Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the InsurTech industry. This time, you get to discover five hand-picked machine learning startups impacting InsurTech.

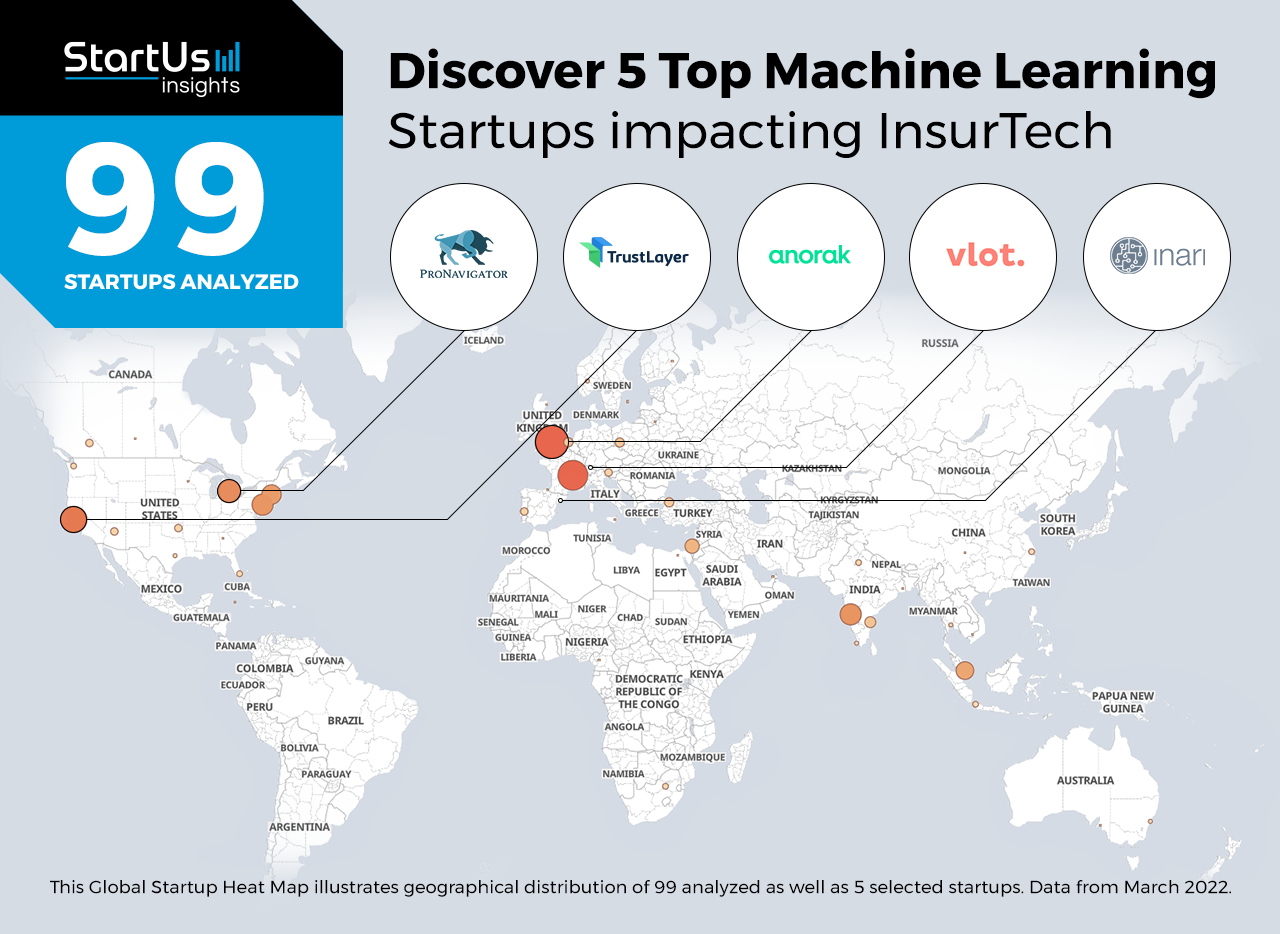

Out of 99, the Global Startup Heat Map highlights 5 Top Machine Learning Startups impacting InsurTech

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 99 exemplary startups & scaleups we analyzed for this research. Further, it highlights five InsurTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 94 ML solutions for InsurTech, get in touch with us.

