The Property Management Industry Report presents an analysis of a sector that is experiencing technological integration and market expansion. It explores the trends influencing real estate asset management, from AI-driven analytics to eco-conscious property solutions. The report examines the firmographic and industry data, highlighting the impact of global economic currents influencing manpower dynamics and investment.

This 2024 property management report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Property Management Industry Report 2024

- Executive Summary

- Introduction to the Property Management Industry Report 2024

- What data is used in this Property Management Report?

- Snapshot of the Global Property Management Industry

- Funding Landscape in the Property Management Industry

- Who is Investing in the Property Management Industry?

- Emerging Trends in Property Management

- 5 Property Management Startups impacting the Industry

Executive Summary: Property Management Report 2024

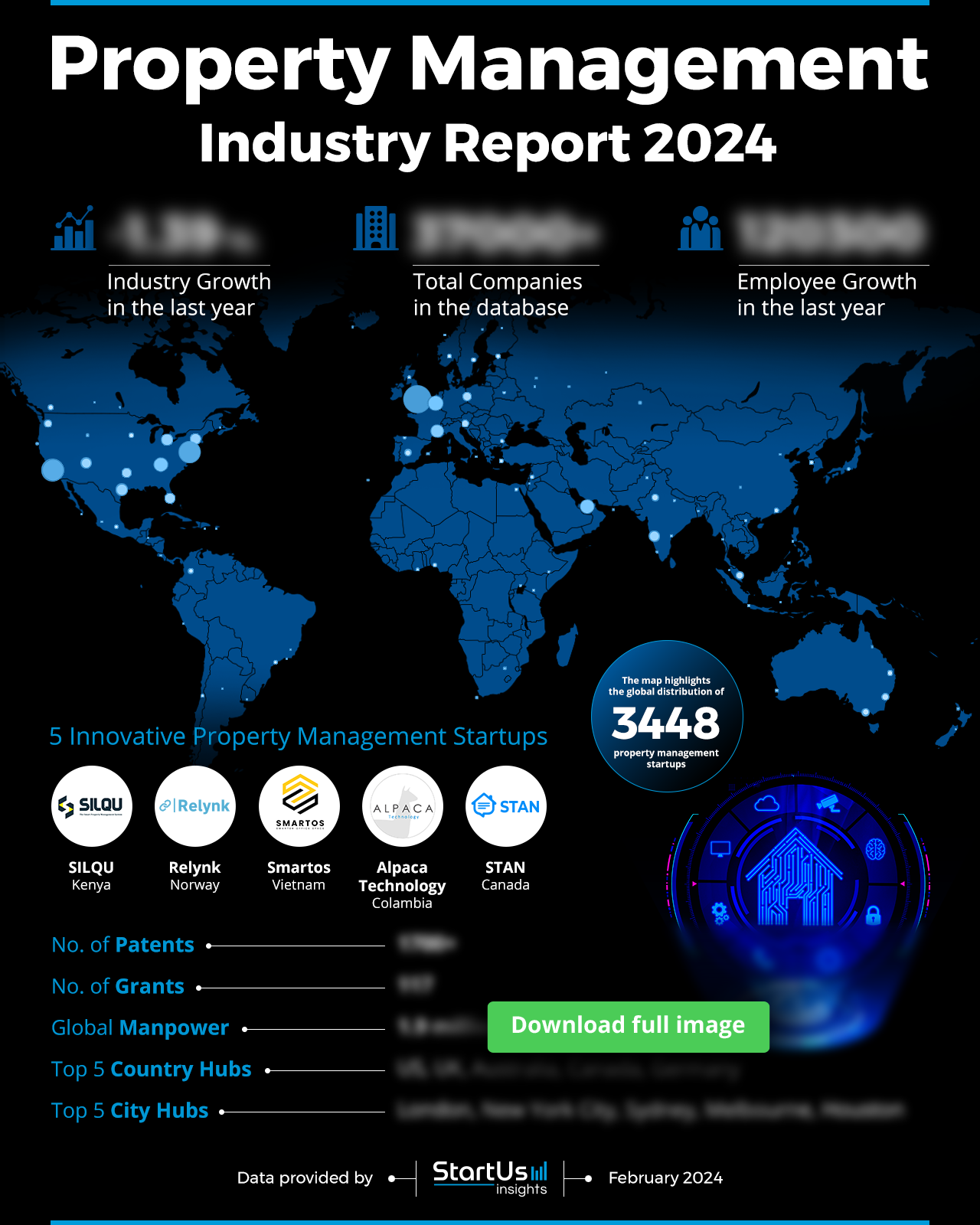

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 3000+ property management startups developing innovative solutions to present five examples from emerging property management industry trends.

