Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Cancer treatment in 2025 is evolving through precision-driven and patient-focused innovations. The global oncology market is expected to reach USD 521.60 billion by 2033, with a CAGR of 8.9% from 2024 to 2033.

The advances in artificial intelligence (AI) integration, targeted therapies, and digitized care models are accelerating diagnosis, customizing treatments, and expanding access to care.

At the same time, immunotherapy and nanoparticle drug delivery are enhancing treatment effectiveness while reducing side effects. As decentralization reshapes the industry, healthcare and biotech leaders and innovation managers must adjust to ongoing clinical and technological changes.

What are the Top 10 Current Trends in Cancer Treatment [2025]?

- AI Integration

- Immunotherapy Innovations

- Advanced Targeted Therapies

- Precision Oncology

- Radiation and Surgical Techniques

- Integrative and Palliative Care

- Nanoparticle Drug Delivery

- Liquid Biopsies

- Bispecific Antibodies

- Digitization and Decentralization

Methodology: How We Created the Cancer Treatment Trends Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 7M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and latest innovations in cancer treatment.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the technological advances in the cancer treatment ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the 10 Current Trends in Cancer Treatment & 20 Promising Startups

For this in-depth research on the Top 10 Cancer Treatment Trends & Startups, we analyzed a sample of 4380+ global startups & scaleups. The Cancer Treatment Innovation Map, created from this data-driven research, helps you improve strategic decision-making by giving you a comprehensive overview of the trends in cancer treatment & startups that impact your company.

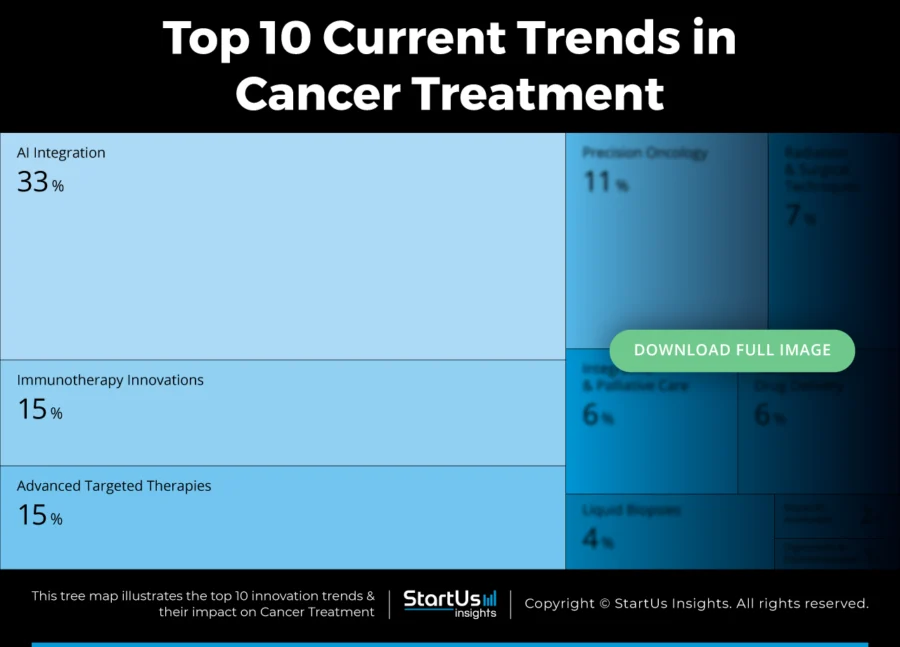

Tree Map reveals the Impact of the Top 10 Current Trends in Cancer Treatment

Clinicians and researchers adopt targeted and accessible approaches to advance cancer treatment. Trends like precision oncology tailor treatments using genetic profiling, while bispecific antibodies open new immunotherapeutic pathways. Liquid biopsies provide non-invasive diagnostic alternatives that support early detection and treatment monitoring.

Further, AI improves pathology, drug discovery, and clinical decision-making. Integrative and palliative care models address patient needs holistically, while digitization and decentralization expand remote diagnostics and therapy access. These developments signal a broader shift toward individualized, technology-driven cancer care.

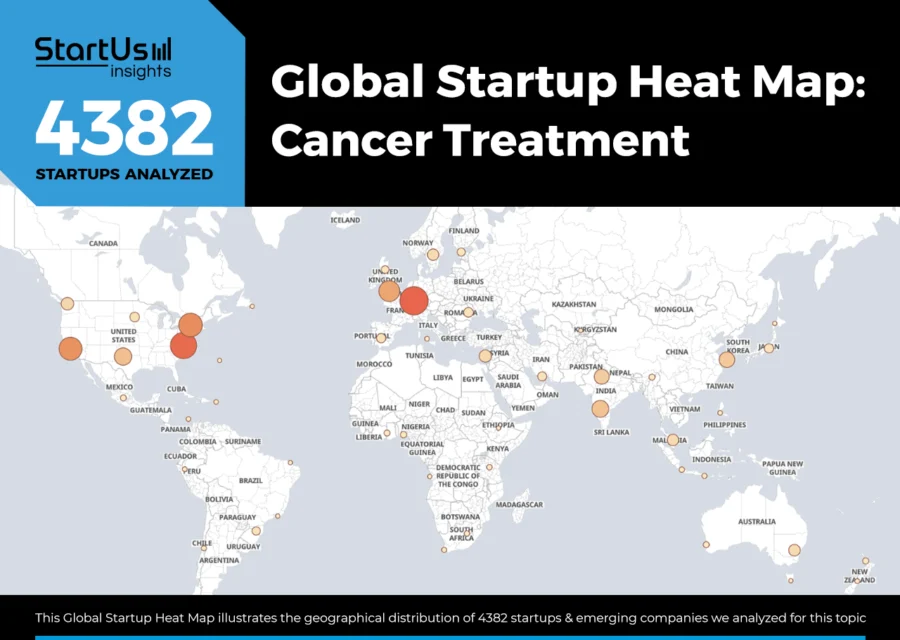

Global Startup Heat Map covers 20 Cancer Treatment Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 4380+ exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the US and India, followed by the UK. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Innovations & Trends in Cancer Treatment?

Top 10 Current Trends in Cancer Treatment [2025 and Beyond]

1. AI Integration

Modern oncology generates massive volumes of data, including high-resolution imaging, genomic sequences, and electronic health records, that far exceed human analytical capacity.

AI plays a vital role in parsing this complexity as it learns from large datasets to support clinical and research advancements.

