Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2025 Waste Management Industry Report outlines the sector’s current state. It covers growth rates, employment patterns, patent activity, and trends in innovation and investment.

According to the Markets and Markets report, the global waste management market will reach USD 1598.1 billion by 2029. It is expected to grow at a compound annual growth rate (CAGR) of 5.6% between 2024 and 2029.

The report highlights major regions, key investors, and emerging startups driving change in the sector. It also explores new technologies such as AI-powered sorting systems and IoT-based smart bins. Additionally, it assesses innovations in route optimization and the growing focus on smart waste management.

These insights enable industry leaders and policymakers to make informed decisions for navigating a dynamic and evolving waste management landscape.

Executive Summary: Global Waste Management Outlook 2025

- Industry Growth Overview: The waste management industry includes 63 844 companies and 2590+ startups. It recorded a slight contraction of 0.38% this year. Moreover, it is projected to grow at a CAGR of 5.6% between 2024 and 2029.

- Manpower & Employment Growth: The global workforce totals 7.7 million. Over the past year, 324700 new employees joined.

- Patents & Grants: The industry holds 691 393 patents filed by 296 791 applicants. Patent filings grew by 2% this year. Additionally, 6590 grants supported research and infrastructure.

- Global Footprint: Key national hubs are the US, UK, India, Germany, and Canada. Leading cities in innovation include London, Sydney, Singapore, Melbourne, and Mumbai.

- Investment Landscape: The sector secured over 15 350 funding rounds. The average investment size reached USD 50.2 million. To date, 10 600 investors have supported 5337 companies.

- Top Investors: Major backers include the European Investment Bank, DBS, GIC, and more. Collectively, these investors committed more than USD 9 billion to the sector.

- Startup Ecosystem: Notable startups are Intellibin (remote waste monitoring), Ouro (supply chain visibility), Aindri (wet waste to energy), Reane (chemical waste reuse), and Ameru (AI-driven sorting).

Methodology: How we created this Waste Management Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles, and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of waste management over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within waste management

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the waste management market.

What Data is used to create this Waste Management Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the waste management market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: The industry attracted over 11 010 news articles and media mentions last year. This reflects ongoing global interest and a steady public conversation.

- Funding Rounds: Our database recorded 15 350 funding rounds across waste technology, logistics, and recycling. Investor engagement continues across these areas.

- Manpower: The workforce includes more than 7.7 million people globally. Last year alone, 324 700 new employees joined due to growing urban demand and infrastructure needs.

- Patents: The patent filings reached 691 393, highlighting efforts to enhance waste collection, environmental practices, and treatment systems.

- Grants: In addition, 6590 grants supported research, pilot projects, and infrastructure development.

- Yearly Global Search Growth: Public interest remains stable. The global search data shows a 0.023% growth rate in industry-related queries over the past year.

Explore the Data-driven Waste Management Industry Outlook for 2025

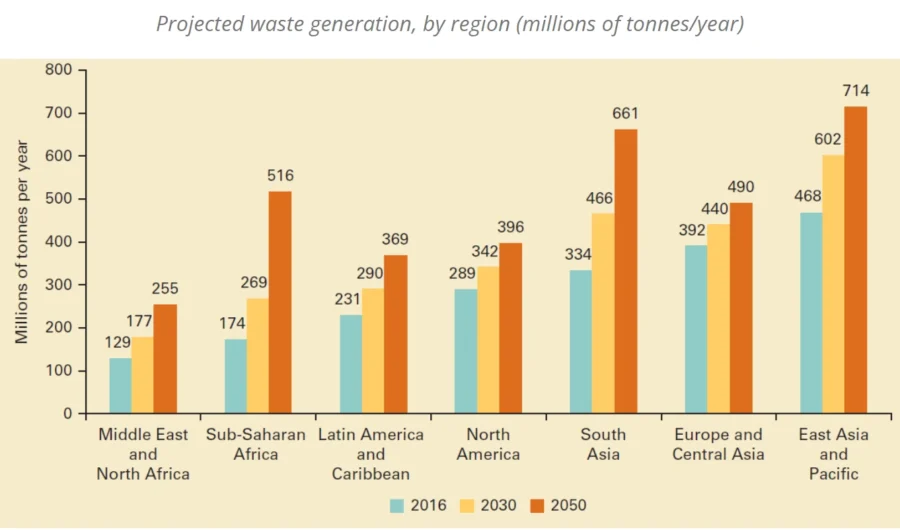

Did you know the world produces 2.01 billion tonnes of municipal solid waste each year? At least 33% of this waste is not managed in an environmentally sound way.

