Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The IMF forecasts current global GDP growth at just 3.3%, which is well below the 3.7% pre-pandemic average. Yet, global businesses are simultaneously witnessing a surge of capital into transformative sectors: USD 4 trillion in digital transformation by 2027, USD 1 trillion in green finance, and a resurgent USD 121 billion in Q1 2025 venture capital funding alone. This guide explores 10 key business trends shaping 2025 for industry leaders to allocate resources intelligently, de-risk decisively, and seize early-mover advantage. You’ll also discover the innovators leading change in this rapidly evolving landscape.

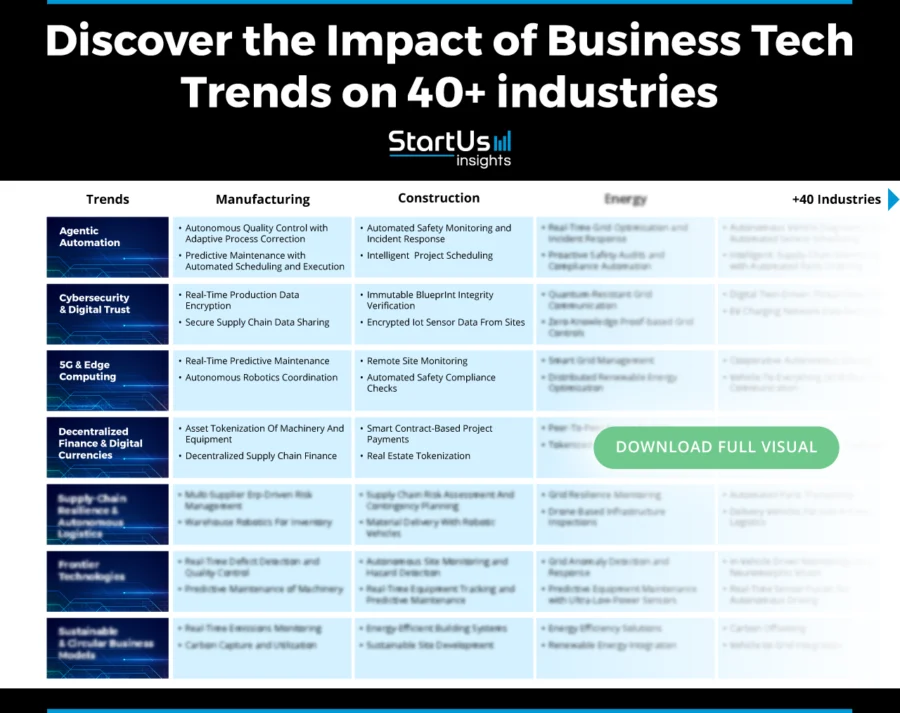

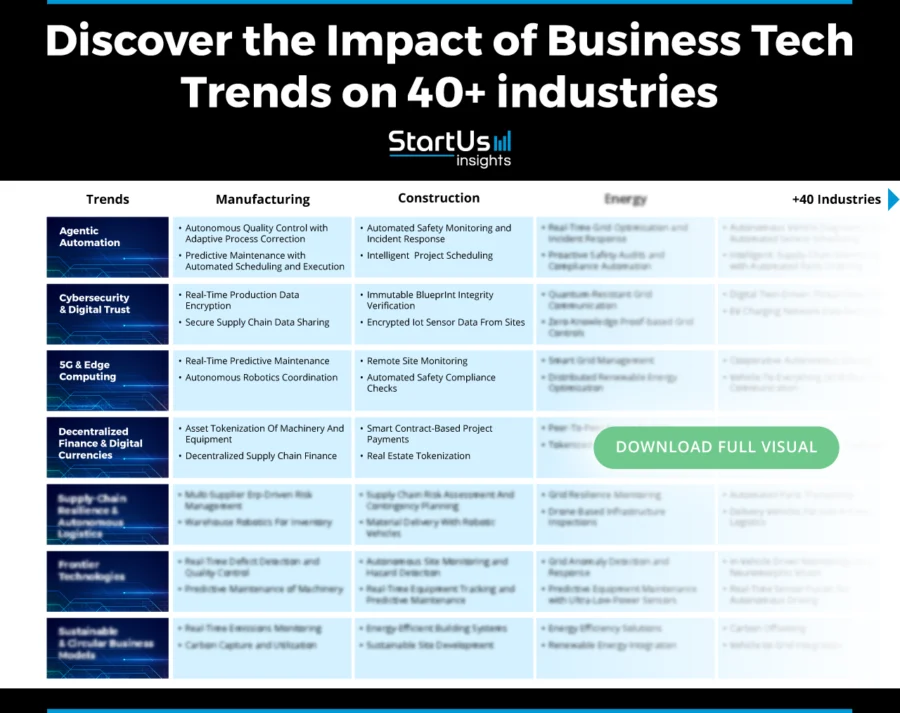

10 Business Technology Trends to Watch in 2025 & Beyond

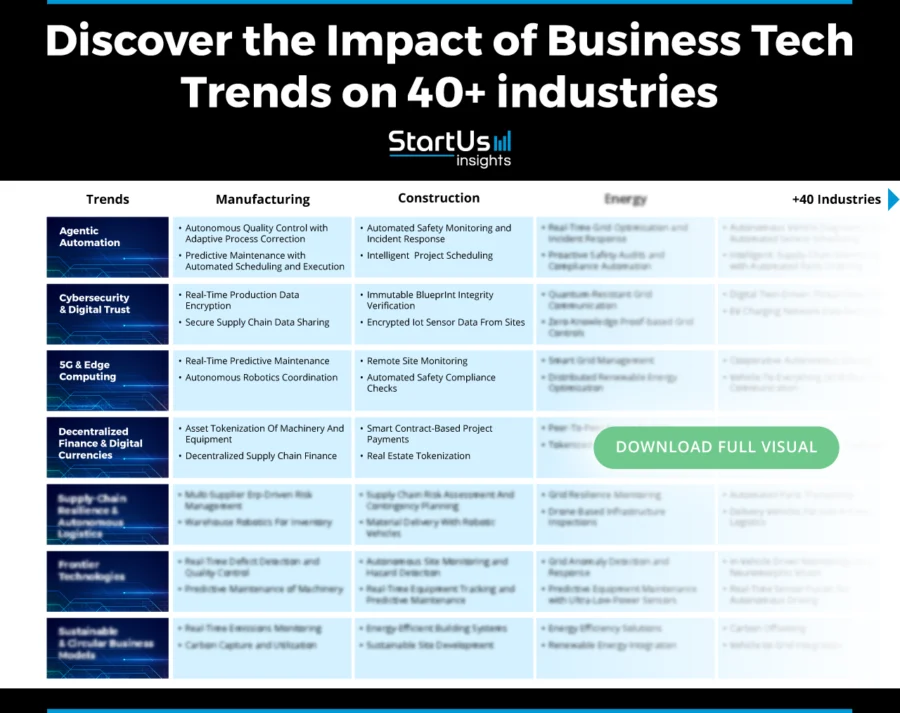

- Agentic AI & Automation

- Cybersecurity & Digital Trust

- Decentralized Finance (DeFi) & Digital Currencies

- 5G & Edge Computing

- Supply-Chain Resilience & Autonomous Logistics

- Sustainable & Circular Business Models

- Hyper-Personalization

- Remote & Hybrid Work Models (AI-augmented)

- Investment in Frontier Technologies

- E-Commerce Evolution

The Convergence Economy

1. The USD 4 Trillion Signal: Why Digital Spend Matters

Worldwide outlays on digital-transformation initiatives will rise from USD 2.5 trillion in 2024 to USD 4 trillion by 2027.

Source: IDC

IDC projects USD 337 billion in AI-supporting tech next year will grow faster than overall IT spending and is set to more than double to USD 749 billion by 2028.

For example, the financial sector is using digital solutions like robotic process automation (RPA) (35.1% CAGR). By 2027, discrete manufacturing will have the most sectoral investments at USD 700 billion through omni-experience platforms.

