Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Executive Summary: What are the Top 10 Chemical Industry Trends in 2026 and Beyond?

The chemicals industry is experiencing a rapid shift driven by technological innovation, sustainability demands, evolving regulations, and changing customer needs. The top chemical industry trends shaping the sector are:

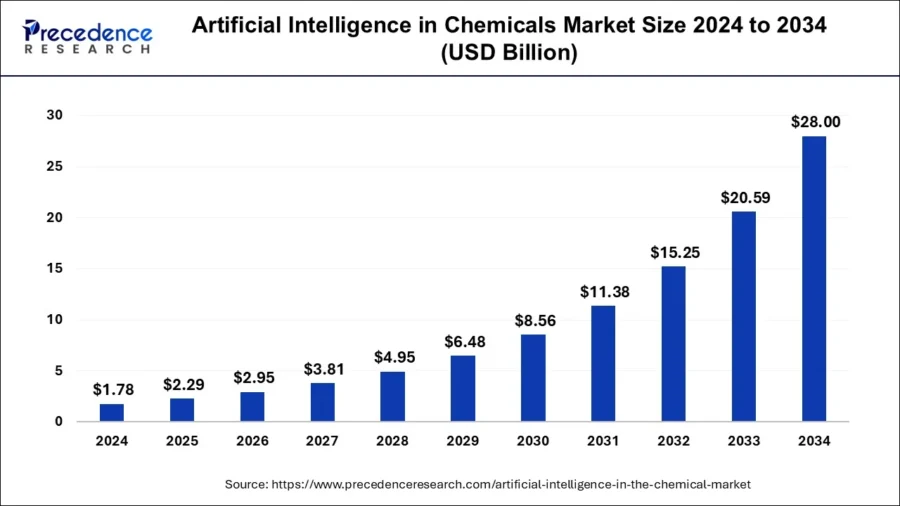

- AI Integration: Global artificial intelligence (AI) in chemicals hits USD 1.41 billion in 2025, projected to reach USD 12.71 billion by 2034. AI improves yield, quality, and forecasting accuracy by up to 50% while reducing downtime and emissions.

- Regulatory Compliance & Safety: 86% of US chemical firms report rising regulatory burdens, with Scope 3 emissions making up 75% of total, but only 30% trackable. Generative AI, digital twins, and blockchain improve compliance while lowering audit risks.

- Circular Economy & Green Chemistry: The green chemistry market exceed USD 150 billion by 2030 at a 10% CAGR, as 90% of firms embed circularity in their strategies.

- Specialty Chemicals: Specialty chemicals will grow from USD 940.7 billion in 2025 to USD 1.33 trillion by 2030. Demand rebounds as clean energy, semiconductors, and electric vehicle (EV) batteries drive high-purity chemical needs.

- Internet of Things (IoT) Integration: The chemical IoT market hits USD 97.9 billion by 2025, growing 21.8% annually. Real-time sensors, predictive maintenance, and digital twins slash downtime and improve asset efficiency.

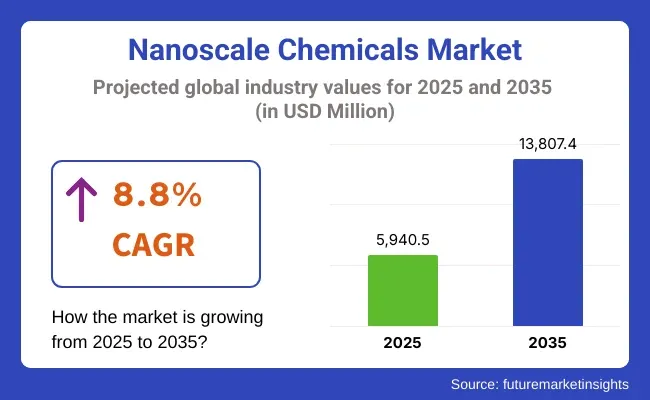

- Nanotechnology: The nanoscale chemicals market reaches USD 5.94 billion in 2025 and grows to USD 13.8 billion by 2035. Nanocatalysts and membranes reduce energy use and emissions and increase reaction selectivity in refining and treatment.

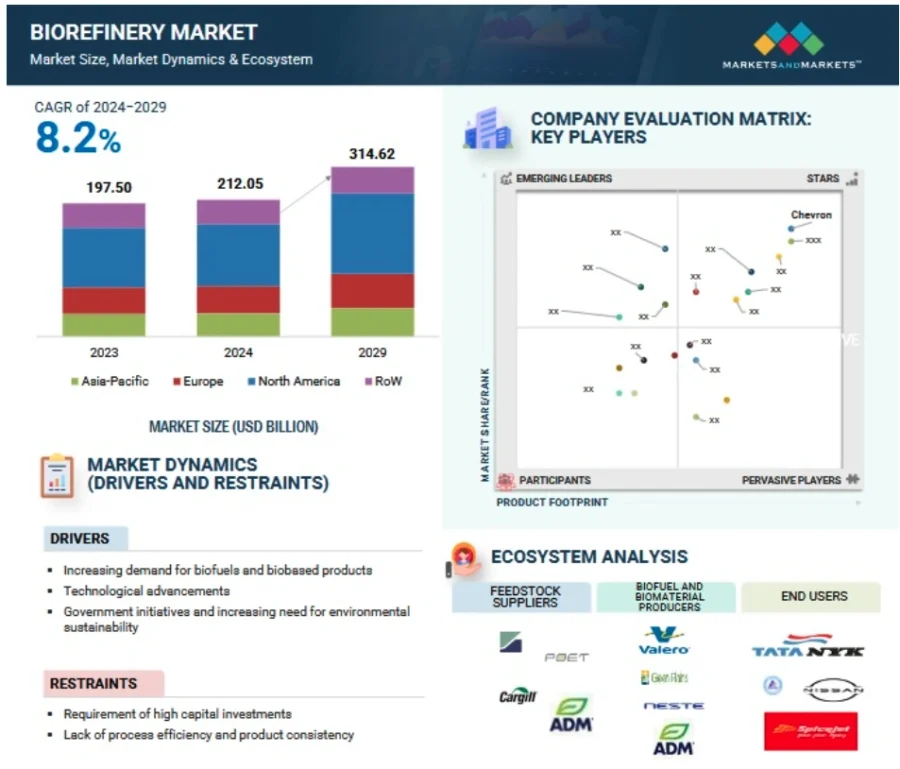

- Biofuels & Biorefineries: The global biorefinery market is projected at USD 314.6 billion by 2029, with biofuels forecast at USD 258.09 billion. Second-gen feedstocks and carbon capture enable low-carbon chemicals and sustainable fuels.

