Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Executive Summary: What are the Top 10 Compliance Trends in 2026 & Beyond?

The compliance industry is evolving rapidly under the pressure of rising regulatory complexity, technological change, and global governance demands. Top compliance innovation trends shaping the sector are:

- Data Protection and Cybersecurity: Between 2023 and 2024, more than 170 new data protection laws were introduced globally, intensifying compliance obligations. The average cost of a data breach reached USD 4.88 million in 2024, driving adoption of Zero Trust, encryption, and AI-based defenses. The global data protection market is projected to reach USD 575.50 billion by 2032, while cybersecurity will grow from USD 218.98 billion in 2025 to USD 562.77 billion by 2032.

- AI Governance and Automation: With the EU’s AI Act and Digital Operational Resilience Act (DORA) raising oversight demands, organizations are embedding responsible AI policies into operations. Surveys in 2025 show 77% of companies prioritize AI governance, while automation reduces compliance costs. The AI governance market is forecasted to reach USD 5.78 billion by 2029, growing at a 45.3% CAGR.

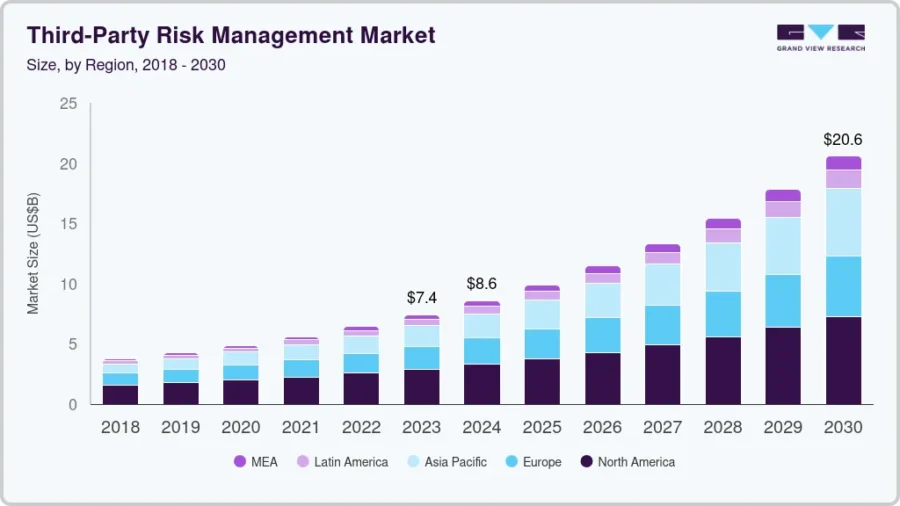

- Third-Party and Supply Chain Scrutiny: Sanctions enforcement and forced labor prevention have elevated third-party oversight. In 2024, US Customs detained an average of 428 shipments per month under the Uyghur Forced Labor Prevention Act (UFLPA). Around 86% of firms increased third-party risk management budgets, and the market is expected to grow to USD 20.59 billion by 2030.

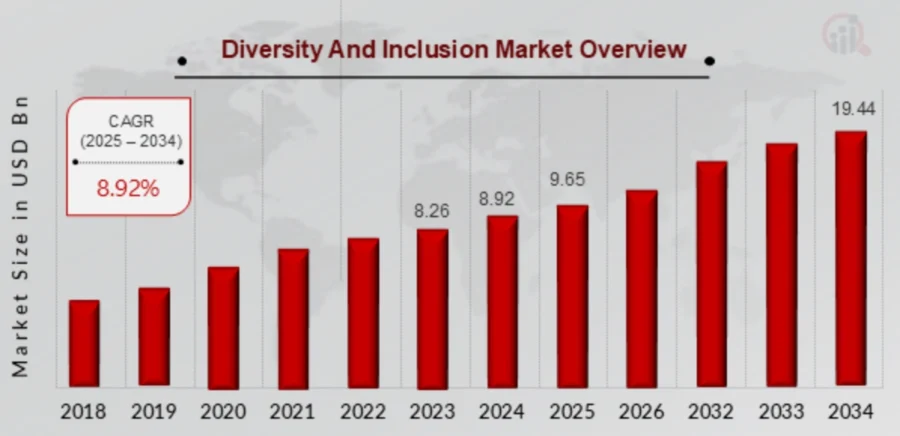

- Diversity, Equity, and Inclusion (DEI) Compliance: A 2024 survey found that 60% of organizations have formal DEI strategies, supported by analytics platforms, pay equity tools, and inclusive recruitment technologies. The DEI compliance market is projected to expand from USD 9.65 billion in 2025 to USD 19.44 billion by 2034.

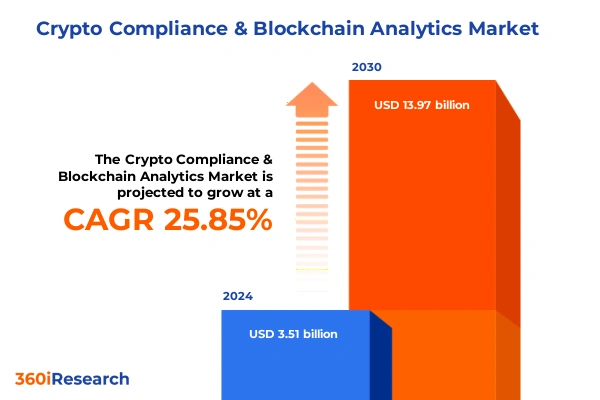

- Blockchain-based Compliance Management: Regulators are penalizing non-compliance more aggressively, with financial institutions facing USD 1.23 billion in penalties in early 2025. Blockchain supports continuous monitoring, smart contract enforcement, and fraud detection. The crypto compliance and blockchain analytics market is expected to reach USD 13.97 billion by 2030.

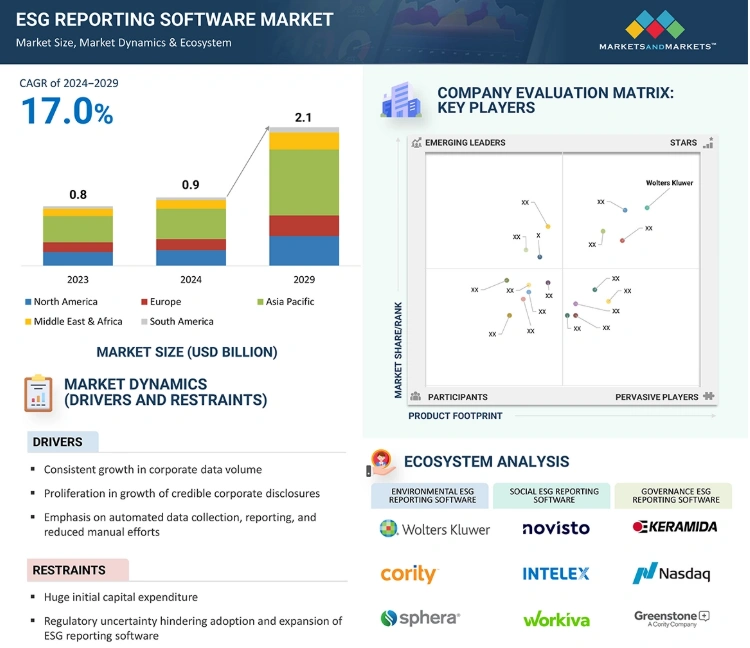

- Environmental, Social, and Governance (ESG) Compliance: Investor demand is accelerating adoption of sustainability standards, with 88% of global investors reporting increased use of ESG data in 2024. However, 47% of companies still rely on spreadsheets for ESG reporting, limiting accuracy. ESG reporting software is expected to grow to USD 2.1 billion by 2029.

