Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2025 Decentralization Market Report explores the growing impact of decentralized technologies across sectors like finance, supply chain management, healthcare, and more. Blockchain, web3, and distributed networks are reshaping business operations, and improving transparency, and security. This report offers stakeholders, investors, and industry leaders a detailed overview of the market’s current state and its potential for growth in the coming years.

Executive Summary: Decentralization Market Outlook 2025

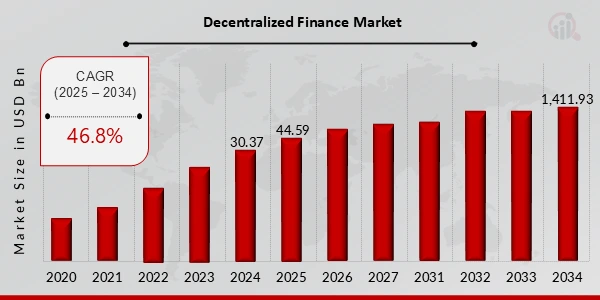

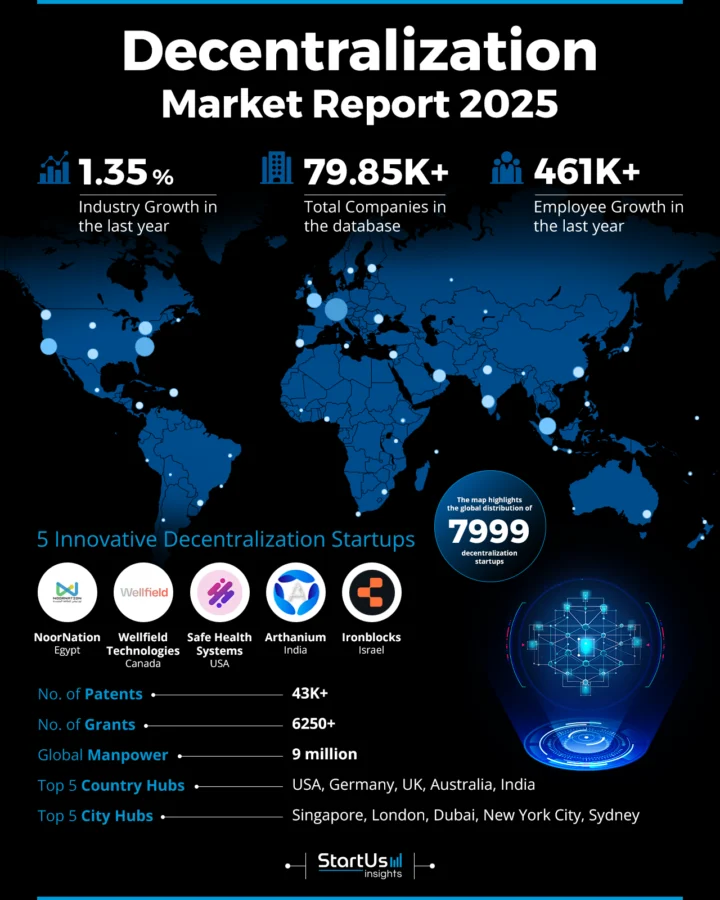

- Industry Growth Overview: The decentralization market has more than 79 850 companies and 7990+ startups. Additionally, the decentralized finance market is expected to grow at a compound annual growth rate (CAGR) of 46.8% from 2025 to 2034. On a granular level, the decentralized market has experienced a growth rate of 1.35% over the past year as per our platform’s latest data.

- Manpower & Employment Growth: The market employs over 9 million individuals globally, with an increase of 461K+ new jobs added in the last year.

- Patents & Grants: The decentralization market features more than 43K+ patents and 6 250+ grants. The patent growth rate is 0.35% yearly, with China and the US leading in patent issuance.

- Global Footprint: Key hubs for decentralization include the US, Germany, the UK, Australia, and India showcasing a diverse global infrastructure supporting market growth. Major city hubs encompass Singapore, London, Dubai, New York City, and Sydney.

