Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The Decentralized Finance Market Report 2025 explores the rapid evolution of DeFi, highlighting trends, technologies like blockchain and cryptography, and its role in improving security, transparency, and accessibility. It offers key insights into funding, employment, and innovation, providing a concise guide for investors, policymakers, and analysts to navigate the future of decentralized finance.

This report was last updated in January 2025.

Executive Summary: Decentralized Finance Market Report 2025

- Industry Growth Overview: The decentralized finance market has grown from USD 42.76 billion in 2025 to USD 178.63 billion in 2029 at a compound annual growth rate of 43.0%. On a micro level, the decentralized finance (DeFi) market had a yearly growth rate of 62.72% as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: Around 208 900 professionals work in the market, and it added 43 800 new workers last year, reflecting its vibrant and expanding environment.

- Patents & Grants: Promoting DeFi innovation, more than 200 patents submitted by more than 60 applicants, with top issuers from the US and Canada. Organizations have awarded 350 grants, further promoting research and development.

- Global Footprint: With major city hubs like Singapore, London, New York City, Dubai, and San Francisco and the top country hubs being the United States, United Kingdom, India, United Arab Emirates, and Switzerland, indicate a globally broad market presence.

- Investment Landscape: More than 7300 investors took part in more than 8400 investment rounds in the DeFi market. The substantial financial support was demonstrated by the average investment value per round, which was USD 18.3 million.

- Top Investors: Key investors Global Emerging Market, Andreessen Horowitz, Continue Capital, and more have collectively invested over USD 5.30 billion.

- Startup Ecosystem: The market’s entrepreneurial spirit and worldwide reach are shown by five emerging startups, DeFi Saver (non-custodial DeFi management), Nord Finance (decentralized finance ecosystem), Decurity (real-time security monitoring of DeFi protocols), Kasuria (investment strategizing platform), and One80.io (sustainable decentralized finance and exchange).

Methodology: How We Created This Decentralized Finance Market Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of decentralized finance over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within decentralized finance

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the decentralized finance market.

What Data is Used to Create This Decentralized Finance Market Report?

Based on the data provided by our Discovery Platform, we observe that the decentralized finance market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: Over 11K publications have been made about the decentralized finance market in the past year. This demonstrates the market’s high level of media engagement and news coverage.

- Funding Rounds: The market demonstrates thriving financial activity and investment prospects with more than 8400 funding rounds in our database.

- Manpower: The market employs more than 208 900 workers and hired 43800 new employees in the past year, showcasing its substantial workforce.

- Patents: The market’s emphasis on innovation and technological advancement is shown by its 200+ patents.

- Grants: Decentralized finance businesses have received 350 awards in total, highlighting the market’s backing from both public and private financial sources.

- Yearly Global Search Growth: With an increase of 150.01% in global search volume over the last 12 months, Decentralized finance indicates greater interest and knowledge around the world.

Explore the Data-driven Decentralized Finance Market Report for 2025

As per The Business Research Company report, the decentralized finance market has grown from USD 42.76 billion in 2025 to USD 178.63 billion in 2029 at a compound annual growth rate of 43.0%.

The market is also projected to grow to USD 26.81 billion by the end of 2025 and is expected to reach USD 2.55 trillion by 2037, with a compound annual growth rate of over 45.4% from 2025 to 2037.

Another analysis suggests that the DeFi market is expected to reach approximately USD 52.37 billion by 2032, growing at a compound annual growth rate of about 9.06% during the forecast period from 2025 to 2032.

The DeFi market report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the market’s dynamic growth and innovation.

Our database demonstrates 10 400 companies and more than 1620 startups working in this domain. Supported by more than 200 patents and 350 awards, decentralized finance has grown at a rate of 62.72% in the last year.

Credit: The Business Research Company

With a 43 800 growth from the previous year, the global workforce is strong, with over 208 900 employees.

Additionally, the global innovation hotspots are shown by the top five country hubs, the United States, the United Kingdom, India, the United Arab Emirates, and Switzerland.

The geographic reach of decentralized finance is shown by the top city hubs, which include Singapore, London, New York City, Dubai, and San Francisco.

Moreoever, North America was the largest region in the DeFi market in 2024, while the Asia-Pacific region is expected to be the fastest-growing in the coming years.

A Snapshot of the Global Decentralized Finance Market

The decentralized finance (DeFi) market has grown by a notable 62.72% annually, indicating its quick development and growing importance on a global scale.

The market’s dynamic and developing nature stands out with over 1620 startups, including 1300 in early-stage development. Companies demonstrate market consolidation and strategic expansion through more than 140 mergers and acquisitions.

