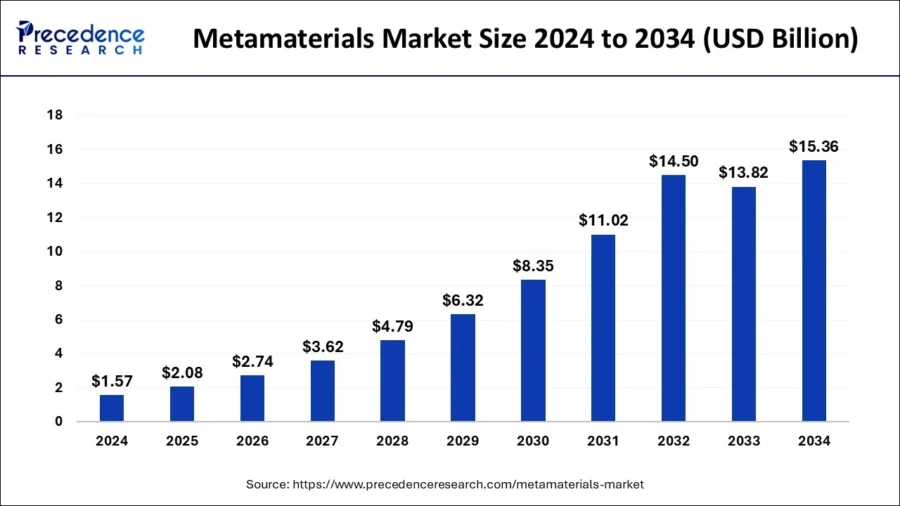

The global metamaterials market size is expected to reach around USD 15.36 billion by 2034 with a CAGR of 25.61%. North America dominates the global metamaterials market with the largest market share of 40%.

Source: Precedence Research

Growth in energy-efficient computing is also driven by regulatory pressure from Fortune 500 firms and 5G/6G deployment using low-energy metamaterial antennas.

Key innovations include self-cooling servers that cut cooling costs and generative AI that reduces the research and development time for materials from 5 years to 18 months.

b. Investment Landscape

Investment in adaptive sustainable materials is accelerating, with both venture capital and corporate R&D driving innovation. Startups like Lambda have raised USD 480 million to develop energy-efficient AI cloud infrastructure. In the smart materials space, memetis secured a 7-figure seed round to advance shape-memory actuators, a key enabler for adaptive systems in electronics and robotics.

c. Enterprise Adoption of ASS

Adaptive sustainable systems are gaining strong enterprise traction across sectors.

- In IT and data centers, companies are implementing AI-driven cooling and self-healing server racks to reduce energy use and downtime.

- Automotive firms leverage shape-memory alloys for lightweighting and metamaterial-based thermal systems to enhance EV battery performance.

- Telecom providers are adopting metasurface antennas for 6G and energy-efficient signal processing.

d. Sector Penetration

- IT/Cloud: Hyperscale data centers aim to reach carbon neutrality.

- Aerospace: New satellites integrate metamaterial-based communication systems.

- Energy: Smart grids deploy piezoelectric sensors for real-time grid balancing and anomaly detection.

Real World Examples

Microsoft’s cold plate cooling reduces emissions by 15%

Microsoft is rethinking how it cools its data centers to cut emissions, water use, and energy demand. In a new study published in Nature, the company compared cooling methods and found that cold plate cooling, where liquid flows directly over chips.

It reduces emissions by 15% and water usage by up to 50% throughout the lifespan of the data center. The company also built an open-access tool to help the industry measure cooling impacts, pushing toward greener, more efficient digital infrastructure.

10. Advanced Earth Observation Systems

Advanced earth observation systems combine high-resolution satellite technologies, superspectral and synthetic aperture radar (SAR) sensors, and AI-powered analytics to deliver real-time environmental intelligence.

Such platforms enable precision monitoring of Earth’s surface, oceans, and atmosphere and support high-impact applications in climate mitigation, urban planning, disaster response, and defense surveillance.

Strategic Payoff

- Climate Action: Reduce up to 2 gigatons of GHG emissions annually, equivalent to removing 476 million gasoline-powered cars, by monitoring deforestation, carbon sinks, and industrial pollution.

