Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Regulatory technology has emerged due to the increasingly complex regulatory landscape across industries. As a result, companies consistently struggle to keep up with detailed and extensive regulatory requirements. To tackle this, businesses are harnessing novel regulatory technologies like advanced analytics, robotic process automation (RPA), machine learning (ML), and more. They automate compliance processes, identify potential risks, and ensure regulatory compliance. Read more to explore all the top 10 RegTech trends and how they boost efficiency, reduce costs, and proactively manage risks.

What are the future trends in RegTech?

- Blockchain

- Cyber Threat Management

- Financial Asset Management

- AML Compliance

- KYC Authentication

- Cloud Computing

- Robotic Process Automation

- Regulatory Change Management

- Predictive Analytics

- Cross-Border Compliance

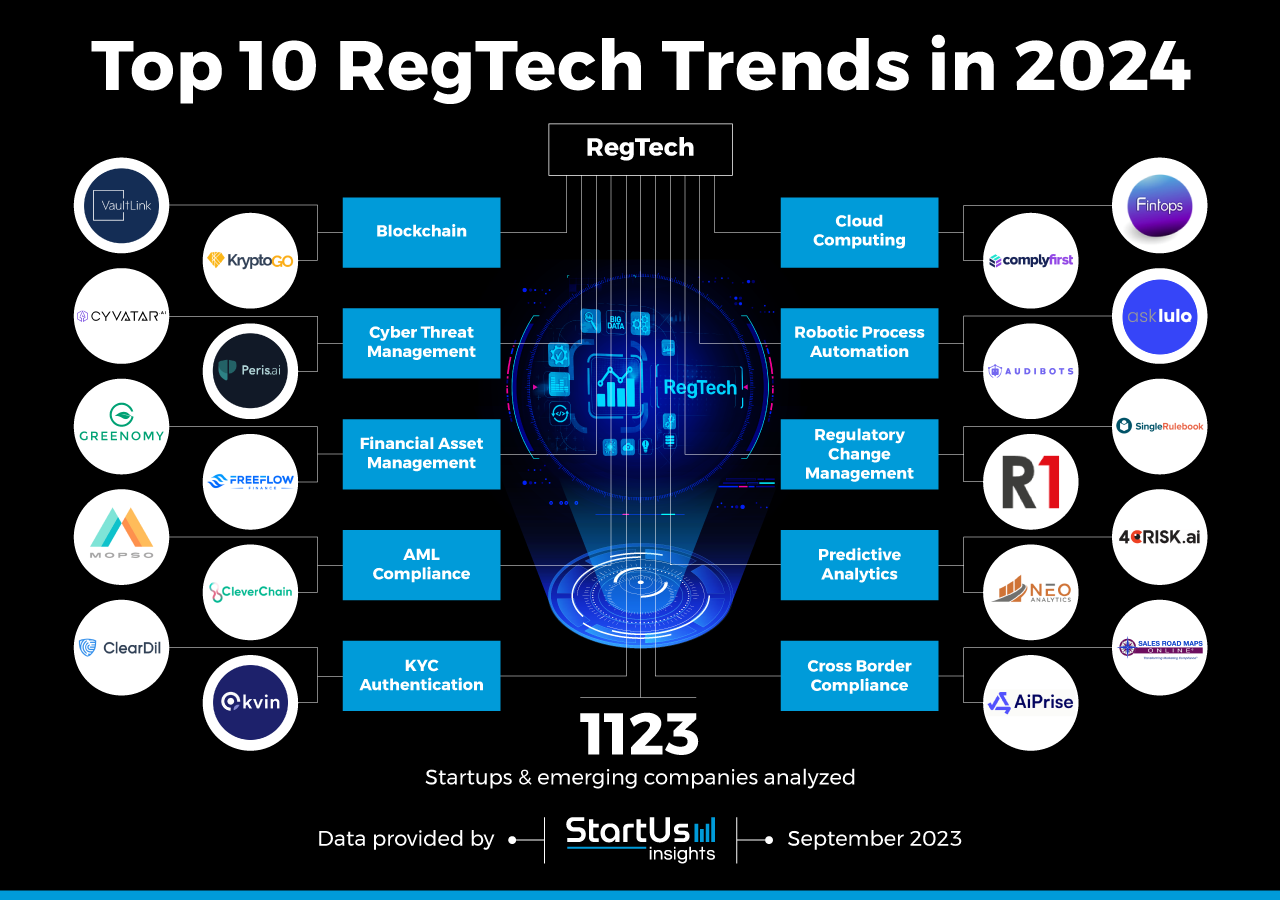

Innovation Map outlines the Top 10 RegTech Trends & 20 Promising Startups

