Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the FinTech industry. This time, you get to discover five hand-picked personal finance startups.

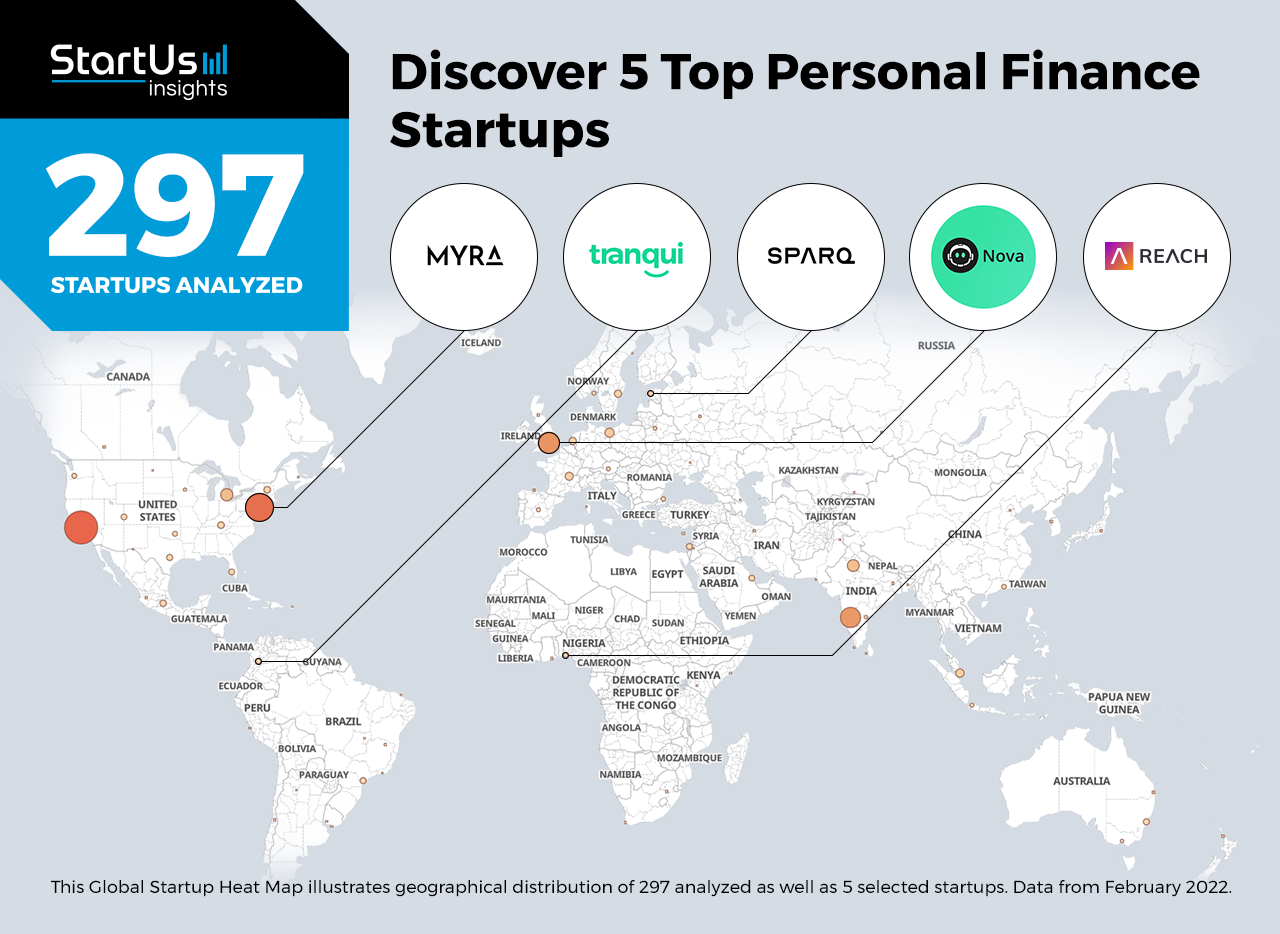

Out of 297, the Global Startup Heat Map highlights 5 Top Personal Finance Startups

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 297 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 292 personal finance solutions, get in touch with us.

Reach enables Expense Management

Founding Year: 2016

Location: Lagos, Nigeria

Use this solution for Spending Tracking

Nigerian startup Reach provides a smartphone application for expense management. The Reach app enables users to automatically as well as manually feed their income and record all expenses that the users make. The app collects transaction data from messages and other banking or financial apps, which the users use on their phones, and provides categorical interpretation. It enables individuals to summarize and manage their spending and make informed financial decisions.

Tranqui provides Debt Planning

Founding Year: 2017

Location: Cali, Colombia

Funding: USD 150 000

Reach out to Tranqui for Bills and Mortgage Management

Colombian startup Tranqui develops a financial platform that for better debt management and planning. The Tranquil platform analyzes its user’s financial goals based on the user’s answers to a set of questions. It then suggests and educates individuals to take actions to reach their financial goals including timely bill payment, debt repayment, as well as tracks progress. Additionally, the startup’s platform provides various tools such as a virtual simulator, negotiation, and debt planning modules that empower users to seek alternative mortgage providers to manage their debts. It reduces the burden of late payment fees, lowers installment value, and enables better debt planning for its users.

Nova facilitates AI-powered Budgeting

Founding Year: 2018

Location: London, UK

Funding: GBP 240 700

Use this solution for Personal Budgeting

British startup Nova builds an AI budgeting app that aggregates various banking apps to assist in personal financial budgeting. Nova’s AI algorithms provide a simplified overview of all transactions accumulated from only those banking applications that the user connects to the app, protecting the user’s privacy. The platform automatically sets a budget based on the user’s past transaction data and warns if their spending goes beyond their set financial objectives. Nova rewards its users with novacoins, the platform’s native crypto tokens, for adhering to their budgets and objectives. The app provides its users with financial education through its simplified user financial data analysis.

SPARQ gamifies Financial Management

Founding Year: 2019

Location: Tallinn, Estonia

Funding: EUR 540 000

Innovate with SPARQ for Neobanking

Estonian startup SPARQ is a financial platform for complete personal finance management. The startup’s smartphone app features a bill and subscription tracking dashboard and enables reserve savings creation and international payment across the European Union. SPARQ app gamifies financial management by enabling individuals to set personal financial challenges and incentivizes their disciplined financial behavior by giving rewards. Individuals are empowered to take control of their finances digitally and in a gamified way by using the app.

MYRA enables Investment Management

Founding Year: 2017

Location: New York, US

Use this solution for Retirement Planning

US-based startup MYRA builds a digital platform to provide dedicated and equitable financial services to US citizens as well as immigrants. The platform is available in three subscription tiers featuring retirement planning, tax, and insurance management, among other services. The platform also offers online consultation with certified financial planners (CFP). It also connects individuals with other financial products that complement the startup’s services to provide comprehensive and personalized investment management.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on open banking, crypto wallets, and peer-to-peer (P2P) transactions. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.