Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

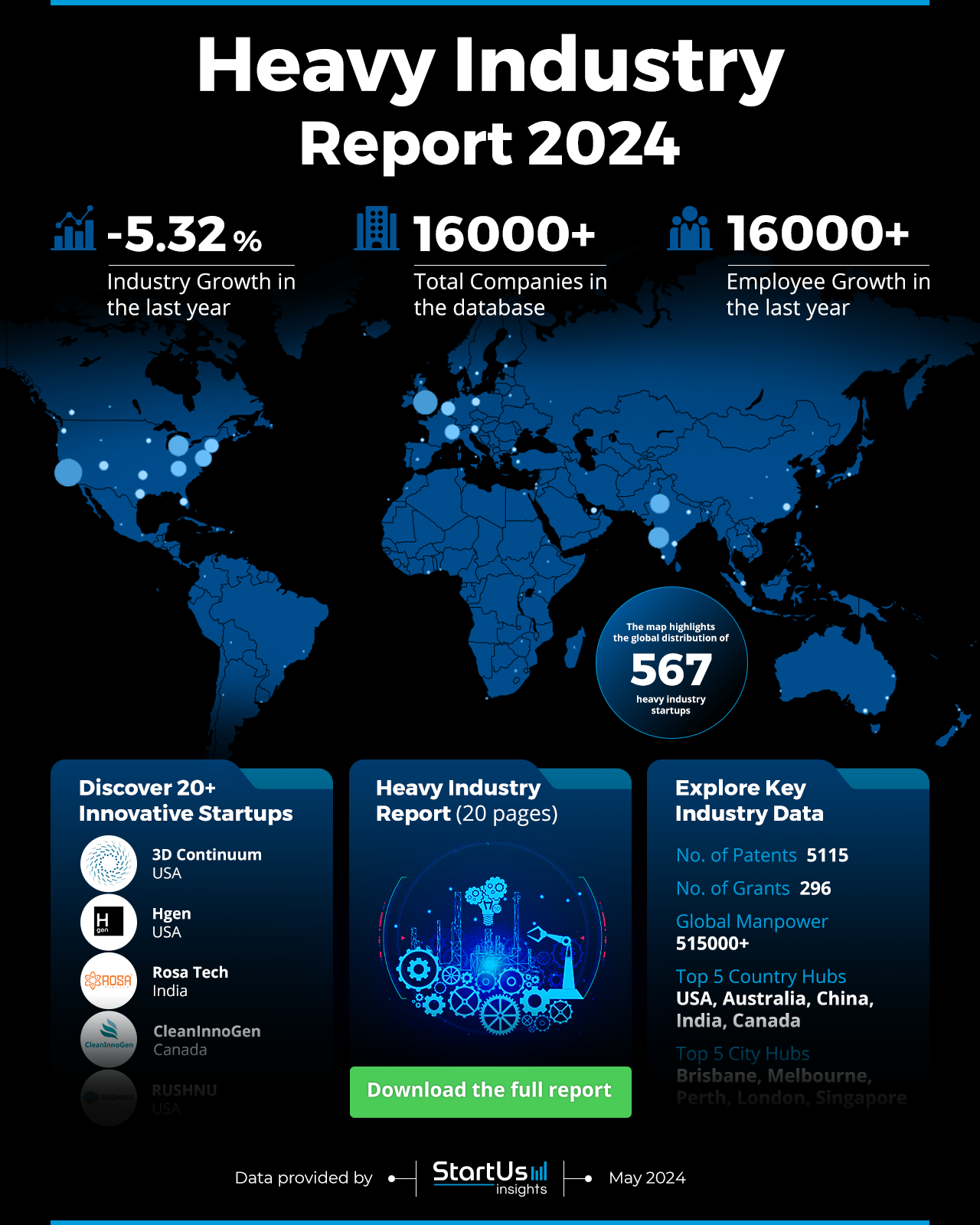

The 2024 Heavy Industry Report provides an analysis of current trends, tech advancements, and investment patterns shaping the global heavy industry sector. This report highlights significant data points, including employment statistics, firmographic data, and key regional hubs. It examines the industry’s innovation landscape, focusing on emerging technologies such as metal 3D printing, casting, and offshore engineering.

This report was last updated in July 2024.

This heavy industry market outlook serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Heavy Industry Market Report 2024

- Executive Summary

- Introduction to the Heavy Industry Report 2024

- What data is used in this Heavy Industry Report?