For this in-depth research on the Top Regulatory Technology Trends & Startups, we analyzed a sample of 1123 global startups & scaleups. This data-driven research provides innovation intelligence that helps you improve strategic decision-making by giving you an overview of emerging technologies in the RegTech industry. In the RegTech Innovation Map, you get a comprehensive overview of the innovation trends & startups that impact your company.

These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 3 790 000+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant technologies and industry trends quickly & exhaustively.

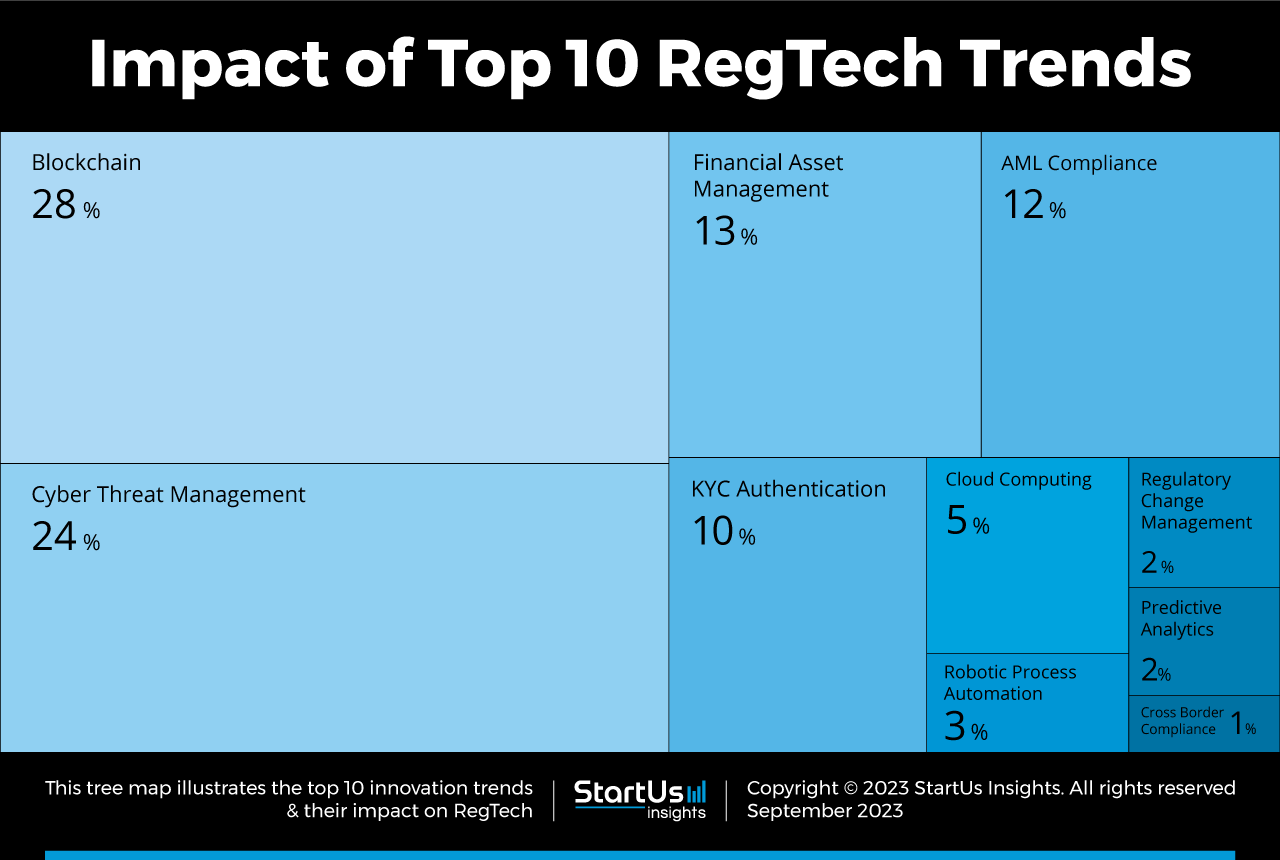

Tree Map reveals the Impact of the Top 10 RegTech Trends

Based on the Regulatory Technology Innovation Map, the Tree Map below illustrates the impact of the Top Trends in Regulatory Technology in 2024. Startups utilize advanced technologies to monitor and counteract cyber threats, ensuring data security against potential breaches. Innovations in asset management optimize investment portfolios and enhance overall decision-making. Further, technological advancements automate AML compliance and KYC onboarding processes, accurately identifying high-risk profiles in real time.

