Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The financial landscape evolves with digitalization and globalization. FinTech startups develop financial orchestration and banking-as-a-service (BaaS) solutions to streamline operations for financial institutions. Loan platforms and customer-centric lending enhance credit access, while investment and financial wellness solutions boost financial literacy. Microfinance data, RegTech, and anti-money laundering technologies ensure inclusion and security. As decentralized finance (DeFi) grows, startups focus on DeFi risk assessment and social investment. Explore such 20 innovative FinTech startups advancing these technologies in 2025 and beyond.

This article was last updated in July 2024.

20 FinTech Startups to Watch in 2025

- Fynhaus – Advanced RegTech Solutions

- Peratera – Cross-border Payments

- JustiFi – Embedded Finance

- Redefine – DeFi Risk Assessment

- Monnai – Data-driven Consumer Insights

- Incard – Financial Platform for eMerchants

- Finxone – No-code FinTech App Building Platform

- Coinlink – DeFi Social Investment Platform

- Lopeer – Hybrid Neobanking

- Finory.tech – Digital Invoicing

- TransactionLink – Financial Orchestration Platform

- Synctera – Banking-as-a-Service

- Levr – Intelligent Loans Platform

- Glass Data – Customer-Centric Lending

- Tallied – Investment & Savings Management

- GajiGesa – Financial Wellness

- Fluid Finance – Microfinance Field Data Collection

- Zabit – Money Laundering Prevention

- OMNIO – Compliance Investigations & Reporting

- Djoin – Transaction Analysis Platform

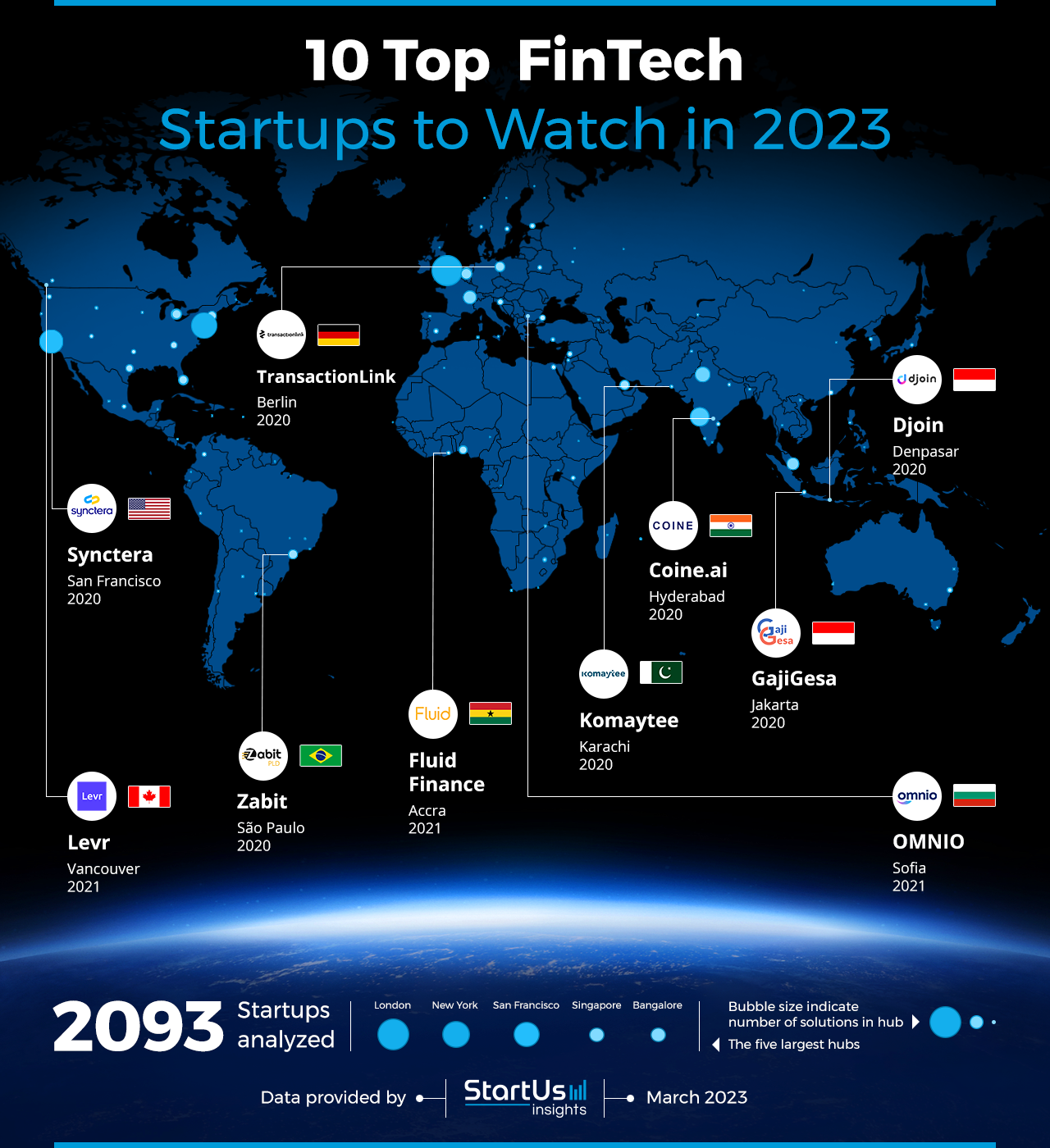

Global Startup Heat Map highlights 20 FinTech Startups to Watch

Through the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering over 4.7M+ startups & scaleups globally, we identified 4736 FinTech startups. The Global Startup Heat Map below highlights the 20 FinTech startups you should watch in 2025 as well as the geo-distribution of all FinTech startups & scaleups we analyzed for this research.

Want to discover all 4700+ FinTech startups & scaleups?

Based on the heat map, we see high startup activity in Western Europe and the USA, followed by India. These energy startups work on solutions ranging from embedded finance and hybrid neobanking to advanced RegTech solutions and DeFi risk assessment.

As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant technologies and industry trends quickly & exhaustively. Based on the data from the platform, the Top 20 FinTech Startup Hubs are in London, New York, San Francisco, Singapore, and Bangalore. The 20 hand-picked startups highlighted in this report are chosen from all over the world and develop solutions for DeFi risk assessment, data-driven consumer insights, cross-border payments, embedded finance, and much more.

Explore 20 Innovative FinTech Startups to Watch (2025)

Fynhaus offers Advanced RegTech Solutions

Fynhaus is a startup based out of the Netherlands that develops advanced RegTech solutions. Its product FORTE offers comprehensive anti-money laundering capabilities, including real-time transaction analysis, pattern detection, and client name-checking against sanction lists. TEMPO, another key offering, addresses SWIFT gpi compliance, enhancing cross-border payment traceability and transparency. This product ensures faster, more transparent payments and provides detailed breakdowns of charges and fees.