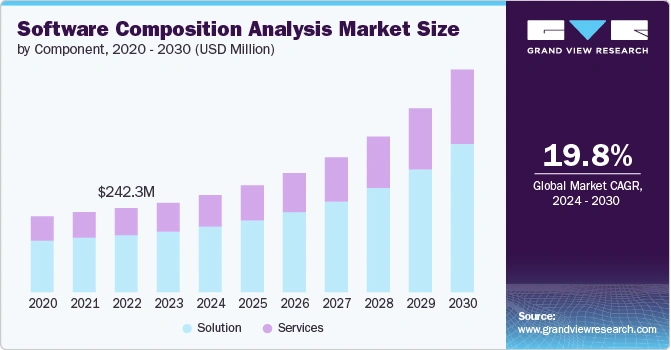

- Technology Licensing and Open Source Compliance: The 2025 OSSRA report revealed that 86% of audited applications contained open source vulnerabilities, while AI-assisted coding introduces new risks. The EU’s Cyber Resilience Act (CRA) is raising scrutiny, and enforcement actions confirm open source licenses are legally binding. The software composition analysis market will grow at 19.8% CAGR through 2030.

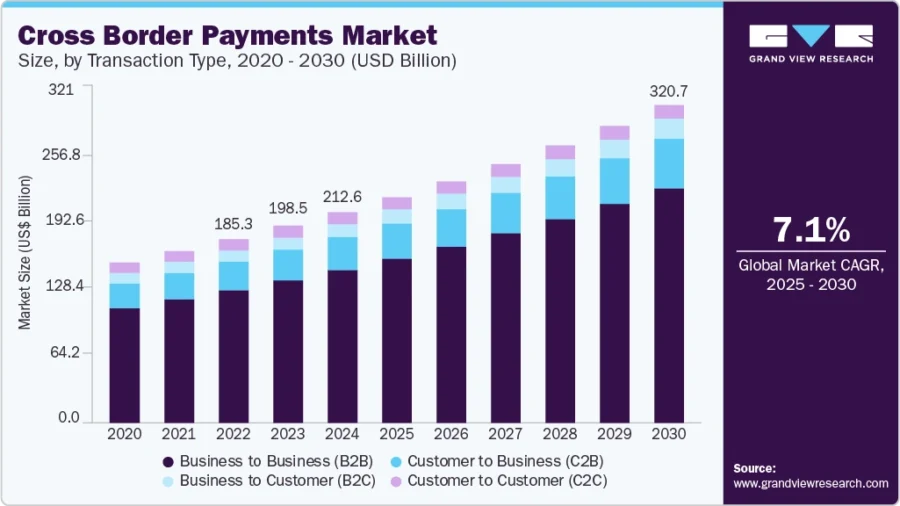

- Cross-Border Regulatory Divergence and Harmonization: Nearly 40 nations enacted close to 100 data localization policies, complicating global compliance. Regulatory divergence in AI, crypto, and payments is prompting harmonization efforts, such as MiCA and the Financial Stability Board’s recommendations. The cross-border payments market is forecasted to reach USD 320.73 billion by 2030.

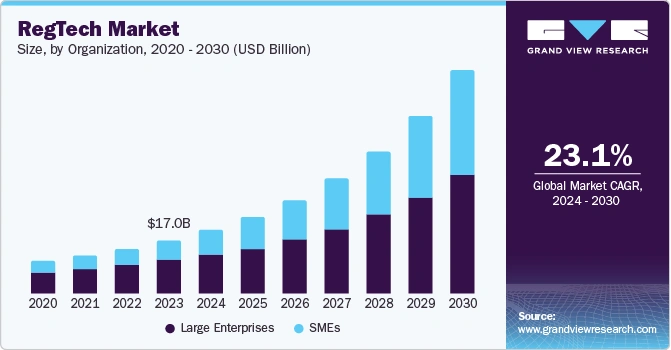

- RegTech Adoption: Compliance costs and penalties continue to escalate, with banks paying USD 19.3 billion in fines in 2024. AI-powered RegTech platforms are reducing false positives, automating reporting, and supporting fraud detection. The RegTech market is projected to reach USD 70.64 billion by 2030, growing at a 23.1% CAGR.

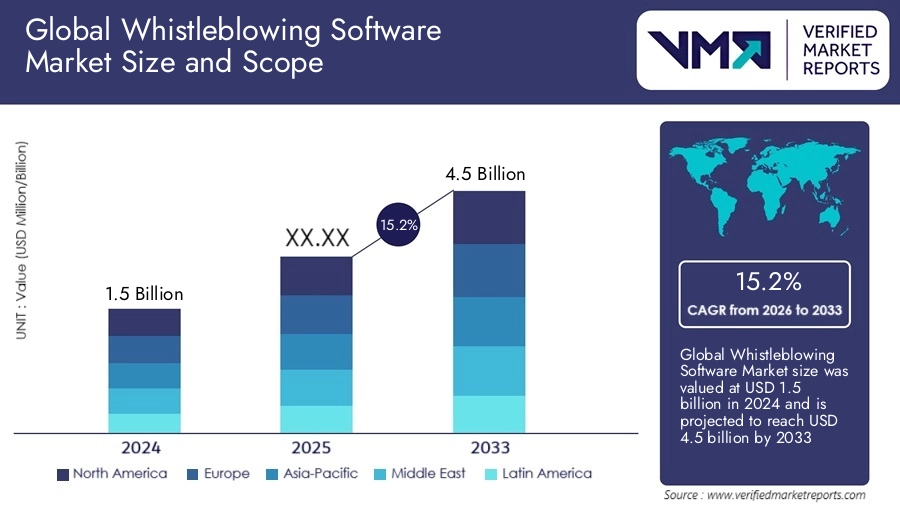

- Whistleblower Protection and Ethical Governance: Regulators are strengthening whistleblower incentives, with the SEC awarding USD 255 million to 47 whistleblowers in 2024. Secure digital reporting platforms and predictive analytics are replacing traditional hotlines. The whistleblowing software market is expected to reach USD 4.5 billion by 2033.

Read on to explore each trend in depth – uncover key drivers, current market stats, cutting-edge innovations, and leading compliance innovators shaping the future.