2. Three Pillars of 2025: Businesses to Thrive Amid Volatility

Intelligence Automation: The USD 990 Billion AI Catalyst

Global AI spending is set to reach USD 990 billion by 2027 as enterprises scale from pilots to production-grade deployments of agentic systems capable of autonomous decision-making.

Pilot deployments already demonstrate a 21 to 27% increase in the scope of automation for software development, finance, and customer support functions.

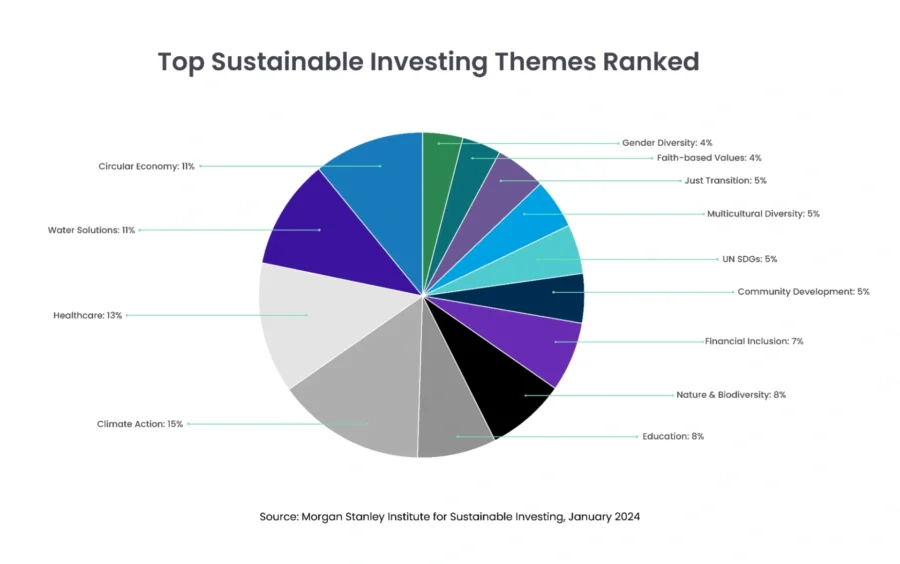

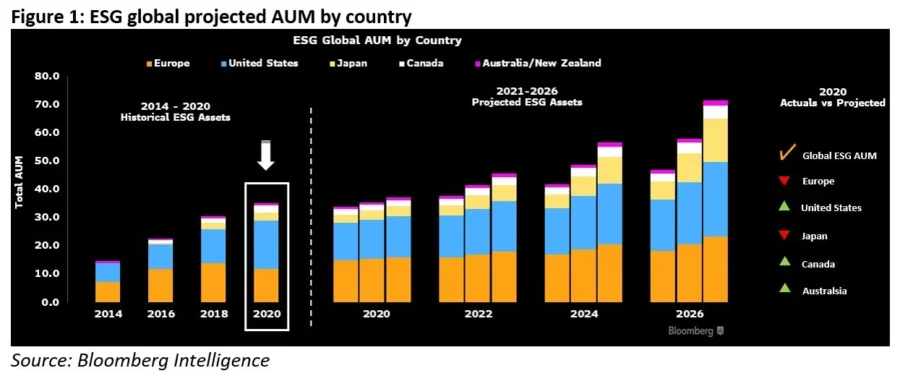

Sustainable Innovation: The USD 50 Trillion ESG Imperative

Global ESG assets surpassed USD 38.2 trillion in 2023, and 70% of executives now view ESG as core to capital allocation.

Source: Evident

By 2024, green and sustainability-labeled debt issuance had again exceeded USD 1.1 trillion, reflecting persistent investor demand despite policy volatility.

Yet, a USD 4 trillion annual gap remains to meet the UN Sustainable Development Goals that create both urgency and opportunity for companies that can commercialize climate-positive technologies.

Resilient Operations: Navigating the 3.3% Growth Ceiling

With global GDP growth capped at 3.3% and at risk of dropping to 2.8% amid tariff flare-ups, resilience has become the new baseline for performance.

Analysis shows 21.2% of global trade flows are already rerouting due to US-China tariffs. WTO models show world merchandise-trade volume contracting 0.2% in 2025 under current tariff regimes.

Questions by Leaders That Matter Most in 2025

How to scale generative and agentic AI while managing talent, IP, and trust risks?

Deploy agent platforms with vector databases and secure sandboxes, backed by AI-risk governance and prompt watermarking.

Upskill teams to drive adoption and target ≥25% productivity gains with minimized model-risk exposure.

What is the concrete roadmap to meet new ESG disclosure rules and monetize sustainability?

Build a unified ESG data model, digitize traceability, and link KPIs to cost savings and premium offerings.

Leverage green finance for capex and ensure audit-ready compliance.

How can supply chains be protected from tariffs, cyberattacks, and geopolitical shocks?

Dual-source critical inputs, nearshore high-risk suppliers, and deploy digital twins for AI-powered scenario planning.

Adopt zero-trust architecture (ZTA) and control-tower visibility to keep <5% revenue at risk and ensure 48-hour tier-1 recovery.

Top 10 Trends in Business Shaping 2025 & Beyond

1. Agentic AI & Automation

Agentic AI solutions perceive, decide, and act autonomously in complex workflows with minimal human oversight. This enables businesses to automate processes continuously and at scale.

Moreover, only 12% of organizations have high-quality, accessible data, and 62% cite poor data governance as a top challenge. Agentic AI automates data validation, integration, and standardization to ensure regulatory readiness.

On the talent front, 12% of professionals possess relevant AI skills, while 40% of workers fear job loss. To tackle this, 56% of companies are integrating low-code platforms and upskilling programs.

This pivot is also because of uncertain ROI. Despite heavy AI spending, 74% of enterprises fail to meet returns, and only 25% of AI initiatives deliver expected value. Thus, the situation prompts organizations to prioritize agentic AI use cases with clear financial justification.

Now, 65% of CEOs justified AI use cases based on ROI, such as predictive maintenance. Offshore oil firms reduced downtime by 20% and boosted output by 500 000 barrels annually.

Strategic Payoff

Operational Efficiency: Automates multi-step workflows that reduce manual effort and accelerate execution. McKinsey estimates that AI-driven process automation delivers an additional USD 200 billion to USD 340 billion in annual productivity gains.

Cost Reduction: Streamlines processes and lowers labor dependency. Enterprises adopting Agentic AI see 30 to 50% cost savings. Also, agentic AI in customer support reduces 50% of costs by handling routine inquiries and intelligent ticket triage.

Enhanced Decision-Making: Real-time insights and adaptive learning enable faster, better business decisions. Early adopters see decision-making times drop by up to 50%.

Scalability: Enables enterprises to expand capabilities without proportionally increasing headcount or resources. Agentic AI absorbs 30% or more growth in transactional volume without adding staff.