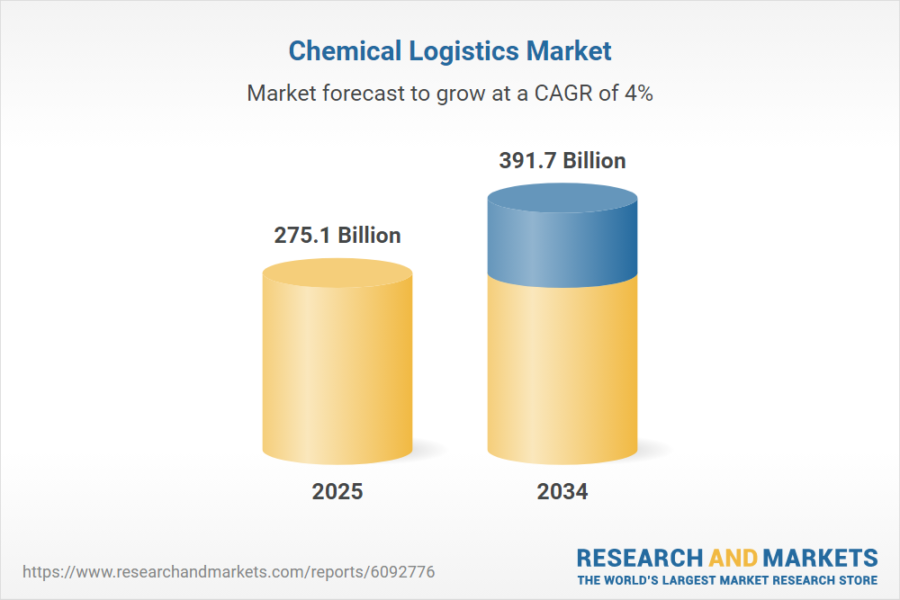

- Supply Chain Resilience: Chemical logistics market grows to USD 309.6 billion by 2025, driven by AI, IoT, and blockchain. Digital twins and predictive analytics reduce lead times and mitigate supply disruptions.

- Blockchain Integration: Blockchain in chemical warehousing will reach USD 21.76 billion by 2029. 80% of firms demand granular product data as blockchain secures supply chains, prevents counterfeiting, and minimizes compliance costs.

- High-performance Materials: The high-performance materials market is projected to reach USD 266 billion by 2031. Nanocomposites and additive manufacturing deliver lightweight, durable parts that improve efficiency in aerospace, EVs, and chemicals.

Read on to explore each trend in depth—uncover key drivers, current market stats, major innovations, and chemical industry-leading innovators shaping the future.

Frequently Asked Questions

1. What is the future of the chemical industry?

The chemical industry is expected to see moderate growth driven by sustainability, automation, and digitalization, with global production projected to rise by 3.5% and a strong focus on decarbonization and specialty chemicals.

2. What are the challenges of the chemical industry?

The key challenges include high energy and feedstock costs, overcapacity, weak demand in major markets, tighter environmental regulations, supply chain disruptions, and the need for increased sustainability and digital transformation.

3. What is the market size of the chemical industry

The global chemical industry market size is projected to reach USD 214.40 million by 2032, growing at a 5.01% CAGR from 2024.

Methodology: How We Created the Chemical Market Trends Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 7M+ global startups, 20K technologies & trends, plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the chemical industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the chemical innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Chemical Industry Trends & 20 Promising Startups

For this in-depth research on the Global Chemical Industry Trends & Startups, we analyzed a sample of 9100+ global startups & scaleups. The Chemical Industry Innovation Map, created from this data-driven research, helps you improve strategic decision-making by giving you a comprehensive overview of the future trends in the chemical industry & startups that impact your company.

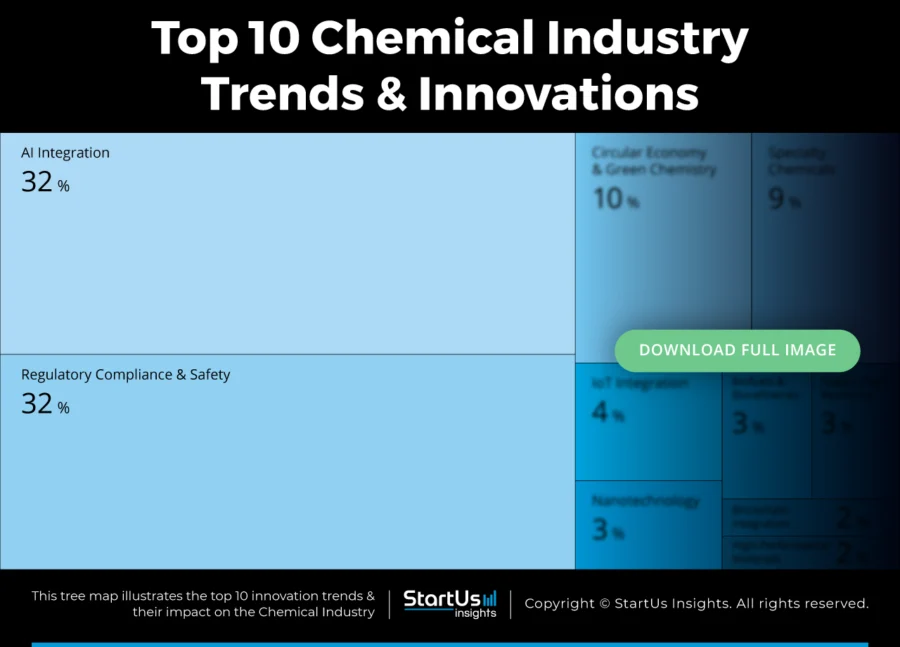

Tree Map reveals the Impact of the Top 10 Chemical Industry Trends

Based on the Chemical Industry Innovation Map, the tree map below illustrates the impact of the top trends in the chemical market.

AI-driven optimization improves R&D, process efficiency, and enhances supply chain forecasting. Tighter regulations push companies to adopt compliance automation, blockchain traceability, and digital twins for real-time monitoring and reporting.

Circular economy principles and green chemistry improve feedstocks and production methods. This reduces emissions and waste. IoT integration enables predictive maintenance, safety improvements, and energy efficiency gains across facilities.

Meanwhile, nanotechnology and high-performance materials unlock new applications in electronics, energy, and advanced manufacturing. Biorefineries and bio-based feedstocks also reduce dependence on fossil resources and support low-carbon growth.

