Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

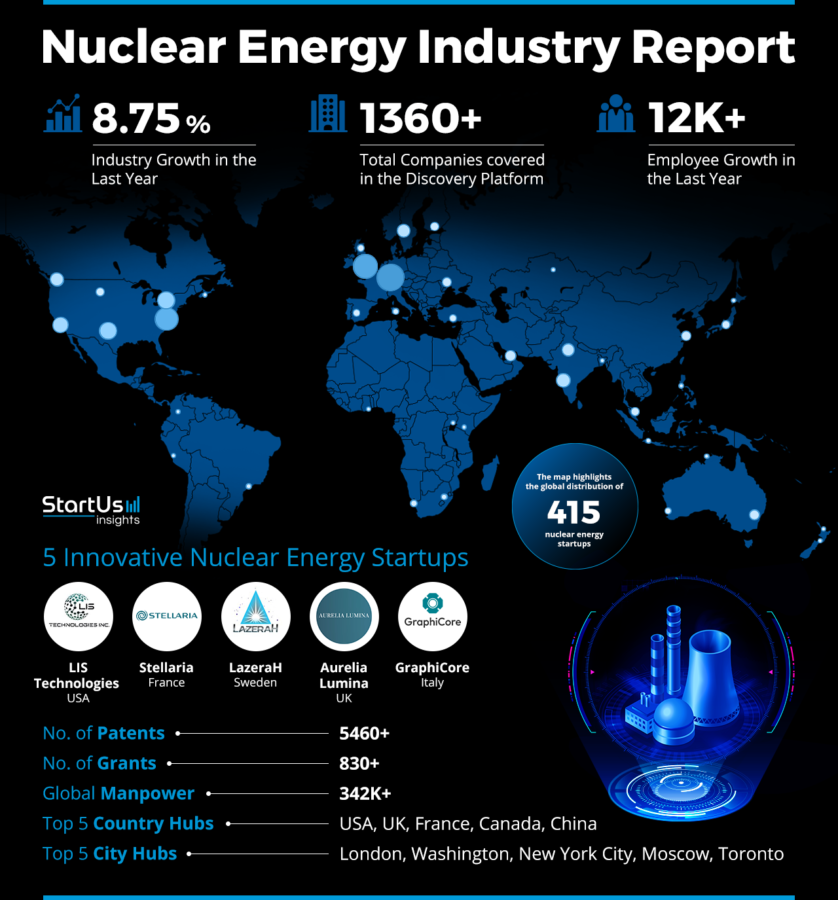

The Nuclear Energy Industry Report 2025 provides a comprehensive analysis of the global nuclear sector through firmographic, innovation, and investment perspectives. Nuclear energy gains momentum through advancements in technologies like novel reactor solutions, radioactive waste management, and detection systems.

Moreover, the report highlights the influence of early-stage ventures with the rise of institutional funding and international partnerships. This assists in building a more technology-driven energy sector. From small modular reactors to antimatter research, the nuclear sector increasingly emerges as a foundation for low-carbon infrastructure and global energy security.

Executive Summary: Nuclear Energy Industry Outlook 2025

- Industry Growth Overview: The global nuclear energy sector recorded an annual growth rate of 8.75%. It is projected to grow from USD 36.72 billion in 2025 to USD 48.68 billion by 2032

- Manpower & Employment Growth: The nuclear industry employs over 342 400 professionals globally. In the past year, the workforce expanded by 12 600 new hires.

- Patents & Grants: The industry filed 5461 patents from 1761 applicants. Additionally, 838 research grants were awarded over the past year. The United States and China lead in patent output, with 1084 and 1010 patents, respectively.

- Global Footprint: Activity is concentrated in key hubs such as the USA, the UK, France, Canada, and China. The leading cities include London, Washington, New York City, Moscow, and Toronto.

- Investment Landscape: The sector closed 722 funding rounds backed by 602 investors, with an average deal size of USD 79.5 million. Over 202 companies received funding, signaling broad-based investor confidence.

- Top Investors: The total investment from the top investors in this sector amounts to approximately USD 7.7 billion. Some of these investors include CDC Group, Export Development Canada, Small Industries Development Bank of India (SIDBI), MacArthur Foundation, and more.