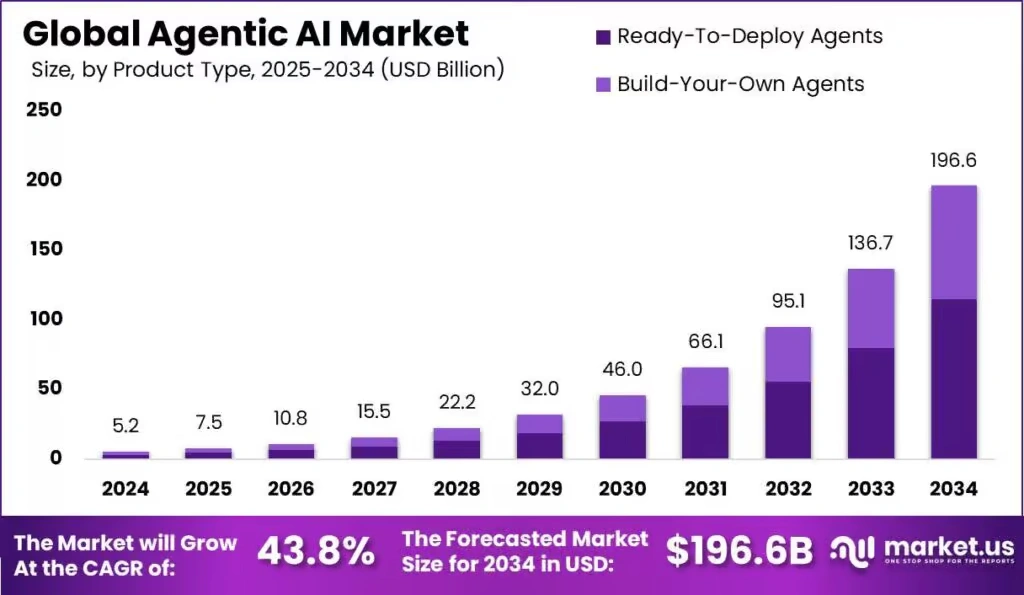

Market Data: Revenue, Projections, and Funding

- Global Market Size: The agentic AI market is projected to reach USD 196.6 billion by 2034. In the United States, the enterprise agentic AI market is expected to grow by a CAGR of 43.6% between 2025 and 2030.

Source: Market.us

- Investment Trends:

- VC funding in agentic AI startups has surpassed USD 2 billion since 2023, with significant investments targeting enterprise workflow automation.

- Landmark deals such as ServiceNow’s USD 2.9 billion acquisition of Moveworks highlight growing corporate urgency to embed autonomous AI.

- Vertical AI specialists are drawing premium valuations – for example, Unique.ai raised USD 30 million in Series A funding for automating financial services.

Real World Use Cases

Financial Services

- JPMorgan Chase invested USD 18 billion in technology, including agentic AI, reducing servicing costs by 30% and boosting customer engagement.

- HDFC Bank and State Bank of India are deploying agentic AI to automate internal workflows and boost efficiency.

Telecommunications

- Telstra is integrating agentic AI into software development and customer service, targeting at least USD 2 billion in annual cost savings.

Retail

- Mastercard uses agentic AI through its Agent Pay framework to autonomously initiate and complete purchases within GenAI-driven product recommendations.

Manufacturing

- Siemens AG leverages agentic AI to monitor real-time sensor data that reduces unplanned downtime by 25% through predictive maintenance.

Core Technologies Connected to Agentic AI and Automation

- Deep Learning: Uses multilayered neural networks to extract patterns from complex, high-dimensional data. It simplifies tasks like speech, vision, and decision-making in autonomous agents.

- Large Language Models (LLMs): Enable agentic systems to understand and generate human-like language that facilitates contextual reasoning, dialogue management, and cross-domain task execution.

- Retrieval-Augmented Generation (RAG): Enhances LLM outputs by retrieving relevant data from external sources in real time. This ensures responses are both context-aware and grounded in factual information.

Spotlighting an Innovator: Pulse

Pulse, an Indian startup, develops an AI-native product management platform that organizes customer feedback into structured insights. It gathers input from support tickets, sales calls, CRM systems, emails, and community forums.

The platform includes a centralized requests dashboard and trend analysis view. These features allow teams to assess and quantify customer demand using metrics such as annual recurring revenue (ARR), net promoter score (NPS), renewals, and upsells.

Additionally, the startup’s platform automates the creation of product requirement documents and marketing materials to keep communication aligned with customer needs.

Pulse also offers a co-pilot assistant for real-time queries, a cross-team insights center for sales and UX optimization, and a product operations tracker to monitor feature progression from insight to execution.

2. Cybersecurity & Digital Trust

Enterprises face a complex threat landscape shaped by AI-generated phishing, deepfake fraud, and nation-state cyberattacks. At the same time, the cost of breaches has surged to an all-time high.

Each incident globally costs an average of USD 4.9 million, and 40% of these breaches involved data stored across multiple environments.

To address this, companies are shifting from perimeter-based defenses to zero-trust architecture, which authenticates every user, device, and connection continuously.

This shift also supports rising regulatory pressure. Over 137 out of 194 countries now enforce data sovereignty and privacy regulations.

Simultaneously, the trust crisis driven by misinformation, algorithmic bias, and surveillance concerns is prompting enterprises to adopt transparency-enhancing technologies. This includes verifiable credentials, digital identity frameworks, and decentralized identifiers.

This shift is also attributed to the rise in bring your own device (BYOD). Remote work is further fueling demand for zero-trust security, with multi-factor authentication reducing account compromise likelihood by 99.9%.

Strategic Payoff

Reduced Breach Risk: Implementing zero-trust strategies reduces the average cost of breaches by USD 1.76 million.

Customer Retention & Loyalty: 66% of US consumers will abandon a brand if they experience a single data breach or unethical use of their data. 44% of consumers attribute cyber incidents to a company’s lack of security measures.

Operational Continuity: Resilience frameworks now integrate digital trust as a critical risk-control layer, especially in the supply chain and financial services sectors. 1 in 3 companies that share reports of breaches report significant or very significant disruption due to a breach, and only 12% are able to fully recover within 100 days.

Market Data: Revenue, Projections, and Funding

- Global Market Size: The cybersecurity market is projected to reach USD 298.5 billion by 2027, growing at a CAGR of 9.4%.

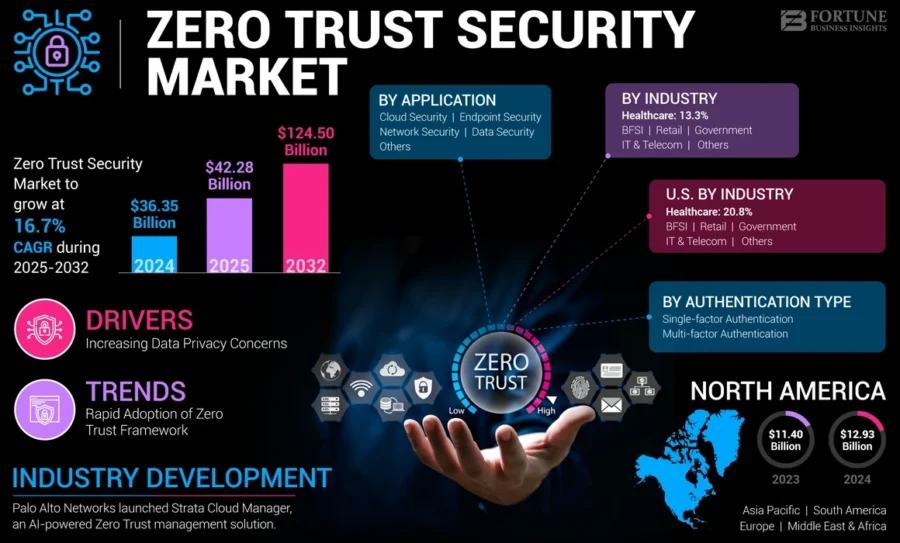

- Zero-Trust Architecture: Adoption is growing at 16.7% CAGR, with projected revenues of USD 124.50 billion by 2032. 72% of organizations state they are adopting or planning to adopt zero-trust architectures within the next two years.

Source: Fortune Business Insights

- VC Investment: Cybersecurity startups raised VC investments of USD 9.5 billion last year. 9% increase from the previous year.

- Notable Deals:

- Wiz raised USD 300 million at a USD 10 billion valuation to scale its cloud-native security platform.

- SentinelOne acquired Attivo Networks for USD 616.5 million to strengthen identity threat detection.

Real-World Use Cases

Financial Services

- IBM partnered with Wimbledon to provide digital presence protection to monitor and defend against cyber threats during the tournament. This ensured the integrity and availability of sensitive events and protected high-profile financial transactions and digital assets.

Healthcare

- Armis secures over 3 billion IoMT devices with its Asset Intelligence Engine by using crowd-sourced analytics to detect anomalies and reduce healthcare security risks.