RegTech startups further leverage blockchain, biometric security, AI, and machine learning to monitor transactions consistently. This improves transparency and enables all stakeholders to verify identities and prevent fraudulent activities. Additionally, cloud computing solutions aid data storage and accurate analysis for regulatory purposes. RPA automates repetitive and rule-based compliance tasks, reducing human errors in regulatory processes. Lastly, smart auditing employs data analytics and AI to conduct comprehensive and efficient audits.

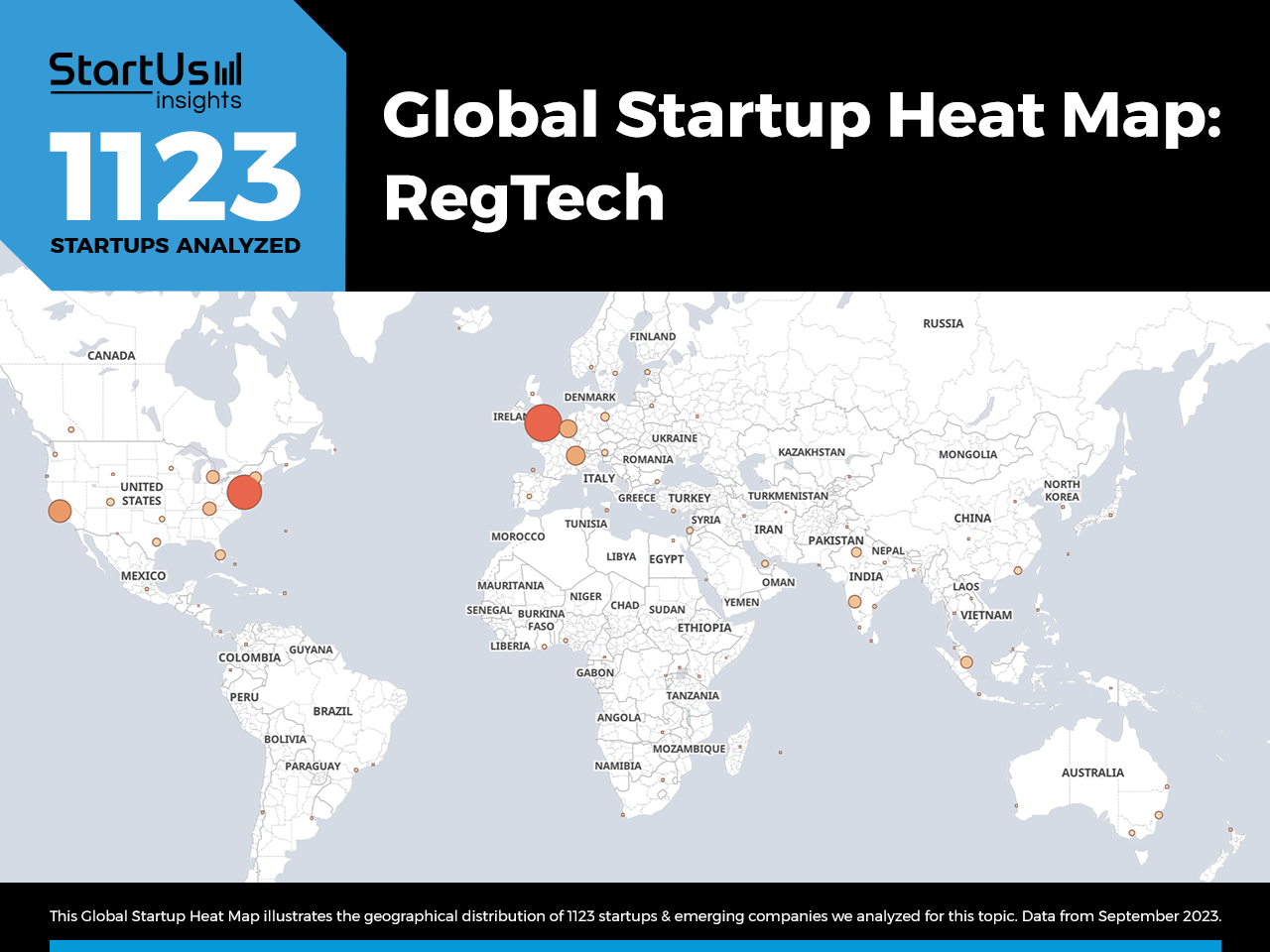

Global Startup Heat Map covers 1123 RegTech Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 1123 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals high startup activity in the East Coast US and the UK.

Below, you get to meet 20 out of these 1123 promising startups & scaleups as well as the solutions they develop. These regulatory technology companies are hand-picked based on criteria such as founding year, location, funding raised & more. Depending on your specific needs, your top picks might look entirely different.

10 Emerging Trends in Regulatory Technology (2024)

1. Blockchain

Emerging companies integrate blockchain solutions to enable real-time tracking of financial transactions to ensure security, transparency, and regulatory compliance. This tackles the issue of identifying and preventing financial criminal activity through automatic monitoring and transaction validation.

Additionally, startups employ technologies such as advanced analytics, distributed ledgers, and smart contracts to create tamper-proof audit trails. Financial institutions benefit from heightened effectiveness, minimized risks, and simplified reporting, ensuring a more accountable and secure financial framework.

KryptoGO aids Regulatory Investigations

Taiwan startup KryptoGO combines AI and blockchain for enhanced business compliance and security. Its regulatory investigation engine provides customer risk scores and uses classification techniques to monitor and record blockchain transactions. Additionally, it generates risk analysis of cryptocurrency addresses and classifies the high-risk customers that require manual review.

The startup’s DLT technology simplifies the exchange of data, searches for sanctions lists, and analyzes digital footprints in real time. This allows businesses to comprehend the background information of an entity. Further, KryptoGo provides compliant customer risk management and monitoring mechanisms for companies to quickly identify financial criminal activities.

