The 2025 GovTech Outlook provides an overview of the latest trends, growth metrics, and developments shaping the sector. This report highlights investment areas, workforce expansion, and technological advancements in civic society. It provides insights into AI governance, digital security, and process automation technologies to show how these trends drive innovation and efficiency. It features firmographic data, industry growth rate, investment patterns, and their impact on public service delivery.

This report was last updated in January 2025.

This market outlook also provides insights to multiple stakeholders like policymakers, investors, economic analysts, and more.

Executive Summary: GovTech Report 2025

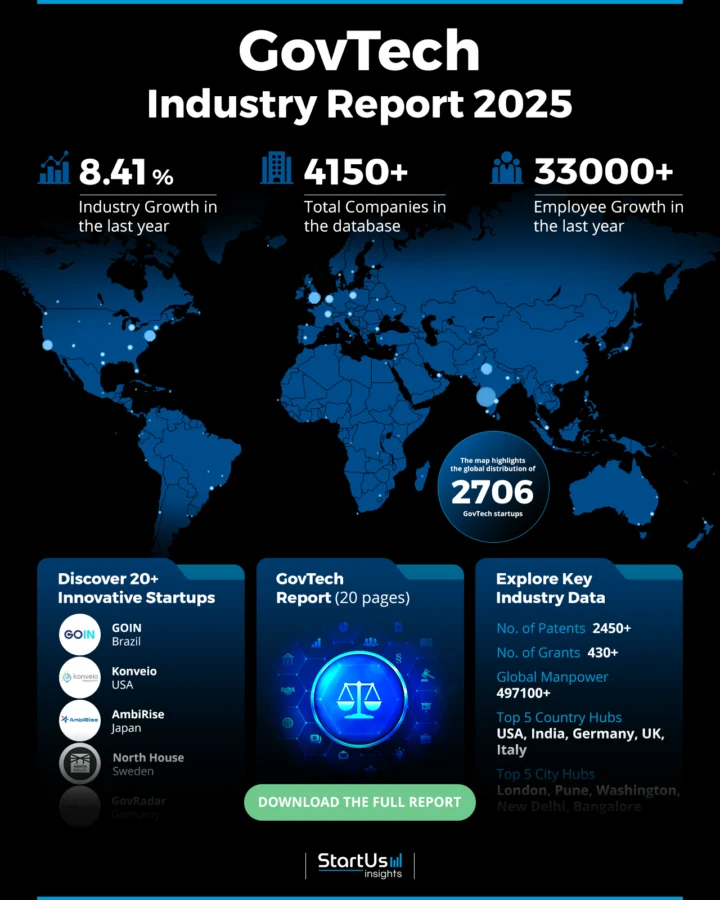

- Industry Growth Overview: The sector includes over 4150 companies and shows an annual growth rate of 8.41%. This reflects the expansion and increasing market interest. The GovTech market is projected to double from USD 606 billion in 2024 to USD 1.42 trillion by 2034.

- Manpower & Employment Growth: The industry employs more than 497K workers, with an addition of 33K new employees in the past year.

- Patents & Grants: Over 2450 technologies in the industry received patents and more than 430 companies received grants.

- Global Footprint: The industry highlights a global presence, with major hubs in the USA, India, Germany, the UK, and Italy. Key city hubs include London, Pune, Washington, New Delhi, and Bangalore. Additionally, Rwanda’s IremboGov platform has digitized more than 98 public services, which saved around 50 million work hours of the citizens.

- Investment Landscape: The sector’s investment activity showcases an average investment value of USD 15.2 million per round. It closed over 1180 funding rounds and involved more than 540 investors.

- Top Investors: The leading investors include Techstars, Inveready, Macquarie Capital, and more. Their total investments sum to USD 513.8 million.

- Startup Ecosystem: Five startup features include: GOIN (public policy simulation), Konveio (document engagement platform), AmbiRise (government billing platform), North House (governance platform), and GovRadar (tender document creation).

Methodology: How We Created This GovTech Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of the govtech sector over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the gov tech industry

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the govtech market.

What data is used to create this govtech report?

Based on the data provided by our Discovery Platform, we observe that the govtech market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: More than 540 news articles were published on govtech in the last year.

- Funding Rounds: Our database documents over 1180 funding rounds closed in this industry.