Innovation drives the decentralized finance market, as over 60 applicants have filed more than 200 patents.

Leading nations like Canada with 64 patents and the United States with 56 patents dominate as top issuers, demonstrating their leadership in DeFi innovation, despite a minor yearly reduction in patent activity of 0.33%.

Explore the Funding Landscape of the Decentralized Finance Market

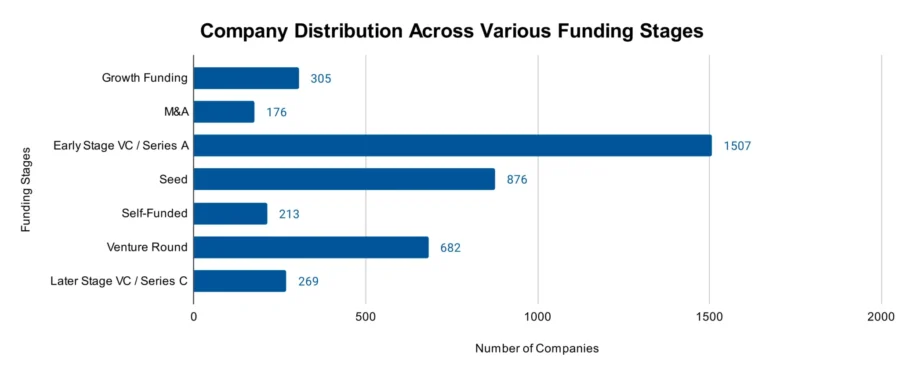

With an average investment of USD 18.3 million per funding round, the decentralized finance (DeFi) market has considerable financial support. More than 7300 investors have expressed interest in the market, demonstrating broad faith in its potential.

The DeFi market finished over 8400 investment rounds, highlighting the market’s capacity to raise substantial funds.

More than 2600 businesses have been able to successfully raise capital highlighting the decentralized finance ecosystem’s widespread appeal and expansion prospects.

Who is Investing in the Decentralized Finance Market?

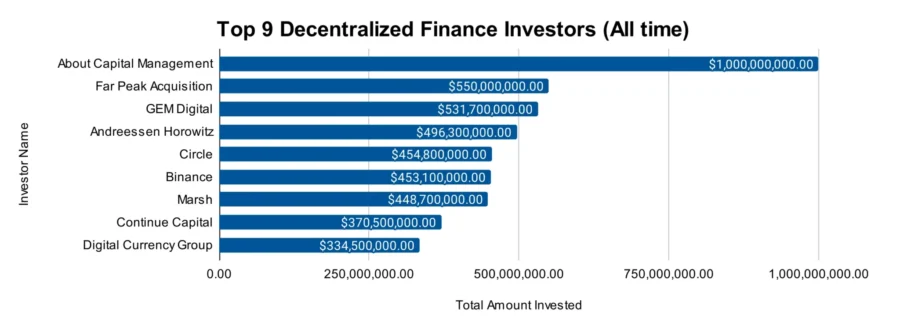

Top investors demonstrate major financial backing and confidence in the decentralized finance market with a combined investment worth about USD 5.30 billion.

- About Capital Management invested USD 1 billion in at least 1 company.

- Far Peak Acquisition contributed USD 550 million to at least 1 company.

- GEM Digital invested USD 531.7 million in 12 companies. GEM Digital committed USD 50 million to SEALCOIN AG to develop a decentralized physical internet network (DePIN) using Hedera’s ledger technology.

- Andreessen Horowitz invested USD 496.3 million across 44 companies. a16z partnered with Eli Lilly to launch a USD 500 million fund to invest in companies developing new medicines and health technologies.

- Circle invested USD 454.8 million in 26 companies.

- Binance invested USD 453.1 million across 28 companies. Binance Labs co-led a USD 43 million Series A funding round for Sahara AI.

- Marsh invested USD 448.7 million in at least 1 company. Marsh McLennan announced a USD 7.75 billion deal to acquire McGriff Insurance Services.

- Continue Capital invested USD 370.5 million across 20 companies.

- Digital Currency Group invested USD 334.5 million in 61 companies. Digital Currency Group (DCG) announced the creation of Yuma, a decentralized artificial intelligence company.

