In the current era of rapid technological evolution, the automotive sector is experiencing unprecedented change. Various innovations are shaping the future of automotive businesses, offering opportunities for increased efficiency, safety, and sustainability. This automotive report provides a comprehensive overview of key technological advancements that are transforming the industry along with key market data. It discusses how businesses leverage these developments to gain a competitive edge and align themselves with the increasing emphasis on environmental and business concerns.

This report was last updated in July 2024.

This automotive report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Automotive Report 2024

- Executive Summary

- Introduction to the Automotive Report 2024

- What Data is used in this Automotive Report?

- Snapshot of the Global Automotive Industry

- Funding Landscape in the Automotive Industry

- Who is Investing in the Automotive Industry?

- 5 Automotive Startups impacting the Industry

Executive Summary: Automotive Industry Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform. It covers more than 3.7 million global startups, as well as 20K+ technologies and emerging trends across industries. In addition to the various market data, we analyzed a sample of 4200+ automotive startups developing innovative solutions to present five innovative examples from emerging automotive trends.

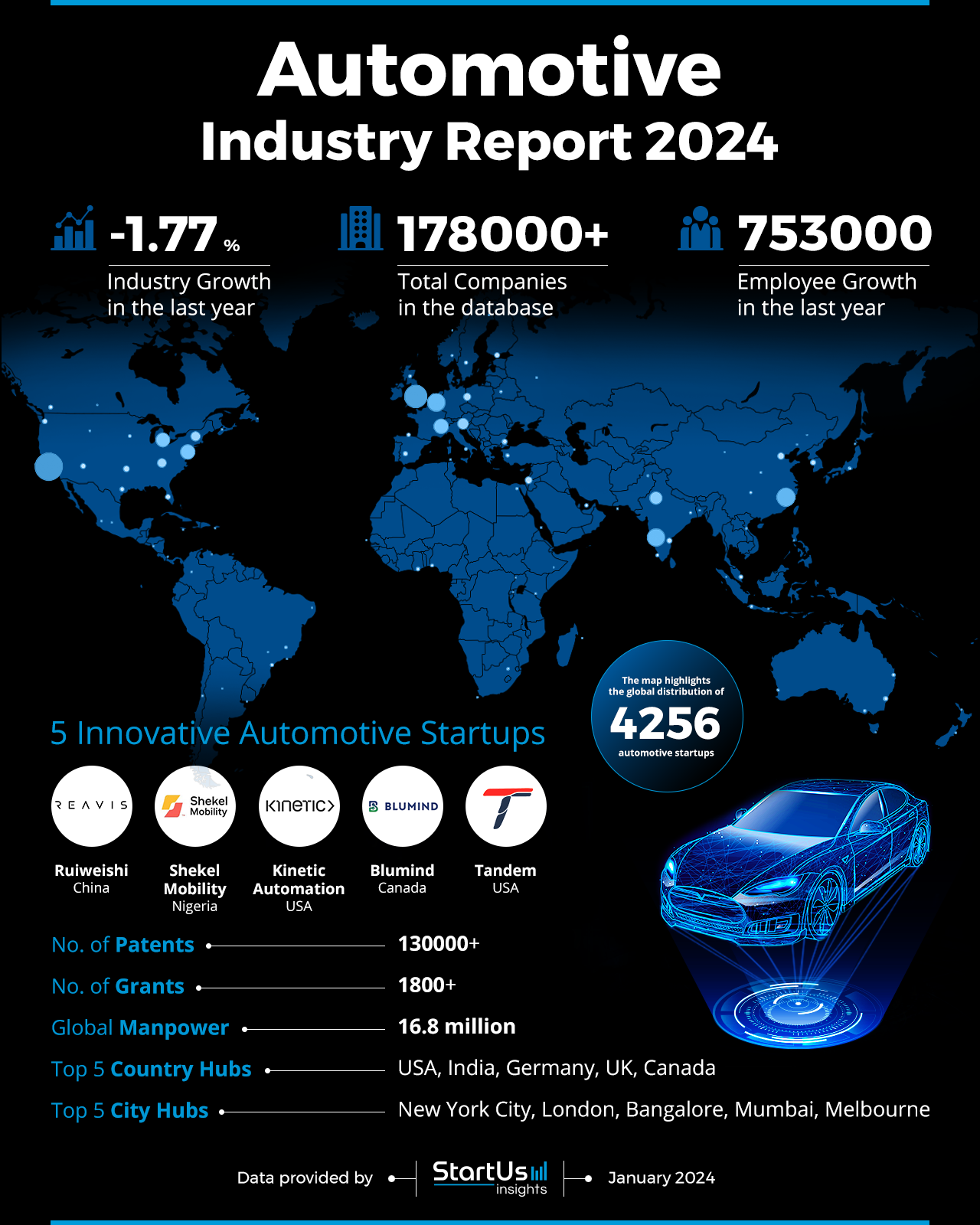

- Industry Transformation: The automotive industry is undergoing significant change, driven by technological advancements and a focus on sustainability. In the last year, the industry witnessed a slight slowing down in growth at -1.77%.

- Technological Innovations: Key areas of innovation include electric vehicles, autonomous driving, digital services, and automotive electronics and sensors. These technologies are vital for OEMs and B2B operations to maintain a competitive edge.

- Market Data: A slowing down in industry growth (-1.77%) indicates cautious recovery post-disruptions (covid, supply chains). The industry consists of 175,000+ organizations globally.

- Global Reach: Top startup hubs are located in the US, Germany, India, the UK, Canada, and China. These startups are pivotal in shaping the industry’s future.

- Funding and Investment Trends: The industry has seen significant funding, with 27000+ funding rounds and over 10000 investors. Key investors include Warburg Pincus, SoftBank Vision Fund, and Goldman Sachs.

- Workforce Dynamics: The industry employs 16.7 million people globally, with an increase of 753,000 jobs in the last year, indicating expansion and adaptation to new technologies.

