Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

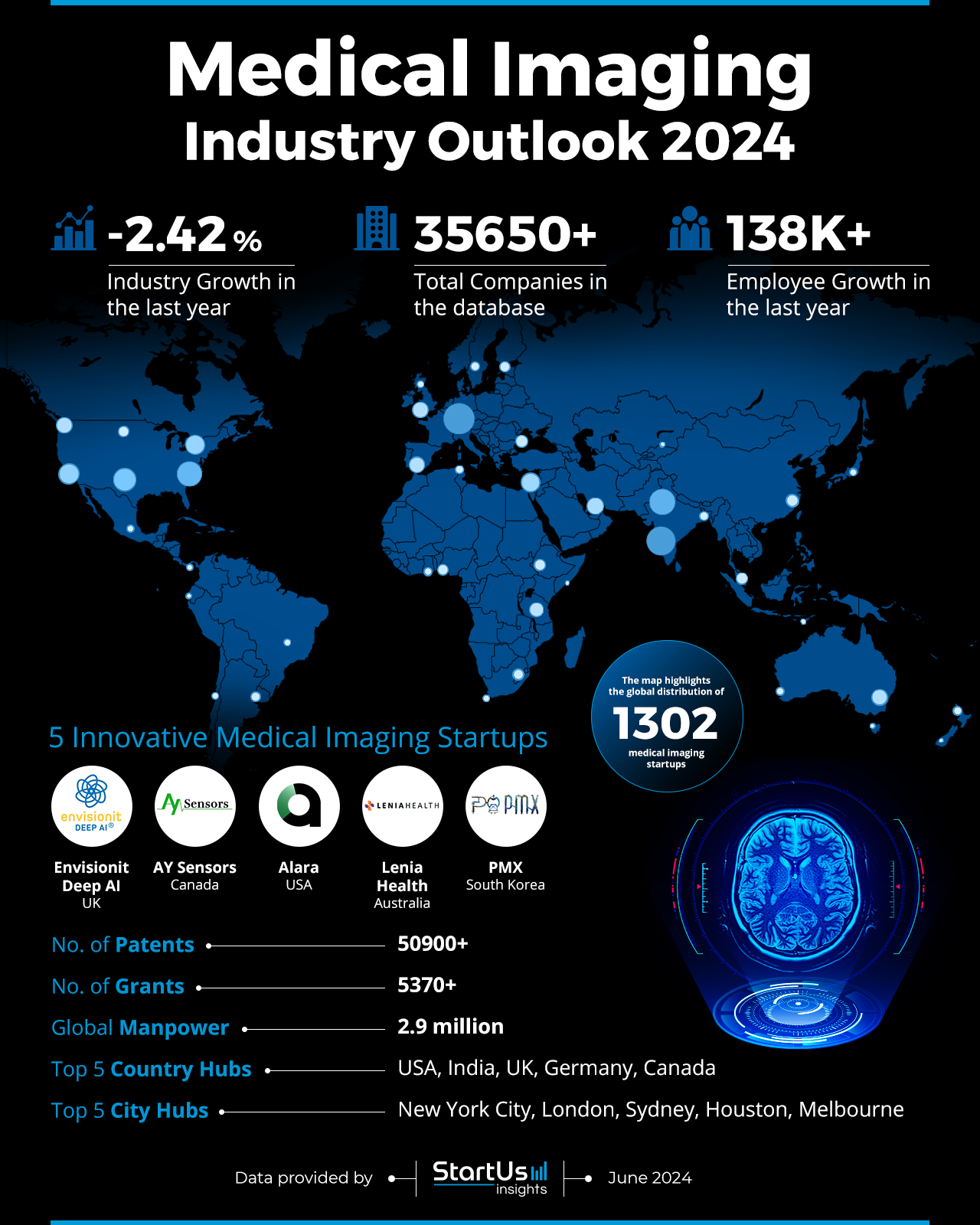

The 2024 Medical Imaging Industry Outlook analyzes the current and future outlook of the medical imaging sector. This report details metrics such as manpower, employee growth, investment trends, and innovation. From patents and grants data to improvements in imaging modalities, like magnetic resonance imaging (MRI) or computed tomography (CT), the industry seeks improvements in diagnostic accuracy and patient outcomes.

This medical imaging report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Medical Imaging Report 2024

- Executive Summary

- Introduction to the Medical Imaging Report 2024

- What data is used in this Medical Imaging Report?

- Snapshot of the Global Medical Imaging Industry

- Funding Landscape in the Medical Imaging Industry

- Who is Investing in Medical Imaging?