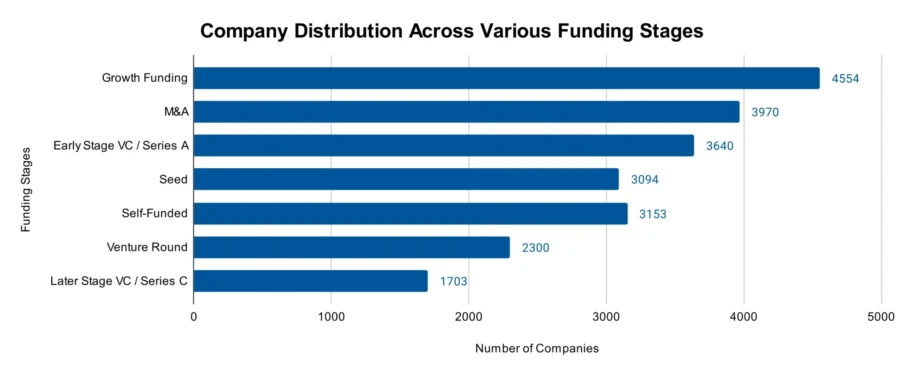

- Investment Landscape: The average investment value per funding round exceeds USD 32 million, with over 28 050 funding rounds closed. More than 19K investors are actively engaged in the decentralization market.

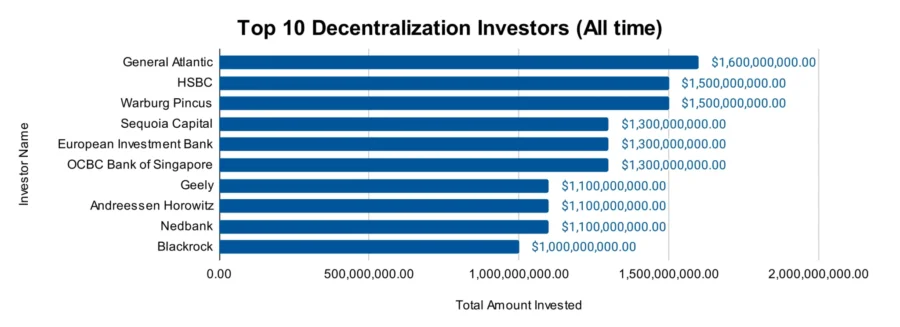

- Top Investors: Major investors include General Atlantic, HSBC, Warburg Pincus, and more are collectively investing over USD 12.8 billion across numerous companies.

- Startup Ecosystem: Five innovative startups, NoorNation (energy and water infrastructure), Wellfield Technologies (decentralized finance), Safe Health Systems (digital health and connected diagnostics platform), Arthanium (trade and supply chain platform), and Ironblocks (modular web3 security layer) showcase the market’s global reach and entrepreneurial spirit.

What Data is Used to Create This Decentralization Market Report?

Based on the data provided by our Discovery Platform, we observe that the decentralization market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The decentralization market recorded over 46 280 publications in news coverage and academic literature last year.

- Funding Rounds: Our database contains data on more than 28 050 funding rounds.

- Manpower: The global workforce in the decentralization market exceeds 9 million, with an additional 461K+ employees added in the past year alone.

- Patents: The decentralization market holds more than 43K patents.

- Grants: Over 6250 grants have been awarded to companies within the decentralization domain.

- Yearly Global Search Growth: The market experienced a yearly global search growth of 10.70%.

Methodology: How We Created This Decentralization Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of decentralization over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within decentralization

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the decentralization market.

Explore the Data-driven Decentralization Market Report for 2025

According to the Market Research Future Report, the global decentralized finance market was valued at USD 30.37 billion in 2024 and is expected to grow by USD 44.59 billion in 2025. It is also predicted to grow to USD 1411.93 billion by 2034 with a CAGR of 10.50% from 2024 to 2034.

The decentralization market outlook 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

With 7 990+ startups in the database and a total of over 79 850 companies, this decentralization domain offers a snapshot of market dynamics.

While the overall market growth in the past year remains modest at 1.35%, major innovation is evident with over 43K patents and 6 250 grants awarded.