VaultLink simplifies Transaction Surveillance

US-based startup VaultLink specializes in blockchain transaction analysis for the banking sector. The transaction surveillance platform continuously monitors potential suspicious activities and high-risk behaviors. It also creates an online representation of all assets held in custody by a bank that enables customers to make instant payments and value transfers.

2. Cyber Threat Management

Cybersecurity is an emerging trend in RegTech that integrates AI, machine learning, and blockchain to tackle the growing menace of cyber threats. Regulatory compliance mechanisms like the KYC registry contain highly sensitive customer information. Therefore, startups develop systems to prevent unauthorized access, minimize malicious threats, and control the consequences of data breaches. Regulatory technologies in this spectrum include cloud security, mobile security, built-in encryption, cryptography, and biometrics.

Cybersecurity assessment platforms further empower organizations to minimize the financial and reputational losses that arise from cyber incidents. This, in turn, promotes a more secure and resilient operational landscape. Cybersecurity solutions significantly impact sectors like finance and healthcare, empowering them to fortify cybersecurity measures and safeguard sensitive information.

Cyvatar.AI tackles Endpoint Breaches

US-based startup Cyvatar.AI provides a cybersecurity platform that allows businesses to achieve compliance by tackling endpoint breaches. It integrates an antivirus system that blocks malicious threats.

Additionally, the platform offers an interactive heat map that visualizes common risks, enabling businesses to mitigate the most significant cyber threats. Cyvatar.AI enables firms to access cybersecurity strategies, execute them, and visualize compliance assessment results within a single dashboard.

Peris.ai offers Cybersecurity Assessments

Indonesian startup Peris.ai develops a cybersecurity assessment platform to safeguard businesses against cyber threats. It proactively identifies vulnerabilities and weak points by simulating a phishing attack on the system, preventing its exploitation by malicious actors.

The startup conducts regular assessments and penetration testing to assist businesses in maintaining compliance with industry and government regulations. Further, real-time network visibility allows for improved decision-making on how to deal with potential threats.