- Startup Ecosystem: Five innovative startups in this sector are LIS Technologies (laser isotope separation), Stellaria (molten salt reactor), LazeraH (antimatter energy reactor), Aurelia Lumina (accelerator-driven reactor), and GraphiCore (graphite reactor decommissioning).

Methodology: How we created this Nuclear Energy Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of nuclear energy over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within nuclear energy

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the nuclear energy market.

What Data is used to create this Nuclear Energy Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the nuclear energy market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: More than 10 570 news articles were published in the last year.

- Funding Rounds: 720+ funding rounds were closed in the last year.

- Manpower: The industry employs over 342 400 workers globally and added more than 12 600 new employees in the past year alone.

- Patents: More than 1760 applicants filed about 5460 patents.

- Grants: The sector was granted about 830 grants.

- Yearly Global Search Growth: The nuclear energy industry experienced a yearly global search growth of 8.06%.

Explore the Data-driven Nuclear Energy Industry Report for 2025

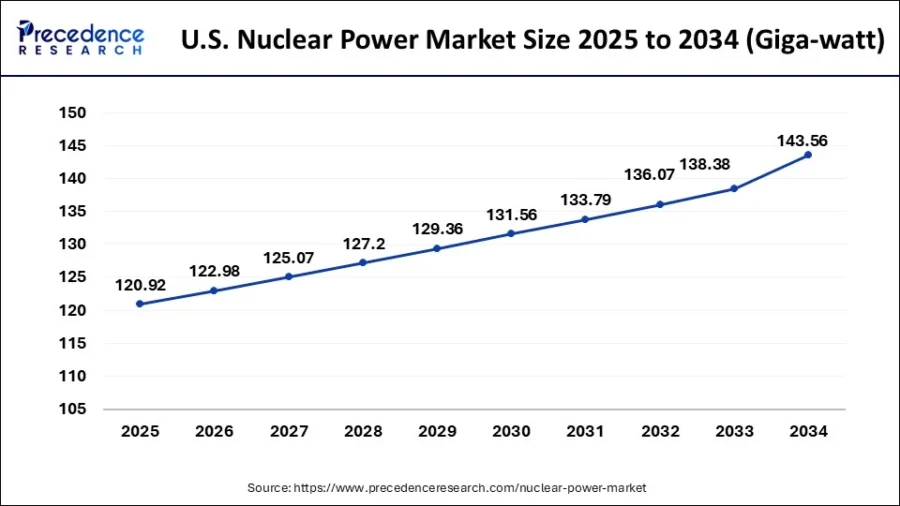

The heatmap section of this report provides a visualization of the current global landscape in the nuclear energy sector. The global nuclear power market is projected to grow from USD 36.72 billion in 2025 to USD 48.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.1% over the forecast period.

Credit: Precedence Research

Global nuclear power demand reached 118.90 gigawatts in 2024 and is projected to grow to 143.56 gigawatts by 2034, expanding at a CAGR of 1.90% from 2025 to 2034.

Our Discovery Platform showcases about 1360 companies in this industry, including 415 innovative startups.

Over the past year, the sector achieved a growth rate of 8.75%. This progress is further reflected in the industry’s focus on research and development, with 5461 patents filed and 838 grants awarded.

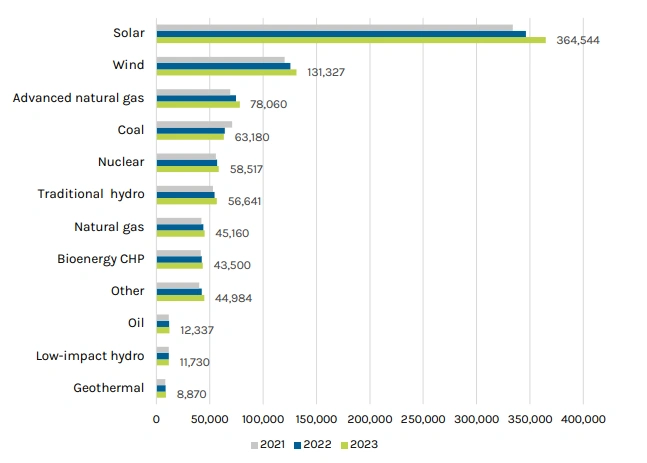

Electric Power Generation Employment by Technology

Credit: US Department of Energy

In 2023, nuclear electric power generation (EPG) businesses employed 58 517 workers and marked a 2.8% increase from 2022.