- Economic Value: Expected to contribute over USD 700 billion in global GDP by 2030 through data-driven gains in agriculture, energy, and infrastructure.

- Operational Efficiency: Improves disaster response speed significantly with real-time flood/fire detection and predictive modeling.

- Defense & Security: Enhances situational awareness with 25 cm-resolution imagery for surveillance, threat detection, and border intelligence.

Market Momentum

a. Market Growth

The global market for satellite earth observation is expected to grow to reach USD 172 billion by 2033 with a CAGR of 6.92%. North America leads with 44% market share; Asia-Pacific is the fastest-growing, with 23% CAGR projected by 2033.

b. Investment Landscape

Startups like SpaceKnow have raised over USD 7 million in the latest stage to develop AI-driven satellite analytics that deliver real-time insights for monitoring and decision-making.

On the corporate side, Amazon leverages EO data to optimize large-scale logistics and route planning, demonstrating the technology’s operational value at scale. Meanwhile,

NTT DATA has launched Marble Visions, a high-resolution 3D Earth observation platform offering 40 cm spatial resolution that is aimed at supporting flood modeling, infrastructure management, and urban planning.

c. Enterprise Adoption of EO Systems

- Companies like SkyWatch are building cloud-based earth observation platforms that streamline how enterprises and governments order, manage, and distribute satellite imagery.

- The growing integration of SAR and high-resolution optical sensors allows for continuous, all-weather monitoring across industries like agriculture, insurance, energy, and infrastructure

d. Sector Penetration

- Climate & Environment: Accounts for 21% of the EO market, and EO is a key tool for GHG tracking and compliance with the Paris Agreement.

- Energy: Growth in offshore wind monitoring and pipeline integrity management.

- Maritime: Synthetic Aperture Radar (SAR) satellites enable round-the-clock ship tracking, even through dense cloud cover

Real World Examples

NTT DATA and Marble Visions launch 3D Earth observation system

NTT DATA has partnered with PASCO and Canon Electronics to develop a high-resolution, high-frequency 3D Earth observation satellite system through its subsidiary, Marble Visions.

Scheduled for its first satellite launch in 2027, the system will offer 40 cm resolution imagery integrated with digital twin platforms. It facilitates applications in urban planning, environmental management, disaster response, and infrastructure development.

11. Space-based Manufacturing and Energy

Space-based manufacturing and energy involve the development of materials and energy systems in orbit, capitalizing on the unique conditions of microgravity, vacuum, and solar abundance. This includes in-space manufacturing (ISM) for pharmaceuticals and advanced materials, as well as space-based solar power (SBSP) systems that transmit clean, continuous solar energy from orbit to Earth.

Strategic Payoff

- Sustainability: A new study by the World Economic Forum states EO can reduce greenhouse gas (GHG) emissions by more than 2 billion Gt of CO2.

- Economic Value: According to a combined study by WEF and Deloitte EO, applications are projected to add over USD 700 billion in global GDP by 2030.

- Space Exploration: On-demand manufacturing in orbit cuts launch costs, enabling modular spacecraft construction and in-space fuel production.

- Energy Security: SBSP provides 24/7 power to disaster-prone or remote regions, strengthening energy grid resilience and coverage.