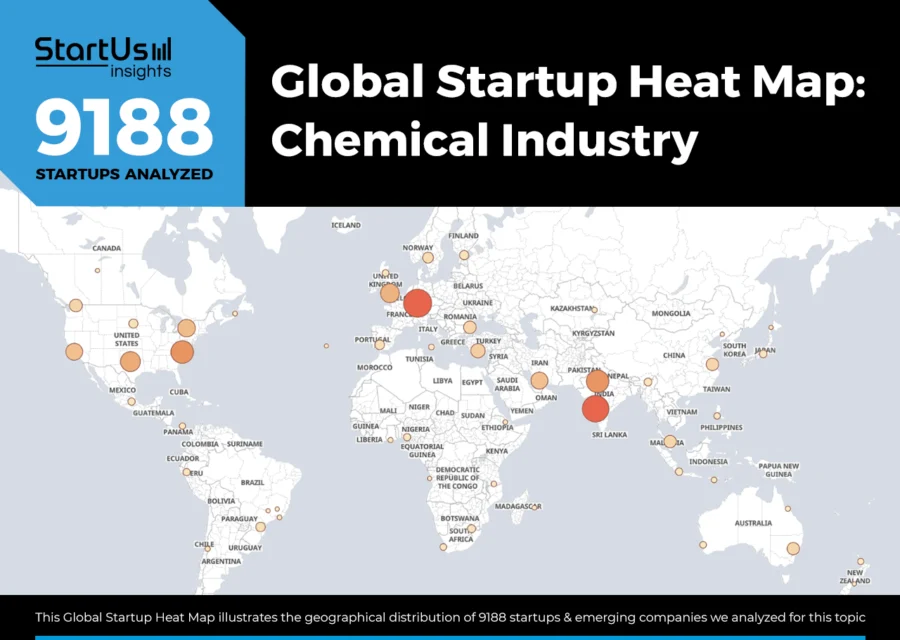

Global Startup Heat Map covers 9100+ Chemical Industry Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 9100+ exemplary chemical industry startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the USA and India, followed by the UK. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore 9100+ Chemical Industry Innovations & Trends?

Top 10 Emerging Trends in Chemical Industry [2026 and Beyond]

1. AI Integration: A USD 1.41 B Market in 2025

AI-driven process optimization and real-time monitoring led to reductions in downtime, increased yield, and improved product quality. In R&D, AI improves the discovery of new compounds and materials for faster identification of chemical formulations compared to traditional methods.

Supply chain optimization is another area of AI-driven improvement, with forecasting accuracy increasing by up to 50% over human predictions. This results in lower inventory levels and less waste. The usage of AI in the chemicals industry increases material discovery, optimizes complex chemical processes, and also ensures safer and more efficient product development..

To reflect this momentum, 75% of industry leaders plan to invest over USD 100 million in AI-based product development by 2025. In 2024, notable investments included UK-based startup Entalpic, which raised over EUR 8.5 million to advance AI-driven decarbonization solutions.

Moreover, in the USA, Albert Invent raised USD 22.5 million in a Series A round to expand its AI-powered R&D platform. It aids chemical companies in accelerating product development and optimizing experiments.

The global AI in chemicals market is estimated at USD 1.41 billion in 2025. It is projected to reach USD 12.71 billion with a compound annual growth rate (CAGR) of 6%. The USA market alone is projected to surge to USD 9 billion by 2034.

Credit: Precedence Research

However, chemical plants face high AI implementation costs, aging infrastructure, and strict regulations, but new solutions address these barriers.

Cloud-based AI tools lower hardware costs and scale across sites. Interoperability software connects legacy systems to unlock siloed process data. Further, automated compliance checks ease regulatory burdens, while explainable AI models strengthen safety and reduce operational risks.

ReactWise offers Chemical Process Optimization Co-Pilot

UK-based startup ReactWise develops an AI co-pilot for chemical process optimization that identifies ideal (bio)chemical reaction conditions without writing any code.

The co-pilot uses machine learning (ML) to build custom reactivity models with a company’s data and predicts yields, selectivities, and other outcomes. It integrates directly with automated laboratory equipment for real-time adjustments and faster experiments.

Moreover, ReactWise combines proprietary reactivity models and a chemical descriptor database covering solvents, catalysts, and acids to provide deeper process insights.

Its cloud-based system also uses multi-tenancy Amazon Web Services (AWS) databases with end-to-end encryption, with an option for on-premise deployment.

MLT Analytics provides Chemical Market Forecasting

Singaporean startup MLT Analytics uses AI and ML to develop customized sales and price forecasting models to predict chemical volumes and revenues by product, market, and region.

It combines proprietary grade-level databases with unstructured trade data. This generates detailed insights to balance supply-demand dynamics, manage specialty chemical inventories, and streamline procurement workflows.

The startup also offers up-to-date insights on market demand, supply trends, and price developments for polymers, feedstocks, and specialty chemicals.

Further, its custom market research analyzes trends in chemical and mechanical recycling, bio-based and sustainable feedstocks, and biodegradable resins. It further examines mono-material packaging structures and non-plastic packaging alternatives.

2. Regulatory Compliance & Safety: 86% of US Producers Report Rising Compliance Burdens

Regulatory complexity continues to intensify, with 86% of USA chemical manufacturers reporting increased regulatory burdens in 2024 and anticipating further escalation in 2025.

The 2021 Code of Federal Regulations (CFR) imposed more than 100 000 restrictions on domestic chemical manufacturing, which account for 10% of all CFR restrictions. Over the past two decades, the number of regulatory requirements has doubled that have been adding complexity and cost to compliance.

New per- and polyfluoroalkyl substances (PFAS)-related policies have been added to the regulatory landscape. In 2024, over 20 new state-level policies were passed in the USA, and Canada and the European Union (EU) introduced more reporting rules and substance restrictions.

The European Chemicals Agency (ECHA) conducted 313 compliance checks in 2024 that covered nearly 2000 registrations and 272 substances. With this, 30% of companies were referred for enforcement due to non-compliance.

These regulatory pressures are compounded by operational and financial challenges. Compliance costs erode margins and constrain investment in innovation. Also, shareholder returns and earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples declined since 2022. The average EBITDA multiple in the sector dropped from 10.5x in 2021 to 7.6x in 2023.

Moreover, Scope 3 emissions account for roughly 75% of the average chemical company’s total emissions. However, only 30% of companies are able to report these due to data and tracking difficulties. As regulatory requirements expand, particularly around sustainability disclosures and product traceability, companies face mounting pressure to modernize their compliance infrastructure.

To address these challenges, the industry turns to advanced technologies. Tools like Accuris Thread and Engineering Workbench Professional centralize regulatory information, automate compliance alerts, and streamline audit readiness. Generative AI solutions, with platforms like Nesh GenAI, automate compliance workflows, regulatory intelligence, and risk assessment.

Additionally, blockchain and digital twin technologies are being piloted to enhance supply chain traceability and real-time emissions monitoring. Similarly, advanced analytics and predictive maintenance deliver 5-10% efficiency improvements in production and compliance management.

CeeGreen builds Regulatory Compliance AI Agents

US-based startup CeeGreen develops AI agents for chemical regulatory compliance that assist companies with complex regulations and avoid costly non-compliance risks.