Over the past decade, AI’s role has been validated across 211 studies (as noted in an ESMO review). This demonstrates utility in tumor detection, biomarker identification, and prognostic modeling.

AI is delivering significant improvements in early cancer detection and workflow efficiency. In the last year, multi-modal AI screening that combined imaging, blood biomarkers, and genomics achieved a 65% improvement in detection rates for certain cancers, while reducing false positives by 40%.

For cancers with typically poor outcomes, such as pancreatic cancer, early detection is life-saving. According to the American Cancer Society’s 2024 report, the five-year survival rate for pancreatic cancer is just 13%, but rises to 44% when diagnosed early and confined to the pancreas.

AI-driven predictive models are also enhancing treatment safety by flagging risks in advance. Leading cancer centers using platforms such as Tempus and ConcertAI have reported fewer emergency hospital visits and severe chemotherapy complications due to real-time prediction of toxic side effects.

In parallel, AI-powered radiomics is improving personalization by accurately predicting which patients will respond to therapies like immunotherapy, thus avoiding ineffective treatments.

Clinical decision-making is also becoming faster and more consistent with AI co-pilot systems. Tools like Roche’s Navify platform have enabled hospitals to reduce treatment initiation times and minimize provider-to-provider variability in care delivery.

Generative AI models, including AlphaFold for protein folding, are revolutionizing oncology research and development by unlocking new therapeutic targets through precise structural predictions.

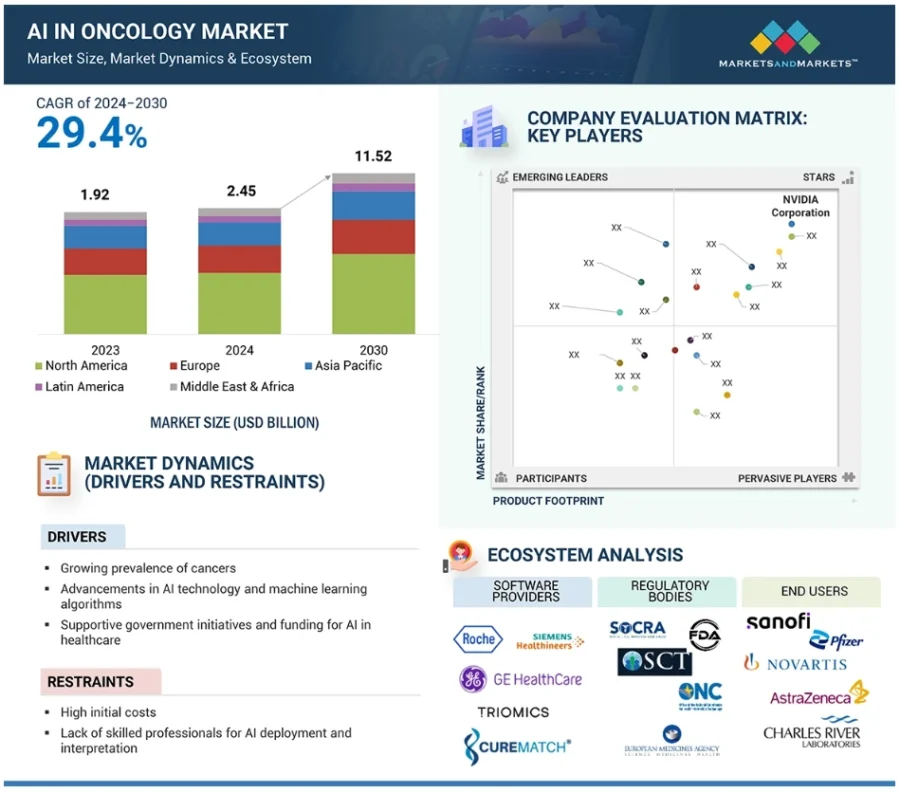

As the integration of AI accelerates across the cancer care continuum, the global AI in oncology market is forecast to reach USD 11.52 billion by 2030, growing at a CAGR of 29.4% from 2024 to 2030.

Credit: Markets and Markets

Avitia advances AI-driven Bioinformatics

Canadian startup Avitia develops an AI-powered molecular diagnostics platform that enables local laboratories to conduct on-site next-generation sequencing (NGS) for cancer mutation detection.

The platform integrates machine learning-based analytics, local genomic testing, and data workflows to identify tumor-specific DNA and RNA mutations from tissue or liquid biopsies. It supports over 50 gene targets and delivers clinical insights within 3–5 days to reduce reliance on central lab processing and minimize delays in treatment decisions.

Avitia uses validated bioinformatics pipelines for high-throughput genomic analysis and clinical reporting, achieving a 99% assay success rate.

Hope Valley AI provides Breast Health Digital Clinic

French startup Hope Valley AI develops a smartphone-based digital breast health clinic that applies multimodal AI for early breast cancer detection using non-ionizing imaging.

The startup’s platform captures video selfies to create digital twins of breast tissue. Then, machine learning models analyze these images to identify anomalies and assess cancer risk over short- and long-term periods.

It combines explainable AI outputs, personalized risk assessment, and breast health education to support informed decision-making for individuals and clinicians. Hope Valley AI deletes raw imaging after analysis and integrates with local clinical workflows to maintain privacy and improve accessibility.

2. Immunotherapy Innovations

Cancer immunotherapy is delivering significant results. Long-term survivors and cures are emerging in diseases like melanoma and certain blood cancers. These outcomes confirm the immune system’s potential in cancer treatment.

The US Food and Drug Administration (FDA) continues to improve immunotherapy approvals. It granted 13 new indications across 11 cancer types in the past year.

Chimeric antigen receptor T-cell (CAR-T) therapy has led to notable advances. Institutions such as the University of Pennsylvania and the National Cancer Institute (NCI) partnered with Novartis and Gilead/Kite to introduce the first CAR-T therapies. These treatments have produced high remission rates for B-cell leukemias and lymphomas.

As of 2025, seven FDA-approved CAR-T therapies – Kymriah, Yescarta, Tecartus, Breyanzi, Abecma, Carvykti, and the newly approved Aucatzyl – target various blood cancers, including myeloma.

In the last year, Umoja Biopharma, with AbbVie and Interius BioTherapeutics received FDA clearance for first-in-human trials using in vivo CAR-T cell generation. This technique aims to produce therapeutic cells inside the patient’s body to simplify logistics and expand access.

Meanwhile, the checkpoint inhibitor class is evolving. PD-1/PD-L1 and CTLA-4 blockers reshaped treatment, and researchers are now investigating new targets such as LAG-3, TIGIT, and TIM-3.