Manufacturing

- A ransomware attack on Johnson Controls led to a USD 27 million loss and 27 TB of data exfiltration. This underscores operational technology (OT) vulnerabilities and the need for cross-industry threat detection.

Core Technologies Connected to Cybersecurity & Digital Trust

- Zero-Trust Architecture: It eliminates implicit trust in networks by verifying every access attempt based on identity, device, and context.

- Privacy-Enhancing Technologies (PETs): It includes homomorphic encryption and federated learning to analyze data without exposing it and preserving compliance & confidentiality.

- Decentralized Identity (DID): Empowers users with control over their digital credentials. It also reduces dependence on centralized authentication systems.

Spotlighting an Innovator: Cyber Legacy Defense

US-based startup Cyber Legacy Defense provides a cybersecurity platform that applies a zero-trust security framework for small to midsize businesses and family offices.

It conducts risk assessments using NIST SP 800-53 and ISO 27001 standards. Then, it develops protection strategies based on vulnerabilities in financial systems, communication tools, and personal devices.

Through its Ransomware RapidShield, the startup performs ransomware penetration assessments. It deploys endpoint detection and response (EDR) tools, and sets up immutable cloud backups with rollback options ranging from 30 to 90 days.

Further, its Phishing Defense & Employee Shield includes monthly phishing simulations, live and on-demand employee security training, and real-time email link scanning.

3. Decentralized Finance & Digital Currencies

Decentralized finance and digital currencies are replacing intermediaries with blockchain-based smart contracts. Over 562 million people globally own crypto assets.

Governments and regulators are also catching up. 134 countries representing over 98% of global GDP are exploring central bank digital currencies, with 66 in advanced stages, including pilots and launches.

The European Central Bank is rolling out its digital euro trials, while India, China, and Nigeria have operationalized digital currency pilots at scale.

The key driver is programmable money. Smart contracts are automating settlements, compliance, lending, and insurance while enabling borderless and real-time financial flows.

In Nigeria, nearly 1 in 3 survey participants reports owning or using cryptocurrency compared to just 6 in 100 participants in the US.

Institutional DeFi adoption is also rising, particularly in trade finance, FX settlements, and carbon credit markets.

Strategic Payoff

Disintermediation & Efficiency: DeFi automates multi-party processes like cross-border payments. It reduces transaction costs by up to 80% and settlement times from days to seconds.

Financial Inclusion: Over 1.4 billion people globally remain unbanked. DeFi wallets enable access to savings, credit, and yield-generating instruments with only a smartphone.

Asset Tokenization: Analysts estimate that tokenized securities could represent USD 5 trillion in market value by 2030, unlocking liquidity in traditionally illiquid assets.

Market Data: Revenue, Projections, and Funding

- DeFi Market Size: The DeFi market’s total value locked (TVL) rebounded to USD 95 billion, with lending and decentralized exchanges (DEXs) accounting for the majority.

- Digital Currency Market: The global digital currency market is projected to reach USD 4.17 billion by 2030.

- Tokenized Asset Market: Projected to reach USD 16 trillion by 2030, driven by adoption in private equity, bonds, and real estate.

- Notable Investment Trends:

- LayerZero Labs raised USD 120 million at a USD 3 billion valuation to enhance cross-chain DeFi interoperability.

- Circle, the issuer of USDC stablecoin, has raised a USD 400 million round co-led by BlackRock and Fidelity.

Real-World Use Cases

Banking & Financial Services

- JPMorgan Kinexys launched a tokenized intraday repo platform and processed USD 300 billion in transactions.

Insurance

- Nexus Mutual offers smart contract-based insurance, where claims are verified and settled without human intervention. This reduces fraud and administration costs.

Retail & Payments

- Visa and PayPal now offer crypto checkout and stablecoin settlement, that led to the crypto adoption among many merchants worldwide.

Carbon Markets

- Toucan Protocol tokenizes carbon credits to enable transparent trading and retirement of offsets. The company attracts participation from major ESG funds.

Core Technologies Connected to DeFi & Digital Currencies

- Stablecoins: Fiat-pegged digital currencies (e.g., USDC, USDT) that provide low-volatility mediums for DeFi transactions and digital payments.

- Smart Contracts: Self-executing agreements coded directly on the blockchain that automate compliance, lending terms, and settlement.

- Zero-Knowledge Proofs (ZKPs): Enable private and verifiable transactions on public chains. This boosts compliance and institutional adoption.

Spotlighting an Innovator: Orange

UK-based startup Orange builds a decentralized finance (DeFi) ecosystem that allows users to access and manage Bitcoin, BRC20 tokens, Stacks, and Ordinals NFTs.

Its product, Orange Wallet, operates as a browser extension that provides a decentralized, non-custodial interface. This allows users to maintain full control over their private keys without third-party involvement.

The ecosystem includes Orange Swap, a decentralized exchange that facilitates asset swaps across supported protocols, and Orange Bridge, which supports cross-chain interoperability.

Further, Orange Marketcap aggregates market data, while Orange Explorer delivers blockchain transaction insights.

Orange Indexer extracts and indexes transaction data from the Bitcoin blockchain and its meta-protocols, enabling real-time analytics. The platform also integrates Orange Assistant, an AI-powered chatbot that provides instant industry information and insights.

4. 5G & Edge Computing

5G and edge computing are becoming essential infrastructure for real-time, data-intensive applications. Over 2.1 billion people globally had access to 5G networks last year, and 5G subscriptions will account for 67% of total mobile connections.

As enterprises digitize operations through IoT, AI, and automation, the volume of data generated at the edge, from factories, vehicles, and devices, is surging. Yet, sending all this data to the cloud is inefficient.

But 5G, when combined with edge computing, processes data closer to the source to reduce latency while delivering faster connectivity and wider bandwidth.

Edge computing offers up to 70% lower latency, 40% faster processing speeds, and significant bandwidth cost reductions.

5G and edge computing together enable applications ranging from autonomous mobility and remote surgery to immersive retail and industrial automation.

Strategic Payoff

Low-Latency Intelligence: Edge-augmented 5G reduces end-to-end latency to under 10 milliseconds, which is crucial for AR/VR, robotics, and telesurgery.

Bandwidth Optimization: Offloading processing to edge nodes reduces cloud backhaul traffic significantly. This reduces cloud costs and improves responsiveness.

Business Continuity & Resilience: Local edge servers maintain operations even if cloud connectivity fails. This type of resilience is a key capability required in manufacturing, defense, and logistics.

Scalable Real-Time Analytics: 5G networks coupled with edge AI support real-time decision-making across distributed assets. It enables predictive maintenance, dynamic pricing, and anomaly detection.

Market Data: Revenue, Projections, and Funding

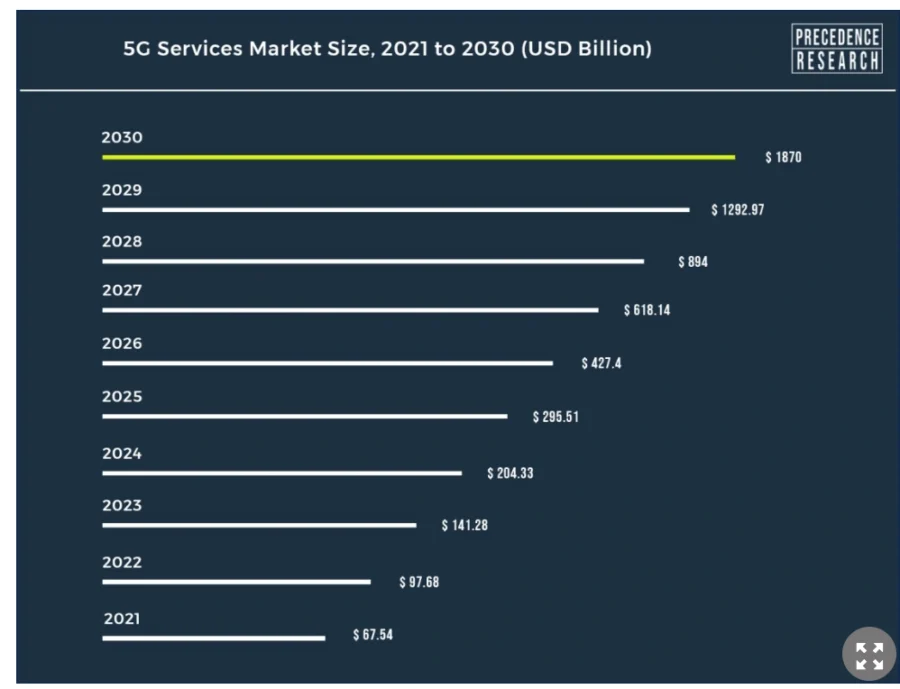

- 5G Market Size: Projected to reach USD 1.87 trillion by 2030, growing at a CAGR of 44.63%.