Its cloud-based platform uses regulatory-informed AI to automate compliance workflows, monitor global regulations, and forecast restrictions before they impact operations.

The agents streamline compliance management by verifying chemical portfolios, labels, and safety data sheets while suggesting safer alternatives. Additionally, they automate the creation of regulatory reports and documentation across jurisdictions.

Foresight makes the Automated Policy Monitoring Assistant

UK-based startup Foresight builds an AI-powered policy monitoring assistant and platform for chemical companies and compliance teams. It scans global sources to provide real-time, expert-validated updates on regulatory changes that directly impact chemicals, substances, and related markets.

The platform automatically generates personalized alerts, impact analyses, and compliance reports to replace manual tracking.

Further, integrated AI assistants aid chemical professionals in analyzing policies and drafting stakeholder updates. They also assist in identifying at-risk substances like per- and polyfluoroalkyl substances (PFAS), lead, or other restricted chemicals.

3. Circular Economy & Green Chemistry: Market to Exceed USD 150 B by 2030

In the UK alone, the chemicals sector comprises 4400 companies, employs 151 000 people, and generates GBP 31 billion in GDP and GBP 50 billion in export goods. Within this, 90% of chemicals are still derived from fossil sources, and the sector contributes 6-8% of national greenhouse gas emissions. Globally, the chemical industry is responsible for nearly 6% of all greenhouse gas emissions.

The global green chemistry market is projected to exceed USD 150 billion by 2030 with a CAGR of over 10%. Yet, the path to a circular and green chemicals industry includes challenges.

High initial investment requirements, especially for closed-loop recycling infrastructure and bio-based production, remain a barrier. This is compounded by gaps in circular infrastructure, complex and evolving regulations, and insufficient customer demand for circular products.

To tackle such issues, the companies adopt alternative feedstocks like biomass, plastic waste, and CO2 for decoupling chemical production from fossil resources. Advances in bio-based polymers, recyclable composites, and carbon capture-integrated manufacturing enable lifecycle carbon reductions.

For example, new materials like polylactic acid (PLA) and polyethylene furanoate (PEF) reduce carbon footprints by up to 50%. Electrification of chemical processes, including the use of renewable electricity for electrocatalysis and electrochemical synthesis, speeds up the shift to low-carbon operations.

Industry surveys reflect the scale of change. 90% of chemical companies report that the transition to a circular economy impacts their business positively. It increases efficiency, resilience, and new market opportunities such as recycling tech or renewable feedstocks. 82% embedded circular principles in their corporate strategies, and 52% say they are advanced in the transition.

Between 2024 and 2025, sustainable chemistry startups attracted over USD 6.6 billion in Q1 2025 alone. Checkerspot secured USD 55 million in Series C funding to scale its WING platform. It replaces petroleum-based ingredients with bio-based alternatives for consumer and industrial products.

GFBiochemicals obtained EUR 15 million to expand commercial production of levulinic acid from biomass. Regulatory pressures, growing market demand for sustainable products, and technological advances drive these investments, making green chemistry more viable and profitable.

Syntetica advances Nylon Recycling

French startup Syntetica develops a proprietary chemical depolymerization process to recycle nylon. It pretreats nylon-rich textile waste to convert polymers into monomers. The startup then uses a no-pressure, low-temperature process to separate nylon 6 and nylon 6,6 from blended materials like elastane, cotton, or polyester.

The process removes dyes and finishes during purification to yield raw ingredients ready to reenter the supply chain.

CascadeBio facilitates Enzyme Immobilization Technology

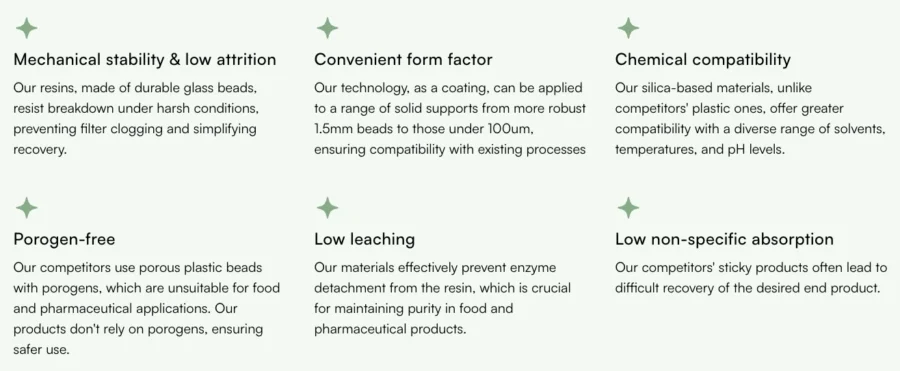

US-based startup Cascade Bio develops an advanced enzyme immobilization technology and a supporting platform that performs more reactions with fewer resources.

The startup’s Body Armor technology analyzes enzyme structures to optimize them with polymer brushes. It immobilizes them on durable silica beads that drop into existing chemical processes. This design cushions enzymes, extends their lifespan, improves solvent and temperature stability, and enables repeated reuse. The technology also lowers costs while maintaining high turnover numbers and process efficiency.

Credit: CascadeBio

Meanwhile, the startup’s platform supports this Body Armor technology by offering a flexible system that integrates these immobilized enzymes into different chemical manufacturing setups.

Its convenient coating format works across various bead sizes to ensure mechanical stability and chemical compatibility without porogens. With low leaching and minimal non-specific absorption, the platform protects product purity and aids users in recovering end products more easily.

4. Specialty Chemicals: Global Market to Hit USD 1 T in 2034

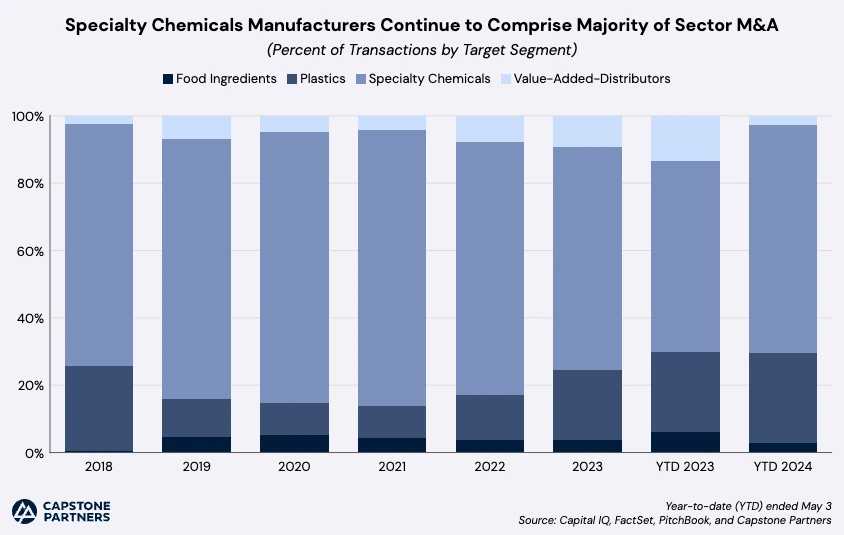

The global specialty chemicals market is projected to grow from USD 940.72 billion in 2025 to USD 1.33 trillion by 2034 with a CAGR of 3.94%. Notably, the specialty chemicals segment accounted for 66.2% of all M&A targets in the chemicals sector during the first half of 2024. It represented a 28.9% year-over-year increase that highlights its strategic importance for both private equity and corporate buyers.