3. Financial Asset Management

Businesses employ big data, analytics, cloud computing, and blockchain to reshape financial asset management within regulatory frameworks. Startups are driving innovation to address compliance and operational efficiency challenges faced by asset management firms, financial institutions, and investors. Through customizable platforms, they accommodate specific asset classes, investment strategies, and geographical jurisdictions. As a result, asset managers easily navigate intricate compliance frameworks while maintaining operational flexibility.

Asset managers must report hundreds of disclosures to multiple entities. At the same time, they need to reduce the number of systems required for regulatory reporting. RegTech solutions harness advanced data analytics and systems integration to produce multiple reports at once. Hence, firms receive the added benefit of centralized data management and getting a clearer picture of their business risk. Companies also leverage natural language processing (NLP), AI, and ML to automate compliance processes and regulatory reporting in financial operations.

FreeFlow Finance offers a Digital Currency Single-Window Platform

Chinese startup FreeFlow Finance provides a digital currency single-window platform to aid governments in transitioning to regulated digital assets. The volatility in digital currencies has raised concerns regarding market manipulation, insider trading, and price fluctuations.

Therefore, this solution enables digital assets to be exchanged globally in a fully compliant system with digital identity functionality. Further, FreeFlow integrates an infrastructure that connects all regional digital and traditional payment rails to enable any country’s strategic digital finance ecosystem development.

Greenomy simplifies Regulatory Reporting

Belgian startup Greenomy provides regulatory reporting software to monitor and adjust investments to ensure compliance. The software integrates sustainability initiatives into portfolios and assets. Further, it allows companies to track and assess their compliance with ESG requirements and get alerts on new developments in the regulatory landscape.

Greenomy uses digitization to modernize data capture and reporting for corporates, credit institutions, and asset managers to meet regulations on sustainable finance EU taxonomy.

4. AML Compliance

It is challenging for financial institutions to navigate the area of anti-money laundering regulations. Financial institutions face billions in compliance costs and penalties, along with damaged credibility and blocks to innovation and growth in case of non-compliance with AML regulations. Therefore, startups leverage AML tracking solutions to tackle money laundering. Technological advances enable businesses to comply with regulatory requirements by monitoring transaction behavior to detect fraudulent patterns across channels.

Startups and scaleups utilize technologies such as AI, machine learning, and big data for financial institutions to achieve better accuracy. These technologies also improve the consistency of flagging and minimize false negatives. AML-focused RegTech solutions thus allow financial institutions to manage the risks of money laundering, terrorism financing, and sanctions.

Mopso offers an Anti-Money Laundering Platform

Italian startup Mopso provides an AML platform that detects illegal activities in daily customer transactions. It incorporates advanced algorithms and machine-learning tools to identify money laundering schemes. Mopso’s network assessment tools enable banks and financial institutions to assess and identify potential customers’ suspicious behaviors more effectively.

CleverChain enables Automated AML Compliance

UK-based startup CleverChain offers an AI-powered customer risk assessment platform to automate AML compliance processes. Using the platform, organizations accurately assess risk in real-time. The startup leverages explainable AI and ML algorithms to identify potential high-risk behaviors.

The startup’s intelligent platform automation allows for improved accuracy and quality while reducing costs. CleverChain enables organizations to significantly reduce time and streamline processes in terms of AML and customer due diligence.

5. KYC Authentication

Another emerging trend in RegTech covers know-your-customer authentication to streamline and enhance the customer onboarding process. Companies leverage advanced AI-driven solutions to complete identity checks, authenticate documents, and assess risks.

Powered by biometric recognition, NLP, and machine learning, KYC solutions accelerate workflows. These innovations lead to a more secure and smooth banking experience for financial institutions, compliance teams, and customers. As a result, businesses benefit from reduced onboarding difficulties, improved accuracy, and better regulatory oversight.

ClearDil provides a KYC Compliance Platform

UK-based startup ClearDil automates KYC compliance workflows to reduce costs, delays, and administrative errors. The platform integrates video interviews, liveness checks, and identity verification using government-issued ID to fight facial spoofing and streamline KYC onboarding.

Further, the startup uses KYC mobile SDK (software development kit) to verify customers’ identities in seconds. Lastly, ClearDil enables compliance teams to streamline risk operations, prevent fraud, and enhance trust by verifying the identity of the customers globally.