Source: Precedence Research

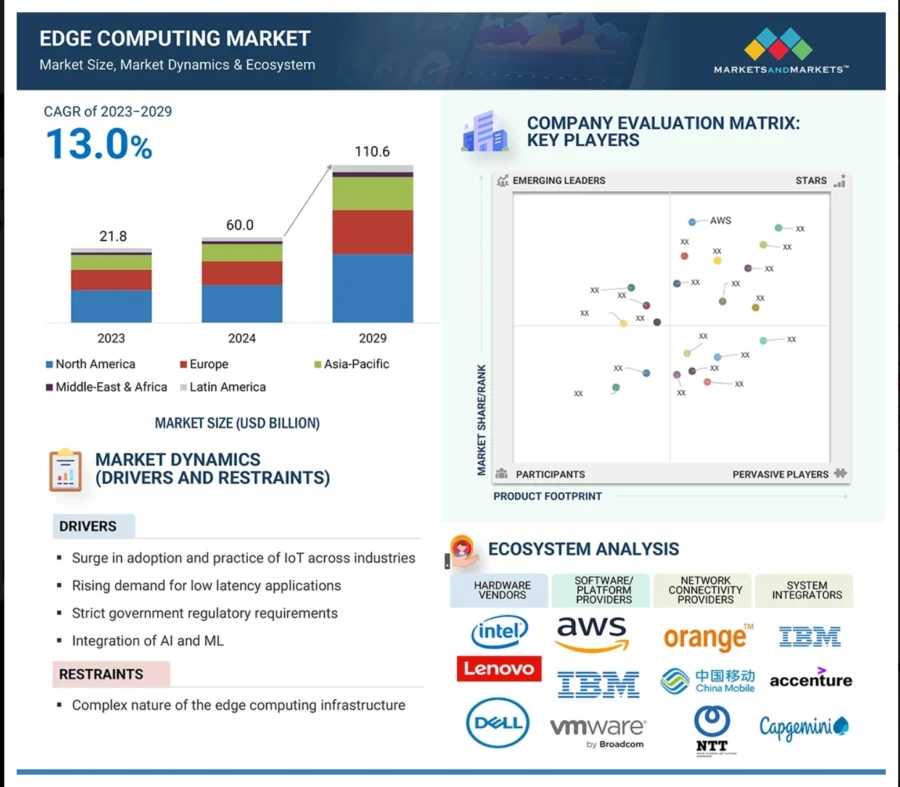

- Edge Computing Market Size: Expected to surpass USD 110.6 billion by 2029 by growing at a CAGR of 13%.

Source: Edge Computing Market

- Funding Trends:

- Swim.ai, a real-time edge analytics platform, raised USD 10 million in a Series B round to accelerate deployment in manufacturing and smart cities.

- Celona enables 5G-based private networks and has secured USD 60 million in Series C funding to serve enterprise and industrial customers.

Real-World Use Cases

Manufacturing & Industrial IoT

- Worcester Bosch uses 5G-enabled edge computing in its smart factories to reduce machine downtime via real-time predictive maintenance.

Retail & Entertainment

- Walmart deployed edge servers in stores to manage real-time inventory, optimize refrigeration, and deliver dynamic pricing without cloud latency.

- SK Telecom in South Korea offers 5G-edge-powered cloud gaming with ultra-low lag to enhance mobile user engagement.

Transportation & Mobility

- Audi and Ericsson partnered to create 5G production lines that control automated guided vehicles (AGVs) with sub-10ms latency in their Ingolstadt plant.

Core Technologies Connected to 5G & Edge Computing

- Multi-Access Edge Computing (MEC): Brings computing capabilities to the edge of cellular networks and enables real-time processing for mobile applications.

- Private 5G Networks: Allow enterprises to deploy secure, dedicated 5G infrastructure with tailored quality of service (QoS), particularly in smart factories, campuses, and logistics hubs.

- Network Slicing: Enables carriers to dedicate isolated virtual 5G network segments for specific enterprise applications for guaranteed bandwidth and latency levels.

Spotlighting an Innovator: Rapid.Space

French startup Rapid.Space provides a cloud and edge computing platform that integrates open-source software, open hardware, and transparent operational processes.

It supports infrastructure across virtual private servers (VPS), content delivery networks (CDN), software-defined networking (SDN), and private 4G/5G networks.

The platform uses Open Compute Project servers and Amarisoft’s virtual radio access network (vRAN) technology to separate signal processing from hardware.

This approach enables flexible deployment of services such as the open radio system (ORS) and EdgePOD for industrial computing and digital resilience.

5. Supply-Chain Resilience & Autonomous Logistics

The geopolitical tensions, extreme weather events, and labor shortages exposed the vulnerabilities of the global supply chain. In response, companies are redesigning supply chains for resilience, transparency, and automation.

Over 77% of 500 CSCOs are leveraging process and task mining to resolve inefficiencies. They are also investing in real-time visibility, AI-driven planning, and more.

Further, the strategic focus is shifting from cost efficiency to risk-resilient supply networks. Companies are increasingly adopting digital twins, autonomous mobile robots (AMRs), and AI-powered logistics orchestration to reduce dependency on manual processes.

Meanwhile, 57% of logistics firms are planning to invest in AI to support supply chain decisions. This shift marks the rise of self-healing supply chains that detect, adapt, and reroute with minimal human intervention.

Strategic Payoff

Disruption Mitigation: Real-time analytics and simulation platforms reduce supply shock impacts by up to 30%. It also enables proactive rerouting and inventory redistribution.

Labor Independence: Autonomous delivery and warehouse robots reduce operational costs by 40% and improve fulfillment speed, especially amid labor constraints.

Inventory Optimization: AI-based demand forecasting reduces excess inventory by 20% and stockouts by 30%, which will improve working capital efficiency.

End-to-End Visibility: IoT and sensor-enabled supply chains provide close to 100% accuracy in shipment traceability and real-time temperature, location, and condition monitoring.

Market Data: Revenue, Projections, and Funding

- Global Supply Chain Management (SCM) Market: Expected to reach USD 46.5 billion by 2030 with a CAGR of 10.9%.

- Autonomous Logistics Market: Projected to hit USD 125.4 billion by 2030, driven by drones, autonomous trucks, and warehouse robotics.

- Notable Funding:

- Gatik, which builds autonomous delivery vehicles, raised USD 85 million to scale mid-mile logistics operations.

- FourKites, a visibility platform, raised USD 100 million from FedEx and others to expand predictive logistics intelligence.

Real-World Use Cases

Retail & E-Commerce

- Amazon uses AI and robotics to automate over 75% of fulfillment center workflows and reduce processing time and human error.

- Zara’s RFID and predictive analytics rebalance inventory across stores in real-time, which reduces unsold stock by up to 25%.

Automotive & Manufacturing

- BMW uses autonomous mobile robots and AI dispatch to move parts inside plants and achieve up to a 30% increase in material flow efficiency.

Core Technologies Connected to Supply-Chain Resilience & Autonomous Logistics

- Digital Twins: Virtual replicas of physical supply chains used to simulate, monitor, and optimize logistics networks in real time.

- Autonomous Mobile Robots: Navigate in dynamic environments in warehouses and manufacturing plants to transport goods without human intervention.