Credit: Capstone Partners

Despite its market size, the sector faced headwinds in 2024, with specialty chemical output declining by 3.2% due to slow recovery in key end-use markets. Companies contend with region-specific safety and environmental standards that drive up operational costs and require ongoing investment in compliance systems.

However, companies like Verbio in Germany are advancing the sector by using metathesis catalysts. They produce renewable specialty chemicals for detergents, lubricants, and plastics from rapeseed oil methyl ester.

At the same time, supply chain issues, including geopolitical tension, disrupt raw material availability and logistics. This leads to production delays and tighter margins. Overcapacity in Asia depresses global utilization rates and puts pressure on margins, especially in Europe.

A rebound is anticipated in 2025 as demand from sectors such as semiconductors, clean energy, advanced materials, automotive, and personal care accelerates. The U.S. CHIPS Act, for example, allocated USD 52 billion to domestic semiconductor manufacturing, which increased the demand for specialty gases and high-purity chemicals.

Similarly, the Inflation Reduction Act unlocked USD 369 billion for clean energy projects in electric vehicle batteries, solar panels, and industrial coatings.

Companies like Ascent Industries redeployed USD 61 million from asset sales into R&D for high-margin specialty chemical products and strategic acquisitions in 2024. Private equity transaction multiples averaged 10.2x enterprise value divided by EBITDA (EV/EBITDA) between 2021 and 2024.

X-HaloChem creates Stimulus-Responsive Monomers

Canadian startup X-HaloChem develops stimulus-responsive monomers that improve antimicrobial performance. Its HaloXCoat and HaloXPlus monomers stabilize chlorine on surfaces by integrating into resin and binder systems such as acrylics, epoxies, and polyurethanes.

This keeps disinfectant properties active for longer and prevents microbial contamination, biofilms, and corrosion. Moreover, the monomers offer features like water-based formulations, rechargeability, durability, and quick pathogen kill rates.

Polar Apex makes Stealth Defense Materials

Finnish startup Polar Apex develops nano stealth materials and performance coatings that enhance the protective and functional qualities of critical equipment across the chemical industry.

Its nano stealth material blocks radar and near-infrared (NIR) observation to provide multispectral coverage. This improves safety and reduces detection risk for sensitive chemical infrastructure and logistics.

The startup’s Inferno Suppressor Cover (ISC) withstands extreme heat up to 1200°C with a secure locking mechanism and detachable outer skin. The multi-use survival bag (MSB) protects workers with thermal imaging defense, hypothermia prevention, and weather resistance.

Further, the Arctic Diving Underlayer (ADU) combines multi-layer insulation and a zero electromagnetic signature design to enhance operator safety for underwater inspections of chemical pipelines or offshore assets.

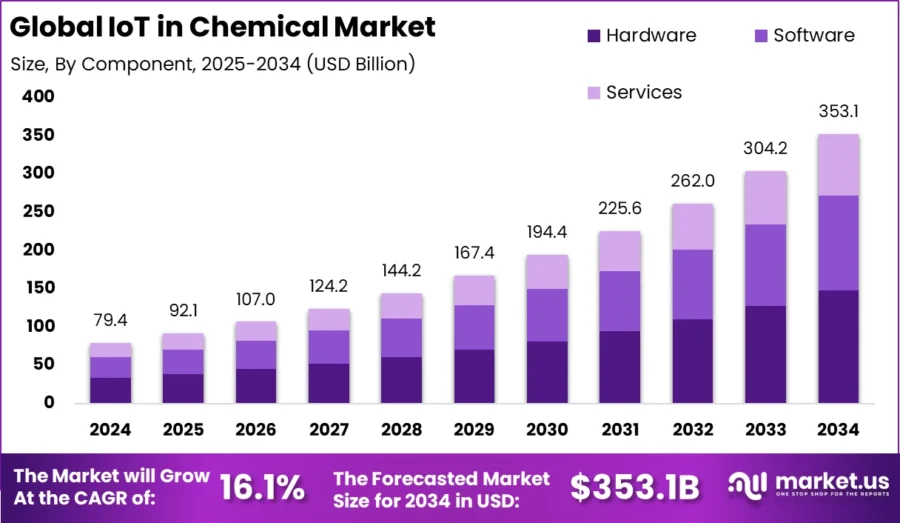

5. IoT Integration: Market to Reach USD 217.91 B by 2029

The integration of IoT in the chemicals industry accelerated with the global market size projected to grow from USD 97.9 billion in 2025 to USD 217.91 billion by 2029, with a CAGR of 22.1%.

North America dominates this sector, capturing over 40% of the market share in 2024. This equated to more than USD 31.76 billion in revenue. The market growth highlights the chemical industry relying on IoT for smart, safe production.

Credit: market.us

However, the sector faces challenges such as cybersecurity risks that escalate as more devices and systems connect. The high initial investment required for IoT hardware, integration, and workforce upskilling remains a barrier, particularly for smaller companies. Data integration complexity is another concern, as legacy systems lack interoperability with modern IoT platforms.

These technologies improve process efficiency, asset utilization, and energy savings to reduce downtime and costs. The deployment of IoT sensors for real-time monitoring of variables such as temperature, pressure, and pH allows chemical manufacturers to maintain optimal production conditions and prevent costly deviations.

Companies like Aloxy, which received EUR 7.4 million, received funding from Dow Venture Capital and Emerson Ventures to expand IIoT solutions for real-time monitoring and safety in chemical manufacturing. AkzoNobel‘s Suzhou plant added an automated line under a EUR 14 million plan to double coatings capacity by 2025.

ReFlow Technologies offers Reactor IoT Analytics

Indian startup ReFlow Technologies develops the Alpha X series, which is an AI-powered device that captures and analyzes operational data generated in real time. For instance, it connects directly to reactors to automatically monitor readings such as real-time and calibrated temperatures for each reactor unit.

By combining automated data capture with AI-driven analysis, Alpha X flags deviations in reactor temperature profiles early, predicts operational issues, and maintains optimal thermal conditions that are critical for yield and product quality.

In addition, on-demand reports and secure data storage allow plant engineers to validate compliance, reduce off-spec batches, and plan proactive interventions.