Credit: Market Research Future

According to the Business Research Company Report, the decentralized finance market will grow from USD 30.07 billion in 2024 to USD 42.67 billion in 2025 at a compound annual growth rate (CAGR) ) of 42.2%. However, on a micro level, the decentralized market grew by a rate of 1.35% last year as per our platform’s latest data.

IMARC report suggests that the decentralized identity market is expected to reach USD 1 153 million from USD 89 628 million, with a CAGR of 62.2% from 2025 to 2033.

According to Metatech Insights, the decentralized prediction market is expected to reach USD 95.5 billion, growing at a CAGR of approximately 46.8% from 2025 to 2035.

Additionally, employee growth is a standout, with 461K new roles added, contributing to a global workforce of 9 million+.

The top five country hubs, the US, Germany, UK, Australia, and India dominate the landscape, with key city hubs like Singapore, London, Dubai, New York City, and Sydney leading as epicenters of activity.

A Snapshot of the Global Decentralized Market

With an annual growth rate of 1.35%, the decentralization market landscape is moderate. Of the 3 483 startups in the database, more than 3 560 are classified as early-stage.

Further, the market is actively consolidating and cooperating, as seen by the more than 3920 mergers and acquisitions.

Regarding intellectual property, the market has more than 43K patents and 3580 applications. The 0.35% annual patent growth rate indicates continued innovation and advancement.

Moreover, the top two patent issuers, China have 15 310+ patents, and the US has 11 260+ patents which highlights their contributions to the development of decentralized technologies.

Explore the Funding Landscape of the Decentralization Market

The average investment value per round exceeds USD 32 million, which showcases the major financial backing the decentralization market attracts. With over 28 050 funding rounds closed, more than 19K investors have actively contributed to shaping the market’s growth and innovation. Additionally, these investments span 9 690+ companies, which highlights the broad appeal and diverse opportunities within the decentralization market.

Moreover, Barry Silbert, founder of Digital Currency Group, launched Yuma which is a decentralized AI company that is developing applications on the Bittensor network.

Who is Investing in the Decentralization Market?

The combined investment value of the top investors in the decentralization market exceeds USD 12.8 billion. Here is a breakdown of their contributions:

- General Atlantic has invested USD 1.6 billion in 5 companies. The company completed its acquisition of Actis which is a global investor in sustainable infrastructure.

- HSBC has funded USD 1.5 billion in 18 companies. HSBC India also partnered with the AGRI3 Fund for a USD 50 million lending program to support sustainable agriculture in India.

- Warburg Pincus has committed USD 1.5 billion to 9 companies. It became a minority shareholder and key client of Aztec Group to improve its U.S. market capabilities and support long-term growth.

- Sequoia Capital has invested USD 1.3 billion in 52 companies. Sequoia Capital, led by partner Pat Grady, has also strengthened its focus on AI investments, backing startups like OpenAI, Harvey, and Hugging Face to become key players in the sector.

- European Investment Bank has allocated USD 1.3 billion to 7 companies. EIB also announced a new partnership with the European Commission to support investments in the European battery manufacturing value chain.

- OCBC Bank of Singapore has invested USD 1.3 billion in 4 companies. It also formed a strategic partnership with Ant International to improve cross-border fund settlements.

- Geely has allocated USD 1.1 billion to at least 1 company. The company announced a joint venture with JSW Group to invest USD 1 billion in the production and development of electric vehicles in India.

- Andreessen Horowitz has invested USD 1.1 billion in 74 companies. It also invested in Plutus which is a creator-focused social platform.

- Nedbank has invested USD 1.1 billion in at least 1 company. It announced a partnership with DP World Trade Finance to deliver working capital solutions across sub-Saharan Africa.

- Blackrock has invested USD 1 billion in 7 companies. It also announced its plan to acquire HPS investment partners for approximately USD 12 billion.

Also, DeFi Agents AI (DEFAI) has secured USD 1.2M to advance its efforts in transforming how users engage with decentralized finance.