- Snapshot of the Global Heavy Industry Market

- Funding Landscape in the Heavy Industry

- Who is Investing in Heavy Industries?

- Emerging Trends in the Heavy Industry

- 5 Innovative Startups impacting Heavy Industries

Executive Summary: Heavy Industry Market Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 550+ heavy industry startups developing innovative solutions to present five examples from emerging industrial trends.

- Industry Growth: The heavy industry sector saw a 5.32% decline in growth last year but remains substantial with over 16000 companies.

- Manpower & Employment Growth: The global workforce includes over 515000 individuals, with 22500 new employees added last year.

- Patents & Grants: Innovation persists with more than 5115 patents and 296 grants supporting the sector.

- Global Footprint: Key hubs include the USA, Australia, China, India, and Canada, with leading cities being Brisbane, Melbourne, Perth, London, and Singapore.

- Investment Landscape: Investment activity is robust, with an average investment value of USD 50 million per round, and over 600 funding rounds.

- Top Investors: Hyundai Heavy Industries: USD 757 million, Esterline: USD 705 million, and more

- Startup Ecosystem: Five innovative startups include 3D Continuum (AI-efficiency), Hgen (hydrogen decarbonization), Rosa Tech (robotics for heavy industry), CleanInnoGen (heat to hydrogen), and RUSHNU (carbon capture technology).

- Recommendations for Stakeholders: Investors should prioritize diversification by supporting innovative technologies like metal 3D printing and carbon capture solutions to maximize returns. Government bodies must implement policies, provide incentives, and fund research to foster industry growth and refine regulatory standards. Companies will look to invest in R&D, form strategic partnerships, and adopt new technologies to stay competitive and drive industrial progress.

Explore the Data-driven Heavy Industry Report for 2024

The Heavy Industry Market Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heavy industry sector, despite experiencing a 5.32% decline in growth last year, remains substantial. The database includes 567 startups and over 16000 companies, indicating a significant presence. Innovation persists with more than 5115 patents and 296 grants supporting the sector.

The global workforce encompasses over 515000 individuals, with an addition of 22500 employees in the last year. Key hubs for this industry include the USA, Australia, China, India, and Canada, with leading cities being Brisbane, Melbourne, Perth, London, and Singapore. The heatmap above visualizes these data points, offering an overview of the industry’s landscape and key hubs.

What data is used to create this heavy industry report?

Based on the data provided by our Discovery Platform, we observe that the heavy industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry received more than 26500 publications in the last year, highlighting extensive news coverage and research interest.

- Funding Rounds: Our database includes data on over 600 funding rounds, reflecting strong investment activity within the sector.

- Manpower: With a workforce exceeding 515000, the industry has grown, adding over 22500 new employees in the past year.

- Patents: The sector holds over 5100 patents, showcasing its innovation and technological advancements.

- Grants: More than 296 grants have been awarded to support ongoing research and development in the industry.

- Yearly Global Search Growth: The industry experienced a 5.43% growth in yearly global search interest, indicating increased public and professional attention.

A Snapshot of the Global Heavy Industry Market

The heavy industry sector has demonstrated significant investment and growth, despite recent challenges. The industry saw an employee growth of over 22500 in the last year, contributing to a total workforce exceeding 515000. With over 16000 companies operating within the sector, the industry’s scale and impact are substantial.

Explore the Funding Landscape of the Heavy Industry

Investment activity is robust, with an average investment value of USD 50 million per round. The sector has attracted more than 330 investors who have participated in over 600 funding rounds, supporting more than 250 companies. This strong financial backing highlights the industry’s potential and investor confidence in its future growth.

Who is Investing in Heavy Industries?

The combined investment value by the top investors in the heavy industry sector exceeds USD 2.2 billion, demonstrating the sector’s significant potential. Notable investors and their contributions include:

- Hyundai Heavy Industries has invested USD 757 million, reflecting strong support for the sector.

- Esterline has allocated USD 705 million, indicating substantial financial backing.

- Sany Heavy Industry has invested USD 374 million, showcasing its strategic investments.

- Export Import Bank of China has allocated USD 300 million, emphasizing its role in industry growth.

- Generate Capital has invested USD 250 million, highlighting its commitment to innovation and development within the sector.

This substantial financial backing highlights the industry’s potential for long-term success and development. It also emphasizes the importance of strategic investments in shaping the future of heavy industry operations.