LEGATO, a modular ISO 20022 transformer, facilitates the transition from SWIFT MT standards to the new XML-based standard, improving AML control and regulatory reporting. ALTO, designed for efficient FATCA & CRS reporting, automates the detection, case management, and report generation process. Finally, FYNConnect, an embedded plug-in layer, ensures communication across various protocols, enhancing the flexibility and deployment speed of their solutions.

Peratera facilitates Cross-border Payments

New Zealand-based startup Peratera offers digital banking and payment solutions for global business expansion. Its platform allows the opening of virtual accounts, facilitating the management of funds across over 190 countries. Peratera’s smart card system allows the issuance of both physical and virtual cards, compatible with Visa and Mastercard in 24 currencies.

The platform eliminates traditional banking fees, offering access to real exchange rates and effective financial management. It incorporates various payment methods like SEPA Instant, Faster Payments, BACS, ACH, and SWIFT, ensuring swift and secure transactions. Moreover, Peratera’s AI-powered anti-fraud system monitors the safety of your transitions 24/7 and protects your card and transaction details.

JustiFi streamlines Embedded Finance

JustiFi is a USA-based startup that provides an embedded finance infrastructure, enabling businesses to integrate banking services directly into their platforms. The startup’s platform supports the creation of deposit accounts and leverages payment facilitation, ensuring funds flow through the user’s platform without relying on third-party processors.

JustiFi’s infrastructure directs all transaction revenue through the user’s platform. This offers more control over processing rates, allowing businesses to retain a larger portion of revenue, enhancing annual recurring revenue (ARR). Additionally, JustiFi offers web components for payments, which are reusable, modular pieces of code that enhance flexibility, reduce development time, and improve security and user experience in payment processing.

Redefine advances DeFi Risk Assessment

Redefine is an Israeli startup that provides portfolio management and security solutions for institutional DeFi funds. The Risk Center is a comprehensive dashboard that aggregates data from multiple wallets and chains for portfolio visualization and risk assessment. DeFirewall offers transaction security through risk analysis and actionable recommendations.

The platform’s Monitoring tool provides 24/7 surveillance of on-chain positions, including contracts, liquidity pools, and governance protocols. Redefine’s Due Diligence tool assists in evaluating the legitimacy of blockchain projects, smart contracts, and wallets. DeFi Dome, another key product, automates security in Web3 with customized exit strategies. This way, Redefine’s tools offer real-time alerts and proactive risk management for DeFi investments.

Monnai provides Data-driven Consumer Insights

USA-based startup Monnai develops a consumer insights platform. Its key features include KYC Compliance which checks data sources such as valid identity cards, data matching, and address verification for real-time user onboarding and approval rate maximization. Credit Decisioning tool analyzes data points like income and spend patterns, payment methods, and lifestyle preferences for financial equality and market growth opportunities.