MakerDAO, Compound, Aave, Uniswap, and Synthetix are driving market growth by offering decentralized lending, borrowing, and trading services.

Top Decentralization Innovations & Trends

Discover the emerging trends in the decentralization market along with their firmographic details:

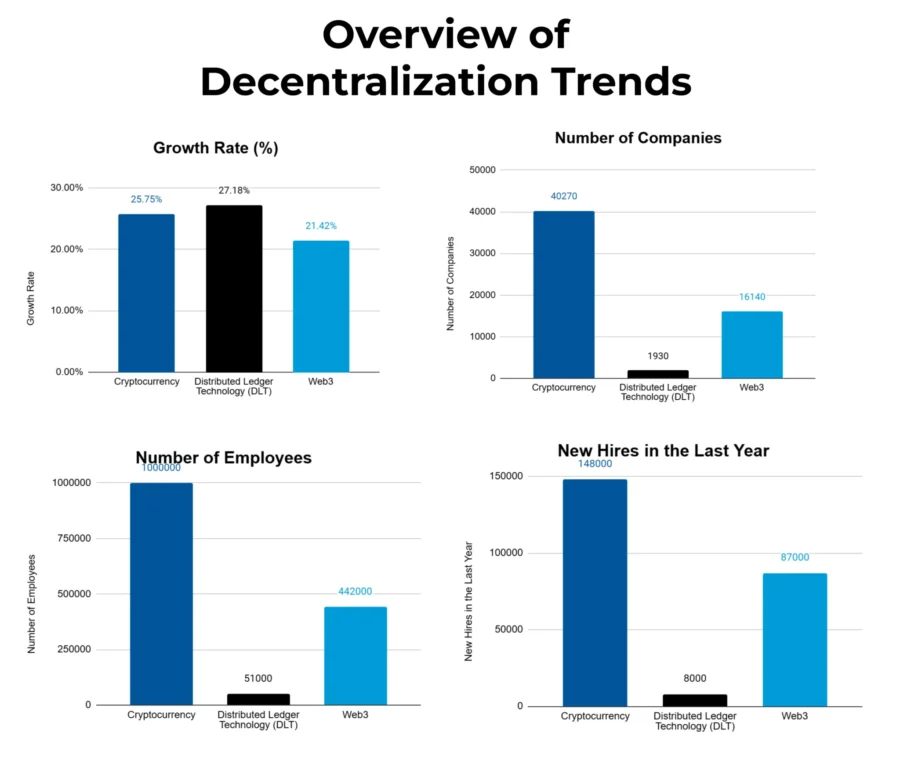

- Cryptocurrency is supported by a vast ecosystem of 40 270+ companies employing over 1 million people globally. With 148K new employees added in the past year, the domain reflects steady growth at an annual rate of 25.75%. Cryptocurrencies improve financial systems by enabling peer-to-peer transactions without intermediaries. Further, as adoption matures, central bank digital currencies (CBDCs) and decentralized finance (DeFi) applications continue to expand the market’s scope.

- Distributed Ledger Technology (DLT) domain comprises over 1 930 companies employing 51K professionals, with 8K new hires in the last year. Demonstrating an annual growth rate of 27.18%, DLT applications enable secure data sharing, smart contracts, and supply chain management. Moreover, it increases trust in multi-party ecosystems by driving data integrity and interoperability in healthcare, finance, and logistics.

- Web3 domain includes 16 140+ companies employing 442K+ individuals, with 87K+ new employees added in the past year, reflecting an annual growth rate of 21.42%. Further, web3 integrates decentralized identities, and tokenized ecosystems to power decentralized social media and creator economy platforms.

According to a Cointelegraph article, the integration of artificial intelligence (AI) into DeFi platforms is anticipated to be a major trend in 2025.

5 Top Examples from 7990+ Innovative Decentralization Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

NoorNation supports Energy and Water Infrastructure

Egyptian startup NoorNation drives the transition to a renewable energy future by delivering sustainable solar energy solutions.

It offers a range of products like the LifeBox system that provides clean energy solutions and electricity for home appliances.