Looking ahead, global waste levels are projected to rise to 3.40 billion tonnes by 2050. This increase will outpace population growth by more than double over the same timeframe.

Credit: World Bank

Further, the waste management industry includes 2598 startups among 63 844 companies. This signals a mature sector experiencing a slight annual decline of 0.38%.

The sector employs 7.7 million people worldwide. Over 324 700 workers joined the industry in the past year. Also, the growth areas include operational expansion and rising urban demand.

Patent filings stand at 691 393, which indicates ongoing innovation in treatment, recycling, and logistics. Besides, in terms of grant activity, the sector was awarded 6590 grants globally.

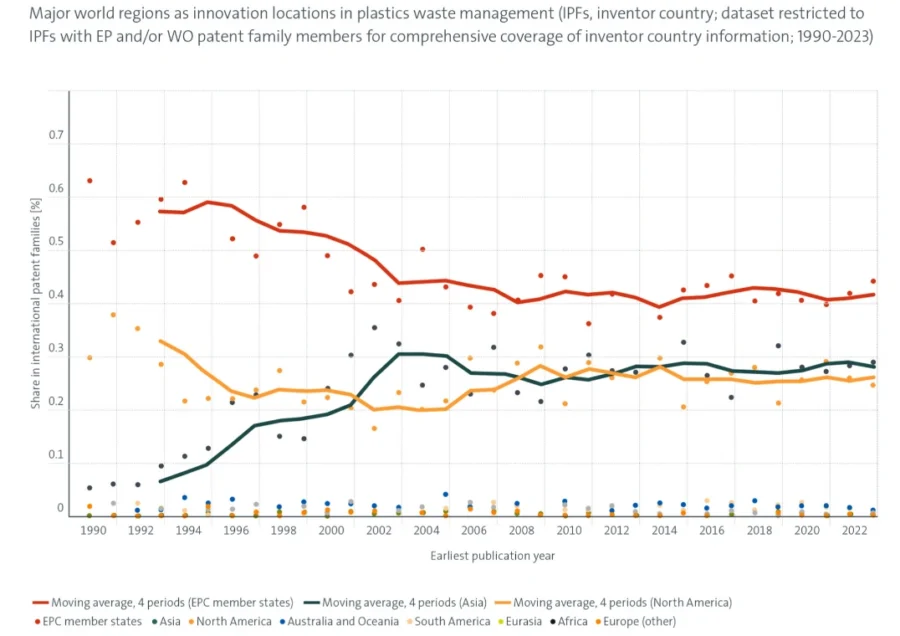

Europe accounts for 44% of plastic waste management patents filed over the past 30 years. Among the top 20 companies, European applicants hold eight spots in recycling patents and ten in recovery patents.

Credit: European Patent Office

After 2015, Japan and South Korea increased their participation in the sector. South Korea, in particular, tripled its bioplastic patent filings between 2020 and 2022. This growth likely reflects national efforts to reduce plastic waste through policy targets.

Moreover, the key country hubs are the US, UK, India, Germany, and Canada. London, Sydney, Singapore, Melbourne, and Mumbai show high levels of activity at the city level.

A Snapshot of the Global Waste Management Market

The waste management industry reported a slight annual decline of 0.38%, pointing to market saturation and the effects of regional policies on growth.

Of the 2598 startups recorded, 1398 remain in early stages. This shows that innovation continues despite broader industry consolidation.