Trust & Fraud Risk feature checks for synthetic identity, bot attacks, identity takeover, and behavior analysis to identify trustworthy users and prevent fraud. Collections Optimization enhances collection processes and improves recovery rates by identity tracing, location verifications, and communication channel analysis.

Incard designs a Financial Platform for eMerchants

UK-based startup Incard makes a financial platform for e-commerce entrepreneurs and influencers. The startup offers a Visa Platinum Metal Card that aligns with the dynamic needs of online businesses. Users benefit from higher monthly spending limits, enhancing their capacity to scale operations. Incard issues unlimited virtual cards for online expenses, which streamlines finance management.

The multi-currency account facility supports global business operations, allowing transactions in multiple currencies like EUR, GBP, USD, HKD, and CHF. Low exchange fees and real FX rates make international transactions more economical. Additionally, Incard integrates an accounting software within its app that enables invoicing and bookkeeping. The platform also syncs with popular apps and accounts for effective financial tracking. Incard’s flexible financing options and accelerated daily payouts further support cash flow management.

Finxone develops a No-code FinTech App Building Platform

UK-based startup Finxone provides a no-code fintech app building platform. Its App Autobuilder automatically creates custom fintech apps based on the user’s requirements and preferences input. Display Widgets offer visual elements for enhanced user interaction. The App Grid lets the users set up their desired combination of user experience and admin capabilities by the most suitable combination of Zones and Roles. While Widgets facilitate diverse functionalities, from data display to complex financial operations.

Flexible Onboarding integrates different user types, enhancing the user experience. The platform also issues both virtual and physical cards, expanding payment options. Integrated with EFT rails and IBANs, Finxone enables financial transactions across borders. Backed by banks and banking-as-a-service (BaaS), it provides secure financial services. Additional features like APIs and backoffice widgets further enhance the platform’s capabilities, making it a versatile solution for fintech apps.

Coinlink builds a DeFi Social Investment Platform

Coinlink is a German startup that designs a DeFi social investment platform. It combines social finance with a DeFi aggregator. The startup integrates multiple blockchains like Base, Ethereum, Polygon, Arbitrum, and Optimism and offers over 15 DeFi services, including liquidity, farming, and lending.

Coinlink enables users to stay updated on new crypto projects and market insights shared by crypto influencers. Users are able to replicate influencer portfolios within the app, gaining early access to investment opportunities. It rewards users with its tokens for engaging with influencer content, fostering a beneficial scenario for both parties. Other features of the solution include transaction tracking, token bridging, asset swapping, and liquidity.

Lopeer enables Hybrid Neobanking

Lopeer is a startup based out of Nigeria that advances hybrid neobanking. Its Virtual Card tool enables users to generate cards for secure online transactions. The Bills Payment feature simplifies the process of paying various bills online.

Lopeer’s Wallet allows global money transfers in local currencies and cryptocurrencies. The startup’s Crypto Swap tool facilitates easy buying and selling of cryptocurrencies. It offers a geolocation feature for local crypto exchanges. The platform supports major cryptocurrencies like BTC, USDT, and WAVES.

Finory.tech analyzes Bank Statements

Malaysian startup Finory.tech develops AI-powered APIs for document automation and financial assessment to streamline loan processing. These tools enable lenders to analyze borrowers’ bank statements, conduct financial assessments, and detect fraud. The platform utilizes data science algorithms to offer an income verification feature for understanding the financial standing. The affordability assessment tool evaluates customers’ income versus expenditures, and facilitates informed lending decisions.

Finory.tech’s financial credibility solution integrates credit reports with bank statement data to assess creditworthiness. Additionally, the platform’s fraud detection capabilities identify subtle financial document tampering to enhance security and reliability in the lending process.

Interested in exploring all 4700+ FinTech startups & scaleups?

TransactionLink develops a Financial Orchestration Platform

German startup TrancactionLink makes a no-code know-your-customer (KYC) and know-your-business (KYB) orchestration platform. The platform features a workflow builder that creates complex onboarding workflows, adds decision logic, and integrates with a variety of digital onboarding services. It also integrates with various essential financial services such as ID verification, anti-fraud solutions, public registries, credit bureaus, and more.

Besides, the platform offers case management by offering customer verification statuses and business viability insights. Through this solution, financial institutions reduce the amount of time and effort spent on the manual review of customer profiles.

Synctera advances Banking-as-Service (BaaS)

US-based startup Synctera offers a BaaS platform to power financial products and services. The platform’s proprietary decoupled ledger accommodates custom account structures, flows, and relationships. This reduces manual processes through centralized customer management.