- Innovative Startups: Examples include Ruiwei Vision (AR heads-up displays for vehicles), Shekel Mobility (technology platform for auto dealership operations), Kinetic Automation (robotics and AI for vehicle maintenance), Blumind (edge AI technology for smart mobility in automotive), and Tandem (hybrid electric vehicle systems for Class-8 trucks).

- Recommendations for Stakeholders: Continuous monitoring of technological advancements and their implications is essential for maintaining competitiveness in the evolving automotive industry landscape.

Explore the Data-driven Automotive Report for 2024

This 2024 Automotive Report encapsulates the substantial growth and scope of the global automotive industry. Data from the Discovery Platform reports a slowing down in the growth of the industry at -1.77% over the last year, which signifies a cautious recovery and expansion, following disruptions in supply chains, governmental policies, and dynamic consumer demand.

The presence of more than 178,000 total organizations indicates the vast network of entities that constitute the industry, including manufacturers, suppliers, service providers, and technology firms, each contributing to the ecosystem’s complexity and dynamism.

The map emphasizes the global distribution of 4256 innovative automotive startups and scaleups, demonstrating the industry’s global reach, with the Top Automotive Startup Hubs located in the US, Germany, India, the UK, Canada & China.

The report analyzes broader industry data as well as firmographic data from these 4256 startups, which are working on cutting-edge technologies from electric vehicles, autonomous driving, and digital services, to automotive electronics and sensors, which are shaping the future of automotive.

What data is used to create this automotive report?

Based on the data provided by our Discovery Platform, we observe that the automotive industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The automotive industry is prominently featured in media coverage, with more than 109K publications in the last year, signifying a strong focus on research and development within the automotive field.

- Funding Rounds: The automotive sector exhibits robust investor interest and financial backing, as evidenced by the 27000+ funding rounds data available in our database.

- Manpower: This industry is a significant employer, contributing notably to the global workforce with more than 16 million workers. In the last year alone, the industry has added more than 750K new employees.