Frequently Asked Questions

1. What is the biggest compliance risk?

A data privacy breach poses a significant compliance risk. Regulations such as the General Data Protection Regulation (GDPR) and the Central Consumer Protection Authority (CCPA) impose financial penalties and damage reputations when organizations fail to comply.

2. What is the future of compliance?

Compliance is shifting toward automation and artificial intelligence (AI). These tools enable organizations to manage regulations more efficiently. Teams are able to prioritize ethical conduct and sustainable practices.

Methodology: How We Created the Compliance Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 7M+ global startups, 20K technologies & trends, plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the compliance industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the compliance innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Compliance Trends & 20 Promising Startups

For this in-depth research on the Top Compliance Trends & Startups, we analyzed a sample of 31 000+ global startups & scaleups. The Compliance Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the compliance industry trends & startups that impact your company.

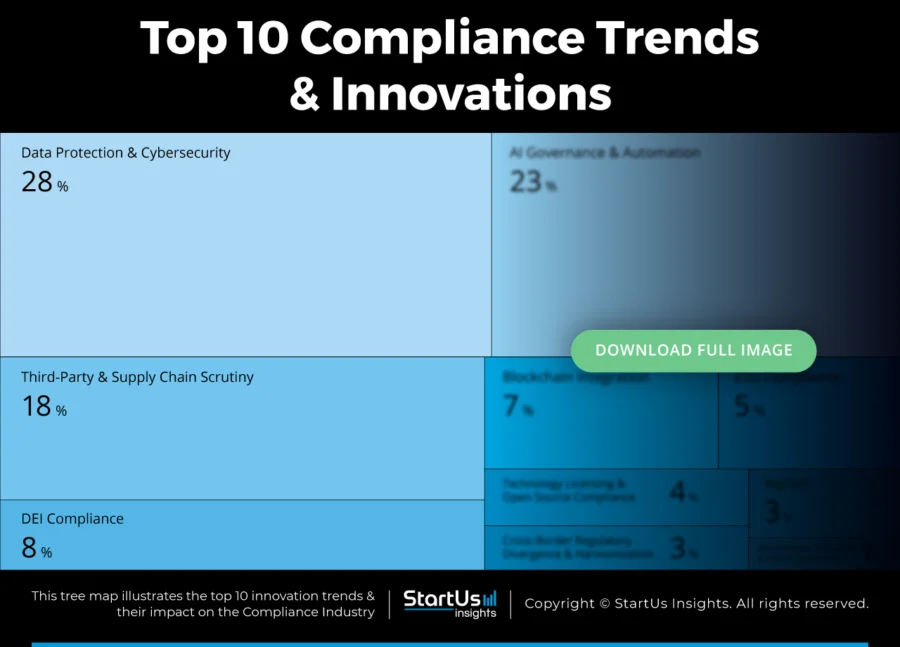

Tree Map reveals the Impact of the Top 10 Compliance Trends

Compliance is changing as digital technologies advance and regulations evolve. Organizations continue to focus on data protection and cybersecurity by using tools that secure sensitive information and support privacy laws like GDPR and CCPA. At the same time, AI governance and automation are gaining traction. These approaches aid in aligning internal policies with algorithmic behavior and data models.

ESG compliance is growing as firms respond to new disclosure requirements and climate-related rules. Third-party and supply chain oversight is expanding. New tools allow for assessing partner risks and promoting ethical sourcing. Blockchain-based systems are also improving transparency, traceability, and audit readiness in regulated environments.

Diversity, equity, and inclusion (DEI) compliance is also growing, especially in hiring and workplace reporting. Meanwhile, multinational firms face challenges with cross-border regulatory alignment. In software-driven businesses, technology licensing and open source compliance remain essential.

Ethical governance is strengthening through improved whistleblower protections and internal accountability frameworks. These developments reflect a shift toward compliance functions that are risk-aware, technology-driven, and globally responsive.

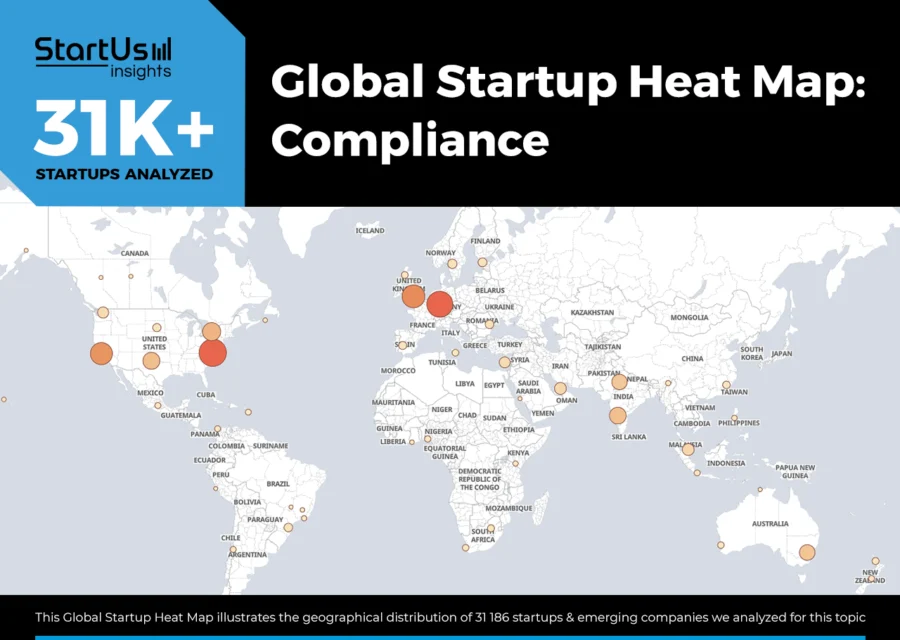

Global Startup Heat Map covers 31 000+ Compliance Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 31 000+ exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the United States and Western Europe, followed by India. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Compliance Innovations & Trends?

Top 10 Emerging Compliance Trends [2026]

1. Data Protection & Cybersecurity: 170+ New Data Protection Laws Introduced Globally (2023-2024)

Organizations are facing more frequent and complex data breaches. David Wall, professor of criminology at Leeds University, noted a sharp rise in ransomware attacks, stating, “We were getting five major ones a year back in 2011, now we’re getting 20, 25 major ones a day.”

For compliance teams, breach-related costs continue to be a major concern. In 2024, the average cost of a data breach reached USD 4.88 million.

At the same time, regulatory pressure continues to grow. Between 2023 and 2024, over 170 new data protection laws were introduced globally. These include national privacy statutes, breach notification rules, and sector-specific cybersecurity mandates.

In response, nearly 70% of service organizations in 2023 had to comply with at least six different security or privacy frameworks, such as GDPR, ISO 27001, HIPAA, and PCI DSS. Moreover, 78% of companies expect compliance requirements to increase annually.

The shift to cloud computing, IoT adoption, and hybrid work has widened the attack surface. Organizations are investing in advanced security technologies. Many are adopting Zero Trust architecture, which requires strict verification for every user and device.

