Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Generally, InsurTech is seen as a spin-off field of FinTech. While FinTech has been causing major disruptions in the banking and investment sectors, InsurTech has received less attention. However, many InsurTech innovations have the potential to fundamentally change how insurance practice looks like in the near future: 3-Connects (connected car, home, and self) will not only greatly improve systematic risk assessment of personal insurances, but will also provide knowledge and incentives for clients to actively reduce risks in their life; blockchain, Artificial Intelligence, and Big Data will fundamentally change how insurance data is stored, shared and analyzed.

This article was last updated in July 2024.

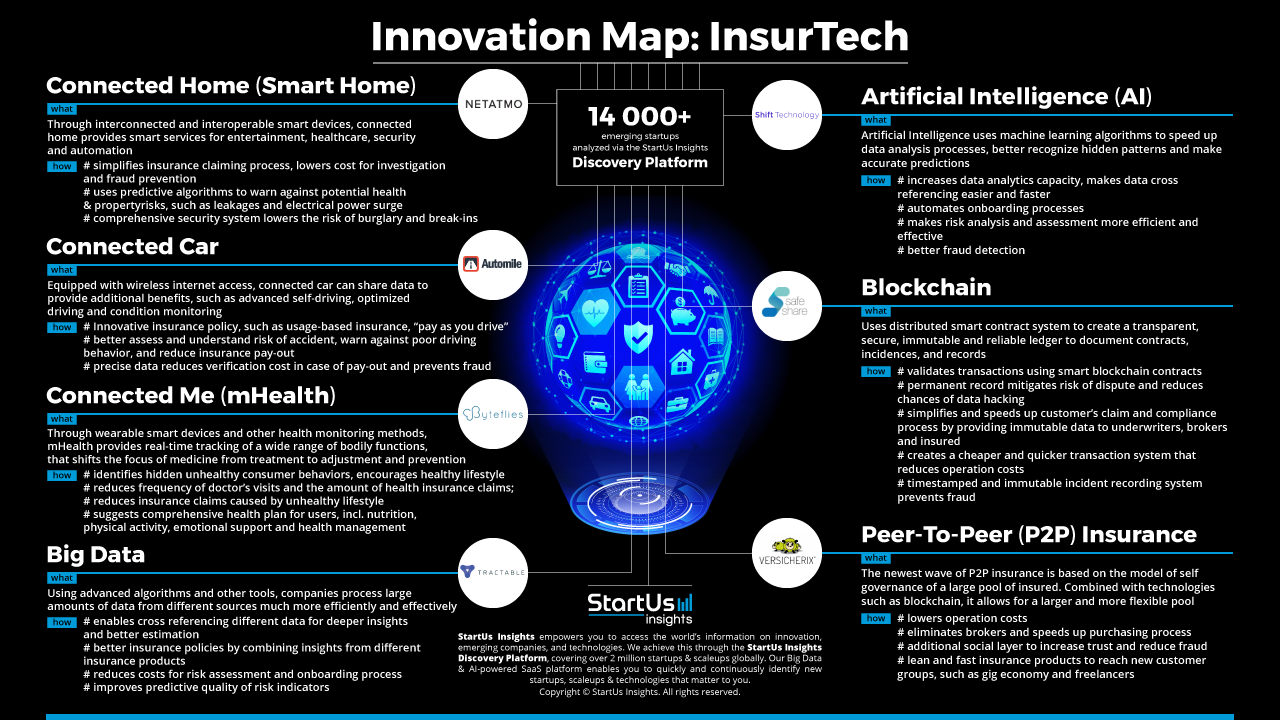

Dive into Our Data-driven InsurTech Innovation Map

At StartUs Insights, we analyzed 14.000 emerging startups to identify the most important emerging innovations and new business models, giving companies in the insurance sector a competitive advantage. The InsurTech Innovation Map is a compact demonstration of our innovation scouting approach, revealing important InsurTechs and technologies with the potential to disrupt the insurance industry.

Ready to explore all 14000+ InsurTech Startups & Scaleups?

3-Connects

The 3-Connects are a crucial part of the Internet of Things (IoT), especially for consumer markets. Through Connected Home (smart home), Connected Car (interconnected self-driving vehicle), and Connected Me (mHealth), the 3-Connects encompass most important aspects of everyday life and are crucial for the future development of InsurTech.

Connected Home (Smart Home)

When connected to a smart central hub, smart home technologies allow real-time monitoring of various home sensory data, such as climate control, air quality and hazard monitoring, security systems, and home automation. Once connected, the system reduces the risk of home break-ins by sending warnings to the homeowner and law enforcement in real time. Predictive algorithms warn against potential health and property risks, such as leakages and electrical power surges. In addition, the data helps insurance companies to simplify the claiming process, to lower the cost of verification, and to prevent fraud.

