Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked startups developing mortgage solutions.

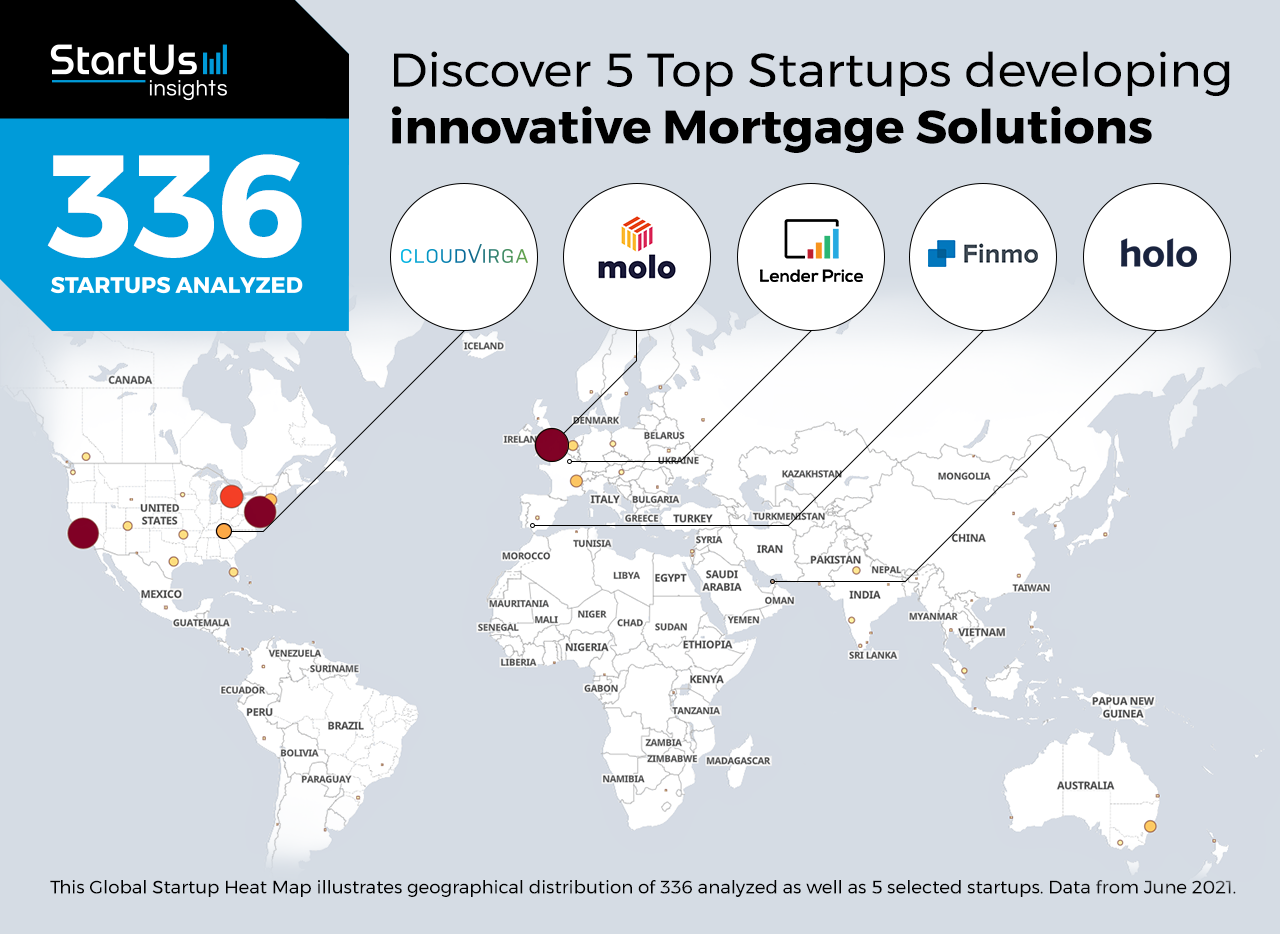

Global Startup Heat Map highlights 5 Top Mortgage Solutions out of 336

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2.093.000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 336 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 331 mortgage solutions, get in touch.