- Emerging Trends in the Medical Imaging Industry

- 5 Innovative Medical Imaging Startups

Executive Summary: Medical Imaging Industry Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1300+ medical imaging startups developing innovative solutions to present five examples from emerging medical imaging industry trends.

- Industry Growth Overview: The industry includes over 35650 companies but saw a dip of 2.42% in growth last year.

- Manpower & Employment Growth: The sector employs about 3 million workers. It saw an increase of 138K in the last year.

- Patents & Grants: The industry holds over 50900 patents and more than 5370 grants awarded.

- Global Footprint: Top country hubs include the USA, India, UK, Germany, and Canada. The leading city hubs are New York City, London, Sydney, Houston, and Melbourne.

- Investment Landscape: The average investment value per round stands at USD 22 million. The sector encompasses over 1800 total investors. It closed more than 6980 funding rounds and over 2700 companies received investments.

- Top Investors: A few of the top investors include the US Department of Energy, the National Science Foundation, and Y Combinator. The combined investment by the top investors exceeded USD 63 million.

- Startup Ecosystem: The top five startups include Envisionit Deep AI (AI-based medical imaging), AY Sensors (perovskite semiconductor materials), Alara (imaging integration platform), Lenia Health (workflow integration), and PMX (multi-modality imaging platform).

- Recommendations for Stakeholders: Diversifying investment portfolios across segments, such as diagnostic imaging, AI-driven imaging solutions, and portable imaging devices, will mitigate risks and maximize returns. Entrepreneurs should leverage AI and machine learning to enhance imaging accuracy and diagnostic capabilities. Governments must increase funding for research and development, create policies to encourage investment, and streamline regulatory frameworks to speed up the adoption of new technologies while ensuring safety and efficacy.

Explore the Data-driven Medical Imaging Market Report for 2024

The Medical Imaging Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The database currently includes 1302 startups that reflect the entrepreneurial growth in the industry. The database offers the market view with over 35650 companies listed. Despite a -2.42% industry growth last year, the sector continues to innovate. The sector filed over 50900 patents that highlight the advancement and technological breakthroughs in the sector. Additionally, more than 5370 companies received grants to support research initiatives.

The global manpower in the industry stands at 2.9 million. Employee growth saw an increase of 138 thousand in the last year to showcase the sector’s growing nature. The top five country hubs include the USA, India, the UK, Germany, and Canada. They serve as key centers for industry activities. The leading city hubs include New York City, London, Sydney, Houston, and Melbourne. These reflect the geographical diversity of the industry’s focal points.

What data is used to create this medical imaging report?

Based on the data provided by our Discovery Platform, we observe that the medical imaging industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: More than 7600 news articles were published on the medical imaging industry in the last year.

- Funding Rounds: Our database records more than 6980 funding rounds. This reflects the investor interest and financial support.

- Manpower: The industry employs over 2.9 million workers, with an addition of more than 138K new employees in the last year.

- Patents: The industry holds over 50900 patents which underscores its innovative capacity.

- Grants: More than 5370 grants are awarded to the medical imaging industry to support development initiatives.

- Yearly Global Search Growth: The industry experienced a yearly global search growth of 7.91%. This indicates the interest and awareness of the market among the global population.

- and more. Reach out to us to explore all data points used to create this medical imaging report.

A Snapshot of the Global Medical Imaging Industry

The industry includes a manpower of 2.9 million. This indicates its workforce and reach. Employee growth is showcased with an addition of 138K new employees in the last year, which reflects the industry’s nature and ongoing expansion. Over 35650 companies operate within the industry to demonstrate its scope and market presence.

Explore the Funding Landscape of the Medical Imaging Industry

The financial landscape shows an average investment value per round standing at USD 22 million. The total number of investors involved exceeds 1800 and indicates a diverse and engaged investment community. More than 6980 funding rounds have been closed underscoring the active investment activities and continuous capital flow within the industry.

Additionally, over 2700 companies received investments to highlight the distribution of financial resources and the industry’s appeal to a broad array of businesses.

Who is Investing in Medical Imaging?

The combined investment value by the top investors in the industry exceeds USD 63 million. The leading investors that advanced the industry through funding to various companies include:

- The US Department of Energy supported 11 companies with a total of USD 2.2 million.

- The National Science Foundation backed 9 companies and contributed USD 3 million.

- Y Combinator funded 8 companies, with a total of USD 1.8 million.

- BPI France provided financial assistance to 7 companies, amounting to USD 55.5 million.

- Techstars endorsed 4 companies with an investment of USD 280K.