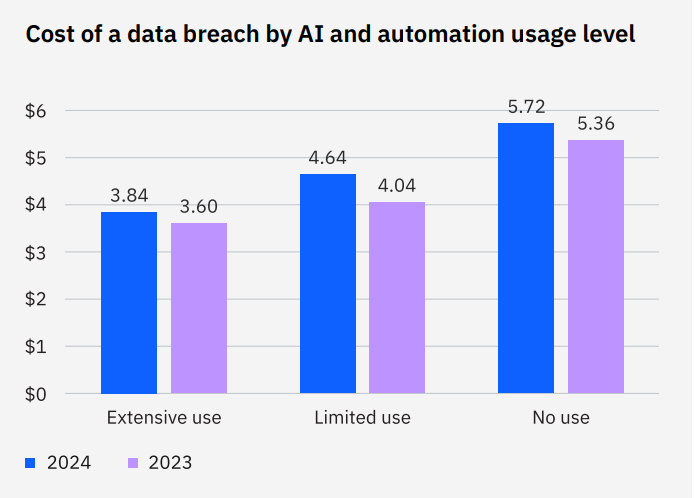

AI and automation are also playing a growing role in cybersecurity. Companies use these tools to strengthen defenses and simplify compliance tasks. According to IBM’s 2024 Cost of a Data Breach report, firms that deployed AI and automation extensively saved USD 1.88 million on average in breach-related costs.

Encryption, multi-factor authentication, and Security-by-Design principles are becoming standard under various regulations. In fact, 84% of professionals report that compliance with frameworks like GDPR and CCPA requires strong encryption and identity management.

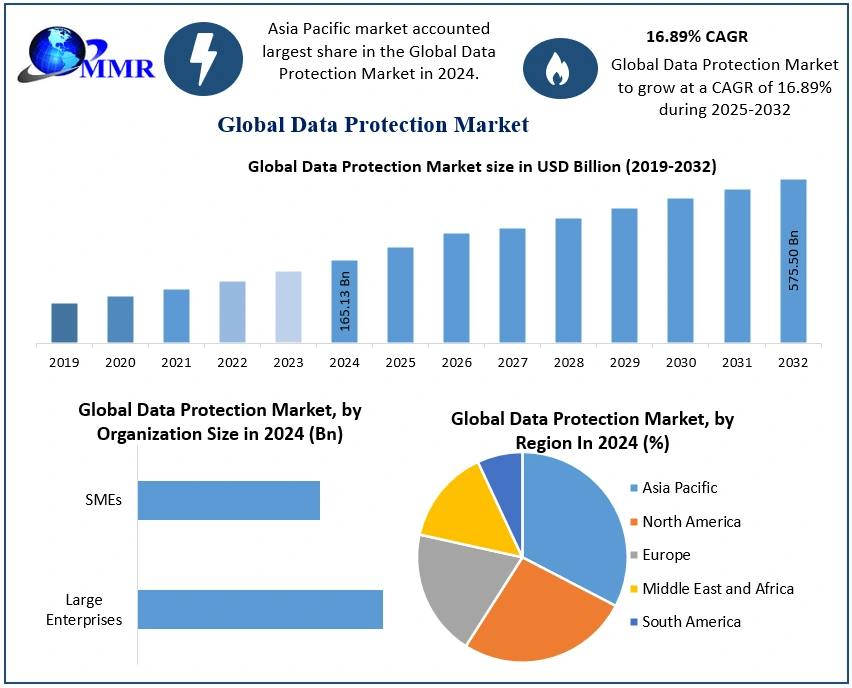

Looking ahead, the data protection market is projected to grow at a CAGR of 16.89% from 2025 to 2032, reaching nearly USD 575.50 billion.

Credit: Maximize Market Research

Similarly, the global cybersecurity market is expected to expand from USD 218.98 billion in 2025 to USD 562.77 billion by 2032, with North America holding a 43.41% share in 2024.

Ayottaz creates Compliance Roadmap & Management Platform

Canadian startup Ayottaz provides a compliance and data protection platform designed for small and medium-sized businesses. It allows organizations to meet certification requirements for ISO 27001, SOC 2, PCI DSS, and GDPR.

The platform integrates security tools into a single dashboard, simplifies project management, and supports team collaboration throughout compliance efforts.

It uses AI to analyze security data, offer recommendations, and support risk mitigation. In addition, it enables continuous monitoring and adaptive security to detect anomalies and adjust defenses as needed.

Ayottaz also offers tailored solutions, staffing support, and full-cycle project management to align compliance programs with industry standards.

Intrusa offers Cybersecurity & Compliance for SMEs

Italian startup Intrusa makes a cloud-based SIEM platform for small and medium-sized businesses. It combines log management, vulnerability assessments, and security monitoring with Microsoft 365 to provide centralized oversight of access, file changes, and system activity.

The platform includes anomaly detection, configuration checks, and data loss prevention. These features allow for the identification of suspicious behavior, reduce risks, and support forensic investigations using legally valid event records. With real-time monitoring and timestamped log retention, it supports GDPR and NIS2 compliance while improving data protection.

In addition, the dashboard allows users to track vulnerabilities, manage access privileges, and adjust security settings.

2. AI Governance & Automation: 77% of Companies Prioritize AI Governance & Compliance

Compliance teams continue to navigate a growing set of regulations. Financial institutions, in particular, must prepare for new laws such as the EU’s AI Act and Digital Operational Resilience Act (DORA). These measures increase oversight requirements for AI systems and operational risk.

Managing complex rules remains costly and resource-intensive. Banks often dedicate 10-15% of their full-time staff to KYC and AML compliance. In several regions, these costs have risen by approximately 10% each year.

To address these challenges, many organizations are adopting AI and automation. These technologies allow reducing manual work and simplifying compliance tasks. Nearly 65% of risk and compliance professionals believe automation lowers both cost and complexity.

Generative AI entered enterprise settings rapidly between 2023 and 2024. Companies are exploring its use in compliance functions. These models are able to interpret regulations, summarize requirements, draft reports, and respond to employee questions in natural language. For example, Microsoft’s legal and compliance teams use generative AI to manage regulatory changes more efficiently.

In addition to supporting staff, agentic AI is emerging as a new approach. These systems deploy multiple AI agents that operate with limited human input. In financial crime prevention, agentic AI is able to manage KYC onboarding, monitor transactions, and close cases within a single workflow.

As AI adoption grows, organizations are building formal governance frameworks. Surveys in 2025 show that 77% of companies prioritize AI governance and compliance. Around 69% have implemented responsible AI policies to guide development and use.