Relatlimab, an anti–LAG–3 agent, was the first of these next-generation inhibitors approved in 2022. Several anti-TIGIT agents are now in late-stage trials for lung and other cancers.

Oncolytic virotherapy is also advancing. T-VEC, the first FDA-approved oncolytic virus for melanoma, demonstrated proof-of-concept. Building on that success, CG Oncology is developing CG0070, a novel adenovirus therapy for bladder cancer. The company’s USD 380 million IPO in early 2024 reflects investor confidence and funds its ongoing Phase III trials.

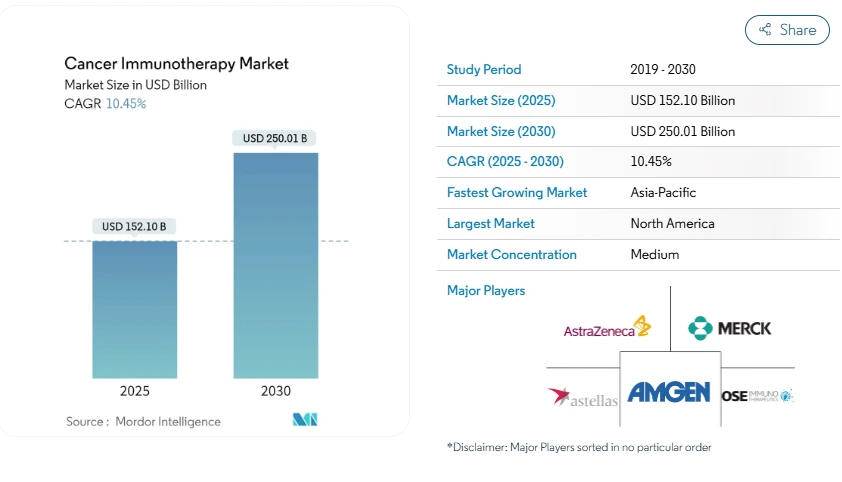

Moreover, the global cancer immunotherapy market is projected to grow from USD 152.10 billion in 2025 to USD 250.01 billion by 2030, expanding at a CAGR of 10.45% during this period.

Credit: Mordor Intelligence

Solid IO builds Tumor-on-chip Platform

Finnish startup Solid IO makes an organ-on-chip platform that replicates the tumor microenvironment to provide real-time insights into cancer response to immunotherapy. The technology integrates patient-derived cancer and immune cells within a bioengineered microfluidic chip, which predicts treatment outcomes before and during therapy with accuracy.

It combines biological modeling, AI, and fluidic engineering to simulate human tumors for enabling clinicians to make data-driven decisions and reduce trial-and-error approaches. The platform supports multiple cancer types and immuno-oncology therapies and offers a scalable diagnostic solution for clinical and research applications.

The startup also aids pharmaceutical innovation by accelerating drug development, validating biomarkers, and refining patient stratification. It links clinicians, researchers, and drug developers.

Further, Solid IO received a EUR 400 000 research and development grant from Business Finland to advance its technology.

Caedo Oncology builds Monoclonal Antibody-Based Therapy

Norwegian startup Caedo Oncology develops CO-1, a bifunctional anti-CD47 monoclonal antibody that enhances cancer immunotherapy by combining immune checkpoint inhibition with direct programmed cell death in tumor cells.

The startup’s antibody targets CD47, a membrane receptor overexpressed by many cancer cells to evade phagocytosis. By blocking its interaction with SIRPα, CO-1 enables immune cells to identify and destroy cancer cells.

At the same time, CO-1 binds to unique epitopes on CD47’s IgV domain, which triggers caspase-independent programmed cell death, a mechanism not seen in other CD47-targeting antibodies.

Preclinical studies show CO-1 eliminates tumors in NSG mouse models as a monotherapy and exhibits high-affinity binding to CD47 across multiple cancer types. It provides immediate tumor cell destruction and sustained immune response.

3. Advanced Targeted Therapies

In late 2024, the US FDA approved 15 new oncology indications in a single quarter, which reflects the rapid evolution of targeted cancer treatments.

Among these approvals were several first-in-class therapies, including revumenib – the first menin inhibitor targeting KMT2A-rearranged leukemia – and zolbetuximab, a HER2-targeted antibody for gastric cancer.

The rise of comprehensive tumor genomic profiling is enabling more personalized treatment strategies. Routine broad sequencing is increasingly being adopted at diagnosis to identify actionable mutations.

Clinical evidence supports this approach, as patients whose therapies are genomically matched experience significantly improved outcomes. This trend is prompting oncologists to call for the standardized implementation of genomic testing across all cancer types.

Pharmaceutical leaders such as Roche and Novartis are doubling down on targeted modalities, ranging from molecular inhibitors to radioligand therapies.

One notable approval is Pluvicto (lutetium Lu 177 vipivotide tetraxetan), authorized for PSMA-positive metastatic castration-resistant prostate cancer (mCRPC) patients previously treated with androgen receptor pathway inhibitors.

Antibody-drug conjugates (ADCs) represent one of the most dynamic segments in oncology. As of December 2024, 16 ADCs have received regulatory approval globally. These therapies combine targeted antibodies with potent cytotoxins to selectively eliminate cancer cells. Besides, the ADC market is expected to reach USD 50 billion by 2030.

Additionally, targeted radiopharmaceuticals deliver radioactive isotopes directly to tumor sites by binding to specific cellular targets through peptides or antibodies. This enables localized radiation with minimal off-target effects.

