Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the InsurTech industry. This time, you get to discover five hand-picked cyber insurance startups.

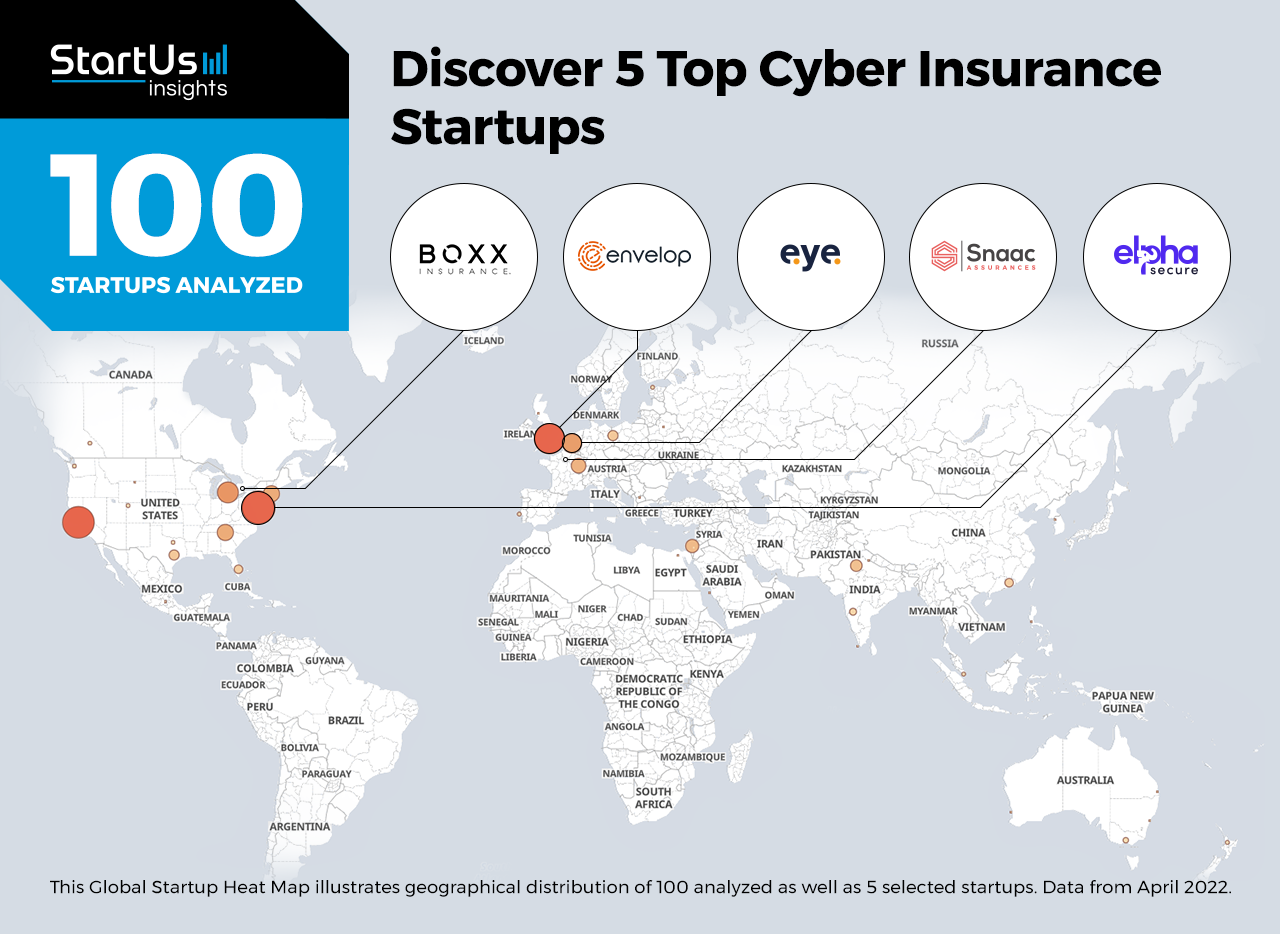

Out of 100, the Global Startup Heat Map highlights 5 Top Cyber Insurance Startups

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 100 exemplary startups & scaleups we analyzed for this research. Further, it highlights five cyber insurance startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 95 cyber insurance solutions, get in touch with us.

Snacc Assurances provides Cyber Risk Protection

Founding Year: 2017

Location: Paris, France

Partner with Snaac for Business Integrity Protection

French startup Snacc Assurances offers cyber insurance to protect businesses from IT risks. In the event of a cyberattack or threat, Snaac Assurances provides IT expertise through the appointment of an investigative expert to measure and prevent future incidents. Besides this, its insurance policy provides crisis management using a crisis coordinator specializing in cybercrime and covers legal expenses for consulting lawyers. This solution secures businesses financially against the increasing threat of cyber attacks.

Eye Security offers Downtime Loss Protection

Founding Year: 2020

Location: Hague, Netherlands

Use Eye Security’s solution for Cyber Threat Monitoring

Dutch startup Eye Security develops cyber threat monitoring solutions. These include threat detection of office networks and cloud environments, incident response, and protecting businesses financially. In the event of a cyberattack, Eye Security’s cyber insurance protects businesses’ finances with downtime loss protection.

BOXX Insurance advances Predictive Cybersecurity

Founding Year: 2018

Location: Toronto, Canada

Collaborate with BOXX Insurance for Personalized Cyber Insurance

Canadian startup BOXX Insurance offers Cyberboxx, a cyber insurance and cybersecurity platform that combines data science and specialized underwriting. It customizes cyber insurance to its client’s requirements, such as customer base, channel, and pockets, to insure against privacy fines and damage. Additionally, the platform improves the digital resilience of companies by providing a cyber SWAT team to tackle identity theft, phishing, and unauthorized access.

Envelop Risk provides Cyber Insurance Underwriting

Founding Year: 2016

Location: London, UK

Innovate with Envelop Risk for Cyber Insurance Analytics

UK-based scaleup Envelop Risk provides specialty cyber insurance analytics and underwriting services. The startup’s scalable cyber reinsurance ecosystem uses augmented intelligence powered by advanced analytics. It uses AI to make optimal predictive decisions for risk analysis, pricing, and portfolio management. Additionally, Envelop Risk’s reinsurance solution offers quota share, stop loss, aggregate stop loss, and risk excess of loss insurances. The startup’s solutions thus enable insurers and reinsurers to access insight into likely attacker targets and existing defenses.

Elpha Secure offers Dynamic Cyber Attack Protection

Founding Year: 2018

Location: New York, US

Reach out to Elpha Secure for Cyber Risk Response

US-based startup Elpha Secure provides real-time dynamic cyber-attack protection. The startup uses a streamlined application and underwriting process with a complimentary external scan to generate a risk scorecard and offer quick insurance quotations. Additionally, Elpha Secure’s platform features tools to defend against ransomware and social engineering as well as offer control over risk response and business data. Moreover, the startup provides critical data backups, multi-factor authentication (MFA), and virtual private networks (VPN) to further strengthen security.

Discover more InsurTech Startups

InsurTech startups such as the examples highlighted in this report focus on cyber threat intelligence, risk management, predictive cybersecurity as well as robotic process automation (RPA). While all of these technologies play a major role in advancing the insurance industry, they only represent the tip of the iceberg. To explore insurance technologies in more detail, let us look into your areas of interest. For a more general overview, download our free InsurTech Innovation Report to save your time and improve strategic decision-making.