Qkvin enables Automated Customer Verification

UK-based startup Qkvin automates customer verification processes, enabling the compliance team to focus on other high-value tasks. The startup leverages AI and ML models to customize manual workflows and processes.

This offers a seamless onboarding experience with automated identity verification and risk assessment. Moreover, Qkvin enables organizations to comply with evolving KYC regulations while reducing the risk of violations, fines, and reputational damage.

6. Cloud Computing

Cloud computing enables scalable infrastructure for data storage, processing, and analysis to address the challenge of complex and evolving regulations. In the past, banks faced challenges in generating the metrics required by regulators, leading to delays in the regulatory process and substantial fines. To avoid this, startups create innovative solutions for swift regulatory adaptation and optimizing compliance cost management. Cloud computing facilitates seamless collaboration with external parties, including regulators and other regulated entities, as it allows remote access.

Cloud-powered regulations management thus streamlines data sharing and collaboration on compliance matters among multiple parties. Cloud-based RegTech solutions empower banks and regulators to develop platforms harnessing artificial intelligence and machine learning. This results in an end-to-end automated system that offers automated financial compliance interpretation. Additionally, data can be continuously monitored, enabling companies to swiftly detect risks and potential non-compliance areas.

ComplyFirst advances Automated Regulatory Reporting

UK-based startup ComplyFirst builds a cloud-based platform that enables firms to automate their regulatory reporting. It streamlines the reporting process from initial data collection to submission. As such, it collects and enriches data using legal logic and validates them to prevent potential conflicts and errors.

Further, ComplyFirst uses legal-vetted workflows to enable firms to focus more on innovation and boost growth while remaining compliant with FCA reporting standards.

Fintops specializes in Financial Risk Management

French startup Fintops employs cloud computing to enhance compliance and financial calculations for banks. The solution speeds up risk calculations, enabling cost reduction by optimizing workload and minimizing computation management costs.

The cloud technology ensures that the sensitive bank data is fully anonymized, encrypted, and stored via a secured transit protocol. Further, Fintops assists financial institutions in handling regulatory and financial risk management faster and more effectively.

7. Robotic Process Automation

Regulatory compliance often requires repetitive manual tasks such as collecting, verifying, and reporting data. As such, RPA utilizes software to automate repetitive compliance tasks, enhancing accuracy and efficiency. Startups leverage other technologies such as AI and ML to enable intelligence process automation and increase efficiency by creating a virtual workforce that learns from data sets.

RPA bots gather and analyze data from diverse sources, perform cross-referencing tasks, and generate precise reports. This not only reduces the risk of human errors but also ensures consistent compliance. Moreover, RPA enables enterprises to perform real-time compliance monitoring by continuously analyzing data from multiple systems and apps. Further, this aids businesses in quickly identifying compliance issues and taking corrective action, reducing noncompliance risks and enabling proactive decision-making.

Audibots makes a Regulatory Compliance Review Bot

Audibots based in Chile offers review bots that detect non-compliance issues through various data sources. This solution protects businesses from possible losses caused by the changes in regulations.

Moreover, the bots review regulatory compliance with taxes, social laws, and patents by saving time and preventing fines. Audibots thus enables businesses to keep track of compliance with tax and labor obligations.

AskLulo designs KYC Bots

AskLulo is a South African startup that develops bots that operate on instant messaging platforms to simplify KYC processes. It allows financial institutions and organizations to quickly guide clients through compliance procedures by streamlining and expediting KYC checks.

The KYC bots revolutionize client identification, making compliance efficient and user-friendly. AskLulo enables the automation of business processes, reducing costs and friction.

8. Regulatory Change Management

Regulatory change management (RCM) is a multi-step process that allows organizations to maintain compliance with newly introduced regulations. The regulatory landscape has become more complex, marked by the volume and speed of regulatory changes that require massive manual work. Regulatory change management streamlines capturing, curating, identifying, extracting, and managing regulatory changes.

RCM tools empower financial institutions to better manage regulatory change by collecting data in one place. This enables compliance teams to organize regulatory changes and map regulatory changes to the firm’s policies and controls. Emerging technologies allow financial firms to enhance their compliance teams’ efficiency and effectiveness.