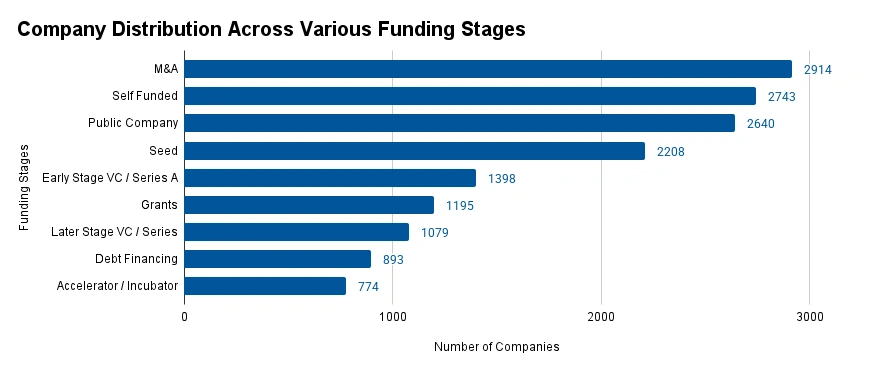

Mergers and acquisitions totaled 2914 transactions. The established players used these deals to acquire niche technologies and enter new markets.

Further, patent filings reached 691 393, submitted by 296 791 applicants. This indicates sustained investment in technology development across the sector.

Also, the annual patent growth holds at 2%. China leads with 356 420 filings, followed by the US at 64 078 and Japan at 44 490. These figures reflect regional strengths in waste innovation.

Explore the Funding Landscape of the Waste Management Market

The waste management industry continues to draw steady investor interest. The average investment per round stands at USD 50.2 million and spans various business stages.

Besides, over 15 350 funding rounds have been closed. It reflects consistent capital flow into recycling, waste logistics, and sustainability-related technologies.

More than 10 600 investors have engaged across the sector. They include venture capital firms, corporate funds, and impact-driven financiers.

Funding has reached over 5330 companies. This shows a broad distribution of capital among early and growth-stage firms focused on waste solutions and infrastructure upgrades.

Who is Investing in the Waste Management Market?

The top investors in the waste management industry have invested over USD 9.19 billion. This capital supports infrastructure development and sustainability-oriented projects.

- The European Investment Bank invested USD 3000 million across 26 companies. It also issued a second loan of EUR 4.7 million, backed by EU guarantees, to aid in reclaiming the Hrybovychi landfill in Lviv.

- DBS allocated USD 925.5 million across 9 companies.

- GIC invested USD 912.2 million in 5 companies.

- International Finance Group committed USD 879.8 million to 16 companies.

- Macquarie Group deployed USD 618.7 million into 4 companies.

- Walmart invested USD 607.6 million in at least one company.

- CPP Investments contributed USD 598.3 million to 4 companies.

- BCI invested USD 567 million in 2 companies.

- RBC Capital Markets backed 5 companies with USD 519.1 million.

- Tortoise Acquisition invested USD 560 million in at least one company.

Top Waste Management Innovations & Trends

Discover the emerging trends in the waste management market along with their firmographic details:

- Sustainable Waste Management involves 2111 companies developing solutions for collection, processing, and disposal. This segment employs 235 700 people and added 13 600 jobs last year. Regulatory pressure, ESG investment, and municipal mandates support its 8.41% annual growth. Further, public and private collaboration continues to expand urban waste capacity, especially in high-density areas.

- Waste-to-Resources supports circular economy goals by turning waste into raw materials for manufacturing, energy, and construction. This segment includes 1407 companies and 81 000 employees. Of these, 5700 were hired last year. Growth stands at 3.56% and is driven by rising landfill costs, raw material shortages, and global efforts to reduce waste.

- Waste Monitoring applies IoT sensors, AI, and analytics to improve efficiency, compliance, and transparency. Currently, 204 companies operate in this area. They employ 7500 people and have added 841 jobs in the last year. With 3.27% annual growth, adoption is increasing as digital waste tracking becomes more common. Besides, the key use cases include bin fill-level monitoring, emissions detection, route planning, and regulatory audits.

5 Top Examples from 2500+ Innovative Waste Management Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Intellibin advances Remote Waste Monitoring

UK-based startup Intellibin builds an AI-powered platform for waste monitoring and analytics. It focuses on real-time data, smart sensors, and automated reporting.