The professional and business services sector added 1079 new jobs. It was the second-largest employment sector within nuclear EPG, with 10 819 workers, following utilities, which led with 41 241 workers.

Based on our data, the global workforce in nuclear energy now stands at approximately 342 400 professionals based on our data, with 12 600 new jobs created in the last year alone.

Geographically, the heatmap identifies the USA, the UK, France, Canada, and China as the top five country hubs. Similarly, London, Washington, New York City, Moscow, and Toronto emerge as leading city centers for nuclear energy activity.

A Snapshot of the Global Nuclear Energy Market

The nuclear energy sector records an annual growth rate of 8.75%. The industry’s innovative landscape is highlighted by the presence of 415 startups, with 40+ identified as early-stage ventures. Additionally, the sector includes 65+ mergers and acquisitions (M&A).

On the innovation front, the industry showcases the intellectual property portfolio, with 5461 patents filed by 1761 unique applicants. However, the yearly patent growth experienced a slight decline of 2.84%. The USA and China emerge as the leading contributors to this patent activity, with 1084 and 1010 patents issued, respectively.

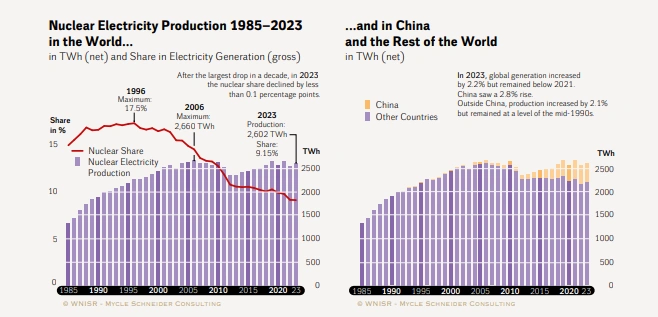

Further, global nuclear electricity production reached 2602 TWh in 2023, with nuclear’s share in electricity generation at 9.15%.

China contributed to the growth with a 2.8% increase in production, while the rest of the world saw a 2.1% rise. The overall increase in global nuclear generation was 2.2%, still below the 2021 level.

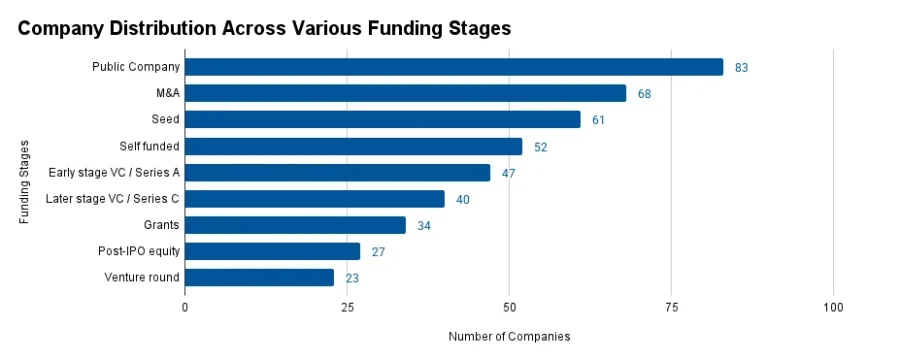

Explore the Funding Landscape of the Nuclear Energy Market

The nuclear energy sector received an average investment value of USD 79.5 million per funding round.

Over 602 investors participated in more than 722 closed funding rounds. This capital has been distributed across more than 202 companies to support both established firms and emerging startups.