Access Top Heavy Industry Innovations & Trends with the Discovery Platform

Metal 3D Printing is a rapidly growing trend within the heavy industry sector, with 1112 companies identified. This sector employs approximately 107000 people, with 6000 new employees added last year, reflecting significant workforce growth. The annual growth rate for metal 3D printing is 51.35%, highlighting its increasing importance and adoption. Companies in this sector focus on creating complex metal parts with high precision and reduced material waste.

Casting remains a significant segment of the heavy industry, with 19,048 companies identified. This sector employs around 1.8 million people, with 71000 new employees added in the past year, indicating a substantial workforce presence. Despite its size, the annual growth rate for casting is -1.89%, reflecting challenges in the sector. While traditional, casting faces competition from newer technologies but remains crucial for large-scale metal part production, particularly in automotive and machinery industries.

Offshore Engineering is a vital and expanding trend within the heavy industry, with 592 companies identified. This sector employs approximately 183000 people, with 6500 new employees added last year, showcasing workforce growth. The annual growth rate for offshore engineering is 12.16%, demonstrating its rapid development. Companies in this sector focus on designing and constructing structures for offshore oil and gas extraction and renewable energy installations.

5 Top Examples from 550+ Innovative Heavy Industry Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

3D Continuum provides AI-driven Efficiency for Heavy Industries

US-based startup 3D Continuum offers an AI-driven platform to enhance industrial efficiency and safety. The platform integrates advanced data analytics to optimize production processes. It handles large volumes of data, providing real-time strategic insights. The AI technology identifies actionable intelligence, reducing costs and improving productivity. It addresses issues of poor data collection and processing in heavy industry. The platform combines human expertise with machine intelligence for better decision-making. This approach transforms industrial operations by leveraging intelligent data for exponential improvement.

Hgen enables Hydrogen-based Decarbonization

Hgen is a US-based startup specializing in developing advanced hydrogen generation technology for heavy industry applications. Its proprietary platform, HydroGen, uses water electrolysis to produce high-purity hydrogen. This technology operates efficiently with a compact design, reducing space requirements. HydroGen integrates seamlessly with existing industrial systems, enhancing operational efficiency. The platform supports continuous hydrogen production, ensuring a stable supply for industrial processes. Hgen’s technology minimizes energy consumption, promoting sustainable practices in heavy industries.

Rosa Tech builds Robotics Solutions for Heavy Industries

Indian startup Rosa Tech specializes in creating robots and embedded systems for heavy industries, defense, agri-tech, and health tech. Its ASTRA platform addresses intra-logistics automation, sensing, monitoring, and safety within heavy industries. ASTRA enhances operational efficiency and safety through advanced mobility solutions. Additionally, Rosa Tech offers the SIMAPS platform, a green idler solution designed to predict and reduce random breakdowns in conveyor systems. SIMAPS focuses on scalability and user-friendliness, ensuring minimal disruption in industrial operations.

CleanInnoGen converts Heat to Hydrogen

Canadian startup CleanInnoGen develops advanced hydrogen production technology for heavy industry. Its thermochemical water-splitting Cu-Cl cycle uses less electricity than conventional methods. The process relies on moderate-high temperature thermal energy, operating at 525 degrees Celsius. CleanInnoGen’s method consumes up to 65% less electricity compared to water electrolyzers. The system produces hydrogen with zero emissions, powered by renewable heat sources.

RUSHNU develops Carbon Capture Solutions

US-based startup RUSHNU specializes in innovative and modular carbon capture solutions for the heavy industry. The company’s technology integrates carbon capture and sequestration into a single streamlined process. This system converts CO2 into stable minerals within minutes, significantly reducing atmospheric CO2 re-entry. Additionally, the process generates profitable by-products that can be used as feedstock. Rushnu’s compact modular units are adept at capturing thousands of tons of CO2, suitable for decentralized emission sources.

Gain Comprehensive Insights into Heavy Industry Trends, Startups, or Technologies

The 2024 Heavy Industry Report highlights significant trends and investment patterns shaping the sector. Despite a recent decline in growth, robust investment and tech advancements are driving any growth. Key areas like metal 3D printing, casting, and offshore engineering demonstrate dynamic development and innovation. Get in touch to explore all 550+ startups and scaleups, as well as all industry trends impacting industrial companies worldwide.