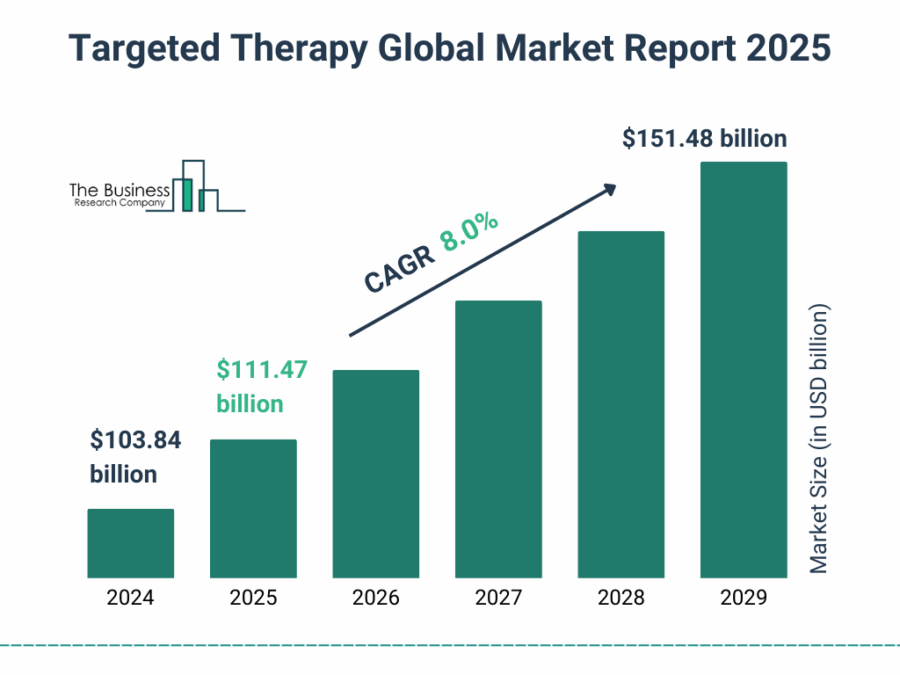

The global targeted cancer therapy market is projected to grow significantly, reaching USD 151.48 billion by 2029, at a CAGR of 8.0%.

Credit: The Business Research Company

Nodus Oncology makes PARG Inhibitor

UK-based startup Nodus Oncology develops NODX-010, a small-molecule inhibitor of poly(ADP-ribose) glycohydrolase (PARG) that targets DNA repair vulnerabilities in cancer cells. The compound blocks PARG’s function in degrading ADP-ribose chains, sustaining PARP autoPARylation, depleting NAD+, and disrupting DNA repair progression.

This interference triggers replication stress and selectively eliminates tumor cells with specific DNA repair defects through a synthetic lethality mechanism. Preclinical studies show tumor growth inhibition in breast cancer models and confirm in vivo target engagement with favorable pharmacokinetics.

Nodus Oncology leverages the relationship between PARP and PARG in DNA repair to offer a therapeutic strategy for cancers that resist current treatments.

Alterome builds a Drug Discovery Platform

US-based startup Alterome makes alteration-specific small molecule therapies that target oncogenic drivers using a structure- and computation-driven approach. It applies its The Kraken platform, a computational chemistry engine that integrates quantum chemistry, molecular dynamics, and free energy simulations, to design selective inhibitors for validated cancer mutations.

This model enables the discovery of compounds that bind specific gene alterations while reducing off-target toxicity to address the limitations of conventional therapies. The drug discovery process combines synthetic and medicinal chemistry with in vitro and in vivo analysis to ensure target specificity and therapeutic durability.

4. Precision Oncology

Precision oncology, powered by molecular diagnostics, tumor biomarkers, and multi-omic profiling, is improving cancer care.

The decline in DNA sequencing costs, from USD 3 billion for the first genome in 2003 to a few thousand dollars in 2024, has made tumor genomic profiling more accessible.

High-throughput next-generation sequencing (NGS) and advanced bioinformatics now allow laboratories to analyze hundreds of cancer-relevant genes within days.

By the end of 2023, 43% of the 217 FDA-approved oncology therapies qualified as precision treatments, with 78 linked to DNA or NGS-detectable biomarkers.

New therapies continue to emerge, including protein degradation treatments such as Elacestrant for certain breast cancers and bispecific T-cell engagers (BiTE) that enhance immune response.

Interest in spatial biology grew in the last year as researchers focused on the tumor microenvironment. MD Anderson Cancer Center launched a program in single-cell spatial omics to study how tumor organization affects therapy response.

Platforms such as 10x Genomics’ Visium, NanoString’s CosMx, and Akoya Biosciences’ PhenoCycler enable spatial mapping of biomarkers across intact tissue sections.

Further, Inside Precision Medicine reported that multi-omics integration, combining genomics, transcriptomics, proteomics, epigenomics, and metabolomics, offers deeper insights into tumor biology.

Moreover, Caris Life Sciences raised USD 168 million in April 2025, bringing its total funding to USD 1.86 billion since 2018. Tempus secured USD 410 million in the last year to expand its AI-driven precision medicine platforms.

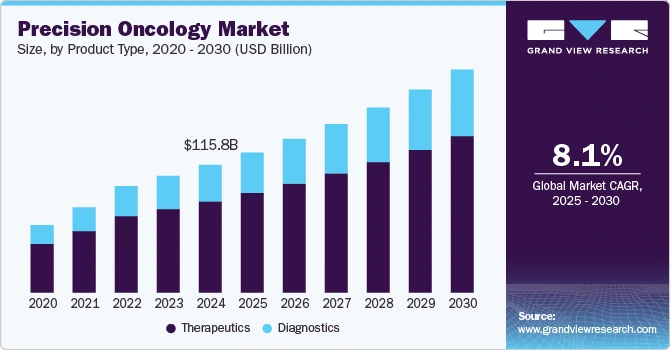

The global precision oncology market is projected to grow at a compound annual rate of 8.05% from 2025 to 2030, driven by advancements in diagnostics, data analytics, and targeted therapeutics.

Credit: Grand View Research

OncoAssure makes Biomarkers for Cancer Management

Irish startup OncoAssure builds OncoAssure Prostate, a prognostic RT-qPCR-based test that stratifies prostate cancer patients by risk of progression using a focused panel of master driver genes. The test identifies four prognostic genes that regulate oncogenic pathways and two reference genes. These selections are based on transcriptomic and mathematical modeling and offer predictive insights beyond standard clinical data.

It integrates the CAPRA score and delivers consistent results with validated reagents compatible with standard laboratory equipment, which enables hospital labs to adopt it easily. The workflow is designed for local execution and supports timely decision-making after biopsy and surgery.

OncoAssure is also developing biomarkers for melanoma, bladder cancer, squamous cell carcinoma, and oesophageal cancer. This approach enables clinicians to personalize treatment, minimize overtreatment, and improve patient outcomes.

Hurone AI provides Precision Cancer Care

US-based startup Hurone AI develops Gukiza, an AI-powered oncology co-pilot that automates clinical workflows, guides treatment decisions, and enables real-time patient monitoring. The platform integrates web-based tools for clinicians and mobile and USSD interfaces for patients to ensure accessibility across different digital infrastructures.

It applies federated learning to diverse datasets to provide explainable, evidence-based insights that align with global and regional treatment protocols. Gukiza automates routine tasks such as symptom tracking, emergency detection, and care plan generation. These functions reduce oncologists’ workload and improve protocol adherence.