- IoT & Telematics: Track assets, shipments, and fleet conditions continuously to support condition-sensitive cargo and operational transparency.

Spotlighting an Innovator: Urban Ray

German startup Urban Ray creates an autonomous aerial logistics system that combines electric drones and automated ground stations to improve urban deliveries.

Its aircraft, The Jelly, takes off and lands vertically, carries up to 6 kg, and travels 30 km. This design supports the transport of time-sensitive goods like medical samples and pharmaceuticals.

The startup’s compact ground station, The Hub occupies a single parking spot and holds up to 40 packages. It automates loading, unloading, and battery swapping to eliminate the need for human intervention.

Urban Ray operates beyond visual line of sight (BVLOS) and uses ducted rotors to reduce noise, which makes it suitable for dense urban areas.

6. Sustainable & Circular Business Models

As climate risks grow, investors, regulators, and consumers want to see clear results in environmental, social, and governance areas.

98.6% of S&P 500 companies publish ESG reports, 56% of CEOs tie incentive pay to sustainability, and 45% say they are already transforming the business model for climate action.

Businesses are adopting circular business models that focus on making products last longer and using closed-loop systems. This includes new ideas like product-as-a-service, industrial symbiosis, using recycled materials, and digital product passports.

At the same time, ESG-driven investment is predicted to hit USD 40 trillion by around 2030, with institutional money going to companies that have been proven to have low-carbon operations and clear governance.

With rules like the EU’s Corporate Sustainability Reporting Directive (CSRD) and the US SEC’s climate disclosure rule, businesses that do not have strong ESG frameworks risk losing investors, which will hurt their reputation, and also pay more for capital.

Strategic Payoff

Revenue Growth via Green Innovation: Companies that simultaneously excel in revenue growth, economic profit, and ESG performance are termed “triple outperformers.

They achieve superior shareholder returns, with over half experiencing annual revenue growth exceeding 10%, compared to less than one in four among their peers.

Investor Preference & Lower Capital Costs: Firms with high ESG scores enjoy lower financing costs and are more resilient during downturns.

Regulatory Readiness: Companies aligning with CSRD, TCFD, and SEC climate disclosure standards avoid penalties and gain faster market access.

Operational Efficiency: Circular models that include reuse, remanufacturing, and recycling reduce material costs.

Market Data: Revenue, Projections, and Funding

- ESG Assets Under Management (AUM): Expected to surpass USD 50 trillion by 2025 will reshape USD 140.5 trillion of global ESG AUM by 2025.

Source: Bloomberg

- Circular Economy Market: Projected to grow to USD 1 trillion by 2032 with a CAGR of 11.5%

- Corporate Carbon Reporting: Net-zero targets currently account for over 66% of the annual revenue of the world’s 2000 largest multinational companies. 37% of corporate net-zero targets fully cover Scope 3 emissions.

- VC Activity:

- Circularise, a digital passport platform for circular supply chains, raised EUR 11 million to advance in bringing circular economy to industrial supply chains.

- CarbonChain offers an AI-fueled carbon accounting platform that secured USD 10 million in Series A to build new carbon accounting and reporting products.

Real-World Use Cases

Consumer Goods & Retail

- IKEA introduced multi-market rollout of product buy-back and resale programs to reduce waste and promote circular ownership.

- Unilever reports that brands with strong sustainability claims grow 69% faster than others in its portfolio.

Fashion & Apparel

- Patagonia’s Worn Wear resale model extends product life and reduces CO₂ emissions by up to 45% compared to conventional cotton.

Manufacturing

- Schneider Electric incorporates circular design into its product lines. This avoided the consumption of 40 000 tons of primary resources and reduced customers’ CO2 emissions by 30 million tons.

Technology & Electronics

- Dell recovers over 100 million pounds of closed-loop plastic parts used on more than 125 different product lines. Dell uses recycled material in its products as well as packaging.

Core Technologies Connected to Sustainable & Circular Business Models

- Blockchain for ESG Auditing: Immutable ledgers record emissions data, supply chain sustainability, and certifications to support auditability and investor reporting.

- AI-Powered Emissions Tracking: Automates Scope 1, 2, and 3 emissions data collection and forecasting to support regulatory disclosure and carbon neutrality.

- IoT & Smart Resource Monitoring: Sensor-driven insights optimize water, energy, and raw material usage in industrial and commercial operations.

Spotlighting an Innovator: TripleR

Belgian startup TripleR builds a digital product passport platform that links bedding products to a cloud-based system using unique QR and RFID identifiers compliant with GS1 standards.

Manufacturers use the platform to prepare master data, generate labels, and register each product at inception to ensure real-time traceability from production to end-of-life.

The startup’s platform stores information on composition, origin, and recyclability while maintaining durability through 40°C washability for prolonged use.

RFID tracking enhances logistics transparency, inventory accuracy, and product authentication. It also provides item-level guidance for dismantling and recycling.

TripleR connects manufacturers, logistics partners, recyclers, and consumers through APIs and a global platform.

7. Hyper-Personalization

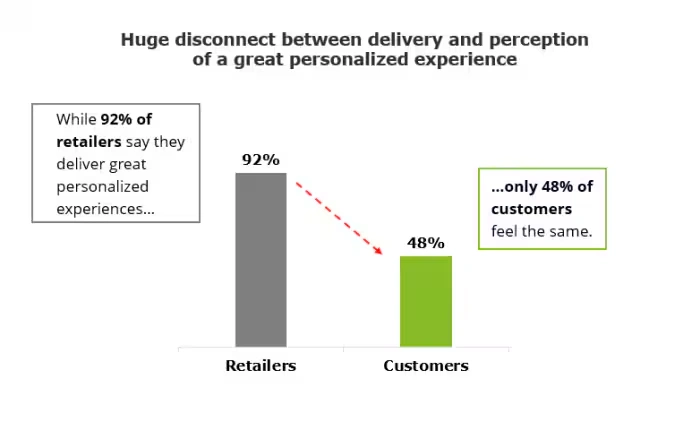

Businesses are adopting hyper-personalization because customers want things that are relevant and instant gratification. It includes dynamically tailoring content, products, services, and interactions using AI, behavioral analytics, and real-time data.

Deloitte says that 80% of consumers are more likely to buy from brands that offer personalized experiences, and 52% expect all offers to be personalized.

Source: Deloitte

The rise of AI-powered recommendation engines, customer data platforms (CDPs), and predictive behavior models is driving this change.

Retailers, banks, and online platforms are using new personalization techniques that change in milliseconds based on context, location, intent, and emotion across devices and channels.

As third-party cookies go away and compliance requirements go up, businesses are using first-party data and privacy-preserving personalization tools like federated learning and differential privacy.

Strategic Payoff

Revenue Uplift: Personalization leaders achieve 40% faster revenue growth than their peers from personalization.

Customer Retention: Personalized experiences drive higher customer lifetime value that improves loyalty, retention, and NPS scores.

Operational Efficiency: AI-driven personalization automates product selection, support routing, and offer targeting. It also achieves a 20% reduction in cost-to-serve.

Conversion Optimization: Real-time recommendations increase average order value (AOV) by 30% and higher click-through rates (CTR).

Market Data: Revenue, Projections, and Funding

- Global Personalization Software Market: It is expected to grow to USD 5.16 billion by 2030, at a CAGR of 23.67%.

- Personalization in Marketing Spend: Retailers are allocating up to 59% of marketing budgets to personalization.

- Notable Funding Trends:

- Dynamic Yield, acquired by Mastercard in 2022, continues to expand its personalization engine across financial services and e-commerce.

- Amperity, a customer data platform (CDP) for enterprise-grade personalization, raised USD 100 million to build privacy-first data intelligence solutions.

Real-World Use Cases

Retail & E-Commerce

- Sephora uses AI and customer behavior data to personalize product recommendations and in-app experiences, increasing conversions by 20%.