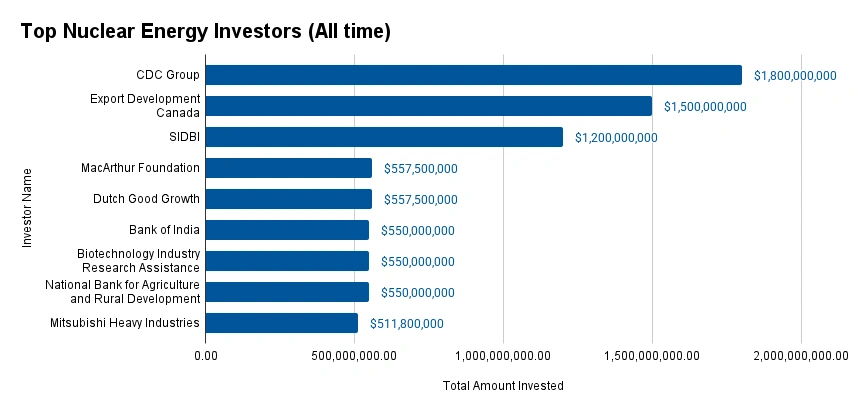

Who is Investing in the Nuclear Energy Market?

The combined value invested by the top investors in the nuclear energy sector exceeds USD 7 billion.

- CDC Group allocated USD 1.8 billion to one company.

- Export Development Canada provided USD 1.5 billion in funding to at least one company.

- SIDBI contributed USD 1.2 billion to a minimum of one company.

- MacArthur Foundation channeled USD 557.5 million into at least one company.

- Dutch Good Growth extended USD 557.5 million to a minimum of one company.

- Bank of India committed USD 550 million to a single company.

- Biotechnology Industry Research Assistance Council invested USD 550 million in one company.

- The National Bank for Agriculture and Rural Development supplied USD 550 million to at least one company.

- Mitsubishi Heavy Industries dedicated USD 511.8 million to at least one company.

Top Nuclear Energy Innovations & Trends

Discover the emerging trends in the nuclear energy market along with their firmographic details:

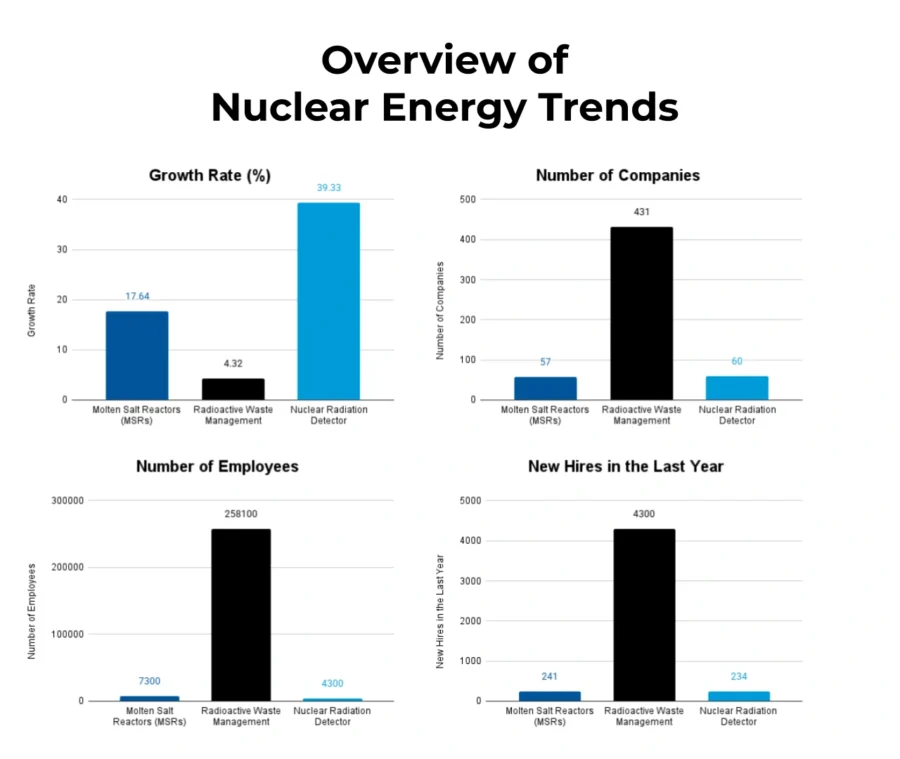

- Molten Salt Reactors (MSRs): The annual growth rate for MSRs stands at 17.64%. With 57 companies identified and a workforce of 7300 employees, the sector includes 240+ new hires in the past year.