- Patents: The 130K+ patents in the automotive industry highlight its commitment to innovation and technological advancement.

- Grants: The sector also benefits from considerable support in terms of grants, with data available on 1875 grants within the industry, aiding the implementation of new technologies.

- and much more!

A Snapshot of the Global Automotive Industry

The automotive industry is demonstrating resilience and growth. The sector currently employs 16.7 million people globally, reflecting its vast scale and integral role in the world’s economy. This workforce figure becomes more impressive when considering the employee growth over the last year, where an additional 753 thousand individuals have found employment in the sector. This expansion in manpower is indicative of the industry’s recovery and expansion post-pandemic, as well as its adaptation to evolving technology.

The automotive industry also sees a substantial influx of funding, directed towards research and development, new product lines, and technological innovations such as electric vehicles and autonomous driving technologies, as well as expansion into new markets. The high value of investments underscores the industry’s commitment to innovation and future growth.

One of the more telling indicators of the industry’s health and growth trajectory is the total revenue generated, highlighting the industry’s significant contribution to the global economy while signaling strong consumer demand and market confidence. It also reflects the success of the industry’s strategies in dealing with challenges in supply chain disruptions, changing consumer preferences, and the transition towards sustainable solutions.

Explore the Funding Landscape of the Automotive Industry

As highlighted by the data, the automotive industry’s funding landscape is dynamic and expansive. The average investment value in the industry stood at USD 18 million in the last year, a figure that highlights the significant financial commitment from investors. This level of investment indicates that backers recognize the potential for high returns and the sector’s strategic importance.

The total number of investors at more than 10000 is a testament to the industry’s appeal and its perceived growth potential. This large pool of investors includes a diverse array of entities such as venture capitalists, private equity firms, corporate investors, and governmental bodies, each bringing different expectations, expertise, and strategic goals to their investments.

Further, the data reveals that there have been more than 27000 funding rounds closed, a clear indication of the industry’s active and vibrant financing ecosystem. This flurry of activity in fundraising suggests a robust pipeline of new projects, startups, and initiatives seeking capital, driving technological advancements in electrification, autonomous vehicles, connected vehicles, and much more.

Overall, the automotive industry’s funding dynamics paint a picture of a sector that is not only attracting significant financial investments but also experiencing a surge in entrepreneurial activities and innovation.

Who is Investing in the Automotive Industry?

Data on investment in the automotive industry provides a combined investment value exceeding USD 8.5 billion from just the top 10 investors. This drives advancements in technology and market expansion. The diversity of these investors, from private equity firms to government agencies, further illustrates the multifaceted nature of the industry’s growth and the opportunities it offers.

- Warburg Pincus: With an estimated USD 2.2 billion in investments in 19 automotive companies, Warburg Pincus demonstrates its commitment to the industry. Its portfolio spans various segments of the industry, reflecting a strategy focused on diversification.

- SoftBank Vision Fund: With investments in 10 companies standing at USD 1.8 billion, SoftBank Vision Fund’s involvement highlights the industry’s technological evolution, given the fund’s focus on transformative technologies and innovative business models.

- Goldman Sachs: The investment in 18 companies by Goldman Sachs, a global finance player, indicates a strong belief in the sector’s profitability and long-term growth prospects. They have invested at least USD 1.5 billion in the industry.

- Tencent: Their investment of USD 1.4 billion in 14 companies signals an interest in the digital and technological aspects of the automotive industry, aligning with Tencent’s broader focus on tech-driven sectors.

- European Investment Bank: With investments in 17 companies, the EIB’s USD 1.2 billion is indicative of the strategic importance of the automotive sector in Europe, particularly in terms of innovation and sustainable development.

- Sequoia Capital China: Their stake in 14 companies highlights the growing importance of the Chinese market in the automotive sector and an emphasis on emerging companies in the region. They have invested more than USD 950 million.

