Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2024 Banking Industry Outlook explores a sector that has successfully faced economic uncertainty and continues to innovate. As digital transformation accelerates, the industry’s adaptation is reflected in trends like open and mobile banking, which have redefined customer engagement and service delivery. This report provides an in-depth analysis of the latest developments, including emerging trends, firmographic data, investment patterns, and innovative startups.

This report was last updated in July 2024.

This banking industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Banking Industry Report 2024

- Executive Summary

- Introduction to the Banking Industry Report 2024

- What data is used in this Banking Industry Report?

- Snapshot of the Global Banking Industry

- Funding Landscape in the Banking Industry

- Who is Investing in the Banking Industry?

- Emerging Trends in the Banking Industry

- 5 Banking Startups impacting the Industry

Executive Summary: Banking Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 6000+ banking startups developing innovative solutions to present five examples from emerging banking industry trends.

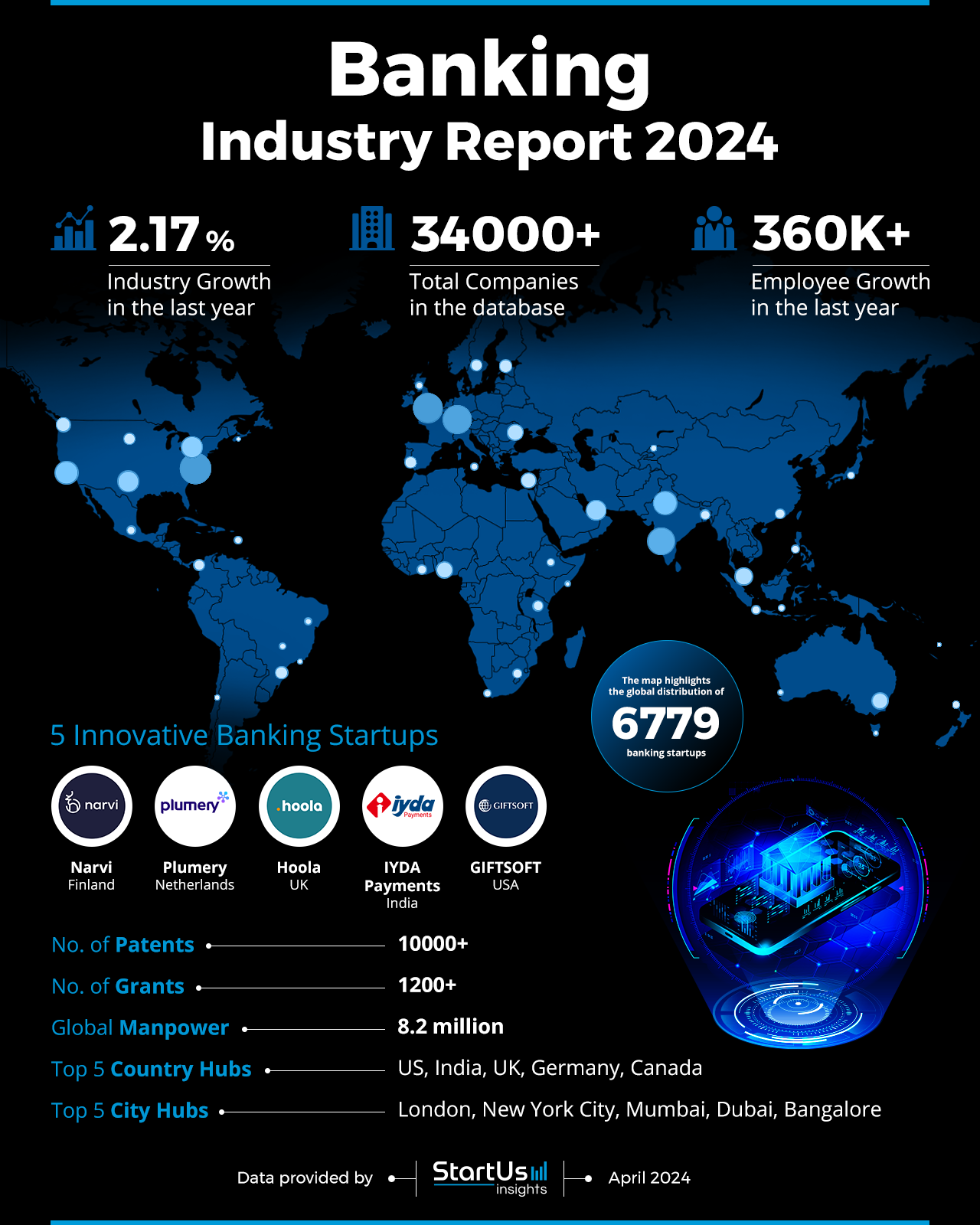

- Industry Growth Overview: The banking industry grew by 2.17% in the last year, with over 34000 companies listed, indicating steady expansion and resilience.