Top Decentralized Finance Innovations & Trends

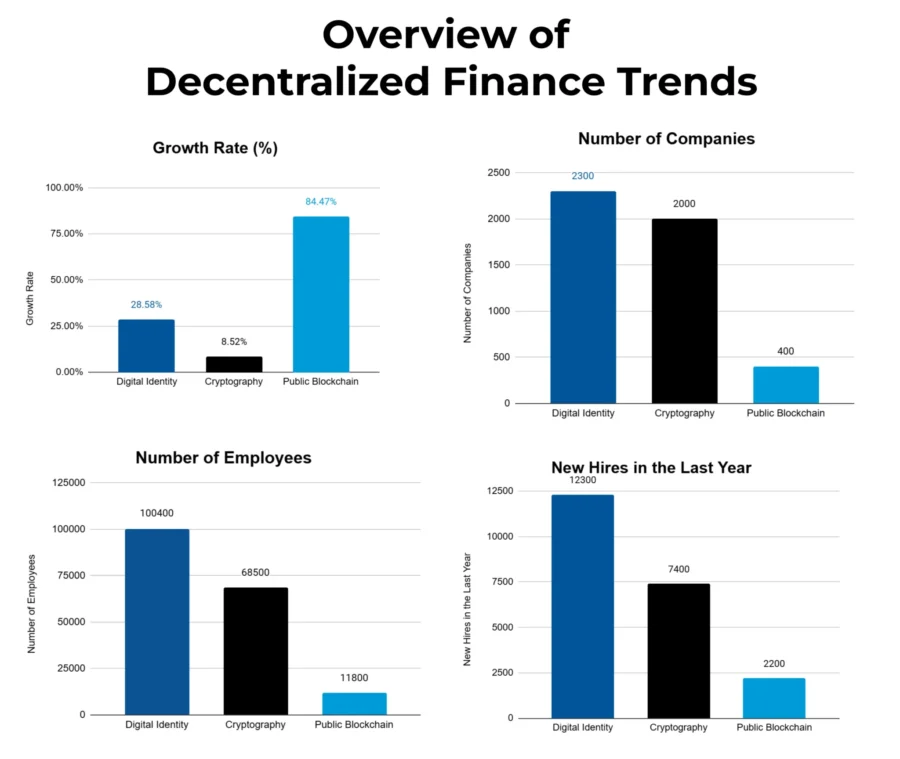

Emerging trends are defining the growth trajectory of the decentralized finance (DeFi) business, which is undergoing fast evolution. Based on firmographic data, the following three trends are leading the market:

- Digital Identity: Digital Identity solutions are essential for improving security and transparency in DeFi, which has over 2300 companies and 100400 employees. With 12 300 new employees joining the workforce last year, the trend has grown at an annual pace of 28.58%, which is indicative of growing investment and development in safe and decentralized identity verification systems.

- Cryptography: With over 2000 businesses and over 68 500 professionals, cryptography serves as the foundation for the security framework of decentralized systems. Last year, the market added 7400 new workers at an 8.52% growth rate. This pattern demonstrates the continuous development of safe encryption techniques that are necessary to protect decentralized financial networks.

- Public Blockchain: At the forefront of the DeFi ecosystem, the public blockchain trend employs 11 800+ people across 400+ businesses. In the last year, it added 2200+ workers, demonstrating an exceptional growth rate of 84.47%. Public blockchain continues to be the cornerstone of DeFi applications, fostering innovation in decentralized apps and smart contracts.

Further, the blockchain technology segment will dominate the DeFi market through applications in fintech and money transfer services.

5 Top Examples from 1600+ Innovative Decentralized Finance Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

DeFi Saver provides Non-Custodial DeFi Management

Serbian startup DeFi Saver‘s non-custodial DeFi management platform enables investors to manage positions and cryptocurrency assets across several decentralized finance protocols.

It incorporates technologies including automated position management, leveraged staking, and loan shifting to simplify intricate DeFi exchanges. The platform gives users exact control and efficiency by supporting limit orders, collateral swaps, and flash loans.

It offers strong liquidation protection and leverage management which include the loan shifter and automation choices like stop-loss and take-profit.

DeFi Saver gives consumers a smooth and safe DeFi experience by implementing a security-first strategy with verified smart contracts and trustless interactions, improving portfolio management, and optimizing profits in a decentralized environment.

Nord Finance creates a Decentralized Finance Ecosystem

Indian startup Nord Finance develops a decentralized finance ecosystem that bridges traditional financial features with blockchain-based solutions.

It provides financial services like investment management, savings, loans, and exchanges with its multichain interoperability and Ethereum network foundation.

The ecosystem includes Nord.Loans for over-collateralized lending, Nord.Advisory for robo-advisory financial planning, and Nord.Savings for risk-adjusted methods to maximize stablecoin yields.

Additionally, Nord.Swap facilitates easy cross-chain asset swaps with no up-front fees that are deducted from final returns.

The $NORD token improves user interaction on all DeFi platforms by facilitating governance, staking, and yield farming.