- The US Environmental Protection Agency assisted 4 companies, allocating USD 340K.

- Venture Kick financed 4 companies, with a total of USD 135K.

- and more. Contact us to explore all investment data in the medical imaging industry.

Access Top Medical Imaging Innovations & Trends with the Discovery Platform

Computer Vision advances with 14202 companies identified in this sector. It employs about 571K individuals and added 66K new employees last year. This reflects an annual trend growth rate of 8.65% and showcases its influence and application in medical imaging.

Image Analysis with 1443 companies identified employs approximately 46K professionals and experienced an influx of 4800 new employees in the past year. Moreover, this trend shows an annual growth rate of 11.41%. These technologies support early disease detection, precise treatment planning, and improved patient care.

Biomedical Engineering is used in about 940 companies operating in this sector. It employs 49K individuals and saw an increase of 3600 new employees over the last year. It reflects an annual trend growth rate of 16.65%. This field integrates engineering principles with medical sciences to develop advanced imaging technologies and devices.

5 Top Examples from 1300+ Innovative Medical Imaging Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a platform demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Envisionit Deep AI offers AI-based Medical Imaging

UK-based startup Envisionit Deep AI utilizes AI to develop medical imaging products, RADIFY and RATify Assurance Tool. The RADIFY platform diagnoses images and highlights abnormalities across X-rays, mammograms, and ultrasounds. While for the chest, it detects tuberculosis and COVID-19 and provides summarized reports. Moreover, it diagnoses breast lesions and supports early detection in breast imaging. RADIFY for ultrasound integrates with mobile tools and achieves radiology-level performance for point-of-care diagnosis. The RATify Assurance Tool validates and monitors real-time evidence and analysis using AI. These AI diagnostic radiology solutions assist with critical findings in intensive care units and emergency rooms.

AY Sensors creates Perovskite Semiconductor Materials

Canadian startup AY Sensors develops high-quality perovskite single crystals for X-ray and gamma-ray detectors to provide sensitivity and resolution for diagnostics. The startup’s technology creates crystals like methylammonium lead bromide (MAPbBr3) and cesium lead bromide (CsPbBr3) that offer crystallinity and X-ray absorption. Its perovskite detectors feature high efficiency, individual photon counting, and reduced dead area between crystals. Additionally, they streamline production through monolithic integration into substrates such as indium tin oxide (ITO)-coated glass and silicon wafers. This approach lowers costs and bypasses traditional high-temperature bonding processes.

Alara builds an Imaging Integration Platform

US-based startup Alara builds a medical imaging technology platform that simplifies sharing medical imaging data securely. Health systems create an account on the Alara platform, provision a gateway, and connect their data systems with enhanced security and visibility. The platform supports compliance with its CMS Measure Compliance software to ensure accurate computed tomography (CT) radiation dosing and patient safety. This setup allows them to monitor data flow and partner with technology companies for secure data sharing and collaboration.

Lenia Health makes Workflow Integration

Australian startup Lenia Health provides scalable and flexible image storage platforms for the medical industry. Its digital imaging and communications in medicine (DICOM) picture archiving and communication systems (PACS) ensure connectivity to all DICOM modalities and secure communication. The startup’s Workflow Orchestrator offers a worklist to manage data from various systems, including scheduling and billing. The Image Viewer supports DICOM and non-DICOM formats, with clinical reporting and mobile access capabilities. Image Connect allows secure, real-time sharing of clinical data without the need for VPNs or emails. These solutions support seamless integration, scalable installation, and responsive design across imaging sectors such as teleradiology, veterinary, and specialty.

PMX develops a Multi-Modality Imaging Platform

South Korean PMX offers health and wellness assessment through its multi-modality imaging platform. The platform-as-a-service solutions include ChestOMX, NeurOMX, and BodyOMX. ChestOMX provides COVID-19 diagnosis via lung structure analysis and segments viral infiltration and 3D lung lobe volume measurement. NeurOMX assesses brain health through MRI, including volumetric quantification and functional analysis. BodyOMX analyzes detailed body composition to manage obesity and vascular health with predictive risk scoring. With these solutions, PMX improves early assessment and treatment across healthcare.

Gain Comprehensive Insights into Medical Imaging Trends, Startups, or Technologies

The 2024 report on medical imaging underscores the sector’s growth, innovation, and financial support. The medical imaging sector faces challenges such as high costs, limited access, and regulatory hurdles. Technologies like AI integration automate image analysis and reduce costs, while cloud-based solutions enhance accessibility. Get in touch to explore all 1300+ startups and scaleups, as well as all industry trends impacting medical imaging companies.