Its WasteLive system uses wireless weight sensors fitted under castor bin wheels. These track volume, contamination, and container status, and transmit encrypted data through Cat-M and NB-IoT networks.

The platform includes GPS-enabled bin tracking and instant fill-level alerts. It also provides insights to reduce missed pickups, emissions, and operational inefficiencies.

Intellibin’s WasteFlow tool extracts data from documents and generates audit-ready compliance reports. It delivers outputs aligned with specific regulatory needs.

Further, the WasteID solution supports tenant-level tracking in shared buildings. It enables pay-as-you-throw billing and identifies high-waste areas to increase recycling rates.

Ouro enables Waste Supply Chain Visibility

US-based startup Ouro creates a decentralized system that regenerates plastic waste into reusable material and offers oversight of the waste lifecycle.

The startup uses modular microfactories to thermally process post-consumer plastic into polymer feedstock. This supports local remanufacturing without relying on export, incineration or landfills.

Each unit features AI monitoring, IoT connectivity, and automated operations to maintain quality and improve efficiency.

The platform tracks the entire waste stream. It captures real-time data on material composition, volume, and outcomes across facilities. Users are able to filter insights by waste type, location or stage.

Ouro enables enterprises, municipalities, and manufacturers to assess recycling partners. It also supports compliance with extended producer responsibility laws and encourages practical action to improve recycling.

Aindri provides a Wet Waste to Energy Solution

Indian startup Aindri builds decentralized biogas plants that convert wet waste into renewable energy for on-site use.

The system collects organic waste from homes, businesses, or factories, then processes it into electricity or cooking gas. It runs as a closed-loop setup without consumables and uses only unskilled labor, which lowers operating costs.

The compact and automated unit produces no odor and requires minimal maintenance. It also generates liquid manure as a byproduct.

Aindri supports green building standards such as IGBC and GRIHA. It aids in meeting composting and renewable energy mandates while reducing emissions and offsetting power costs.

Reane creates Chemical Waste to Eco-friendly Products

Bosnia and Herzegovina-based startup Reane makes a modular system that converts plastic and hazardous chemical waste into reusable fuel and eco-friendly products.

The startup applies low-temperature pyrolysis for plastics and uses proprietary chemical treatments for industrial by-products. This approach prevents harmful emissions during processing.

Its system includes automated controls and data-driven monitoring. The scalable design fits a range of industrial settings.

Reane processes varied waste streams, including multilayer plastics and chemicals, without pre-sorting or adding substances. The outputs include synthetic oil and other high-value materials.

The startup advances sustainable waste management through automation and clean-tech integration. It also supports circular economy goals and contributes to decarbonization with zero-emission operations.

Ameru offers AI-Powered Waste Sorting

Bulgarian startup Ameru builds an AI-enabled system for waste sorting and material discovery. Its smart bin uses an 8MP HD camera, Nvidia Jetson Orin Nano processor, and a 360-degree receptacle to detect and sort over 90 waste types with high accuracy.

A 10.1-inch HD display provides recycling feedback. The startup’s system connects to the cloud for real-time updates and analytics. Besides, pan-tilt mechanics ensure accurate disposal.

The bin pairs with a web platform that delivers interactive waste reports to facility managers. Ameru’s material intelligence software uses machine learning to simulate material properties, refine compositions, and shorten R&D cycles.

Gain Comprehensive Insights into Waste Management Trends, Startups, and Technologies

In 2025, the Waste Management industry continues to move toward circularity, digital tools, and sustainable practices, despite modest growth. New trends such as AI-based sorting, decentralized composting, and landfill carbon capture are changing operational approaches.

Looking ahead, scalable and tech-driven solutions will gain traction as firms aim to cut environmental impact and meet evolving regulations and consumer expectations. Get in touch to explore 2500+ startups and scaleups, as well as all market trends impacting waste management companies.

![Dive into the Top 10 Workplace Safety Trends & Innovations [2026]](https://www.startus-insights.com/wp-content/uploads/2025/07/Workplace-Safety-Trends-SharedImg-StartUs-Insights-noresize-updated-420x236.webp)

![Explore the 10 Emerging Smart City Trends [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/Smart-City-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)