- Nike integrates app data, purchase history, and store visits to deliver hyper-personalized product drops and fitness plans.

Banking & Fintech

- HSBC deploys AI-based personalization engines for dynamic financial advice. This improves customer engagement and product uptake.

Healthcare

- Mayo Clinic integrates wearable data and EHRs to personalize treatment plans and outreach, increasing patient adherence.

Entertainment & Streaming

- Spotify and Netflix rely on collaborative filtering and deep neural networks to serve uniquely curated playlists and content feeds, which drives watch/listen time up.

Core Technologies Connected to Hyper-Personalization

- Customer Data Platforms: Aggregate and unify customer data from all touchpoints to enable single customer views and real-time personalization.

- AI Recommendation Engines: Use collaborative filtering, neural networks, and reinforcement learning to predict and serve the next best action or product.

- Predictive Analytics & Behavioral Modeling: Analyze browsing history, purchase intent, micro-conversions, and psychographics to anticipate customer needs.

Spotlighting an Innovator: Pupila Brand Studio

Brazilian startup Pupila Brand Studio builds an AI-powered branding platform that centralizes brand management and automates the creation of visual and written content.

It stores brand assets such as logos, typography, colors, and photography in the Brand Zone, a digital hub designed for real-time access and collaboration.

The platform’s AI uses these inputs to generate marketing content, including imagery and copy, allowing companies to execute creative strategies efficiently.

Through the Brand Studio, users personalize brand expressions while maintaining consistency across formats and communication channels.

Pupila also provides interactive access to brand strategy, which improves communication and reduces inefficiencies in content production.

8. Remote & Hybrid Work Models (AI-augmented)

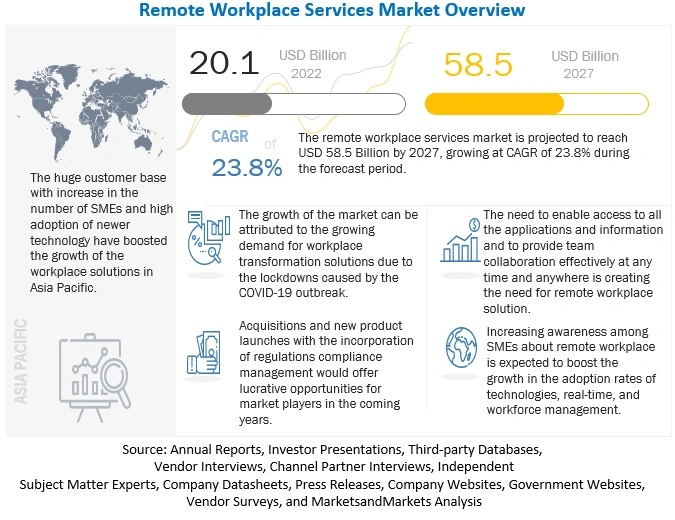

87% of global organizations have permanently adopted hybrid work setups, while 16% operate fully remotely. This shift is driven by flexibility, productivity, inclusivity, and agility.

To sustain this transition, companies are increasingly adopting AI-powered tools to manage workflows, augment collaboration, and enhance employee well-being.

From intelligent scheduling assistants and virtual co-pilots to AI-generated meeting summaries and predictive burnout detection, enterprises are embedding machine intelligence into daily workstreams.

For instance, over 86% of executives plan to scale up investment in Gen AI to support hybrid workforce management in 2025, according to Accenture.

Moreover, real-time productivity analytics, AI-driven performance evaluations, and adaptive learning systems are shaping distributed workforce enablement.

As a result, the workplace is evolving from location-centric to outcome-centric, with AI enhancing engagement and automation.

Strategic Payoff

Productivity Gains: AI-augmented hybrid work models boost productivity by up to 34% for novice and low-skilled workers with minimal impact on experienced and highly skilled workers.

Talent Retention & Attraction: Companies offering flexible, remote options see 25% higher employee retention and draw from wider global talent pools.

Reduced Operational Costs: Hybrid models cut real estate and facility expenses up to 30%.

Data-Driven Decision-Making: Organizations leveraging AI for workforce analytics see 2x faster decision cycles and improved workforce planning accuracy.

Market Data: Revenue, Projections, and Funding

- Global Hybrid Work Tech Market: Expected to exceed USD 58.5 billion by 2027 at a CAGR of 23.8%, driven by demand for remote infrastructure, AI collaboration tools, and workforce analytics.

- AI in HR Market: Forecast to grow at a CAGR of 24.8%, reaching USD 15.24 billion by 2030, with use cases in recruitment, performance, and engagement.

Source: Markets and Markets

- VC Investment Trends:

- Glean, an AI-powered workplace search engine, raised USD 200 million to streamline hybrid knowledge work.

- Oyster HR, which manages global remote hiring and compliance, raised USD 150 million.

Real-World Use Cases

Technology & Consulting

- Microsoft integrates Copilot into Teams and Outlook to enable AI-generated action points, meeting summaries, and personalized task management.

- Deloitte uses AI to analyze collaboration patterns and recommend optimal hybrid schedules, improving project efficiency.

Financial Services

- Goldman Sachs implemented AI-driven sentiment and fatigue tracking across teams to preempt burnout and optimize work-life balance.

Healthcare & Pharma

- Pfizer uses virtual collaboration labs and AI bots to accelerate cross-border R&D between remote teams to reduce trial design timelines.

Education & Training

- Coursera and edX use adaptive learning AI to personalize course content based on employees’ knowledge gaps and learning speed.

Core Technologies Connected to Remote & Hybrid Work Models

- Co-Pilots & Virtual Assistants: Enable employees to better manage tasks, emails, meetings, and content creation through natural language interaction.

- Virtual Collaboration Hubs: Combine asynchronous and synchronous communication tools to improve meeting efficiency and content retrieval.

- AI-Powered Learning Management Systems (LMS): Personalize training paths based on skill gaps and employee performance.

Spotlighting an Innovator: BWith

Israeli startup BWith builds an AI-powered office management platform that automates seat allocation and predicts attendance to improve hybrid workspace efficiency.

The startup’s platform analyzes organizational structure, employee preferences, departmental needs, and schedule changes to assign desks dynamically without manual input.

It runs continuously to monitor space usage, identify underused areas, and evaluate opportunities for real estate optimization or headcount growth.

BWith integrates with enterprise systems and generates automated recommendations to manage space effectively while maintaining team cohesion.

9. Investment in Frontier Technologies: Semiconductors, Quantum, SpaceTech & More

Geopolitical tensions and supply chain disruptions have made semiconductor self-reliance a national priority. The US, the EU, and China have allocated over USD 380 billion in chip subsidies through 2030, while AI workloads drive demand for advanced nodes and chiplet architectures.

Simultaneously, quantum computing has attracted over USD 42 billion in public and private capital that is targeted at breakthroughs in optimization, cryptography, and materials science.

SpaceTech is also witnessing a renaissance. Enabled by reusable rockets, micro-satellites, and AI-driven Earth observation, the global space economy is on track to hit USD 1.8 trillion by 2035, according to McKinsey.

Strategic Payoff

Geopolitical Resilience: Domestic semiconductor and quantum investments reduce exposure to foreign supply chokepoints and enable secure, high-performance computing infrastructure.

R&D Differentiation: Frontier tech leadership creates exponential IP advantages in industries like pharma, energy, defense, and finance.

Climate & Sustainability Edge: Fusion energy, quantum chemistry, and low-orbit satellites accelerate sustainable transitions by enabling clean energy, optimized supply chains, and precision agriculture.

Capital Market Momentum: Startups in frontier tech command premium valuations and are increasingly backed by sovereign wealth funds, defense agencies, and strategic corporate VCs.

Market Data: Revenue, Projections, and Funding

- Semiconductors: The global semiconductor market is projected to reach USD 1 trillion by 2030 with an annual growth rate of 7% to 9%, driven by AI, 5G, and EV demand.

- Quantum Computing: The market is projected to grow from USD 5.3 billion in 2023 to USD 9.4 billion by 2030, at a CAGR of 36.3%.