Market Momentum

a. Market Growth

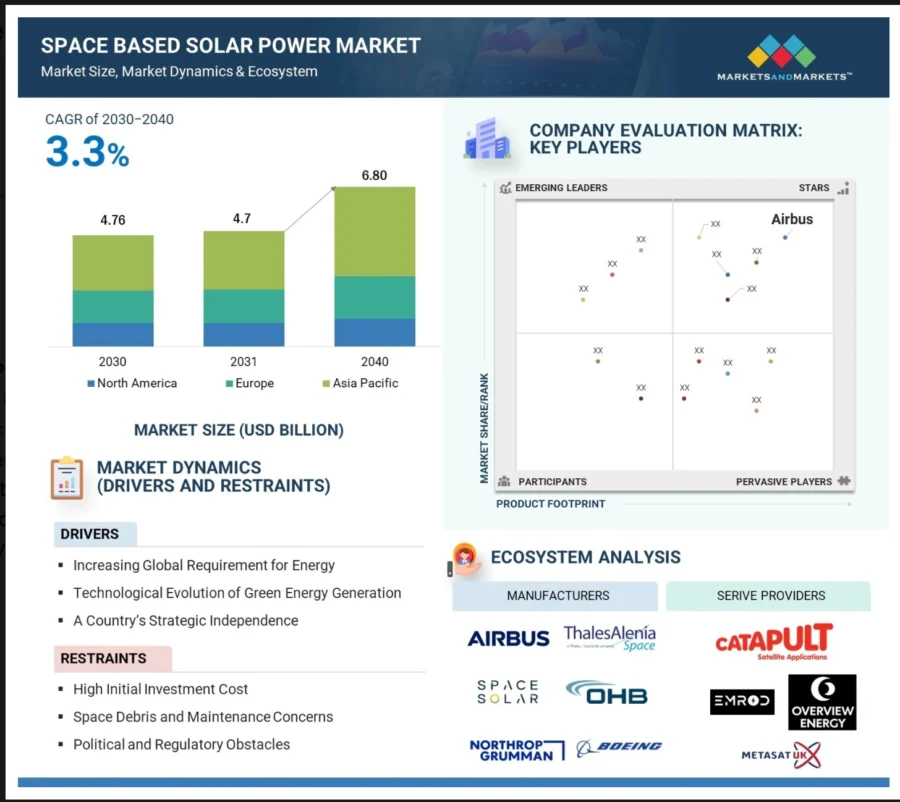

The in-space manufacturing market is projected to grow to USD 4.10 billion by 2030, at a CAGR of 22.47%, while the space-based solar power market is expected to reach USD 4.7 billion by 2030, highlighting strong commercial momentum in orbital production and energy systems.

Source: Markets and Markets

b. Investment Landscape

Space tech startups secured USD 6 billion in venture capital funding in 2024, with Space Forge leading a seed funding round of USD 10.2 million for reusable microgravity manufacturing satellites.

c. Enterprise Adoption of Space-Based Systems

Major aerospace and energy firms like Northrop Grumman and Mitsubishi Electric are actively investing in space-based energy (SBSP) R&D.

d. Sector Penetration

- Defense & Aerospace: Enabling in-orbit satellite servicing, SBSP-powered forward operations, and 3D-printed spacecraft components for mission agility and cost efficiency.

- Pharma & Biotech: Advancing drug purity, accelerating protein modeling, and stabilizing biologics through microgravity-enabled manufacturing.

- Telecom: Manufacturing next-gen satellite parts in orbit, integrating SBSP with satellite constellations, and enhancing 6G readiness with metamaterial antennas.

Real World Examples

Varda Space’s Microgravity Drug Production

Varda Space Industries leverages microgravity environments to enhance drug formulation and crystallization. Their W-1 mission successfully produced crystals of ritonavir, an HIV medication, in space, demonstrating improved stability and purity compared to Earth-based manufacturing.

Utilizing a comprehensive approach that includes terrestrial process development, hypergravity screening, and autonomous in-orbit processing, Varda produces high-value therapeutics.

The company has secured USD 90 million in Series B funding to expand its operations, with plans for additional missions to further validate and commercialize space-based drug manufacturing.

Explore all Emerging Deep Tech Trends & Solutions

With thousands of emerging technologies and startups, navigating the right investment and partnership opportunities that bring returns quickly is challenging.

With access to over 7 million emerging companies and 20K+ technologies & trends globally, our AI and Big Data-powered Discovery Platform equips you with the actionable insights you need to stay ahead of the curve in your market.

Leverage this powerful tool to spot the next big thing before it goes mainstream. Stay relevant, resilient, and ready for what is next.

![10+ Top Deep Tech Trends [2025-2030]: From Key Statistics to Strategic Enterprise Payoffs](https://www.startus-insights.com/wp-content/uploads/2025/05/Deep-Tech-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)

![Business Resilience Planning: 10 Strategies & Technologies to Tackle the Current Market [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/Business-Resilience-Planning-SharedImg-StartUs-Insights-noresize-420x236.webp)

![10 Biggest Business Trends: What to Invest in, Build, and Watch Closely [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/06/Business-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)