The startup’s precision care model delivers real-time, personalized treatment guidance to clinicians and offers patients timely information throughout their care journey.

5. Radiation and Surgical Techniques

Healthcare systems are increasing investments in advanced cancer treatment technologies. Proton therapy, once focused on prostate cancer, is now used for breast, head and neck, and other tumors. This expansion is strengthening provider confidence and driving infrastructure development.

In the US, academic and private entities are collaborating to improve access. Connecticut’s first proton therapy center, a joint venture between Yale New Haven, Hartford HealthCare, and Proton International, is scheduled to open in 2026 to address a regional gap.

FLASH radiotherapy is also advancing. Preclinical studies show that ultra-high-dose FLASH proton radiation controls tumors while minimizing damage to healthy tissue. Researchers at Penn demonstrated real-world viability by successfully treating a pet dog with osteosarcoma using conformal FLASH proton therapy.

In the last year, MD Anderson Cancer Center introduced its AI-driven Radiation Planning Assistant globally. The tool automatically contours tumors on CT scans and generates radiotherapy plans in minutes to improve efficiency for clinics facing staffing shortages.

Moreover, the FDA approved CMR Surgical’s Versius system, a modular robotic solution for minimally invasive keyhole surgeries, in late 2024.

Governments are also investing in radiotherapy equipment. The UK allocated GBP 70 million toward this technology as part of its broader GBP 1.5 billion cancer care strategy.

Besides, the surgical robotics market is projected to reach USD 23.7 billion by 2029, with a CAGR of 16.5% from 2024 to 2029.

Credit: Markets and Markets

BrachyDOSE offers Cancer Treatment Quality Control Tool

Lithuanian startup BrachyDOSE develops a real-time in vivo dosimetry system that improves brachytherapy accuracy and safety by measuring radiation doses during treatment and predicting side effects.

The startup’s system includes a flexible, disposable sensor placed in standard implantable tubes near the tumor, a scanner for data retrieval, and a machine learning-based software platform that analyzes dose delivery and forecasts injury risks.

The sensor is made from tissue-equivalent material and does not require calibration or re-sterilization. It captures data with 0.1 mm accuracy and integrates with existing radiotherapy equipment.

Clinicians use one to five sensors per procedure, depending on the treatment plan. After therapy, the software identifies discrepancies between prescribed and delivered doses to alert clinicians to potential complications or treatment deviations.

BrachyDOSE’s process supports personalized care, reduces errors, and aids clinical decision-making without additional personnel training.

Emet Surgical advances Cancerous Tissue Recognition & Surgical Guidance

US-based startup Emet Surgical builds Enhanced Surgical Precision (ESP), an AI-powered system that assists surgeons in minimally invasive procedures by analyzing live video streams and overlaying anatomical guidance and cancer detection cues in real time.

The system functions as a surgical co-pilot by identifying critical structures and flagging suspicious tissue using machine learning algorithms and intellectual property licensed from the University of Minnesota.

ESP provides pathology-informed insights directly to the surgeon’s monitor during dissection and simulates a gross exam in the OR. It integrates with existing laparoscopic and robotic setups and requires no additional instruments or training.

6. Integrative and Palliative Care

Global demand for palliative care has grown by 74% over the past three decades and it reached 73.5 million people in 2021, according to The Lancet Global Health. This increase reflects the expanding need for symptom management and holistic support across a range of serious illnesses, and not just terminal conditions.

In response, the American Medical Association‘s House of Delegates adopted new ethical guidelines, which reinforces physicians’ responsibility to provide or refer patients for appropriate palliative care.

Many oncology centers use electronic patient-reported outcome (ePRO) tools to track symptoms in real time and trigger timely interventions.

In the last year, New York Cancer & Blood Specialists introduced the Canopy continuous care platform with remote symptom monitoring. The system reduced emergency department visits and hospitalizations among cancer patients by 22%.

Further, virtual reality (VR) is emerging as a complementary therapy for pain and psychological distress. A 2024 meta-synthesis across the US, UK, Canada, and Australia analyzed 156 terminally ill patients. Findings showed that VR therapy provided short-term pain relief and improved mood. Patients reported enhanced emotional control and comfort, especially when immersed in environments that recalled personal memories or featured calming visual content.

Meanwhile, pharmacogenomics is gaining attention as a tool to personalize symptom control in palliative care. Researchers are studying genetic testing, such as CYP2D6 genotyping, to optimize opioid selection and dosing for improving pain relief while reducing side effects.

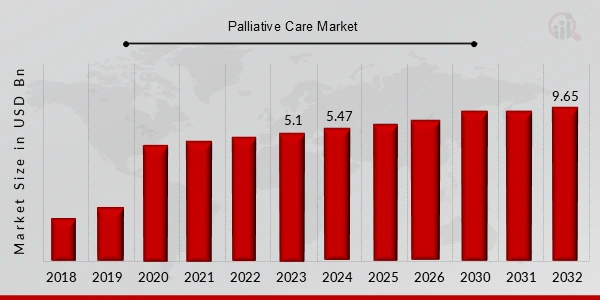

Besides, the palliative care sector is projected to reach USD 9.65 billion by 2032, with a CAGR of 7.4% from 2023 to 2032.

Credit: Market Research Future

Citrus Oncology creates Virtual Multi-Specialty Cancer Support Clinic

US-based startup Citrus Oncology makes a virtual multi-specialty cancer support clinic that provides expert-led care for managing side effects and pre-existing conditions throughout cancer treatment.

The platform connects patients and oncology practices with board-certified specialists, including endocrinologists, cardiologists, dermatologists, nephrologists, psychiatrists, and palliative care physicians. It offers asynchronous eConsults and video visits to ensure timely access to expertise.

Further, its AI integration simplifies documentation and supports clinical workflows. Oncologists initiate peer-to-peer referrals, and patients receive expert guidance within 72 hours. The platform focuses on chemotherapy and immunotherapy toxicities, radiation side effects, and comorbid conditions such as diabetes, thyroid disease, heart failure, and mental health disorders.

Citrus Oncology provides patient- and oncologist-initiated consultation pathways that support survivorship and previvor care, and reduce hospitalizations linked to treatment complications.

Epilog advances Disease and Life Management

Israeli startup Curia develops a personalized digital platform that enables cancer patients to navigate treatments, clinical trials, and expert consultations based on their specific cancer type and stage. The platform collects user data through a structured intake process and applies machine learning to match patients with therapy options, ongoing studies, and specialized physicians.