- Radioactive Waste Management: With an annual growth rate of 4.32%, managing radioactive waste remains a cornerstone of the industry. It includes 431 companies and employs a workforce of 258 100 with 4300 new employees added in the last year.

- Nuclear Radiation Detector: The nuclear radiation detector market includes at least 60 companies and a total of 4300 employees. It hired 234 new employees in the past year. This domain shows an annual growth rate of 39.33%.

5 Top Examples from 400+ Innovative Nuclear Energy Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

LIS Technologies develops Laser Isotope Separation Technology

US-based startup LIS Technologies offers laser isotope separation technology (LIST) that excites uranium hexafluoride (UF6) molecules using infrared lasers. This process separates the isotopes needed for nuclear fuel.

The technology applies the condensation repression isotope selective laser activation (CRISLA) method to target a specific vibrational mode of the U-235 isotope. It uses shorter wavelengths and materials with low absorption.

This reduces costs, avoids scaling issues, and supports uranium enrichment for both large-scale nuclear reactors and small modular reactors (SMRs) and microreactors.

Stellaria builds a Molten Salt Nuclear Reactor

French startup Stellaria develops Stellarium, a molten salt fast neutron reactor for in-operation fuel renewal. It operates using liquid fuel, including uranium, thorium, plutonium, and americium, to achieve thermal stability.

Further, the reactor operates at atmospheric pressure and includes four containment barriers along with a buried installation for enhanced protection against seismic and aerial risks. As internal temperatures rise, the expanding fuel passively slows the nuclear reaction to allow automatic power regulation without external controls.

The process of fuel preparation involves reprocessing the waste nuclear material, followed by salt purification and customization. The fuel is transported as solid granules and melted within the reactor.

Stellarium enables in situ regeneration and fissioning to balance fuel consumption with minor actinide destruction and plutonium preservation. After extended operation, the salt undergoes recycling and purification for petrochemical plants, mining operations, and data centers.

LazeraH offers Antimatter Energy Reactor

Swedish startup LazeraH develops an antimatter reactor that uses the annihilation of hydrogen in its quantum state to convert matter into antimatter and release energy. The reactor brings protons and antiprotons into proximity to convert atomic mass into energy.

This process achieves full mass-to-energy transformation to provide a clean and efficient energy source. Each compact reactor generates 800 MWh per year. Further, it operates at a power amplification factor of nearly 200 times. Thus, it turns 1250 W of laser input into 248 000 W of net energy output to provide higher energy efficiency.

Aurelia Lumina provides an Accelerator-driven Nuclear Reactor

UK-based startup Aurelia Lumina develops an accelerator-driven small modular reactor (SMR) that generates clean energy by consuming depleted nuclear waste as fuel. The startup’s technology uses a particle accelerator to initiate and sustain the energy generation process.

The use of nuclear waste as fuel and a compact design offer power without the variability of other clean energy sources. It addresses the global energy supply crisis to support both residential and industrial needs.

GraphiCore offers Graphite Reactor Decommissioning

Italian startup GraphiCore develops a vacuum-based grabbing system for decommissioning graphite-moderated nuclear reactors. It reduces the risk of graphite cracking and avoids decommissioning hazards by applying steady compression matched to graphite’s physical behavior.

Moreover, the system’s grabbing mechanism fits into any graphite-moderated reactor. It handles large volumes of graphite blocks in aging reactors to cut waste and improve overall reactor performance.

Gain Comprehensive Insights into Nuclear Energy Trends, Startups, and Technologies

This Nuclear Energy Industry Report 2025 records a sector transitioning into a new phase of innovation, sustainability, and increased deployment. With growing startup activity, funding rounds, and a globally distributed workforce, the industry reflects both scale and agility.

While patent growth has slightly slowed, the core technological base remains decent, with strategic research and sustained public-private interest. The industry shows continued development of advanced reactors, safer waste management, and compact power systems. This shifts it from legacy infrastructure to modular, efficient, and clean alternatives.

Get in touch to explore 400+ startups and scaleups, as well as all market trends impacting nuclear energy companies.