- Manpower & Employment Growth: The sector employs 8.2 million people globally, with an increase of 360000 employees over the past year.

- Patents & Grants: Innovation in the sector is evident with over 10000 patents filed and more than 1200 grants awarded.

- Global Footprint: Major hubs are in the US, India, UK, Germany, and Canada with city hubs, including London, New York City, Mumbai, Dubai, and Bangalore.

- Investment Landscape: The sector demonstrates robust investment activity with over 9000 funding rounds and an average investment value of USD 61.9 million.

- Top Investors: Key investors like the International Finance Corporation, European Bank for Reconstruction and Development, and more have invested over USD 10 billion collectively.

- Startup Ecosystem: Highlights five innovative startups – Narvi (API First Banking), Plumery (Embedded Analytics), Hoola (Generative AI and Open Banking), IYDA Payments (Neobanking Platform), and GIFTSOFT (AML & Fraud Detection).

- Recommendations for Stakeholders: Stakeholders should embrace emerging trends like AI, blockchain, and sustainable finance to propel the banking sector towards a more secure, efficient, and inclusive future.

Explore the Data-driven Banking Sector Report for 2024

The Banking Industry Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The report highlights an industry growth of 2.17% in the last year, suggesting steady expansion amidst economic fluctuations. Our database comprises over 34000 banking companies worldwide, showcasing the industry’s vastness and diversity.

Coming to the employee growth in the last year, 360000+ new employees were added, signaling robust job creation and the sector’s capacity to generate employment at scale. Further, the global manpower is 8.2 million within the banking industry.

What data is used to create this banking industry report?

Based on the data provided by our Discovery Platform, we observe that the banking industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The banking industry had over 99000 publications in the last year, showing significant media attention.

- Funding Rounds: Data from over 9000 funding rounds in our database demonstrates the industry’s robust investment activity.

- Manpower: With a workforce of more than 8 million, the sector added over 360000 new employees last year, showcasing its growth and vitality.

- Patents: The industry’s innovative edge is evident from its 10000+ patents, underscoring its focus on technological advancements and intellectual property.

- Grants: With more than 1200 grants awarded, the industry’s commitment to research and development is clear.

- Yearly Global Search Growth: Experiencing a yearly global search growth of 15.81%, the banking industry reflects its growing relevance and popularity.

A Snapshot of the Global Banking Industry

With a manpower of 8.2 million individuals, the sector underscores its critical role in employment and economic stability. In the last year, the industry has seen a surge, adding 360000 new employees. This growth reflects the industry’s resilience and adaptability in the face of changing financial landscapes and technological advancements.

Moreover, the sector includes over 34000 companies, from multinational corporations to agile startups, each contributing to the industry’s innovation. These firms play a crucial role in the global economy, facilitating transactions, investments, and capital flow across borders.

Explore the Funding Landscape of the Banking Industry

With an average investment value of USD 61.9 million, the sector showcases its financial robustness and commitment to fostering substantial economic development and innovation. Its expansive and dynamic nature is further evidenced by the involvement of more than 3000 investors. These investors, from venture capitalists to institutional entities, have collectively closed more than 9000 funding rounds.

Further, the investments are made across more than 4000 companies. This distribution of investments underscores the industry’s role in supporting ventures, from startups in fintech to established firms innovating traditional banking models. This investment approach ensures a vibrant, competitive, and forward-looking industry ready to meet the challenges and opportunities of the digital age.

Who is Investing in the Banking Industry?

The banking industry has seen an influx of investment from the top investors, collectively exceeding the USD 10 billion mark.

- International Finance Corporation stands out with USD 4 billion invested across 41 companies, signaling robust confidence in the sector’s potential.

- The European Bank for Reconstruction and Development follows with USD 2 billion investment in 35 companies, demonstrating its commitment to economic development and innovation.

- Bain Capital has invested USD 1.5 billion in 6 companies, highlighting a focused approach towards high-impact opportunities.

- The U.S. International Development Finance Corporation has invested USD 1.2 billion in 7 companies, supporting sustainable economic growth.

- Y Combinator has contributed USD 20.6 million across 25 companies, nurturing the next generation of fintech innovators.

- Techstars, with investments of USD 2.1 million in 17 companies, continues to support early-stage startups, fostering innovation and growth.

- Citi’s investment of USD 734.4 million in 11 companies showcases its strategic investment approach towards fostering digital banking and fintech solutions.

