Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover five hand-picked Web3 startups impacting FinTech.

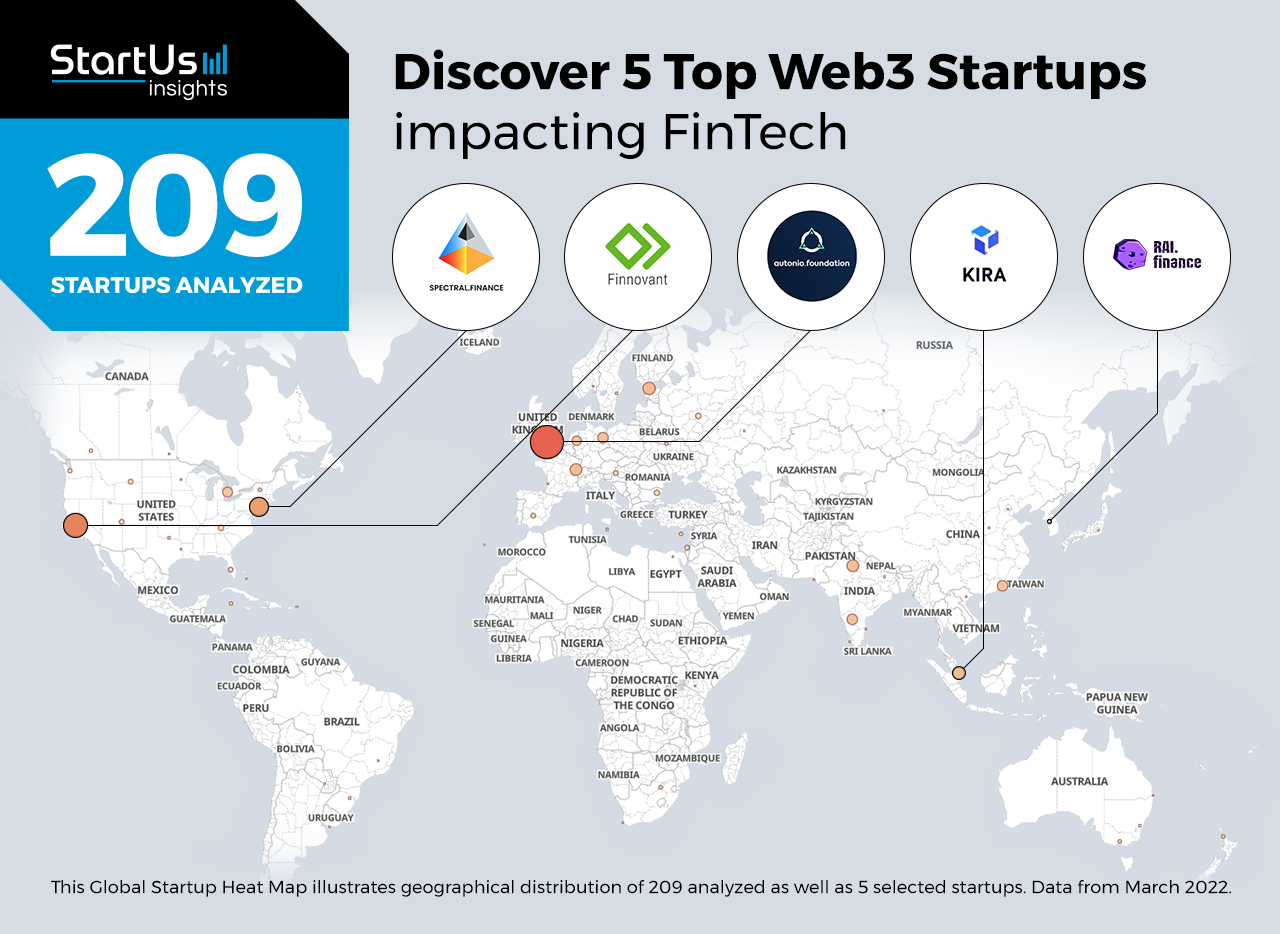

Out of 209, the Global Startup Heat Map highlights 5 Top Web3 Startups impacting FinTech

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 209 exemplary startups & scaleups we analyzed for this research. Further, it highlights five Web3 startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 204 Web3 solutions for FinTech, get in touch with us.

Kira builds a Decentralized Finance (DeFi) Network

Founding Year: 2019

Location: Singapore

Funding: USD 5 M

Partner with Kira Core for High-Liquidity Staking

Kira is a Singaporean startup that offers a Web3 DeFi network. The startup combines proprietary solutions for proof of stake (PoS), automated market maker (AMM), and initial validator offering (IVO) to develop a cryptocurrency ecosystem. Financial decentralized app developers host their applications on this network, allowing users to deposit and stake their assets. Moreover, these assets are accessible across cross-chains, which increases asset liquidity. It also provides uncapped value at stake from real-world and interchain space. This increases network activity and, in turn, incentivizes users to deposit and stake assets.

RAI.Finance develops a Decentralized Social Trading System

Founding Year: 2020

Location: Seoul, South Korea

Funding: USD 1,5 M

Use this solution for Decentralized Autonomous Organizations (DAO)

South Korean startup RAI.Finance offers a decentralized social trading system. The startup’s multi-chain decentralized finance protocol utilizes digital asset trading and socializing to improve the trading experience. It also allows users to share index token sets, participate in decentralized governance for protocol upgrades, and analyze investment data. This, in turn, improves asset liquidity in decentralized finance, mitigating fragmentation across the existing DeFi ecosystem.

Spectral Finance facilitates Credit Risk Assessment

Founding Year: 2020

Location: New York, US

Funding: USD 6,8 M

Innovate with the startup for Decentralized Credit Risk Modeling

Spectral Finance is a US-based startup that provides Spectrum, a liquidity aggregation platform for DeFi. It uses an on-chain credit scoring system and a collateral subsidization model to identify programmable creditworthiness protocols. Spectrum gathers and assesses various on-chain transaction data from multiple sources as a composable asset, enabling decentralized credit risk modeling. This allows lenders to improve borrower risk assessment and better control their identity and pseudonymity on the blockchain.

Finnovant advances DeFi Cybersecurity

Founding Year: 2018

Location: Mountain View, US

Funding: USD 6 000

Collaborate with Finnovant for Multi-Modal Biometric Finance (BioFi)

Finnovant is a US-based startup that provides Say-Tec, a multi-modal biometric solution for DeFi cybersecurity. It leverages face and voice biometrics to authenticate users for device unlocking, account logins, and data access, while keeping the biometric data on the device. Besides, it supports decentralized web architecture, including blockchain access, cryptocurrencies, wallets, and exchanges. The startup thus allows Web3-based fintechs to eliminate the need for multiple passwords and reduce fraud.

Autonio Foundation enables Automated Crypto Trading

Founding Year: 2018

Location: Bristol, UK

Reach out for Cross-Chain Trading Analytics

UK-based DAO Autonio Foundation offers AI-based automated crypto trading. Its solution, NIOX Suite, combines decentralized exchange (DeX), liquidity mining, and market-making to automate crypto trading. This allows investors and traders to conduct trading analyses, deploy trading algorithms, copy successful traders, and exchange cryptocurrencies across cross-chains. Like most DAOs, it offers staking rewards and free tools to encourage user participation in product development and organizational governance.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on decentralized FinTech infrastructure, user-centric product & service development, DeFi as well as automated trading. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.