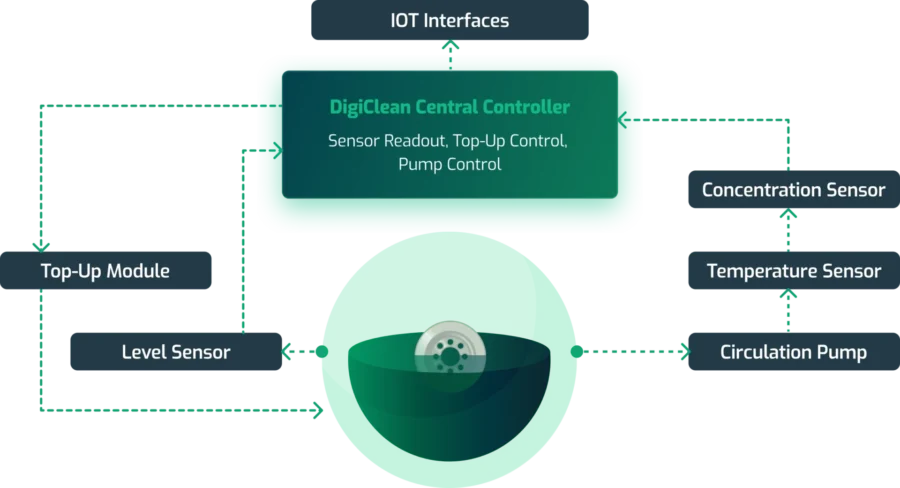

Digiclean Solutions provides Chemical Cleaning Process Optimization

Swedish startup Digiclean Solutions provides an AI-driven chemical cleaning system that optimizes chemical usage through real-time fluid monitoring and control.

Credit: Digiclean Solutions

Its automated platform tracks process fluids continuously, removes the need for manual sampling, and adjusts chemical usage instantly to maintain efficiency. This reduces the amount of chemicals used in cleaning fluids.

Also, the platform minimizes CO2 emissions and reduces waste and energy costs while ensuring full traceability and regulatory compliance.

6. Nanotechnology: Market to Hit USD 13.8 B in 2035

Nanomaterials such as carbon nanotubes and graphene improve the strength, conductivity, and durability of composites, coatings, and electronic materials. Nanocatalysts enable chemical reactions to occur at lower temperatures and with greater selectivity. This reduces both energy consumption and waste for petroleum refining, hydrogen production, and pharmaceutical synthesis.

Environmental applications with nanostructured adsorbents and membranes facilitate metal ion removal, advanced wastewater treatment, and carbon capture. In manufacturing, nano-engineered processes like Nano One’s One-Pot cathode synthesis streamline production. It uses fewer steps, less energy and water, and a scalable design to make cathode materials more sustainably.

Credit: Future Market Insights

Moreover, the nanoscale chemicals market is estimated at USD 5.94 billion in 2025 and is projected to reach USD 13.8 billion by 2035 with a CAGR of 8.8%. The USA has allocated a record USD 2.2 billion to the national nanotechnology initiative in its 2025 budget.

Some companies, like BASF and Nano One Materials, invested in nanotechnologies. For instance, BASF leads in nanoscale catalysts and clean energy solutions. Nano One Materials secured government and industry funding for its nano-structured battery cathode materials. Similarly, NanoXplore advances graphene applications for plastics and batteries, supported by multi-year contracts and plans for a new battery gigafactory.

Despite progress in nanotechnology for catalysts and specialty chemicals, high energy costs, especially in Europe, increase production expenses for energy-intensive nanomaterials. Geopolitical conflicts, climate events, and port strikes disrupt supply chains for key inputs and equipment, raising costs and delaying projects.

Stricter regulations push chemical producers to use cleaner, safer nanoparticle methods. Economic uncertainty, inflation, and changing demand in automotive, construction, and coatings make scaling nano-based chemicals harder. Issues with transparency, inventory, and quality checks remain critical for nanomaterials that need precise specifications and traceability.

Given these pressures, green nanotechnology improves solar cell efficiency, develops lighter and stronger composites, and creates more sustainable chemical processes. AI and predictive analytics enhance R&D, supply chain management, and operational efficiency.

Further, nanomembranes and metal-organic frameworks (MOFs) for selective separations, water purification, and carbon capture assist companies in meeting regulatory and sustainability goals.

NanoTech Innovation makes Nanotech Corrosion Coatings

Canadian startup NanoTech Innovation develops an eco-friendly coating product that improves corroded surfaces into a protective anti-corrosion layer with minimal surface preparation.

Its technology uses ingredients extracted from the bark, peel, and roots of the pomegranate plant, which react with existing rust to create a durable coating that also serves as a primer.

This eliminates the need for abrasive blasting and toxic chemicals, shortens treatment time, and allows application in hard-to-reach areas. Additionally, the coating dries quickly, remains non-hazardous, and offers long-lasting protection to reduce labor and replacement costs.

ADOXIMA offers Advanced Oxide Materials Production

Australian startup Adoxima produces specialized oxide materials using its disordered nano-cluster (DNC) technology. Its process integrates elements through controlled reactions to adjust physico-chemical properties like surface area, particle size, doping, and mixed metal oxide formation.

Moreover, the startup produces materials that meet product specifications while reducing wet waste and environmental impact.

Credit: ADOXIMA

Also, by using the tailored nano-scale properties, Adoxima’s materials achieve performance advantages. For instance, smaller particle sizes enable denser, stronger materials with improved strength, flexibility, and durability. A high surface-to-volume ratio increases reactivity and heat dissipation.

7. Biofuels & Biorefineries: Markets to Reach USD 258 B & USD 314 B by 2029

The chemicals industry witnesses a change as bio-based chemicals and materials replace traditional petrochemical-derived products, particularly in specialty chemicals, polymers, plastics, and resins.

Similarly, Enilive’s Gela biorefinery in Italy produces 400 000 tonnes of sustainable aviation fuel annually from waste feedstocks using advanced hydrotreated vegetable oil (HVO) technology.

The renewable chemicals market is forecast to grow at a CAGR of 5.01% to reach USD 214.40 million by 2032. Biorefineries are central to this transition, enabling the conversion of agricultural and industrial residues into high-value chemicals and fuels. Thus, they support circular economy principles and reduce dependence on fossil resources.

However, the chemical industry still faces challenges in scaling bio-based production. Competition for feedstocks with food and feed sectors raises concerns about land use, food security, and biodiversity.

Technical hurdles such as catalyst deactivation and inefficient biomass conversion slow the development of low-carbon chemicals. Integrating biocrudes into existing refineries poses risks like thermal instability and corrosion in chemical processing units.

To tackle these barriers, the chemical industry is adopting advanced solutions. Industrial biotechnology and synthetic biology boost conversion yields for bio-based chemicals while helping reduce production costs.