NoorNation’s Noor Box is a home solar system that efficiently powers homes and businesses using premium components in basic and pro models.

Additionally, the startup’s Solar-Irrigation-as-a-Service (SIaaS) model enables farmers to access modern, solar-powered irrigation systems through a pay-as-you-go approach.

Further, NoorNation’s PV modules, available in monofacial and bifacial types, maximize energy production by utilizing direct, reflected, and diffuse sunlight.

Wellfield Technologies enables Decentralized Finance

Canadian startup Wellfield Technologies develops decentralized finance (DeFi) solutions that enable businesses to use blockchain technology for financial empowerment.

Its product suite includes protocols like LiquiFy, which utilizes automated market makers (AMMs) to create decentralized fixed-income, lending, and derivatives products.

Moreover, sBTC, a fully decentralized ERC20 token pegged to Bitcoin and XBC-DEX which is a trustless exchange that supports cross-chain swaps of digital assets without intermediaries.

The startup company also offers Coinmama for onboarding customers globally at scale. Further, VaultChain is another solution for tokenizing real-world assets like gold and silver, and its technology in LiquiFy for optimizing liquidity pools.

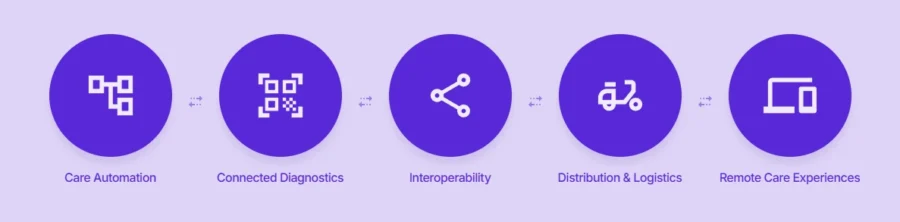

Safe Health Systems provides Digital Health and Connected Diagnostics Platform

Safe Health Systems, a US-based startup, builds a connected diagnostics platform enabling decentralized healthcare delivery.

The platform tackles challenges like at-home diagnostics with patented rapid diagnostic test (RDT) scanning software and wireless signal capture to reduce errors.

It also improves remote primary and complex care experiences by offering tools for medication adherence support, electronic health record (EHR) integration, and more.

Additionally, Safe Health enables easy access to siloed, decentralized health data for real-time diagnostics.

Arthanium provides a Trade and Supply Chain Platform

Arthanium is an Indian startup that develops decentralized applications (DApps) to streamline and secure global trade processes across industries.

Its solutions include DocConekt for paperless trade and certification, IoTConekt for secure supply chain tracking, and trade finance automation tools.

The startup also uses blockchain technology to provide transparent, and secure data for supply chain tracking, anti-counterfeiting, and digital identity creation.

Additionally, by integrating smart contracts and IoT sensors, Arthanium simplifies workflows, improves operations visibility, and safeguards against counterfeiting and diversion.

Ironblocks provides a Modular Web3 Security Layer

Ironblocks, an Israeli startup, provides a modular security layer for web3 with decentralized protection for blockchain projects.

It uses the Venn Security Network to integrate on-chain firewalls, rollup-specific guards, and hybrid security architectures.

The startup’s on-chain firewall blocks malicious transactions in real time without disrupting protocol operations.

In addition, the roll-up guard employs high-accuracy operators and rapid response mechanisms to protect roll-up ecosystems effectively.

Gain Comprehensive Insights into Decentralization Trends, Startups, or Technologies

In 2025, the decentralization market will grow as advancements in blockchain, decentralized identity, and decentralized finance (DeFi) transform industries.

These innovations will improve data security, increase transparency, and bring more inclusive business ecosystems. Moreover, companies will increasingly adopt decentralized solutions to streamline operations, improve trust, and unlock new opportunities for collaboration and efficiency.

Get in touch to explore all 7990+ startups and scaleups, as well as all market trends impacting decentralization companies.

![Future of Robotics: 12 Trends Powering the Next Wave [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/06/Future-of-Robotics-SharedImg-StartUs-Insights-noresize-420x236.webp)