Single Rulebook specializes in Regulation Tracking

UK-based startup Single Rulebook develops integrated software to search, share, and manage regulatory change more efficiently. It allows businesses to synchronize all policies and systems as well as control them to reach regulatory requirements, track changing regulations, and reduce risk.

Single Rulebook’s platform incorporates features like interactive rule maps to provide visual guidance of each rule. The regulation tracking tool monitors the decision-making and reports on actions/courses taken, providing a comprehensive audit trail.

RequirementONE provides a Regulatory Change Management Platform

Singaporean startup RequirementONE offers a regulatory change management platform for instantaneous access to global regulatory developments. This tool collects regulatory updates from various sources on time.

Hence, the platform constantly monitors the websites of global regulators, industry associations, and standards. This allows organizations to identify new regulatory updates promptly, regardless of the language.

9. Predictive Analytics

Regulatory compliance involves the assessment of a vast volume of data to detect potential hazards and ensure adherence to regulatory prerequisites. Compliance teams conventionally rely on time-consuming models to assess risks of non-compliance. To tackle this, startups leverage statistical algorithms, predictive modeling, and machine learning to identify potential compliance issues on time.

The incorporation of predictive analytics into Regtech significantly enhances the efficiency and accuracy of compliance operations. They allow companies to forecast risks by analyzing historical data, market dynamics, and regulatory shifts. This enables companies to stay ahead of the curve and make informed strategic choices.

4CRisk.ai improves Information Security Management

US-based startup 4CRisk.ai makes an information security program that provides predictive analytics and decision-making insights. It facilitates the early detection of risks by assessing the robustness of controls, policies, and incident remediation strategies.

Thus, it allows businesses to minimize compliance costs and decrease the risk of non-compliance. 4CRisk.ai leverages AI to extract relevant governance, risk, and compliance intelligence to convert risks into opportunities.

Neo-analytics provides a Cloud-based Regulatory Analytics Tool

Australian startup Neo-analytics provides a financial regulatory management platform that utilizes predictive analytics for banks to remain ahead of anomalies and expose hidden customer behaviors. It integrates into bank systems to enable 360 degrees of cognitive surveillance.

The startup’s cloud-based analytical tool also combines AI and NLP to monitor and compare input from regulators and scan operational data, ensuring businesses remain compliant. Neo-analytics specializes in AI and ML, enhancing customer visibility and enabling digital data utilization.

10. Cross-Border Compliance

Cross-border compliance is a transformative change in global regulatory compliance, enhancing operations and reducing compliance risks. Understanding the differences between domestic and international payments is crucial for businesses to make safe and efficient cross-border payments. Cross-border compliance deploys AI, ML, and data analytics to create a harmonized regulatory framework across diverse jurisdictions.

Automation plays a pivotal role as it facilitates identity verification while AI and ML further enable proactive detection of suspicious activities. RegTech solutions streamline compliance processes and reduce the risk of fines and reputational damage for multinational corporations. The trend also reduces risks associated with international financial operations, thereby increasing investor confidence.

Sales Road Maps Online ensures Cross-border Marketing Compliance

UK-based startup Sales Road Maps Online offers business-focused insights into the alternative investment fund (AIF) cross-border marketing regulations. This solution provides businesses with the necessary information and guidance to adhere to the diverse regulatory frameworks of various jurisdictions.

Researching marketing restrictions for AIFs across international jurisdictions is both time-consuming and costly. SRMO’s intuitive interface allows businesses to easily navigate and find the compliance information they need efficiently.

AiPrise accelerates Cross-Border Payments

US-based startup AiPrise develops an AI-powered platform that makes cross-border payments safer and easier. It streamlines regulatory compliance through a unified dashboard across vendors. With each verification, AiPrise employs a series of third-party APIs to conduct processes like KYC, KYB, AML checks, fraud detection, and data enrichment.

The company’s AI-enabled systems conduct customer due diligence checks in real time, ensuring that transactions remain compliant with regulations. AiPrise offers a customizable onboarding flow for companies to boost growth while meeting cross-border requirements.

Discover all Regulatory Tech Trends, Technologies & Startups

The future of RegTech looks promising with increased automation, standardization, and simplification across industries. It will further evolve as financial institutions launch new services, prompting new regulations and compliance costs. Furthermore, advances in AI significantly improve risk and compliance management processes by analyzing vast amounts of data, enabling automated compliance decisions.

The RegTech Innovations, Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.