It provides curated educational content, connects patients through its cancer twin feature, and enables direct clinical trial applications within the app. Additionally, it builds a trusted support network that includes caregivers and healthcare providers to ensure access to unbiased, time-sensitive information.

7. Nanoparticle Drug Delivery

This year, MIT researchers developed a scalable method for manufacturing polymer-layered nanoparticles to reduce production time and enable large-scale synthesis of drug-loaded particles. This advancement supports the increasing demand for nanomedicine in oncology.

At the same time, pharmaceutical companies such as Pfizer, Merck, and Takeda formed strategic partnerships with nanotechnology innovators to co-develop lipid nanoparticle (LNP) delivery systems and secure intellectual property for commercialization.

Lipid-based nanoparticles, including liposomes and solid lipid nanoparticles, remain central to clinical nanomedicine because of their biocompatibility and effectiveness in chemotherapeutic delivery. One example is Onivyde (liposomal irinotecan), which gained FDA approval in February 2024 as a first-line therapy for pancreatic cancer following successful Phase 3 trials.

Polymeric nanoparticles are also emerging as adaptable drug carriers. They are made from biodegradable materials like PLGA and novel block copolymers and enables controlled release and tumor-specific targeting. Tel Aviv University researchers created a dual-drug delivery platform using polymeric nanoparticles to co-localize agents in breast and skin tumors for improving efficacy and reducing toxicity.

Further, SN BioScience in South Korea is developing SNB-101, a polymeric nanoparticle formulation of the insoluble chemotherapeutic SN-38. In the last year, the FDA and EMA granted SNB-101 orphan designations and FDA Fast Track status for treating small-cell lung cancer.

Also, Nanospectra Biosciences and the University of Virginia validated AuroShells, a gold-silica nanoparticle platform for prostate cancer therapy. A 2024 multi-center study found that focal laser ablation with these nanoparticles left 73% of patients with no viable tumor on biopsy after one year, without significant adverse effects.

The US National Cancer Institute launched the Toward Translation of Nanotech Cancer Interventions (TTNCI) program in late 2024 to accelerate clinical adoption.

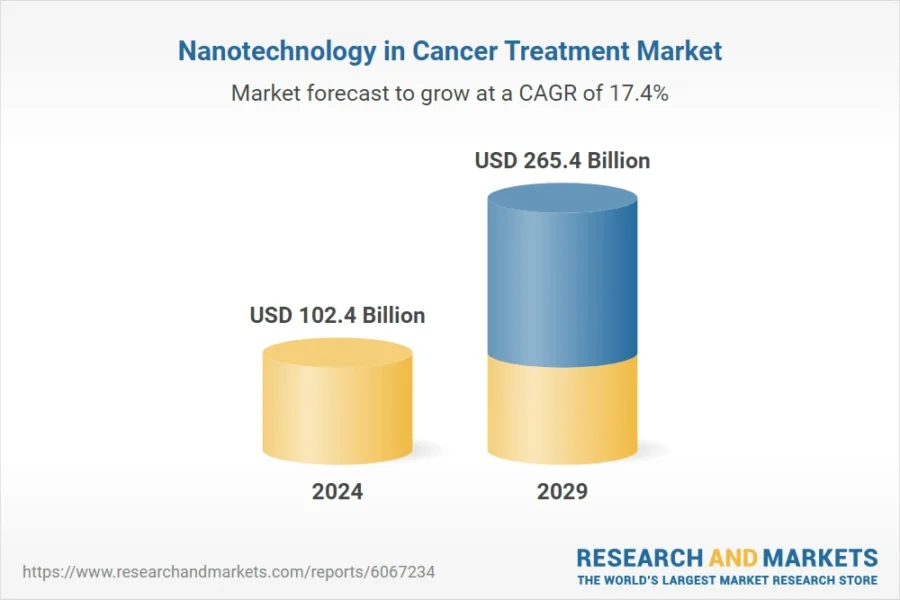

Moreover, the nanotechnology market for cancer treatment is projected to reach USD 265.4 billion by 2029, growing at a CAGR of 17.4% between 2024 and 2029.

Credit: Research and Markets

NaDeNo Nanoscience enables Direct-to-Tumor Drug Delivery

Norwegian startup NaDeNo Nanoscience builds a nanotechnology-based drug delivery platform that improves cancer treatment precision by enabling direct-to-tumor release of encapsulated chemotherapy drugs. Its proprietary PACA (poly(alkyl cyanoacrylate)) nanoparticles encapsulate FDA- and EMA-approved hydrophobic drugs without chemical modification to ensure stable delivery and sustained therapeutic presence at the tumor site.

Administered into the peritoneal cavity, the nanoparticles distribute evenly across tumor nodules. They release 30% of the drug immediately, 40% over eight hours, and 30% over two to four weeks, then degrade into non-toxic byproducts. The formulation bypasses receptor-based targeting, which allows for uniform tumor penetration without surface ligands.

Preclinical studies show a 97% tumor reduction and extended survival in ovarian cancer models compared to free drug. The platform also modulates the tumor microenvironment to improve immune response while limiting systemic toxicity.

NaDeNo Nanoscience further allows pharmaceutical and biotech partners to overcome delivery challenges for potent small-molecule therapies.

Polar NanoPharma makes a Nanotechnological Platform

Spanish startup Polar NanoPharma develops ECOSTRATAR, a water-based nanotechnology platform that creates polycarbamate-polyurea nanocapsules for targeted drug delivery in oncology.

It uses a one-pot, surfactant-free synthesis process to produce biocompatible and biodegradable nanoparticles that encapsulate a range of therapeutic agents. This includes small molecules, peptides, proteins, and metal complexes, all of which are left unmodified.

The nanocapsules respond to the acidic tumor microenvironment to improve drug accumulation at tumor sites and enable pH-triggered intracellular release. This mechanism protects therapeutic payloads during circulation, prevents early degradation, and reduces systemic toxicity.

Further, the platform’s modular design allows precise control over particle size, stability, and functionalization based on therapeutic requirements.

8. Liquid Biopsies

Recent studies highlight a persistent challenge in oncology. Insufficient tumor tissue often limits genomic testing, delaying or preventing access to precision therapies.

To address this issue, oncologists increasingly order both tissue and liquid biopsies in parallel to improve the chances of identifying actionable mutations. Blood-based diagnostics serve as an important alternative, particularly when tissue sampling is not possible.

In March 2024, a trial published in the New England Journal of Medicine showed that Guardant Health’s Shield test detected 83% of colorectal cancers identified by colonoscopy, with approximately 90% specificity. Based on these findings, the FDA approved Shield in July 2024 as the first blood-based screening test for colorectal cancer.