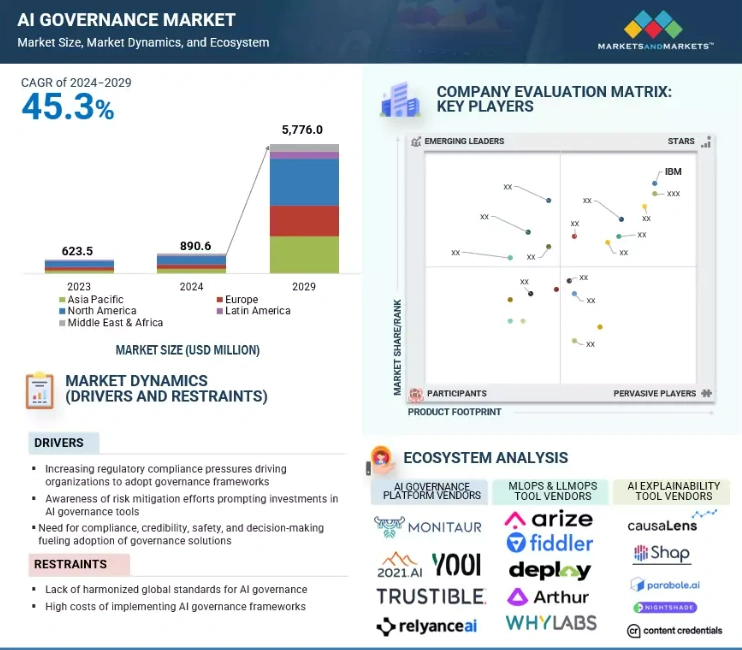

Besides, the global AI governance market is projected to reach USD 5.78 billion by 2029, with a CAGR of 45.3% from 2024 onward.

Credit: Markets and Markets

Enzai creates an AI Governance Platform

UK-based startup Enzai offers an AI governance platform that enables organizations to adopt AI responsibly and manage regulatory and operational risks. It organizes project intake and approval workflows, builds centralized AI inventories, and maps use cases to recognized compliance frameworks. These steps support oversight throughout the AI lifecycle.

The startup’s platform automates compliance checks and integrates continuous monitoring. It also provides a governance dashboard with real-time visibility into project status, policy alignment, and regulatory readiness.

It offers features such as role-based collaboration tools, approval workflows, review cycles, and branded reporting. These tools improve accountability and transparency.

Ciphrix builds Compliance Automation Software

Australian startup Ciphrix provides an AI-powered compliance platform that automates evidence collection, risk assessment, and policy creation for enterprises. It uses intelligent agents across cloud infrastructure to gather compliance data and integrates with more than 400 systems. The platform also monitors for compliance drift and addresses issues as they arise.

Additionally, Ciphrix provides AI-driven vendor assessments, automated policy generation, and documentation that supports audits. These features enable alignment with regulatory standards while reducing manual effort.

The platform includes modules for employee oversight, compliance tracking, and audit support within a broader governance, risk, and compliance framework.

3. Third-Party & Supply Chain Scrutiny: 86% of Companies Increased TPRM Budgets in the Past Year

Companies are facing growing pressure to strengthen oversight of suppliers, vendors, and other third parties. Geopolitical events have played a role. For instance, the Russia-Ukraine war in 2024 prompted closer scrutiny of sanctions evasion through third-party channels.

In the USA, regulators increased enforcement of the Uyghur Forced Labor Prevention Act (UFLPA), which restricts imports linked to forced labor. In 2024, US Customs detained an average of 428 shipments per month, up from roughly 342 per month in 2023.

Other regions followed suit. By late 2024, the European Union adopted the Corporate Sustainability Due Diligence Directive (CSDDD). This regulation requires large companies to identify, prevent, and address human rights and environmental risks across their global supply chains.

In response, many organizations expanded their third-party risk management (TPRM) programs. Notably, 86% of companies increased their TPRM budgets over the past year. To formalize oversight, firms introduced specific policies and controls. Around 87% have written guidelines for employee interactions with third-party partners. Additionally, 74% maintain a code of conduct for third parties, and 66% of those require vendor attestation. Moreover, 85% conduct risk-based compliance due diligence as a routine practice.

Technology adoption is also accelerating. By late 2024, 64% of companies reported shifting to purpose-built platforms for managing third-party risk and compliance. These systems replace spreadsheets and siloed tools.

Among those using integrated TPRM solutions, often part of broader GRC or VRM platforms, 77% saw improvements across the vendor lifecycle, including onboarding, monitoring, and offboarding.

Moreover, the global third-party risk management market is expected to reach USD 20.59 billion by 2030, growing at a compound annual rate of 15.7% from 2024.

Credit: Grand View Research

hoggo provides Third-Party Compliance

Swiss startup hoggo offers an AI-powered compliance automation platform built for legal and privacy teams. It automates vendor risk assessments by reviewing policies, data processing agreements, and subprocessors, which aids in reducing manual work.

The platform includes smart vendor intelligence that filters by data types, risk levels, and compliance frameworks. This feature improves visibility into third-party data access. It also provides real-time alerts for policy changes, new subprocessors, and security incidents to support continuous monitoring.

Additional tools include automated questionnaires, audit-ready documentation, and one-click reporting for GDPR, DORA, and AI Act compliance. The platform supports collaboration across legal, privacy, and security teams, which aids in simplifying compliance across multiple frameworks.

SCIP enables Supply Chain Risk & Compliance Management

US-based startup SCIP offers a risk and compliance management platform that identifies supply chain vulnerabilities at both the part and vendor level. It assesses supplier performance, lead times, revenue impact, and country of origin to highlight exposure areas. In addition, it integrates automated sanctions checks and tariff analysis to support regulatory compliance.

The platform includes AI-driven vendor risk analysis, scorecarding, and part-level risk scoring. These tools allows organizations to anticipate vulnerabilities, compare supplier performance, and refine sourcing strategies. It also provides continuous monitoring and real-time alerts, which allows teams to respond quickly to changing risks and compliance demands.

Moreover, SCIP supports sanctions screening, forced labor compliance, vendor certification tracking, and trade policy analysis.

4. DEI Compliance: 60% of Organizations Have Formal DEI Strategies

DEI compliance continues to gain importance in corporate governance and risk management. A 2024 McKinsey report found that companies with ethnically diverse executive teams were 36% more likely to outperform peers in profitability.

According to a 2024 survey by Paradigm, 60% of organizations have a formal DEI strategy, marking a 9-point increase from 2023. Many companies are adopting HR analytics platforms to identify inequities and measure progress. These tools analyze hiring, promotion, and compensation data to flag bias and suggest adjustments. For example, pay equity software is able to detect wage gaps and model corrective actions.

AI is also being introduced to reduce bias in HR processes. AI-driven resume screening and blind recruitment tools allow for expanding candidate pools by focusing on skills rather than demographic indicators.

To support inclusive practices, new platforms offer scalable training solutions. E-learning tools include DEI simulations that allow employees to practice inclusive behaviors in virtual environments.

As compliance reporting requirements grow, software providers have launched modules for DEI reporting. These tools automate diversity reports, pay equity analyses, and regulatory filings. For instance, Affirmity’s analytics platform enables organizations to prepare affirmative action plans and monitor non-discrimination compliance throughout the talent lifecycle.