Moreover, second- and third-generation biorefineries that use non-food feedstocks like agricultural residues and algae minimize competition with the food supply and reduce environmental impacts. Integrating green hydrogen and carbon capture technologies further decarbonizes chemical processes and creates new value chains.

Credit: MarketsandMarkets

Projections for 2025 for the biorefinery market are expected to reach as high as USD 314.62 billion by 2029 at a CAGR of 8.2%. The biofuels market itself is forecasted to climb to USD 258.09 billion by 2029. The North American biorefinery market is expected to surpass USD 90.8 billion by 2034, and the U.S. biofuels market is projected to reach USD 38.32 billion in 2025.

Further, SGP BioEnergy secured USD 250 million to build Panama’s Golden City Biorefinery for targeting 2.6 billion gallons of advanced biofuels annually. Alder Renewables gained over USD 2 million in US grants and private investment for its SAF project in Québec.

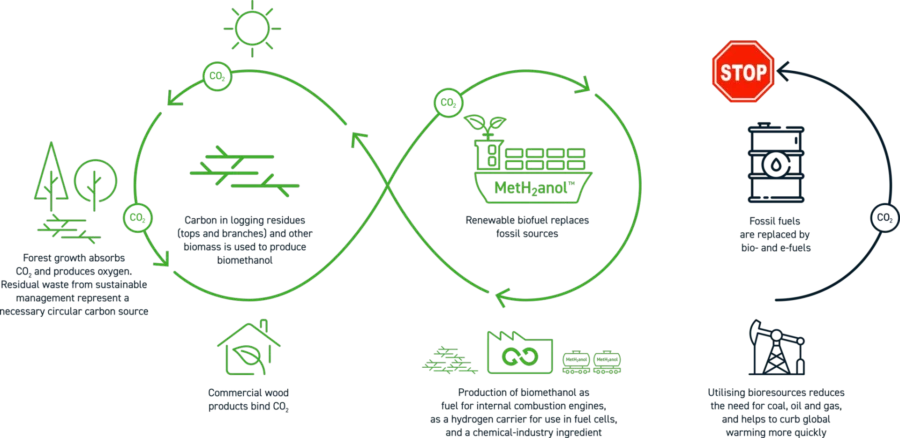

Glocal Green streamlines Biomethanol Production

Norwegian startup Glocal Green produces climate-neutral biomethanol. Its process uses logging residues, sawmill waste, demolition wood, and fish-farming sludge to generate synthesis gas in a self-fuelled, energy-efficient system.

Credit: Global Green

This system combines gasification and pyrolysis at high temperatures. By adding hydropower-based electrolysis, it more than doubles methanol output while avoiding fossil emissions.

Additionally, the biomethanol serves as a carbon-neutral fuel for ships and vehicles and a sustainable input for chemical industries.

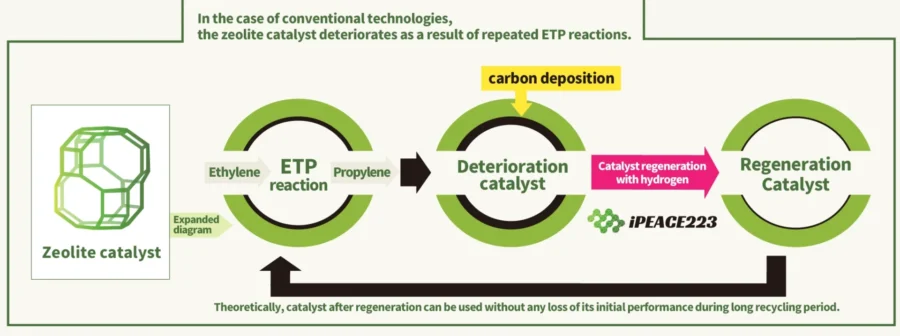

iPEACE223 advances Zeolite Catalyst Technology

Japanese startup iPEACE223 develops a zeolite catalyst technology that converts bioethanol into clean fuels and chemicals through its ethylene to propylene (ETP) process.

The technology produces bioethylene from bioethanol and then uses a specially modified chabazite (CHA) zeolite catalyst to convert ethylene into biopropylene. It regenerates the catalyst through a hydrogen treatment that avoids irreversible damage and keeps performance stable over many cycles.

Credit: iPEACE223

Moreover, it maintains catalyst efficiency and reduces the need for frequent replacement. Also, the technology enables the continuous production of bio-propylene that feeds into sustainable liquified petroleum gas (LPG), polypropylene, and other chemical products. This reduces CO2 emissions and provides carbon neutrality.

8. Supply Chain Resilience: Average Lead Times for Shipments Increased by 25-35%

Credit: Research and Markets

The chemical logistics market is projected to reach USD 309.6 billion in 2025 at a CAGR of 7.2% through 2034. It is expected to be valued at USD 580.8 billion in 2034. This segment is driven by the adoption of digital tracking, IoT-enabled sensors, and automated warehousing that enable real-time visibility and enhance safety in chemical transport and storage.

The average lead times for chemical shipments increased by 25-35% compared to pre-pandemic levels. For instance, shipments that once took three weeks now often require five to six weeks due to rerouting and congestion.

Moreover, the chemical industry faces challenges, including complex and evolving global regulations for hazardous materials and environmental compliance. Geopolitical tensions and raw material shortages further disrupt chemical production and supply continuity. Many chemical companies also struggle with fragmented data and outdated IT systems.

To address these risks, the industry ramps up investments in technology and strategic sourcing. AI-driven platforms now support real-time supply chain visibility, predictive analytics, and proactive disruption management tailored for chemical logistics and materials flow.

IoT and automation improve tracking of sensitive chemicals and increase operational efficiency. Blockchain enhances traceability and regulatory compliance for high-risk chemical shipments. Digital twins allow chemical companies to simulate supply chain scenarios, assess vulnerabilities, and manage risk more effectively.

Additionally, the chemical industry saw major supply chain investments focused on resilience and digitalization. Mstack Chemicals raised USD 40 million in Series A funding to expand specialty chemical operations and enhance digital logistics.

Valdera secured USD 15 million to develop its AI-driven sourcing platform. Knowde obtained USD 60 million in Series C to advance its master data management and AI tools for supply chain modernization.

ChemCloud offers a Procurement Management Platform

Australian startup ChemCloud builds a digital procurement platform that streamlines the raw material sourcing process, from approvals to final delivery. Using built-in AI, ChemCloud automates repetitive tasks like quote tracking, delivery updates, and certificate of analysis (COA) storage.

Additionally, the platform provides tools to share digital price lists, offer instant quotes, with milestone tracking. It combines procurement approvals, requests for quotations (RFQs), order tracking, analytics, and supplier management in a single interface. This reduces manual workflows and controls spending for the supply chain.