Beyond screening, liquid biopsies allow monitoring disease progression and treatment response. Circulating tumor DNA (ctDNA) in blood reveals drug resistance or relapse signs before radiographic changes appear.

Additionally, ctDNA is transforming minimal residual disease (MRD) monitoring. Detecting trace amounts of tumor DNA after surgery or chemotherapy enables to identify patients at risk of recurrence.

Multi-analyte liquid biopsy is further refining diagnostic accuracy. In November 2024, Exact Sciences reported promising results from a multi-cancer early detection trial. The study combined DNA methylation signals, tumor protein levels, and gene mutations to improve early-stage cancer detection across multiple tumor types.

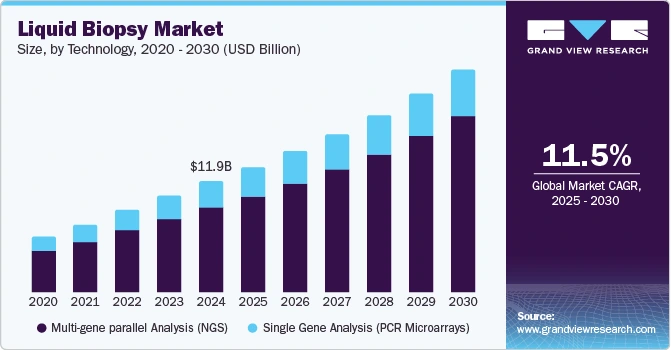

Moreover, the global liquid biopsy market is projected to grow at a CAGR of 11.54% from 2025 to 2030.

Credit: Grand View Research

Oncoliq offers Multi-cancer Early Detection

Argentinian startup Oncoliq develops a liquid biopsy platform for early, non-invasive cancer detection by analyzing microRNA signatures from routine blood samples. It isolates circulating microRNAs through a standardized extraction process and uses real-time PCR with machine learning algorithms to identify patterns linked to early-stage malignancies.

The platform integrates into annual health checkups for delivering real-time, cost-effective results without requiring specialized infrastructure. Its high sensitivity supports early detection before symptoms appear and enables ongoing monitoring during and after treatment.

Oncoliq focuses on reducing global cancer mortality by offering accessible and decentralized screening tools.

Rarity Bioscience advances Ultrasensitive Multiplex Assay

Swedish startup Rarity Bioscience develops superRCA, a multiplexed molecular assay platform that detects rare DNA mutations in tissue and liquid biopsy samples with precision. The technology uses padlock probes and rolling circle amplification to convert target sequences into large, easily detectable DNA clusters, which are analyzed with standard flow cytometry.

This approach identifies rare variants at a sensitivity of 1 in 100,000 for supporting applications such as minimal residual disease monitoring and early cancer mutation detection. The startup’s platform runs over 150-plex assays from a single sample and delivers results within four hours without requiring new hardware.

Rarity Bioscience offers specific, efficient mutation analysis through decentralized workflows and expands access to molecular diagnostics.

9. Bispecific Antibodies

Bispecific antibodies are administered in community clinics and expand treatment options for patients who cannot travel to centralized centers.

It shows effectiveness in hematologic malignancies, including relapsed or refractory cases. In aggressive B-cell lymphomas, combining CD3-targeting bispecifics with standard chemoimmunotherapy improves outcomes.

For example, adding epcoritamab, a CD3×CD20 bispecific, to first-line R-CHOP therapy in high-risk diffuse large B-cell lymphoma (DLBCL) achieved a 100% overall response rate (ORR) and an 87% complete response (CR) rate. 83% of CR patients remained in remission after two years.

The field is advancing toward trispecific antibodies, which add a third targeting domain to enhance immune activity or prevent tumor escape.

Johnson & Johnson is developing a trispecific antibody that targets BCMA, GPRC5D, and CD3 by combining teclistamab and talquetamab mechanisms in a single molecule. Early data show strong myeloma-killing activity with reduced toxicity.

New formats are emerging, including bispecific antibody-drug conjugates (ADCs) and fusion proteins. These approaches link targeting antibodies with toxic payloads or immune-stimulating cytokines. Bicara Therapeutics is developing bifunctional fusion drugs that deliver IL-2 to tumors while blocking PD-1 to amplify immune responses where needed.

Investment in bispecific antibody therapies is growing. In November 2024, Merck paid USD 588 million upfront, with up to USD 2.7 billion in milestones, for rights to LaNova Biopharma’s LM-299, a PD-1×VEGF bispecific.

Novartis also entered a USD 125 million upfront agreement with Dren Bio to co-develop bispecific myeloid cell engagers. It brought the total deal value near USD 3 billion.

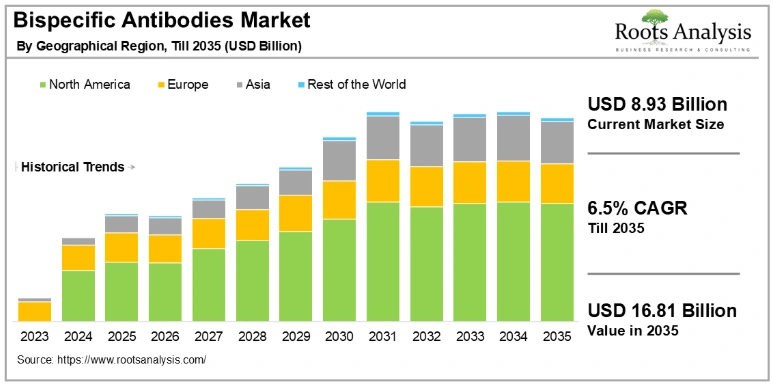

Additionally, the global bispecific antibodies market is projected to grow from USD 8.93 billion in 2025 to USD 16.81 billion by 2035 at a CAGR of 6.5%.

Credit: Root Analysis

Allink Biotherapeutics creates a Bispecific Antibody Platform

Chinese startup Allink Biotherapeutics makes bispecific antibodies and antibody-drug conjugates (ADCs) using its STAR-Lite and Hy-BEAM platforms to advance targeted therapies for oncology and immunology.

The startup designs molecules that engage multiple disease targets for improving therapeutic precision and addressing complex cancer signaling pathways.

Its lead programs ALK201 and ALK202 target FGFR2 and EGFR/c-Met. They are in clinical trials for advanced solid tumors. The platform focuses on rational drug design, integrating biological characteristics and translational research to identify ADC targets with strong clinical relevance.