Further, it streamlines account and transaction reconciliation by processing and controlling transactional, operational, and reference data, preventing missing transactions or funds. Moreover, Synctera’s ledgers are independently audited by external partners, including service organization control (SOC) 2, Type II attestation, and payment card industry data security standard (PCI DSS) certification.

Levr makes an Intelligent Loan Platform

Canadian startup Levr provides an intelligent loan platform that simplifies loan applications for small businesses. The platform features a dashboard that streamlines application preparation. It allows financial companies to upload financial documents and invite decision-makers and accountants to review them.

The platform then leverages AI to customize loan matches based on company business data and offers built-in support resources, including guides and templates. Besides small business loans, it provides solutions for merchant cash advances and venture debt financing. Levr’s solution enables small businesses to receive personalized assistance and suggestions for loan applications.

Glass Data provides Payment Monitoring & Security

Brazilian startup Glass Data provides advanced intelligence, security, and observability solutions for financial organizations and large payment operations. It utilizes AI and behavior analysis to monitor financial transactions and ensure security and efficiency. The Anomaly Detection feature employs machine learning to identify operational failures or fraudulent behavior in commercial establishments and among end customers.

Moreover, Fraud Control uses bot detection algorithms to prevent bot and brute force attacks on financial transactions, including card testing scenarios. Additionally, Payment Analytics, a business intelligence tool, enables real-time exploration and analysis of transactions.

Tallied manages Credit Card Value Chain

US-based startup Tallied offers an infrastructure for creating and scaling consumer and corporate credit card programs while featuring customizable rewards and secure transaction processing. The platform utilizes APIs and a sandbox environment for the development and deployment of credit programs.

As a cloud-native solution, it includes fraud prevention and regulatory compliance tools. Tallied supports integration with existing financial systems and allows businesses to launch and scale credit services. The startup supports fintechs, financial institutions, and embedded finance providers.

GajiGesa promotes Financial Wellness

GajiGesa is an Indonesian startup that develops a financial wellness platform for employees. Its product, Earned Wage Access (EWA), allows employees to access their salary before the company pay date, which reduces financial stress and increases loyalty.

Besides, the startup’s employee management application serves as a central source for payroll data, attendance, salary calculation, and payslip generation. GajiGesa’s solutions thus enable companies to reduce turnover rates and retain talent through better employee-centric financial systems.

Fluid Finance enables Microfinance Field Data Collection

Fluid Finance is a Ghana-based startup that specializes in microfinance services. Its FLUID software enables field agents to work faster and build trust with customers through video-traceable digital account creation and payment collection.

The startup’s mobile app approves new accounts within 30 minutes and protects microfinance deposits from suppression through a video payment feature. FLUID’s tracking of field operations allows finance managers to assess field team performance and reduce the possibility of fraud.

Zabit facilitates Money Laundering Prevention

Zabit is a Brazilian startup that offers a solution for money laundering prevention. The solution monitors transactions as well as features high-volume processing and allows teams to set custom rules and parameters.

Additionally, it automatically screens the office of foreign assets control (OFAC) and united nations security council (UNSC) sanction lists. The solution provides alerts based on rules and simplifies case management to comply with regulations. This enables financial bodies to create risk matrices of business and frequently classify customers’ risk.

OMNIO aids Compliance Investigations & Reporting

Bulgarian startup OMNIO provides an AI-driven compliance investigator that meets regulatory standards and eliminates inefficiency. The startup’s product, Customer Monitoring (CM), screens entire client databases to identify positive and negative customers. On the other hand, Compliance Investigations & Reporting (CIR) performs investigations, files suspicious activity reports (SARs), and creates periodic monitoring reviews.

OMNIO’s other products include Transaction Monitoring (TM), a rule engine that monitors and analyzes suspicious activity, as well as Fraud Detection (FD), which protects organizations from threats. These solutions simplify compliance operations and automate financial regulatory functions for companies.

Djoin delivers Transaction Analysis

Djoin is an Indonesian startup that creates a web-based core system for small financial institutions. Its LPDmax system features transaction data management with 24-hour online access, product customization, automatic bookkeeping, dynamic user and access rights, and more. It also analyzes transactions and financial conditions with nominative reports of deposit accounts, loans, and depositors.

Additionally, the system features comprehensive Lembaga Perkreditan Desa (LPD) management with loan collectability calculation, LPD health assessments, and more. This solution enables smaller village financial institutions to access or optimize better transactions and reduces the possibility of risks.

Discover All Emerging FinTech Startups

The FinTech startups showcased in this report are only a small sample of all startups we identified through our data-driven startup scouting approach. Download our free FinTech Innovation Report for a broad overview of the industry or get in touch for quick & exhaustive research on the latest technologies & emerging solutions that will impact your company in 2025!

![Discover the Top 10 FinTech Trends & Innovations [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/FinTech-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)