- SpaceTech: Private SpaceTech startups, such as Bryce Tech’s start-up-space, raised USD 8 billion in 2022, led by Earth observation, launch services, and in-orbit analytics.

- Fusion Energy: Over USD 6.2 billion in private capital has been invested in fusion startups, with Helion securing a USD 425 million Series F investment round to commercialize fusion power.

Real-World Use Cases

Semiconductors

- TSMC and Intel are deploying AI-optimized chiplet designs to power next-gen LLMs and automotive SoCs. It reduces power consumption by 25% to 30% per operation.

Quantum Computing

- Microsoft’s Azure Quantum launched Majorana-1, the first topological qubit processor, targeting fault-tolerant quantum computation for chemistry and machine learning workloads.

- Goldman Sachs partners with QC Ware to run quantum simulations for financial portfolio optimization.

SpaceTech

- Planet Labs and BlackSky deliver real-time Earth imaging to support disaster response, urban planning, and agricultural monitoring.

- Amazon’s Project Kuiper is deploying a constellation of 3000+ satellites to expand global broadband coverage.

Fusion Energy

- TAE Technologies and Commonwealth Fusion Systems are developing compact fusion reactors targeting commercial-scale energy by early 2030s.

- Helion’s 2028 contract with Microsoft provides 50 MW of commercial fusion electricity.

Core Technologies Connected to Frontier Technologies

- Chiplet Architecture: Modular semiconductor designs enable high-performance integration with better thermal and power efficiency.

- Topological Qubits: Exotic quantum hardware with intrinsic error protection improves stability for fault-tolerant computation.

- Synthetic Aperture Radar (SAR): AI-enhanced imaging from satellites for all-weather, real-time Earth observation across defense, agriculture, and infrastructure applications.

- Fusion Confinement Methods: Magnetic (tokamak, stellarator) and inertial (laser-driven) techniques are being commercialized for abundant, zero-carbon baseload energy.

Spotlighting an Innovator: SPHERICAL

Dutch startup SPHERICAL develops semiconductors and software-defined satellite power subsystems to improve aerospace mission performance and adaptability.

The startup manufactures its own microchips and embeds digital control points to support software-defined hardware architectures. These semiconductors withstand high radiation levels and remain immune to single-event latch-ups, ensuring reliability in space.

SPHERICAL refines electronics to core functions and enhances size, weight, power, and cost (SWaP-C) efficiency. It reduces component counts by a factor of ten and removes unnecessary elements.

Further, its power conditioning and distribution units (PCDUs) are software-configurable, which allows teams to adjust mission requirements without changing hardware.

10. E-Commerce Evolution

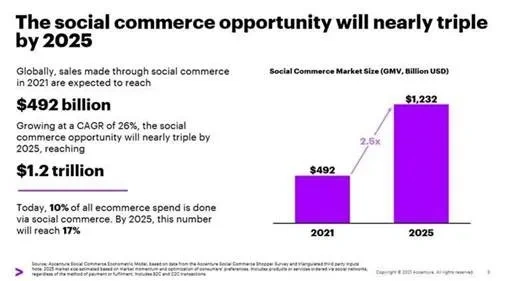

With global retail e-commerce sales projected to reach USD 6 trillion, the industry is embracing immersive, social, and AI-native commerce experiences.

Consumers now expect hyper-relevant, real-time shopping journeys that span channels. These experiences range from live-stream product demos and AI chat shopping to AR-based virtual try-ons and 1-click social checkout.

Meanwhile, 73% of 46 000 shoppers prefer multiple platforms before making a purchase, prompting brands to adopt omnichannel personalization.

The rise of conversational commerce and direct-to-avatar transactions in the metaverse is reshaping how brands engage and convert.

At the same time, backend innovations in composable commerce architectures, headless platforms, and AI-driven fulfillment are streamlining operations to keep pace with demand volatility.

Strategic Payoff

Higher Conversion Rates: Live shopping and social commerce increase conversion rates up to 10x higher than in conventional e-commerce.

Reduced Cart Abandonment: Personalized checkout flows and real-time support reduce cart abandonment and increase sales revenue by up to 35%.

Lower Fulfillment Costs: AI-optimized last-mile logistics and inventory routing lower delivery costs. For example, Walmart reduced last-mile delivery costs by 20% by increasing store-fulfilled orders and utilizing parcel stations to consolidate deliveries.

Improved Customer Retention: Seamless, personalized omnichannel experiences drive higher repeat purchase rates over siloed e-commerce models.

Market Data: Revenue, Projections, and Funding

- Social Commerce Market: Forecast to exceed USD 1.2 trillion by 2025, driven by influencer-driven sales and platform integrations.

Source: Accenture

- AI-enabled E-Commerce: Expected to be a USD 22.6 billion market by 2032, powering recommendation engines, personalization, and fraud detection.

- Funding Highlights:

- Fabric, a headless commerce platform, raised USD 140 million to accelerate product development through automation and intelligence, along with geographic expansion.

- Vue.ai, specializing in AI-powered retail personalization, secured USD 17 million in Series B.

Real-World Use Cases

Fashion & Apparel

- Zara uses AI to localize inventory and enable augmented reality try-ons to reduce returns.

- Nike integrates mobile apps, loyalty programs, and virtual storefronts for a frictionless phygital shopping experience.

Beauty & Cosmetics

- L’Oreal deploys AI-powered skin diagnostics and virtual makeup try-ons to increase product conversion.

Grocery & FMCG

- Instacart uses predictive algorithms for cart building and delivery slot optimization, which increase average order value.

Core Technologies Connected to E-Commerce Evolution

- Headless & Composable Commerce: Separates frontend and backend layers to deliver flexible, modular, and API-driven customer experiences.

- Conversational AI & Voice Commerce: Powers real-time shopping assistance, smart recommendations, and voice-enabled checkout through chatbots and smart speakers.

- AR/VR Shopping Experiences: Offers immersive, spatial product engagement through mobile devices, smart mirrors, and virtual storefronts.

Spotlighting an Innovator: Avatly

UAE-based startup Avatly creates a fashion-focused metaverse platform that combines 3D environments with e-commerce tools to enhance how users explore and purchase clothing.

It uses Unreal Engine 5 to build digital spaces, including a 300 000-square-meter virtual mall on a tropical island. It is accessible on smartphones, desktops, VR headsets, and Apple Vision Pro.

The startup’s platform allows users to navigate as customizable avatars, try on digital garments, share outfits, and buy virtual or physical clothing through interactive AR/VR boutiques.

Avatly’s ecosystem includes a digital tailoring studio that employs Blender and Marvelous Designer to produce realistic 3D apparel. A Magento-based commerce backend supports transactions, while blockchain integration enables NFT-based ownership of digital fashion and assets.

Additionally, Avatly introduces a meta-commerce model that connects social engagement with affiliate monetization using cost-per-try-on metrics.

Explore Latest Business Tech Trends & Companies

With thousands of emerging technologies and startups, navigating the right investment and partnership opportunities that bring returns quickly is challenging.

With access to over 7 million emerging companies and 20K+ technologies & trends globally, our AI and Big Data-powered Discovery Platform equips you with the actionable insights you need to stay ahead of the curve in your market.

Leverage this powerful tool to spot the next big thing before it goes mainstream. Stay relevant, resilient, and ready for what is next.

![10 Biggest Business Trends: What to Invest in, Build, and Watch Closely [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/06/Business-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)

![Future of Robotics: 12 Trends Powering the Next Wave [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/06/Future-of-Robotics-SharedImg-StartUs-Insights-noresize-420x236.webp)

![Innovation During Recession: Key Data-Driven Strategies to Thrive [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/Innovation-during-Recession-SharedImg-StartUs-Insights-noresize-420x236.webp)

![Business Resilience Planning: 10 Strategies & Technologies to Tackle the Current Market [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/Business-Resilience-Planning-SharedImg-StartUs-Insights-noresize-420x236.webp)