Accenture has embedded inclusion into its culture and compliance efforts. By 2024, it supported 90 LGBT+ employee networks across 45 countries, with over 141 000 allies involved. The company updated policies and benefits to promote equity and celebrated Pride in 47 countries, up 68% from the previous year.

Looking ahead, the diversity and inclusion market is expected to grow from USD 9.65 billion in 2025 to USD 19.44 billion by 2034, reflecting a CAGR of 8.92%.

Credit: Market Research Future

Talign makes a Workforce Intelligence Platform

US-based startup Talign offers Talent Kinetics, a workforce intelligence platform that connects talent strategies with long-term business goals. It analyzes data across the employee lifecycle to support workforce planning, assess employee sentiment, flag retention risks, and evaluate job applicants.

The platform includes analytics for forecasting talent needs, identifying skill gaps, and tracking workforce trends. It also provides benchmarking tools to compare performance across industries and regions.

Besides, Talign integrates DEI intelligence to highlight equity gaps, measure inclusion, and support diversity initiatives with data-driven insights.

The platform features tools for reporting, learning progress tracking, and workforce optimization to support compliance and development. These capabilities enables HR teams to lower turnover, increase engagement, and strengthen organizational resilience.

GetConduct supports Culture Compliance

Indian startup GetConduct creates a culture compliance platform that supports inclusion, safety, and accountability in the workplace. It blends data, legal frameworks, and technology to create a system for monitoring workplace culture, onboarding employees, and delivering e-learning modules. These modules cover topics such as bias identification, inclusive practices, and the POSH Act, 2013.

The platform includes guided complaint filing, anonymous query handling, and secure documentation storage. These features allow for standardization of redressal procedures and protect confidentiality. Additionally, GetConduct provides analytics on learning progress, diversity indicators, and cultural trends to support leadership decisions.

5. Blockchain-based Compliance Management: Crypto Compliance & Blockchain Analytics Market to Reach USD 13.97B by 2030

Regulators have increased enforcement activity, which is prompting organizations to prioritize compliance. In the first half of 2025, financial institutions faced USD 1.23 billion in penalties, up from USD 238.6 million during the same period in 2024.

Blockchain’s transparency and immutability support real-time recordkeeping. It enables organizations to reduce non-compliance risks. Blockchain simplifies audits and strengthens regulatory oversight by offering verifiable data.

According to a report by Accenture and McLagan, blockchain could lower infrastructure costs for eight of the ten largest investment banks by 30%, saving between USD 8 billion and USD 12 billion annually. Shared distributed ledgers eliminate duplicate reconciliation efforts, which reduces audit and reporting expenses.

Traditional compliance often relies on delayed reporting and fragmented data. Blockchain addresses these issues by enabling continuous, tamper-proof monitoring of transactions and controls. Auditable trails generated on-chain simplify regulatory reporting and inspections.

In 2025, compliance teams are using AI and machine learning to enhance blockchain oversight. These tools automate transaction monitoring and fraud detection, identifying anomalies faster and more accurately than manual methods.

Cryptographic techniques such as zero-knowledge proofs (ZKPs) are aiding in balancing transparency with privacy. For example, EY’s Blockchain Analyzer uses ZKPs to verify compliance without exposing sensitive transaction details.

Smart contracts are also gaining traction. These self-executing programs embed regulatory rules directly into transactions, enforcing compliance automatically.

Besides, the crypto compliance and blockchain analytics market is projected to reach USD 13.97 billion by 2030, growing at a compound annual rate of 25.85%.

Credit: 360iResearch

Defy offers Crypto Asset Compliance

Turkish startup Defy creates blockchain solutions that improve transaction security, support compliance, and build trust across digital ecosystems. Its Pre-Check Standard Solutions run regulatory and policy checks before executing transactions. This process reduces financial crime risks and ensures compliance with relevant requirements.

The platform also includes Live AML Solutions that apply algorithms and continuous monitoring to detect, manage, and report suspicious activity in real time. Besides, its Detailed Investigation Tool provides analysis and documentation of irregular transactions. These features assist compliance officers and security teams in conducting investigations more efficiently.

LexChain enables Blockchain-based Immigration Compliance

US-based startup LexChain builds a blockchain-based platform that automates immigration compliance for US employers. It uses distributed ledger technology to streamline Form I-9 processing, connect with E-Verify, and support near real-time audits of employee documentation.

The platform records each action in an immutable ledger. This allows employees, employers, legal teams, and auditors to input, validate, and review data securely. It promotes transparency and supports accountability throughout the process.

LexChain includes secure data storage, automated error detection, and audit tools that assist communication with government investigators during compliance reviews. It also offers visibility across organizational, departmental, and employee levels, aiding HR teams in monitoring risk metrics and audit outcomes.

6. ESG Compliance: 88% of Global Investors Increased Use of ESG Information in the Past Year

Investors continue to prioritize transparency on environmental, social, and governance issues. Many factors ESG data into capital allocation decisions. In fact, 88% of global investors reported increasing their use of ESG information over the past year.

Public sentiment also supports responsible business practices. This pressure encourages companies to adopt ESG standards. A recent survey found that 83% of consumers believe companies should actively shape ESG practices rather than respond passively or rely on surface-level efforts.

The demand for automation and analytics is rising. Companies must collect data on carbon emissions, energy use, workforce diversity, and supply chain audits. These data points often come from different systems and must be accurate and verifiable to meet audit requirements.

Despite this need, 47% of companies still use basic spreadsheets to manage ESG data. This approach limits their ability to meet tight reporting deadlines and assurance standards. To improve performance, 59% of companies have adopted advanced data management systems, and many are exploring new technologies.

Specialized ESG compliance platforms are gaining traction. These cloud-based tools offer centralized dashboards to track sustainability metrics, manage reporting frameworks such as GRI, SASB, and ISSB, and maintain data integrity.

Looking ahead, ESG-focused investments are expected to reach USD 35 trillion by 2025, representing nearly half of all professionally managed assets.

Meanwhile, the global ESG reporting software market is projected to grow to USD 2.1 billion by 2029, with a CAGR of 17% from 2024.

Credit: Markets and Markets

Atlas Metrics enables ESG Compliance & Performance Management

German startup Atlas Metrics offers a sustainability and risk intelligence platform for private markets. It automates non-financial data management across businesses, portfolios, and value chains.

The platform collects and standardizes ESG data, then applies AI-driven aggregation and simulations. It generates audit-ready reports aligned with global frameworks such as CSRD, SFDR, and GRI.

In addition, its risk engine identifies multi-vector risks, while carbon accounting follows PCAF and GHG Protocol standards. Besides, materiality analysis uses automated surveys and scoring to highlight key non-financial factors.

Atlas Metrics also provides customizable dashboards, ESG visibility across portfolios, and collaboration hubs that link suppliers, borrowers, and partners in a unified data network. Further, logic builders support custom metrics, and automated multistandard reporting reduces manual effort while improving data accuracy.

EcoVerum provides ESG Legal Compliance

Dutch startup EcoVerum offers an ESG compliance platform that automates data handling, validation, and reporting. It enables organizations to meet regulatory requirements with accuracy and transparency.