- Tiger Global Management, with USD 584.4 million invested in 12 companies, emphasizes its focus on high-growth potential within the fintech sector.

- Goldman Sachs has further invested USD 580.7 million in 11 companies.

- JP Morgan, with investments of USD 75.2 million in 13 companies, highlights the industry’s attractiveness to major banking institutions.

Access Top Banking Innovations & Industry Trends with the Discovery Platform

The key banking industry trends, supported by comprehensive firmographic data, provide a detailed view of the industry’s landscape. Book a demo to explore all banking trends with the Discovery Platform.

- Open banking is a prominent trend within the banking industry, with 2100+ companies actively participating. This segment employs a workforce of 393000+ employees, and added 26100+ new employees over the last year, reflecting an expanding sector. The annual trend growth rate of 15.36% further underscores the rapid adoption of open banking practices. This represents a shift towards more transparent, accessible, and interconnected financial services, enabling third-party developers to build applications and services around the financial institutions.

- Virtual banking represents a newer but transformative trend in the banking industry, with 126 companies creating new paths for digital-first banking experiences. It employs 12800 individuals and has grown by 1000 new employees in the last year. Further, it experienced an annual trend growth rate of 2.67%. Virtual banking’s appeal lies in offering banking services that are entirely online, eliminating the need for physical branches, and redefining convenience and accessibility for tech-savvy consumers.

- Banking security is a critical concern and a significant trend within the industry, with 880 companies focused on fortifying financial transactions and data. Despite a slight annual trend growth rate decline of -0.68%, the sector maintains a workforce of 192000+ employees, with 8100 new hires in the last year. This underscores the continuous importance of security measures in safeguarding the financial ecosystem against evolving cyber threats. Explore all banking trends with a platform demo today.

5 Top Examples from 6000+ Innovative Banking Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Narvi offers API First Banking

Finnish startup Narvi provides cross-border banking solutions for businesses. It provides IBAN accounts that support global payments and transfers. The platform includes a feature for instant SEPA payments, which expedites euro transfers within the EU/EEA. Narvi’s backend API allows for data access and manipulation. This API integrates with various systems, including web and mobile applications. Further, the security of data and API access is ensured through authentication and API key generation.

Plumery provides Embedded Analytics

Dutch startup Plumery offers embedded analytics to banks and fintechs. It collects data from customer journeys and platform status, and with visual analytics, it reveals key insights. The Plan-Do-Act-Check (PDAC) method guides planning, execution, continuous improvement, and quality assurance. Plumery’s platform provides the necessary critical insights to optimize digital experiences. Further, the platform enables building and delivering differentiated product capabilities in a fintech-grade developer environment.

Hoola builds a Generative AI Banking Platform

UK startup Hoola develops a generative AI platform for financial institutions to create custom GPTs. The platform utilizes open banking data to streamline personal financial management. It offers solutions for customer support and marketing automation. The startup’s platform centralizes customer communications, making it easier for businesses to manage. It offers an intuitive method to automate FAQs and conduct WhatsApp campaigns. Hoola also allows businesses to design workflows that suit their requirements. Further, it includes tools for budgeting, investing, and tracking expenses securely.

IYDA Payments provides a Neobanking Platform

Indian startup IYDA Payments creates a neobanking platform for rural areas. The platform provides a variety of services such as banking, bill payments, recharges, travel, taxation, online medicine, online shopping, loans, credit cards, and more. It functions as a rural retail banking channel, with over 250000 rural touchpoints. Further, IYDA Payments offers banking-as-a-service (BaaS), enabling third parties to develop their financial products using the existing infrastructure.

GIFTSOFT automates Payment, AML & Fraud Detection

US startup GIFTSOFT develops the eGIFTS system to simplify processing for both domestic and foreign banks across different networks. This system checks payments for violations of the OFAC/Sanction list and notifies the bank about potential fraud. It also offers GIFTSWEB, a web-based banking system compatible with any integrated payment, back-office, or accounting system. The startup also provides the Investigations and Compensation System (ICSWEB), which automates the process of logging, tracking, controlling, adjusting, and reporting investigation and compensation cases. Lastly, GIFTSEDD, the anti-money laundering solution, offers analytical tools to actively monitor and identify potential suspicious, unusual, and fraudulent transactions.

Gain Comprehensive Insights into Banking Trends, Startups, or Technologies

The banking industry outlook shows a sector poised for a future shaped by innovation and digitization. The advent of trends such as AI, blockchain, and sustainable finance promises a transformation in banking, enhancing security, efficiency, and customer focus. Get in touch to explore all 6000+ startups and scaleups, as well as all industry trends impacting banking companies.