Connected Car (Interconnected Self-Driving Vehicle)

Equipped with wireless internet access, a connected car shares data to provide additional benefits, such as advanced self-driving, optimized driving, and condition monitoring. Data on driving behavior and car conditions allow insurance companies to better understand their clients’ driving style, more effectively assess traffic risks, and even provide a real-time warning in high-risk regions. In the case of insurance claims, this data reduces verification costs and effectively prevents fraudulent claims.

Connected Me (mHealth)

Through wearable smart devices and other health monitoring methods, mHealth provides real-time tracking of a wide range of bodily functions, that shift the focus of medicine from treatment to adjustment and prevention. Based on real-time monitoring and historical data, mHealth can suggest comprehensive health plans for users, including nutrition, physical activity, and emotional support. In doing this, it encourages users to adopt a healthier lifestyle in the long run, reminds users to undergo regular health check-ups, and ultimately reduces occurrences of severe health issues thus lowering the amount of health insurance claims.

Looking for specific InsurTech Innovation Trends?

Big Data

As the IoT makes a vast number of data points available, this wealth of information puts insurers at a great advantage as they gain important insights that were not available to them before. Big data adds value to the insurance industry as an important data infrastructure. It provides better insights into what is important for clients and helps companies to redesign their solutions. For example, the seemingly endless onboarding and health risk assessment process become redundant, since all this data will be readily available. Instead, big data enables the discovery of interesting and accurate predictors of risk that do not involve asking people questions.

Artificial Intelligence (AI)

Artificial Intelligence uses machine learning algorithms to speed up the data analysis process, better recognize hidden patterns, and make accurate predictions. It is not only a crucial component for insurance companies to handle large amounts of data efficiently and effectively but also supports automating many processes, such as onboarding and patient history investigation. It also takes over many aspects of risk analysis and prediction, so that companies can focus their attention on building relationships with their clients.

Blockchain

Despite the hype surrounding cryptocurrencies, blockchain technology has not been adopted in prominent cases. However, its time-stamped, irrefutable, and immutable ledger and smart contract feature are particularly valuable for future operational processes of insurance: insurance company, broker, and client have access to transparent information with a much lower chance of data breaches; risk tracking and fraud detection is much easier and less time consuming; procedure of transaction, claim handling, and customer compliance are simplified significantly and cost less.

Peer-To-Peer (P2P) Insurance

Even though P2P insurance is not a new model, it has gone through 2 iterations: The first wave is distributive, where a small group of individuals with similar risk levels pool money together to cover each other; the second wave is a carrier model, where the group shares the risk by paying the premium jointly. After a period of time, the leftover unclaimed pool of insurance premiums will be paid back to the group.

The newest wave of P2P insurance, also called Self-governing P2P Insurance, combines blockchain technology and the traditional community structure. It significantly enhances trust among the insured and allows for a much larger shared insurance pool. Blockchain eliminates brokers and significantly boosts the speed of the purchasing and claim process. Through blockchain, insurance companies will be able to provide more adaptive and flexible products to niche market segments.

Disruptive Startups In The InsurTech Industry Include:

- Netatmo is a smart home startup based in France, which offers a comprehensive security system, and a weather system including a personal weather station alongside wind and rain measurements. Netatmo also covers air care and energy optimization within the home.

- Swedish startup Automile has developed a Software as a Service (SaaS) solution that includes various perks such as driver identification, real-time tracking, and geofencing technology to improve safety. Additionally, the startup provides information in the form of a report to the driver aiding them to decrease their premium by sending alerts in the event of driving above the speed limit or other poor driving behavior.

- Belgian startup Byteflies has developed a wearable medical device, Sensor Dot, that is able to measure several medical metrics in real time. It can be attached to any surface area of the body and can be used in a set of 5 to provide a precise measurement. These medical grade real-time data can help to accelerate clinical trials and monitor the progress of physiotherapy treatment.

- Paris-based Shift Technology implements Artificial Intelligence in an effort to help insurers save money by fighting fraud. The startup’s SaaS solution ensures that “efficient algorithms are tailored to reproduce fraud handlers’ deductive reasoning, making investigations quicker and easier than ever”.

- London-based Tractable uses Artificial Intelligence to make the information collected from big data visible and understandable. Specialized in Insurance and Medical Imagery for visual representations of a body’s interior, this startup promises organizations to “perform like never before”.

- UK startup Safeshare uses blockchain technology to provide insurance solutions targeting the sharing and on-demand economy, thereby potentially increasing consumer confidence in these areas. One of the advantages they offer is their short-notice insurance available for varying time spans at competitive rates.

Explore Emerging InsurTech Startups & Technologies

Similar to FinTech, these cutting-edge technologies bring not only disruptions in business processes but will lead to a fundamental transformation of customer engagement and business models: insurances will shift from paying out insurance claims to actively engaging customers to reduce the risk factors or prevent potential damage in the first place.

It is crucial for insurance companies to stay ahead of the competition in adopting these technologies and to discover the business opportunities InsurTech startups offer.