Nord Finance makes decentralized investing easier by providing a safe, intuitive environment that enables users to create wealth and accomplish financial objectives using blockchain technology.

Decurity provides Real-time Security Monitoring of DeFi Protocols

UAE based startup Decurity offers real-time security monitoring solutions for decentralized finance (DeFi) protocols with an emphasis on risk reduction and exploit detection.

Its product Defimon finds flaws and possible exploits before they affect smart contracts by using bytecode analysis, transaction simulation, and event processing algorithms. The platform notifies users early, enabling them to act quickly when a DeFi protocol is targeted.

Some of the key features include an incident response system to unwind positions during emergencies, risk assessment via vulnerability scanning, and monitoring of more than 50 protocols.

The startup also aids investigations by tracking questionable activity from fundraising to laundering.

In addition, Decurity protects DeFi protocols by providing proactive security. This lowers risks for asset managers, ecosystems, and projects inside the decentralized financial ecosystem.

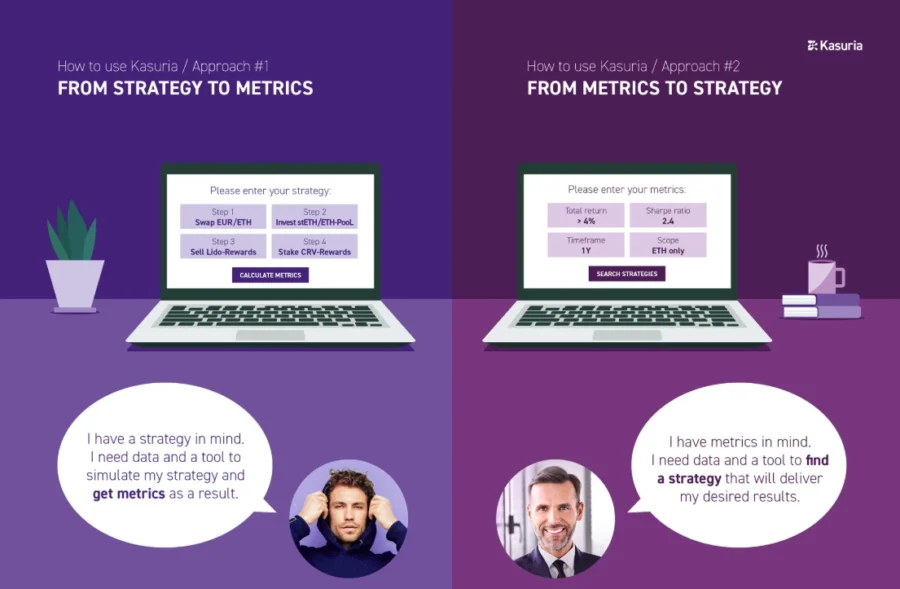

Kasuria offers an Investment Strategizing Platform

German startup Kasuria offers a platform for investment strategy that makes decentralized finance (DeFi) decision-making easier.

The platform offers thorough insights and tools for developing, simulating, and monitoring multi-step DeFi strategies by combining a data-as-a-service approach with an intuitive web application.

Kasuria’s ability to combine interconnected financial data and provide real-time measurements enables users to evaluate investment risks, returns, and strategy performance using historical data or custom-defined criteria.

Its features include portfolio construction, cross-strategy benchmarking, and smooth interaction with many DeFi protocols.

Further, the startup enables investors to negotiate the intricacies of DeFi ecosystems by providing accurate, useful insights to refine their financial plans to optimize profits and accomplish desired results.

One80.io enables Sustainable Decentralized Finance & Exchange

UK-based startup One80.io creates sustainable decentralized finance (DeFi) platform that makes trading, earning, and investing easier within a global financial ecosystem.

The platform offers wallet connectivity, cheap exchange rates, and instantaneous Ethereum-based token trading without requiring users to register.

It enables users to receive benefits by integrating staking, farming, and liquidity pools by locking in cryptocurrency assets to support the protocol.

The One80 token powers the ecosystem by enabling users to trade, farm, stake, and spend while benefiting from its token distribution methodology.

One80.io allows traders to engage in a decentralized, sustainable financial system designed to meet current and future demands.

Gain Comprehensive Insights into Decentralized Finance Trends, Startups, or Technologies

According to the 2025 Decentralized Finance (DeFi) market research, innovation and growing global usage have rapidly expanded the market. Trends like digital identity, cryptography, and the public blockchain shape the ecosystem. They drive technological developments and create opportunities for investors and companies.

Get in touch to explore all 1600+ startups and scaleups, as well as all industry trends impacting 10400+ companies.