The platform collects ESG data from various sources and consolidates it into a single repository. It then standardizes the data to XBRL formats, supporting comparability across industries for CSRD compliance. AI-powered validation detects inconsistencies and flags potential greenwashing risks, which aids in maintaining data integrity and protecting organizational credibility.

Additionally, EcoVerum integrates generative AI to support natural language queries and automate the creation of legally compliant reports. This reduces manual effort and improves traceability. The platform also includes fraud detection, version control, and analytics tools that provide insights into sustainability performance.

7. Technology Licensing & Open Source Compliance: 86% of Audited Apps Contain Open Source Vulnerabilities

Governments and enterprises are placing greater emphasis on software transparency and license compliance. New regulations, such as the EU’s Cyber Resilience Act (CRA) and Digital Operational Resilience Act (DORA), require organizations to manage software risk with more discipline.

Recent software supply-chain attacks have highlighted the need to understand the origin of all code, whether open source or proprietary. Open source compliance and security operate as joint priorities. According to the 2025 OSSRA report, 86% of audited applications contained open source vulnerabilities. Many organizations discovered that outdated or untracked components create serious security risks.

Meanwhile, AI-assisted software development has introduced new compliance challenges. Tools like GitHub Copilot generate code based on large open source datasets, raising concerns about potential license violations. In response, companies began drafting policies in 2024 to manage AI-generated code and prevent unlicensed snippets from entering production. This shift is prompting compliance teams to monitor AI outputs and train developers accordingly.

New technologies, including cloud services and machine learning models, are also influencing changes in open source licensing. Organizations are reevaluating governance practices. Many have established Open Source Program Offices (OSPOs) and adopted formal compliance standards to manage these risks.

Legal enforcement has reinforced the importance of license adherence. In 2024, courts fined Orange EUR 800K for using a GPLv2-licensed component (Lasso) without releasing the modified source code. The ruling confirmed that open source licenses carry enforceable legal obligations.

Besides, the global software composition analysis market is projected to grow at a compound annual rate of 19.8% from 2024 to 2030.

Credit: Grand View Research

Delve provides Agentic Compliance

US-based startup Delve offers an AI-powered compliance automation platform that simplifies evidence collection and accelerates security certifications. It uses AI agents to gather documentation, tailor workflows, and support frameworks such as SOC 2, GDPR, HIPAA, PCI-DSS, and ISO standards.

The platform includes features like questionnaire autofill, screenshot automation, code scanning, and policy support. These tools aid in reducing manual errors and save time. In addition, Delve provides a free trust report to simplify enterprise reviews and build customer confidence. It also offers real-time support through Slack and access to dedicated compliance specialists.

Delve enables startups, midmarket firms, and enterprises to manage compliance efficiently.

The startup recently raised USD 32 million in Series A funding to expand its AI agent capabilities for compliance.

Double Open offers Open Source Compliance

Finnish startup Double Open creates an open-source compliance and security platform that integrates into CI/CD pipelines. It automates license checks and monitors vulnerabilities across software projects.

The platform scans repositories, generates software bills of materials in SPDX and CycloneDX formats, and applies standardized license statements to support accurate reporting. It includes default rule sets, customizable configurations, and a user-friendly interface that simplifies onboarding and reduces engineering workload.

Additionally, Double Open prioritizes vulnerabilities, provides continuous monitoring, and delivers updates aligned with the EU Cyber Resilience Act. These features allow teams to manage risks more effectively.

The platform operates from EU-controlled datacenters to ensure GDPR compliance and maintain data sovereignty. It also promotes transparency through open-source licensing.

8. Cross-Border Regulatory Divergence & Harmonization: 40 Nations Enacted ~100 Data Localization Policies

Geopolitical shifts are prompting countries to introduce distinct laws for data and trade, disrupting global regulatory alignment. For instance, nearly 40 nations have enacted close to 100 data localization policies, often citing national security concerns.

Meanwhile, rapid innovation has outpaced international consensus, which is leading regions to adopt divergent approaches. In AI regulation, China applies a top-down, algorithm-focused model. The US favors case-by-case guidance, while the EU’s AI Act plans to ban certain high-risk applications. These differences make it difficult for companies to maintain a single global AI compliance framework.

To address fragmentation, global standard-setters are working toward shared legal tools. Countries use standardized contractual clauses for cross-border data transfers, such as the EU’s Standard Contractual Clauses. Although enforcement varies, these clauses offer a common foundation for data privacy compliance.

In December 2024, the Financial Stability Board released recommendations to align payment regulations and data governance across jurisdictions.

The EU’s MiCA regulation, which took effect in 2024, introduced a unified licensing regime for crypto assets. This move has encouraged cross-border activity and provided institutional investors with clearer regulatory expectations.

Technology continues to play a key role in compliance. Automation supports consistent control enforcement, generates real-time alerts for regulatory thresholds, and maintains audit trails across systems.

Additionally, organizations are adopting Compliance-as-a-Service models and outsourcing specific functions to external experts or cloud platforms. These shifts enable managing complexity and reducing internal burdens.

Further, the global cross-border payments market is expected to reach USD 320.73 billion by 2030, growing at a compound annual rate of 7.1% from 2025.

Credit: Grand View Research

The Cozm enables Cross-Border Compliance

UK-based startup The Cozm offers a global mobility compliance platform that automates cross-border regulatory tasks and reduces administrative burden for travel and mobility teams. It connects with business systems to manage filings, monitor compliance, and deliver real-time risk assessments across EU Posted Worker Directives, tax, immigration, and social security regulations.

The platform’s Cozm Travel module is for business travel compliance, and Cozm Unity module is for mobility operations. It uses AI-driven automation and predictive compliance tools to file notifications and certificates quickly. This reduces delays and manual errors.

Additionally, The Cozm provides built-in reporting, equal pay calculations, and secure power of attorney workflows across jurisdictions. These features support regulatory alignment and allow cost control.

Tokenz creates a Global Payment Platform

Singaporean startup Tokenz provides a payment and compliance platform for the creator economy. It enables businesses to monetize digital content across global markets.

The platform supports more than 200 payment methods in 170 countries. It optimizes localized checkout flows to improve customer experience. Tokenz manages tax filings, legal compliance, invoicing, and revenue recognition. It also assumes liability for regulatory obligations across jurisdictions.

Further, the startup includes a fraud prevention engine that detects anomalies without blocking valid transactions. It provides dispute resolution tools that simplify chargeback management. Moreover, developers are able to access plug-and-play APIs, interactive documentation, and sandbox testing to ease integration.

9. RegTech Adoption: Market to Reach USD 70.64B by 2030

Organizations continue to face rising volumes and complexity in regulatory requirements. This expansion is placing pressure on compliance teams and increasing demand for automated solutions. In financial reporting, new global rules introduced in 2024 forced many firms to revise their compliance processes.