Inari.io offers Insurance Portfolio Management

Founding Year: 2017

Location: Barcelona, Spain

Use Inari’s solution for Automating Policy Lifecycle Functions

Inari.io is a Spanish startup that uses machine learning (ML) and blockchain for insurance data management. The startup’s software as a service (SaaS) platform recreates the entire insurance policy flow from risk analysis and policy submission to reporting and compliance monitoring. Inari’s ML silo on its platform analyzes risks and recommends actions to match customers’ policy needs. Inari enables insurance companies to manage their portfolios efficiently and ensure their clients’ needs are analyzed in a data-driven approach.

Vlot enables Life Insurance Risk Analytics

Founding Year: 2017

Location: Zurich, Switzerland

Funding: USD 1,1 M

Reach out to Vlot for Dynamic Life Insurance Risk Analysis

Vlot is a Swiss startup that leverages advanced analytics to minimize risks associated with life insurance policies. Vlot’s platform analyzes the current life scenarios of individuals, such as their marital and financial status. With this information, the platform generates a gap assessment report and offers bespoke insurance plans that meet specific client criteria. Vlot also assists individuals to navigate changing circumstances and recommends timely adjustments to their insurance coverage.

TrustLayer facilitates Insurance Verification Automation

Founding Year: 2018

Location: San Francisco, USA

Funding: USD 21,7 M

Parrtner with TrustLayer for Business Coverage Verification

TrustLayer is a US-based scaleup that uses ML algorithms to ensure businesses have correct insurance coverage before they are partnered with. The TrustLayer platform connects all stakeholders of the insurance life cycle: the insured, the requester, and the broker. This enables the requester to check insurance details to save time during communications. Business insurance details are automatically checked on the platform to ensure they are correct and compliant. All this data is stored on the blockchain to make it immutable and easily verifiable by all parties involved. TrustLayer reduces risks and enables its clients to access certified insurance information.

Anorak provides Personalized Insurance Plans

Founding Year: 2017

Location: London, UK

Funding: USD 19,2 M

Collabortae with Anorak for Insurance Policy Matching Solutions

UK-based scaleup Anorak develops an automated insurance matching platform to match individuals with appropriate insurance policies. The platform leverages ML and big data to assess the current and past medical records of clients. Additional factors, such as family, finances, and work hazards, are also taken into account to recommend the best policies for them. This empowers clients to gain security by availing the most suitable insurance policies to protect their families.

ProNavigator offers Insurance Data Management

Founding Year: 2016

Location: Kitchener, Canada

Funding: USD 4,4 M

Work with ProNavigator for Fast Insurance Query Processing

ProNavigator is a Canadian startup applying machine learning to extract data insights for insurance companies. ProNavigator’s platform Sage acts as a central repository to access insurance data available at insurance firms. This data includes process manuals, bulletins, forms, and more. ProNavigator’s platform deep dives into the data and addresses queries raised by insurance agents. This enables insurance companies to reduce operating costs by lowering the in-bound call time to address client requests. This also improves employee efficiency since they deal with more clients in a shorter time.

Discover more InsurTech Startups

InsurTech startups such as the examples highlighted in this report focus on insurance portfolio and verification automation, insurance risk analytics, as well as process optimization and personalization. While all of these technologies play a major role in advancing the insurance industry, they only represent the tip of the iceberg. To explore insurance technologies in more detail, let us look into your areas of interest. For a more general overview, download our free InsurTech Innovation Report to save your time and improve strategic decision-making.