Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

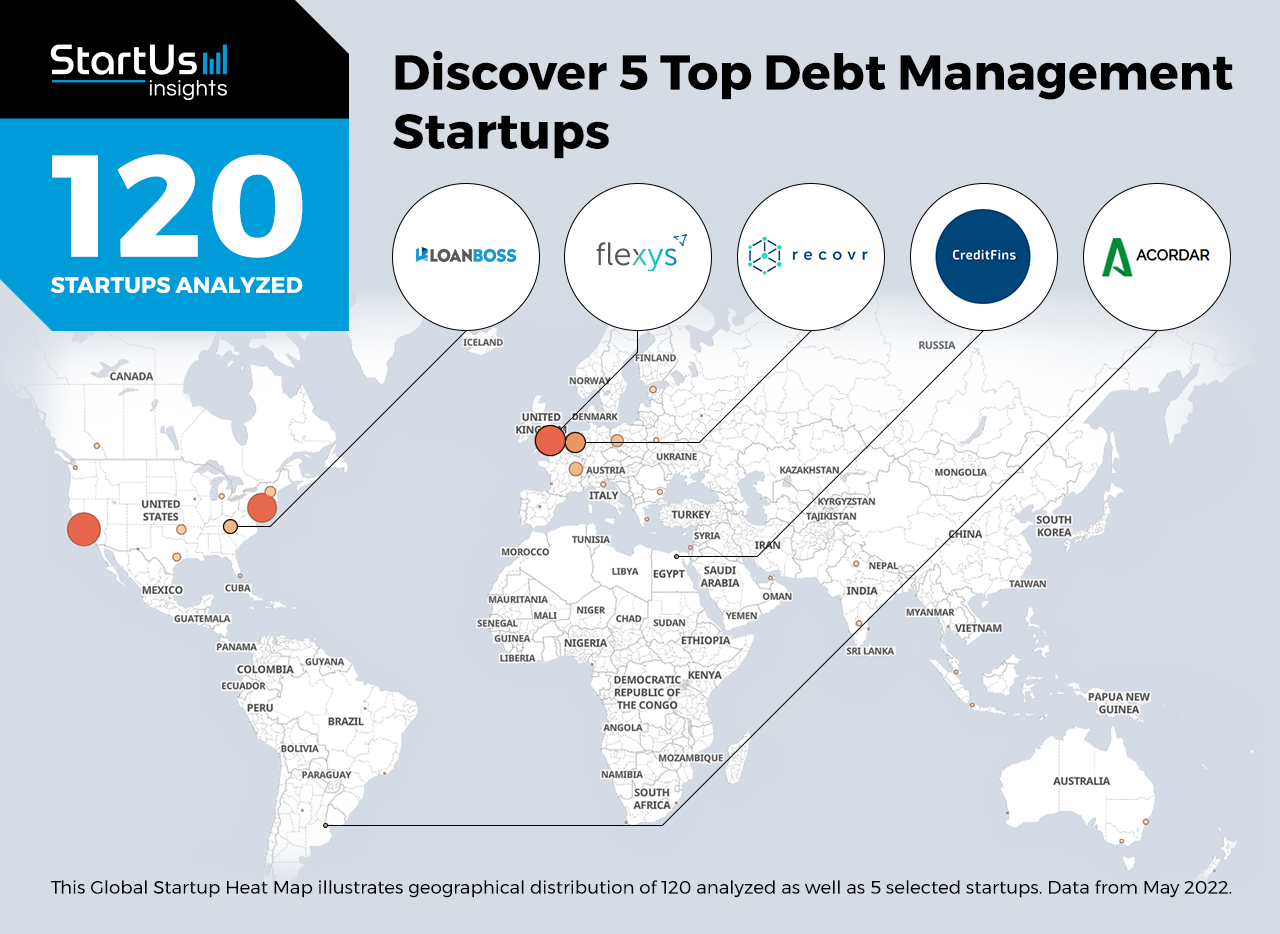

Out of 120, the Global Startup Heat Map highlights 5 Top Debt Management Startups

Startups such as the examples highlighted in this report focus on centralized data management, debt analysis, credit management as well as machine learning (ML) and advanced analytics. While all of these technologies play a significant role in advancing the financial services industry, they only represent the tip of the iceberg. This time, you get to discover five hand-picked debt management startups.

The Global Startup Heat Map below reveals the geographical distribution of 120 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on scouting criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 115 debt management solutions, get in touch with us.

Flexsys develops a Cloud-based Debt Management Platform

Founding Year: 2016

Location: Bristol, UK

Partner with Flexsys for Digitized Debt Management

UK-based startup Flexsys develops Control+, a cloud-based debt management platform. It allows users to implement new business models or make changes to meet regulatory or business requirements. Control+ also automates workflows with additional features, such as performance monitoring, across the collections landscape. Further, the startup provides a modular solution, Contain, to manage late-stage collections and litigations. As a result, the startup’s platform enables financial companies to improve debt collection efficiency and reduce late payments.

Loanboss provides Debt Reporting Software

Founding Year: 2019

Location: Charlotte, US

Use this solution for Debt Monitoring

US-based startup Loanboss offers a debt management platform for commercial real estate professionals. It features tools to replicate and automate internal reports that provide insights into borrowers’ recourse exposure, refinance (refi) opportunities, internal budget, and more. In addition, the tools assist with viewing loan documents, managing lender compliance, and refi analysis. The platform is also integrable with existing systems and provides security features such as nightly backups. This allows real estate companies to improve debt data management as well as offers real-time market data and hold-sell analysis.

Creditfins offers a Credit Management App

Founding Year: 2020

Location: Cairo, Egypt

Collaborate with Creditfins for Personal Financial Advisory

Egyptian startup Creditfins makes a mobile-based credit card management platform. It provides users with tailored debt management plans while also offering exclusive hands-on financial advisory. Moreover, once a user completes the contractual process, the startup moves the funds to their bank account within 3 business days. The app also consolidates credit card debts into single, low monthly payments with easy payoff scheduling to make debt repayment tracking easier. This way, the startup’s smart financial management solution allows its customers to mitigate late-fee penalties and improves their financial freedom.

Acordar makes a Debt Negotiation Platform

Founding Year: 2017

Location: Buenos Aires, Argentina

Reach out to Acordar for Debt Recovery

Argentine startup Acordar develops an artificial intelligence (AI)- and ML-based platform for debt recovery. It is a centralized management solution to store all customer information to communicate with clients and supports multiple payment options to increase the likelihood of debt collection. The platform supports debtors by providing them with personalized messages and a simple portal for communication, enabling omnichannel sales and real-time campaign tracking.

Recovr creates Invoice Management & Collection Software

Founding Year: 2017

Location: Saint-Gilles, Belgium

Use this solution for Invoice Collection

Belgian startup Recovr provides a software solution that centralizes credit management and debt collection. It features invoice follow-up using real-time alerts, automated reminders for unpaid invoices, and a simplified payment portal for bill payment. The software also automates bank reconciliation by connecting to bank accounts, tracking cash flow in real-time, and reconciling cash receipts with bills. Besides these, Recovr calculates late payment fees and provides expert legal advice through lawyers that will put the client’s debits on notice and summon them to pay. This saves the time, cost, and effort of debt collection agencies in credit management and debt collection.

Where is this Data from & how to Discover More FinTech Startups?

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. The insights of this data-driven analysis are derived from our Big Data- & AI-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & lets you scout relevant startups within a specific field in just a few clicks. To explore financial technologies in more detail, let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.