Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the FinTech industry. This time, you get to discover five hand-picked impact investments startups.

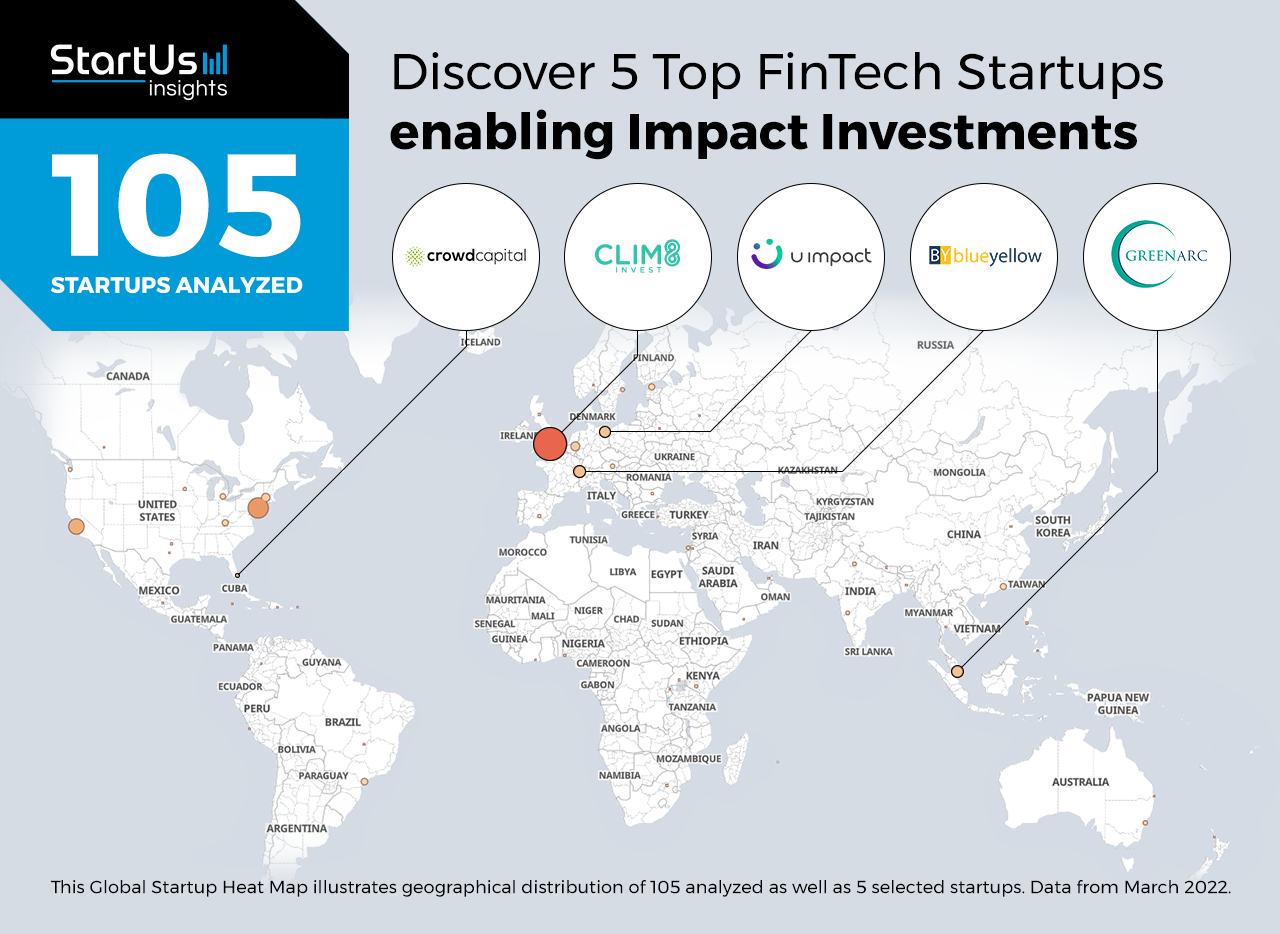

Out of 105, the Global Startup Heat Map highlights 5 Top Startups enabling Impact Investments

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 100 exemplary startups & scaleups we analyzed for this research. Further, it highlights five Impact Investments startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 100 impact investments solutions, get in touch with us.

Crowd Capital offers Socially Responsible Investment (SRI)

Founding Year: 2019

Location: Miami, USA

Funding: USD 890 000

Reach out for Home Refinancing

US-based startup Crowd Capital builds a fintech platform that offers socially responsible investment (SRI) opportunities. The platform enables loan modification and equity retention for home loan borrowers at the risk of foreclosure to prevent homelessness. The startup’s risk mitigation engine uses its proprietary AI datasets to scan through delinquent home mortgages and builds risk profiles. These risk profiles guide investors to make impactful investment decisions while minimizing their risks and maximizing returns.

Green Arc provides AI-powered Impact Measurement

Founding Year: 2017

Location: Singapore

Partner for AI-based Impact Analytics

Singaporean startup Green Arc develops an AI-powered impact measurement platform for assessing environmental, social and governance (ESG) factors for debt financing in emerging markets. The startup utilizes global impact investing network’s (GIIN) IRIS indicators to identify the impact of investments. Banks, financial institutions, as well as professional investors and asset owners, use the startup’s solution for impact analysis and reporting of their investment portfolio. Moreover, Green Arc provides information to encourage investment in financial products that consider environmental action and facilitate financial inclusion.

Ü Impact facilitates Sustainable Investing

Founding Year: 2019

Location: Berlin, Germany

Collaborate for Retail Investment

German startup Ü Impact provides a data insights and investment platform to bring sustainable investment options for retail investors. The startup’s sustainable investment-as-a-service platform vets ethical investment products to curb greenwashing and to ensure data transparency. It connects sustainable investment products with fund managers and retail investors looking to fulfill their ESG investments. Moreover, the platform provides sustainability insights and impact assessments to asset owners and enables projects to financially scale their sustainability efforts.

Blueyellow enables Eco-Investment

Founding Year: 2019

Location: Zurich, Switzerland

Use for Clean Energy Projects

Swiss startup Blueyellow makes a fintech platform enabling trading and investments in global renewable energy projects. It enables project developers, municipalities, governments, utilities, and asset managers to trade renewable and clean energy assets. The platform matches buyers’ risk or returns profiles by comparing key parameters for each project and suggesting suitable projects for eco-investments. Further, it allows investment advisors, due-diligence experts, and insurance companies to grow their business by showcasing their services to the target audience.

Clim8 advances Climate Positive Investment

Founding Year: 2019

Location: London, UK

Funding: USD 15,7 M

Innovate for ESG Stock Investment

UK-based startup Clim8 enables investments in projects accelerating United Nations Sustainable Development Goals (UN-SDGs) and tackling climate change. It provides information on potential financial returns of selected companies and funds taking climate-positive actions. The startup’s stocks & shares individual savings accounts (ISA) invests in said companies and funds on behalf of each user. It then enables portfolio growth and tax savings for users along with impactful investments. Additionally, Clim8’s platform lets users choose their risk profiles and enables climate positive investments of smaller amounts as well.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on socially responsible investment, climate-positive investment, AI-based impact analytics as well as sustainable retail investment. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.