As compliance operations grow more expensive, companies are turning to technology to improve efficiency. The financial impact of non-compliance became clear in 2024, when banks paid USD 19.3 billion in penalties for regulatory violations.

AI and machine learning play a central role in RegTech solutions. These tools analyze large datasets and identify risks more quickly and accurately than manual methods. Investment in AI-driven analytics is growing, with applications ranging from fraud detection to intelligent document processing. Machine learning models further reduce false positives in transaction monitoring by distinguishing between normal and suspicious patterns, allowing investigators to focus on high-risk alerts.

Interest in generative AI also surged in 2024. A global RegTech survey found that 73% of industry respondents expect generative AI to significantly impact the sector within two years, especially in regulatory compliance and financial crime prevention.

Advanced RegTech platforms integrate real-time data feeds with automated workflows. For example, when a transaction triggers an alert, the system is able to pause the transaction, notify compliance officers, and generate a draft suspicious activity report, all in real time.

Cloud-based RegTech solutions are becoming standard for scalability and fast deployment. Many banks and companies are shifting from siloed, on-premise systems to flexible Software-as-a-Service platforms.

One Latin American bank improved its fraud detection rate from below 50% to over 90% after adopting a RegTech solution that used behavioral biometrics.

Looking ahead, the global RegTech market is expected to reach USD 70.64 billion by 2030, growing at a compound annual rate of 23.1% from 2024.

REGTECH DATAHUB provides a Regulatory Data Framework

Danish startup REGTECH DATAHUB offers a regulatory data platform that retrieves, organizes, and consolidates records from 945 trading venues into a structured framework. It processes data from sources such as ESMA for MiFID II reporting, GLEIF for LEI ownership hierarchies, and ANNA-DSB for ISIN issuers. The platform then integrates this data with client systems to support compliance efforts.

It includes modular components like MiFID II data warehousing, Solvency II hierarchy mapping, CRR II ownership integration, credit hierarchy generation, and ISIN-to-LEI mapping. Organizations are able to select only the modules they need, which enables to manage costs and reduce complexity.

In addition, the platform offers transparency in algorithmic markings and issuer hierarchy insights to support counterparty risk management. It also enables registration of ultimate parent entities for improved oversight.

Sekuritance offers a Reusable Identity Gateway

Irish startup Sekuritance creates a compliance and digital identity management platform that combines KYC, KYB, AML, and transaction monitoring into a single system. Its Reusable Identity Gateway allows individuals and businesses to manage and verify digital identities securely across platforms to reduce friction in compliance processes.

The platform automates onboarding by capturing and digitizing customer data in one location. It applies business rules to simplify authentication and minimize process gaps. It also includes a secure vault with encryption for storing sensitive information, ensuring only clients can access their data. Further, transaction monitoring APIs generate risk scores based on financial activity to support real-time oversight.

Additional tools include AI-based fraud detection, electronic signatures, mobile data capture, and robotic process automation. These features improve operational efficiency while supporting regulatory compliance.

10. Whistleblower Protection & Ethical Governance: SEC Awarded USD 255M to 47 Whistleblowers

Governments worldwide are introducing stronger whistleblower protection laws, which prompts organizations to improve their internal reporting systems. In the EU, the Whistleblower Protection Directive requires member states to adopt national laws that safeguard whistleblowers.

In the US, the Department of Justice launched a three-year Corporate Whistleblower Awards Pilot Program in August 2024. This initiative offers financial rewards to insiders who report corporate misconduct.

Enforcement agencies continue to support whistleblowing and penalize companies that obstruct it. In 2024, the US Securities and Exchange Commission awarded over USD 255 million to 47 whistleblowers.

Digital reporting tools are more common than telephone hotlines. Most large organizations have adopted secure online portals, available around the clock and in multiple languages. These platforms allow employees and third parties, such as suppliers, to report concerns from any location.

Mobile apps and QR code-based systems are also gaining traction. These tools offer anonymity, real-time case tracking, and two-way communication through secure inboxes, features that traditional hotlines often lack.

Regulators increasingly expect companies to use technology not only to collect reports but also to identify risks early. This shift is driving integration between whistleblower case management and analytics platforms.

Organizations analyze reporting trends and apply predictive models to detect high-risk areas, such as repeated complaints tied to a specific region or manager.

Further, modern incident management systems are streamlining case handling. These platforms automate key steps, including alerting investigation teams, tracking deadlines, logging actions, and generating reports for leadership.

Besides, the whistleblowing software market is projected to reach USD 4.5 billion by 2033, growing at a compound annual rate of 15.2% from 2026.

Credit: Verified Market Reports

Visslan creates Whistleblower System

Swedish startup Visslan offers a whistleblowing and compliance platform that supports adherence to the EU Whistleblowing Directive. It combines secure reporting, policy guidance, and optional expert case management in one system.

The platform replaces email and complex tools with a GDPR-compliant solution hosted under ISO 27001 and aligned with ISO 37002 standards. It enables anonymous, encrypted submissions through a user-friendly reporting channel.

Visslan centralizes case handling and provides customizable whistleblower policies, checklists, and guidance to reduce administrative burden. Organizations may also opt for independent case management by legal experts to improve credibility and simplify investigations.

Daiki advances Ethical Governance

Austrian startup Daiki provides an AI governance platform that centralizes compliance, monitoring, and risk management for organizations using AI. It maintains a patented AI registry that catalogs use cases, assesses risk and value, and supports alignment with the EU AI Act and ISO 42001 standards.

The platform consolidates documentation into a single source, allowing legal, technical, and compliance teams to collaborate and stay aligned on AI deployment. It includes proprietary tools such as an LLM bias and safety checker, which evaluates model outputs against responsibility criteria to reduce risk.

The startup’s platform meets GDPR requirements and provides strong data protection. It also delivers integrated compliance management through structured risk strategies, ongoing oversight, and transparent verification using the Daiki badge.

Moreover, Daiki recently raised EUR 1.5 million in seed funding

Discover all Compliance Trends, Technologies & Startups

The next-generation technologies will influence how organizations manage compliance. Predictive analytics, automated regulatory tracking, and real-time ESG risk scoring are becoming key tools.

In addition, quantum-resilient security, AI-generated audit trails, and compliance-as-a-service (CaaS) platforms are gaining momentum. These solutions enable organizations to respond to regulatory demands with more speed, clarity, and adaptability.

Together, these innovations are reshaping compliance operations. They enable businesses to maintain oversight, reduce manual effort, and adjust to evolving regulations in a more structured and efficient way.

The Compliance Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.

![Discover the Top 10 Compliance Trends & Innovations [2026]](https://www.startus-insights.com/wp-content/uploads/2025/09/Compliance-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)

![Discover the Top 10 Accounting Trends & Innovations [2026]](https://www.startus-insights.com/wp-content/uploads/2025/09/Accounting-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)

![10 Top Embedded Finance Startups & Companies to Watch [2026]](https://www.startus-insights.com/wp-content/uploads/2025/07/Embedded-Finance-Startups-SharedImg-StartUs-Insights-noresize-420x236.webp)