- Manpower: With a workforce exceeding 497K workers, the industry has grown by more than 33K new employees in the past year.

- Patents: More than 2450 technologies received patents to showcase the development and intellectual property in the industry.

- Grants: Over 430 companies received grants.

- Yearly Global Search Growth: Yearly global search growth stands at 91.47%, showing rising public interest.

Explore the Data-driven GovTech Report for 2025

The GovTech Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap highlights key metrics and shows 2706 startups and over 4150 companies in the database. The industry grew 8.41% last year, with 2450+ patents and 430+ grants. The global workforce comprises 497100+ employees, with an increase of 33000+ last year.

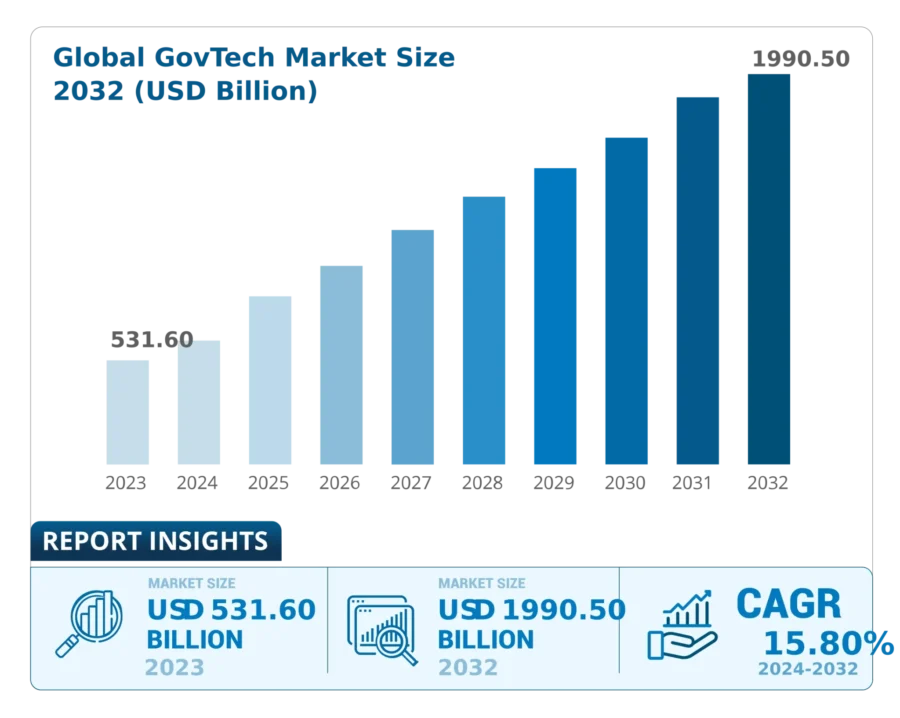

The global govtech market size was USD 531.60 billion in 2023 and is projected to touch USD 1990.50 billion by 2032, at a CAGR of 15.80% during the forecast period.

Credit: Business Research Insights

Major hubs include the USA, India, Germany, the UK, and Italy and city hubs include London, Pune, Washington, New Delhi, and Bangalore. These regions serve as key nodes of innovation for government technologies. Additionally, the heatmap shows a surge in tech sectors and reflects increased R&D investments with advancements in AI and automation. Additionally, Ukraine launched “Diia”, a platform that integrated 30 government services and key documents.

A Snapshot of the Global GovTech Industry

The govtech report reveals growth and activity across several areas. The sector’s workforce comprises 497K+ employees, with 33K new employees added in the past year alone. This expansion highlights the sector’s ability to create new job opportunities. In addition, the industry includes over 4150 companies. Such a company base highlights the sector’s reach and the variety of players contributing to its development and innovation.