Allink Biotherapeutics supports development with a structured chemistry, manufacturing, and controls (CMC) infrastructure that ensures scalability and consistency in bispecific-linker-payload combinations.

CytoArm develops a Non-viral Bi-functional Antibody

Taiwanese startup CytoArm builds the BsAb Armed-T therapy platform, a non-viral bi-functional antibody technology that activates and redirects T cells to target tumor cells. It uses dual-arm antibodies, with one arm binding to CD3 receptors on T cells to initiate activation and the other targeting tumor-specific antigens to guide T cells to cancerous tissues.

This targeted engagement triggers direct cytotoxicity and tumor cell apoptosis without genetic modification. It adjusts the tumor-targeting arm and creates adaptable antibody constructs for more than 50 oncological conditions.

Additionally, the platform’s non-viral design supports scalable, off-the-shelf production of Armed-T cell therapies to reduce manufacturing complexity and expand clinical use.

10. Digitization and Decentralization

Policy and reimbursement changes are driving digital transformation in oncology. Medicare and private insurers now cover telehealth and remote patient monitoring (RPM) services, supported by new billing codes for cancer care.

Regulatory bodies such as the FDA and EMA are also encouraging the integration of digital tools in clinical trials and everyday practice.

Cancer patients in rural areas or those with limited mobility increasingly seek remote care options. Surveys show many patients not only accept digital tools but often prefer them for certain aspects of treatment.

Remote patient monitoring allows tracking symptoms and vitals between clinic visits through smartphones, wearables, and ePRO tools. A 2024 study of 1392 oncology patients found that RPM participants had 19% fewer hospitalizations at three months and 13% fewer at six months compared to those receiving standard care.

Tele-oncology peaked during the COVID-19 pandemic, with nearly one-third of oncology visits conducted remotely. While usage has declined post-pandemic, it remains well above pre-COVID levels. A 2023 national survey found that 50% of US cancer survivors had used telehealth in the past year.

Healthcare providers are expanding infrastructure to meet demand. In 2024, more than 100 US hospitals and health systems launched or upgraded regional cancer centers to reduce patient travel for care.

Further, programs offer chemotherapy, immunotherapy, and palliative care at home. A 2024 study of over 38 000 oncology infusions (3084 patients in clinic vs. 145 patients at home) found no significant difference in safety between home and clinic settings. Infusion reaction rates were comparable (0.16% at home vs. 0.19% in clinics), and 48-hour acute care visit rates remained low (1.4% at home vs. 1.2% in clinics).

Clinical trials are also shifting toward decentralized models, which makes participation easier for patients outside major academic centers. Direct-to-patient trials and local care integration are becoming more common in oncology research.

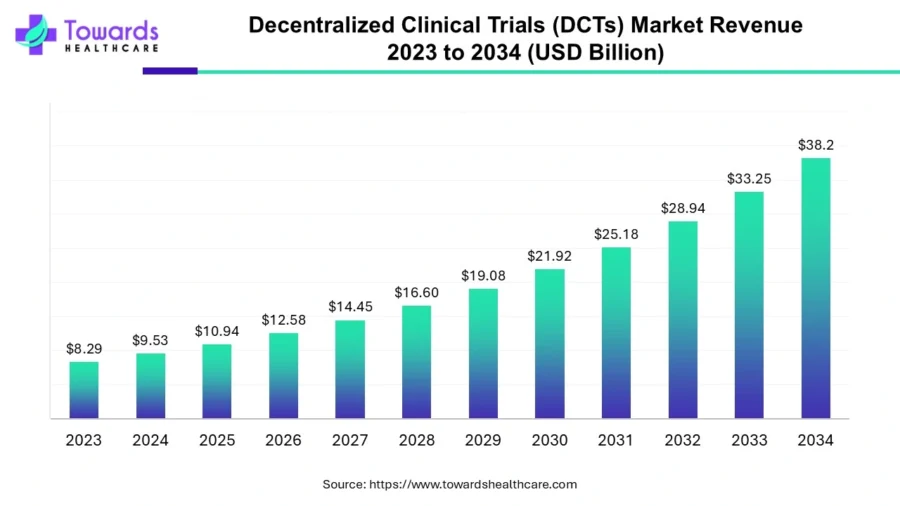

Besides, the global decentralized clinical trials market is projected to reach USD 38.2 billion by 2034, growing at a CAGR of 14.9% from 2024 to 2034.

Credit: Towards Healthcare

VIDANEX builds Digital Pathology Platform

Malaysian startup Vidanex develops an AI-powered digital pathology platform that improves cancer diagnostics. It does so by digitizing workflows and applying machine learning for clinical interpretation. The platform converts pathology slides into high-resolution digital images and uses AI models trained to detect abnormalities in cancers such as breast and pancreatic.

It enables remote access to diagnostic tools, supports real-time collaboration among clinicians, and reduces turnaround times by simplifying manual tasks. The platform ensures secure, encrypted data handling and complies with regulatory standards to protect patient confidentiality.

Further, Vidanex’s infrastructure and user-friendly interface make it accessible to clinics and hospitals of all sizes.

HomeNurse4U creates Decentralized Trial Solutions

Indian startup HomeNurse4U delivers decentralized clinical trial solutions by deploying mobile nurses to conduct research visits in patients’ homes. The platform provides phlebotomy, clinical supplies management, site support, and patient care coordination. This reduces travel burdens and supports diverse trial protocols in more than 60 countries.

Its PatientPledge concierge service simplifies logistics, handling appointment scheduling, transportation, and reimbursement while ensuring protocol fidelity in non-traditional settings.

HomeNurse4U enables trial participation outside conventional sites and strengthens patient recruitment and retention. It also shortens trial durations and improves data quality through continuous care.

Discover all Cancer Treatment Trends, Technologies & Startups

Cancer care is set to evolve with emerging innovations that have yet to become standard practice. Organoid-based drug testing could improve personalized treatment matching, while real-time tumor monitoring may allow therapy adjustments during treatment.

Additionally, synthetic biology-based therapies and AI-driven multi-omic analysis are also advancing to create more adaptable and responsive treatment approaches. As these technologies come together, oncology will move toward greater precision, faster interventions, and better patient outcomes.

The current trends in cancer treatment & startups outlined in this report only scratch the surface of the trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.

![Explore Top 10 Current Trends in Cancer Treatment [2025]](https://www.startus-insights.com/wp-content/uploads/2025/05/Current-Trends-in-Cancer-Treatment-SharedImg-StartUs-Insights-noresize-420x236.webp)