The platform further integrates with the enterprise resource planning (ERP) system to centralize procurement data. It manages approved materials and creates document registers and safety data sheets (SDS) alerts.

Bizinbiz Technologies provides a Digital Order Management Solution

Indian startup Elchemy by Bizinbiz Technologies offers DOMS, a digital order management solution. It connects every stage of the order lifecycle, from confirmation and manufacturing to export clearance, shipment departure, real-time tracking, and final delivery.

Also, by combining advanced payment tracking, proforma invoice management, and live updates on shipment status, it brings transparency to the users.

9. Blockchain Integration: Facilitates Access to Chemical Information

Blockchain-based solutions improve tracking in logistics, which increases demand for chemical warehousing. Notably, 80% of chemical companies now report increased demand for detailed product chemistry data, which increases the adoption of blockchain for compliance and transparency.

In Europe, chemical companies spend about USD 11.5 billion annually on regulatory compliance, a burden that blockchain reduces by automating secure data flows and simplifying legal procedures.

Despite an 8% revenue decline in 2023, chemical companies increased their R&D investments by 2% and capital expenditures by 6% in 2024. Further capital expenditure growth forecasts for 2025 reflect the push for digital and sustainability initiatives, including blockchain adoption.

Blockchain’s solutions in the chemical industry go beyond simple record-keeping. By integrating with technologies like radio frequency identification (RFID) and IoT, blockchain enables real-time tracking. It also verifies raw materials, production lots, and finished products. This ensures authenticity, prevents counterfeiting, and allows for precise documentation of a chemical’s lifecycle.

For example, companies like Stahl and KRAHN Chemie use blockchain-based tracking systems to certify the origin of raw materials and trace them throughout the supply chain.

Further, blockchain supports the industry’s sustainability and circular economy goals by enabling tracking of hazardous substances and facilitating access to chemical information for recyclers and waste operators. Dual-layer setup secures both business transactions and real-time data between plant devices by protecting critical information at every level.

Futur-AI provides Material ID Certification

Italian startup Futur-AI offers an advanced data certification and management solution that secures details of composite component production using AI algorithms and blockchain technology.

The solution tracks chemical, physical, and operational data across phases of the chemical production cycle. It records this information in an immutable blockchain ledger for data integrity and traceability.

Moreover, the startup’s algorithm automates the transcription of industrial data to ensure the composite material’s features remain certified and tamper-proof.

SafeOne Chain offers Chemical Production Tracking

German startup SafeOne Chain develops an AI-powered blockchain platform that secures and tracks chemical production with full transparency and traceability.

It uses a private proof-of-authority blockchain combining Bitcoin (BTC) and Ethereum Virtual Machine (EVM) technologies. Every step from raw materials to final delivery is recorded on an immutable ledger. Smart contracts and dedicated software certify production data, maintain compliance, and enable real-time supply chain visibility.

The startup’s SafeBurst tool offers AI-driven email marketing for crypto-friendly outreach. The Launchpad supports safe project launches, and SafeOne Insurance protects against fraud.

Further, the SafeOne Wallet ensures secure digital asset management, and the payment solutions with fiat onramp simplify token transactions.

10. High-Performance Materials: Market Projected at USD 266 B by 2031

High-performance materials (HPMs) are critical enablers in the chemical industry to enable safer, more efficient production. Their lightweight, high-strength, and chemical-resistant properties aid chemical manufacturers in developing advanced composites, coatings, and specialty polymers that meet strict performance and sustainability standards.

These materials provide strength, durability, thermal stability, and resistance to harsh chemicals and extreme temperatures. Thus, these materials are vital for applications like corrosion-resistant piping, membranes, and high-performance plastics.

The global market for high-performance materials is projected to reach USD 266 billion by 2031, with a CAGR of 18% between 2024 and 2031. Among this, high-performance composites are expected to reach USD 36.8 billion by 2034 at a CAGR of over 10%.

Emerging technologies such as additive manufacturing allow chemical companies to produce complex, lightweight, and customized components more efficiently while minimizing waste. Smart manufacturing using AI, IoT, and robotics further optimizes the processing of advanced materials in real time.

Also, material innovations, including nanocomposites and hybrid materials, open new possibilities for multifunctional products. These combine structural strength with energy storage or environmental sensing.

However, the chemical industry still faces challenges in scaling production, managing high costs, and improving recyclability, as many HPMs involve specialized processes and are difficult to recover at end-of-life.

To address these issues, the sector sees strategic investments from governments and private players alike. For instance, Honeywell spun off its advanced materials business as part of a USD 9 billion strategy to strengthen its specialty materials portfolio.

Boston Materials raised USD 13.5 million to advance carbon fiber technologies for aerospace and electric vehicles. Additionally, Thintronics secured USD 23 million to develop high-performance insulators for AI data centers.

Nione offers Niobium Nanoparticle Production

Brazilian startup Nione develops nanometric niobium technology that enhances the physical and chemical properties of materials used throughout the chemical industry.

Moreover, its patented process produces niobium nanoparticles on a large scale, which improve features such as corrosion resistance, thermal conductivity, mechanical strength, and durability.

These nanoparticles integrate into coatings, catalysts, piping systems, and specialized equipment exposed to harsh chemicals.

i2Cool provides Chemical Process Thermal Management

Hong Kong-based startup i2Cool develops thermal insulation coatings to manage heat efficiently across facilities and equipment. Its i2 Coating uses polymer blends and multi-scale inorganic nanoparticles to provide high solar reflectivity and mid-infrared emissivity. This reduces heat absorption and enhances heat dissipation without extra energy or refrigerants.

Moreover, by applying this coating to storage tanks, pipelines, and processing units, chemical plants benefit from solar reflectivity and mid-infrared emissivity. It lowers surface temperatures and minimizes thermal stress on materials.

Further, the coating is water-based, waterproof, flame-retardant, and showcases hydrophobic properties to ensure durability in demanding industrial environments.

Discover all Chemical Industry Trends, Technologies & Startups

As the chemical industry evolves, next-generation technologies, circular production models, and smarter supply chains reshape how chemicals flow through the economy. Looking ahead, companies investing in advanced materials, digitalization, and sustainable feedstocks today position themselves to meet climate goals and grow within a low-carbon, resource-efficient market.

The Chemical Industry Trends & Startups outlined in this report only scratch the surface of the trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.

![Explore the Top 10 Chemical Industry Trends & Innovations [2026]](https://www.startus-insights.com/wp-content/uploads/2025/07/Chemical-Industry-Trends-SharedImg-StartUs-Insights-noresize-1-420x236.webp)

![10 Top Startups Advancing Machine Learning for Materials Science [2025]](https://www.startus-insights.com/wp-content/uploads/2025/06/Machine-Learning-for-Materials-Science-SharedImg-StartUs-Insights-noresize-420x236.webp)