Cloudvirga creates a Digital Mortgage Platform

Conventional mortgage processes are both time-consuming and tedious to the consumer as well as the lender. The average time it takes to apply for a mortgage varies between a few days to several weeks, including lots of paper-based transactions, multiple touchpoints, and repeat interactions. This results in unpredictable delays, inefficiencies, and poor customer experiences. The digitization of the mortgage process removes most of the problems associated with paper-based mortgages.

US-based startup Cloudvirga provides an intelligent digital mortgage platform. The main benefit of their platform is not just collecting applications but automating processes that are normally done by office staff. Additionally, complex calculations are performed at the point of sale to create underwriter-ready loans. Thereby the platform significantly reduces the time to close loans and provides a better customer experience.

Lendesk specializes in a Digital Mortgage Platform for Professionals

The process of digitizing the mortgage process provides many benefits to customers and mortgage professionals. As the mortgage industry moves to digital platforms, mortgage professionals require training and upskilling to be able to efficiently use such tools and realize the benefits of digitalization. Startups are creating software that interacts with other digital services and platforms. Solutions also provide professionals with training that allows them to navigate the software in a short time.

Canadian startup Lendesk develops the digital mortgage platform Finmo that is tailored to better assist mortgage professionals. The features of the platform include an intuitive and dynamically changing application to reduce the effort of applicants. Additionally, a system for the automation of documentation tasks and integration with other CRM solutions also reduces the time to process applications and close deals for professionals. Further, Lendesk provides dedicated training sessions for individuals or groups to help them implement and efficiently utilize their platform.

Lender Price develops a Real-time Mortgage Pricing Engine

The market for issuing mortgages is highly competitive with customers often comparing multiple lenders before making decisions. In order to stay competitive, mortgage lenders need to constantly monitor the pricing offered by their competitors and tailor their pricing accordingly. Startups are developing analytics software that use performance benchmarking & statistical algorithms to help mortgage lenders to create better offers for their customers.

US-based startup Lender Price provides an all-in-one decision suite called FLEX. It includes a pricing engine that provides real-time analytics to manage pricing for conforming, non-conforming, qualified and non-qualified mortgages, portfolio, and specialty loans. The engine is built on a big data platform, powered by machine learning algorithms and works on all mobile devices. Lender Price’s pricing engine utility allows correspondent lenders, banks, and credit unions to manage product pricing for all mortgage types.

Holo provides a Mortgage Recommendation Engine

When customers are looking to apply for a mortgage they screen numerous potential mortgage lenders before making a decision. This process is labor intensive, time consuming, and is hindered by constant market price fluctuations. The results of which are likely to invalidate any research as they may be outdated or lead to missed offers and deals. To this end, startups are developing digital mortgage platforms that use customers’ preferences and details and match them with the best possible mortgage lenders for their requirements.

UAE-based startup Holo develops an online platform that automates and optimizes the process of finding mortgages. The platform works by assessing eligibility with a few simple questions along with the type of mortgage that the user requires. Holo X is the startup’s partnership program that provides their partners such as real estate agencies, UAE property developers, financial advisor firms, and insurers, with an out-of-the-box mortgage quotation system. Some of the features in the Holo X program include customized applications, email notifications, and monthly reporting.

Molo Finance develops Mortgage Calculation Tools

There are many calculations involved when applying for a mortgage, such as estimating the amount that can be borrowed, checking for eligibility, matching mortgage criteria with mortgage deals, and more. Traditionally, all of these steps are done by the customer, with each of the lenders that they approach, which is an inefficient process. To solve this challenge, startups develop digital lending platforms that are integrating tools to assist users with the mortgage calculation process.

UK-based startup Molo Finance provides an online mortgage platform that offers users a simple and fair way to get a buy-to-let (BTL) mortgage. In addition to its mortgage application, Molo provides three other tools to assist users when applying for a mortgage. These include a mortgage calculator, an eligibility check application, and a mortgage finder tool. These tools optimize Molo Finance’s buy-to-let mortgage deals for first-time landlords, corporations, remortgage, and houses in multiple occupations (HMO).

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on blockchain, big data, augmented reality (AR) as well as advanced analytics. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.