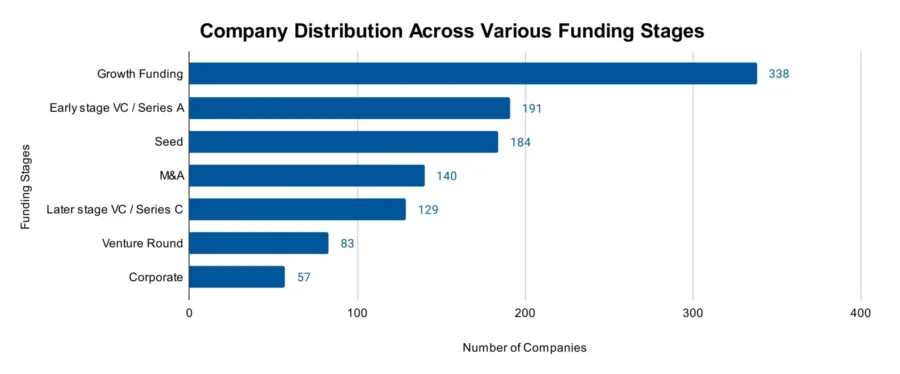

Explore the Funding Landscape of the GovTech Industry

Investment activity expands with an average investment value of USD 15.2 million per round. The total number of funding rounds closed exceeds 1180. It showcases investor engagement in the sector’s potential. More than 540 investors contributed to the industry’s development and invested in over 460 companies.

This data underscores the vitality of the industry and highlights the manpower, employee growth, and investment activity.

Who is Investing in GovTech Sector?

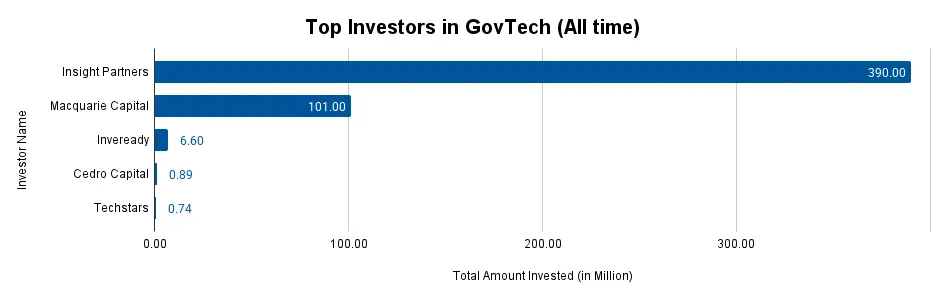

The combined investment value of the top investors in the industry exceeds USD 513 million. The following are key investors and their contributions:

- Insight Partners contributed USD 390 million to 2 companies. It invested in PayIt, a digital government and payment platform that simplifies transactions between citizens and state, local, and federal government agencies

- Macquarie Capital allocated USD 101 million to 2 companies. It invested in Earth Resources Technology (ERT) which provides scientific, engineering, environmental, and IT services to US Federal agencies like NOAA, NASA, and US Space Force.

- Inveready financed 2 companies with a combined sum of USD 6.6 million. Through Weatherford Capital, it has invested in OpenGov, a cloud technology company that assists government officials with tasks such as budgeting and citizen engagement

- Cedro Capital supported 2 companies with a total funding of USD 887 000. It also invested in StartGi, a Brazilian technology company that simplifies the process of selling to the public sector.

- Techstars backed 6 companies with a total funding of USD 735 000. Cloverleaf AI, a Techstars 2021 portfolio company, recently raised USD 2.8 million to help government tech suppliers