- US Department of Energy: Investing an estimated USD 915 million in 11 companies, their focus is on advancing automotive technologies that align with energy efficiency and sustainability goals, reflecting governmental support.

5 Top Examples from 4200+ Innovative Automotive Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Ruiweishi develops Projector Technology for Smart Cockpits

Ruiweishi is a Chinese startup founded at the University of Cambridge in the UK. The startup focuses on developing augmented reality (AR) heads-up displays (HUDs) for vehicles. Ruiwei Vision introduces projection HUD technology that displays images on a windshield without distortion as well as full-depth 3D displays.

It achieves this with technical features including a wedge film for ghosting-free displays and 3D AR algorithms. Ruiwei’s projection technologies convert windshields into smart cockpits for human-machine interaction.

Shekel Mobility builds a Dealership Management Platform

Nigerian startup Shekel Mobility builds a technology platform to enhance auto dealerships’ operations. It provides a comprehensive set of tools for finding, financing and selling cars. Its products include Shekel Credit, Shekel Business, and Shekel Pay. These offerings facilitate inventory financing, streamline business operations, and enable seamless and secure transactions.

The platform allows dealers to access credit, trade vehicles, and manage their business from a mobile app. Shekel Mobility simplifies and improves the efficiency of dealership business processes, offering a one-stop solution for dealership needs.

Kinetic automates Digitized Vehicle Maintenance

US-based startup Kinetic transforms vehicle maintenance for modern digitized vehicles. As vehicles incorporate more sensors and technologies, servicing them is becoming more complex. Kinetic establishes service centers with robotics and AI capabilities to efficiently calibrate and repair both gas-powered and electric vehicles. It also caters to all makes and models.

By automating maintenance processes, Kinetic services vehicles much faster than manual methods while achieving high precision target placement. This allows businesses to keep up with the growing needs of the modern vehicle landscape. Kinetic’s model is particularly beneficial for dealerships, independent repair shops, national repair chains, and fleets.

Blumind advances Automotive Semiconductors with Edge AI

Canadian startup Blumind advances automotive semiconductor technology with its edge AI for smart mobility. It focuses on low latency, small size, and low power solutions. It caters to various industries, including automotive, drones, and robotics. Blumind’s technology features low power consumption, a small physical footprint, and rapid response times.

Its solutions are compatible with both analog and digital sensors and use standard industry software like PyTorch and TensorFlow. Blumind’s AI technology finds applications in collision avoidance, environmental awareness, gesture and voice control, and attention monitoring in smart mobility systems.

Tandem facilitates the Transition to Hybrid Electric Trucks

US-based startup Tandem focuses on electrifying the transportation industry, specifically targeting Class-8 vehicles. Its products include the Tandem Centaur and Tandem PowerPack which transform trailers and trucks into hybrid electric vehicles. This innovation addresses the challenge of reducing carbon emissions in the heavy-duty transportation sector. By electrifying trailers and tractors, Tandem offers a solution that benefits the environment and enhances the efficiency of commercial fleets.

Tandem Centaur is an attachable hybrid system for semi trucks that allows fleets to lower costs and transition to electric driving. Tandem PowerPack is a modular rack system that allows refrigerated trailers to operate with zero emissions. This is done by trucks running entirely on the electric power from the rack.

Attaching these solutions to existing diesel trucks avoids the high upfront expenses of converting fleets to fully electric vehicles. Owners extend the lifespan of their current trucks while significantly lowering operating expenses compared to diesel, natural gas, hydrogen, or fully electric options.

Gain Comprehensive Insights into Automotive Trends, Startups, or Technologies

The future of the automotive industry is tied intrinsically to technology and innovation. The advancements discussed in this automotive report present significant opportunities for businesses in the automotive sector. Big breakthroughs in EV battery technologies, autonomous driving capabilities, and advanced safety features will transform the industry in the future. Get in touch to explore all 4000+ startups and scaleups, as well as all industry trends impacting automotive companies.