Access Top GovTech Innovations & Trends with the Discovery Platform

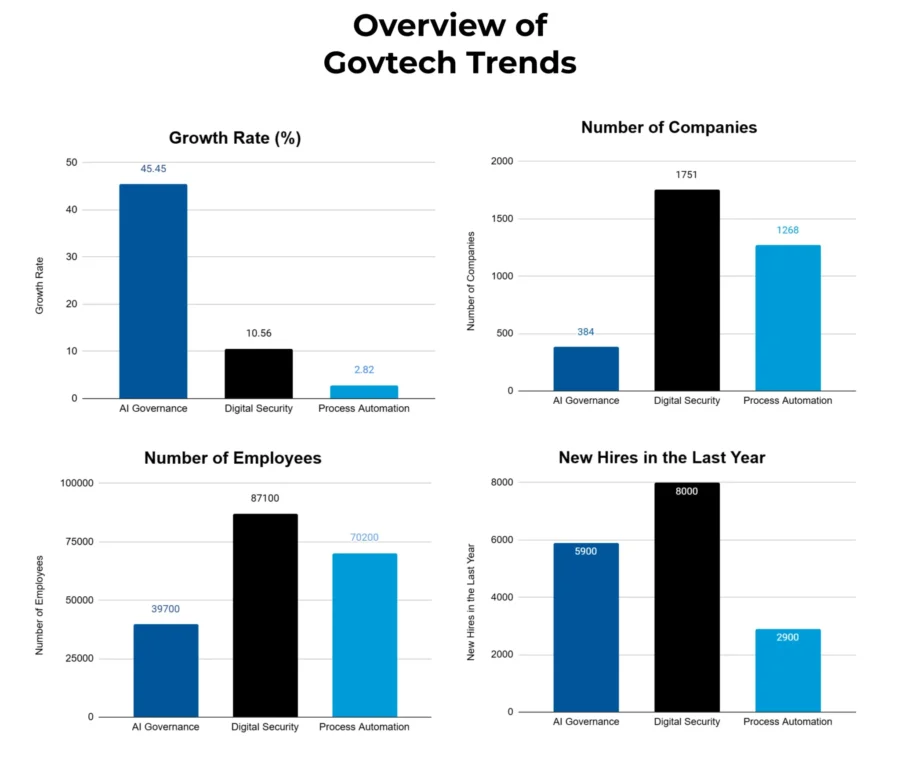

Several key trends are driving growth in the govtech sector. Here are a few of them along with the firmographic data:

- AI Governance showcases 322 companies identified in this space. The sector employs 20K+ workers, adding 2.7K new employees in the past year. The annual trend growth rate stands at 53.62%, indicating development and increasing investment.

- The Digital Security sector comprises 1994 companies, collectively employing 145K individuals, with 11.4K new employees added in the last year. It shows an annual trend growth rate of 1.96%.

- Process Automation expands with 11341 companies identified. This sector employs 782K+ individuals, with an increase of 67K new employees in the last year. The annual trend growth rate stands at 9.15%.

5 Top Examples from 2700+ Innovative GovTech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

GOIN provides Public Policy Simulation

Brazilian startup GOIN uses data and evidence in public policies to develop projects from understanding it to prototyping its implementation. Its public policy analysis offers access to ex-ante and ex-post evidence and data.

Moreover, its public policy simulation evaluates the impact of proposals through simulations and analyzes intervention results during planning. In addition, it offers dengue outbreak prevention services by providing data to prioritize public service efforts against dengue.

Konveio develops a Document Engagement Platform

US startup Konveio develops a document engagement platform by transforming static documents into mobile-friendly draft plans. It enables feedback on draft plans and simplifies managing public comments with AI-powered tools. The platform also includes navigation through different detail levels and public comment features that streamline feedback collection.

Konveio’s AI search functionality unlocks insights by answering questions about documents. While its presentation boards replicate in-person engagement processes, interactive documents offer visually engaging ways to publish content. In addition, Konveio’s tools manage context-rich comments, automate tagging, and generate ready-to-share reports.

AmbiRise builds a Government Billing Platform

Japanese startup AmbiRise’s billing platform digitizes invoice issuance and receipt using QR code data linking to minimize disruptions to existing workflows. It allows businesses to submit a power of attorney to the government for simplifying the invoicing process from the first claim onward. The platform only needs claim information and eliminates the need for printing or stamping documents.

North House develops a Governance Platform

Swedish startup North House’s policy management software enables the establishment, maintenance, and anchoring of governing documents for organizations. The platform controls publishing by setting it up while inviting editors and reviewers.

Key features include visualization tools for audits and comprehensive audit trails for quality assurance and external audits. Its anchoring report feature tracks organizational adherence to governance policies. Thus, it reduces risks and streamlines processes.

GovRadar creates Tender Documents

German startup GovRadar provides a web-based software solution to streamline procurement processes for public purchasers. Its module, GovRadar AI, optimizes tender documents through AI, offers text suggestions, and conducts research across documents. GovRadar Tenders module offers access to the tender documents database from public clients with features like intelligent search and document previews.

The GovRadar Markets module includes a product database for defining supply specifications and enables a direct comparison with market offerings. The GovRadar Documents module guides the creation of contracts and forms to develop document templates without programming knowledge. The solution saves time and effort in procurement tasks through AI digitalization.

Gain Comprehensive Insights into GovTech Trends, Startups, or Technologies

The 2025 GovTech Outlook highlights the growth of the government technology sector. While highlighting key trends such as AI governance, digital security, and process automation, the report also reveals investment and workforce expansion. Contact us to explore all 2700+ startups and scaleups, as well as all industry trends impacting govtech companies.