- Industry Growth Overview: The property management industry experienced a dip of -1.39% in annual growth with over 37000 companies listed.

- Manpower & Employment Growth: The sector employs a workforce of 1.9 million with 120000+ new employees added last year.

- Patents & Grants: It showcases over 1700 patents and 117 grants, evidencing innovation.

- Global Footprint: It has significant hubs in the US, UK, Australia, Canada, and Germany, and top cities include London, New York City, Sydney, Melbourne, and Houston.

- Investment Landscape: It reveals an average investment value of USD 24.9 million per round, with more than 1500 investors and over 3000 funding rounds.

- Top Investors: The sector spotlights collective investments exceeding USD 1.3 billion by leading investors like Morgan Stanley, Goldman Sachs, Tiger Global Management, and more.

- Startup Ecosystem: 5 innovative startup features include SILQU (tenant-landlord optimization) and Relynk (real-time data integration), Smartos (PropTech SaaS solutions), Alpaca Technology (Digital Twin for facility management), and STAN (AI-driven communication automation).

- Recommendations for Stakeholders: With growing shortages in real estate availability for large sections of populations, there is an increasing focus on efficient tools to manage property. Globally, new opportunities are increasing rapidly as demand for real estate soars everywhere. Tracking and adjusting to such changes play a vital role in having a competitive edge.

Explore the Data-driven Property Management Industry Report for 2024

The Property Management Industry Report uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The report indicates a minor contraction, with -1.39% growth over the past year. A total of over 37000 companies are listed in the database. Contrasting this decrease, the industry has seen employee growth. It employs 1.9 million people worldwide, with 120000+ new employees added in the last year.

What data is used to create this property management report?

Based on the data provided by our Discovery Platform, we observe that the property management industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The property management industry has been featured in over 10000 news publications.

- Funding Rounds: Our database has recorded over 3000 funding rounds, demonstrating financial engagement.

- Manpower: It employs 1.9 million workers, and has added over 120000 new employees in the past year.

- Patents: The sector holds more than 1700 patents, showing its innovative nature.

- Grants: The industry has received 117 grants, highlighting its commitment to research and development.

- and more. Book a demo to explore all data points used in this report.

A Snapshot of the Global Property Management Industry

The property management sector shows stability in the current economic environment, supported by its workforce of 1.9 million. This workforce is spread across more than 37000 companies globally. The sector has seen an increase in talent, with 120000 new employees added in the last year.

Explore the Funding Landscape of the Property Management Industry

The property management sector is receiving notable investment. The average investment value is USD 24.9 million, indicating a considerable capital inflow into this market. Over 1500 investors are involved in the industry, showing a wide interest in the sector’s potential profitability and strategic importance. More than 3000 funding rounds have been closed. Further, over 1500 companies have received investment, suggesting a balanced distribution of financial support across the industry.

Gain comprehensive insights into the property management industry

Who is Investing in Property Management?

The top investors in the property management industry have collectively invested more than USD 1.3 billion in the industry. Some of the top investors include:

- Morgan Stanley has invested USD 347 million into three different companies, showcasing a focused financial commitment.

- Goldman Sachs, with investments totaling USD 314 million across three companies, reflects its strategic investment approach in the industry.

- Tiger Global Management has allocated USD 266 million across two companies, indicating a targeted investment strategy aimed at supporting high-growth potentials.

- SoftBank Vision Fund has invested USD 240 million in two companies, showing its confidence in the sector’s innovative capabilities.

- Aareon, with an investment of USD 168.9 million in three companies, supports the industry’s technological advancement and service enhancement.

- Linley & Simpson has invested USD 122.6 million across five companies, suggesting a diversification approach in its investment strategy.

- SVB Capital has invested USD 96 million in three companies, highlighting its role in promoting growth within the sector.

Gain Access to Top Property Management Innovations & Industry Trends with the Discovery Platform

The data showcases the growing trends in the property management sector over the last year. These trends encompass rental management, estate property management, real estate management, and more. Book a free platform demo to explore all property management trends.

Real estate management is the most mentioned trend, with 3100 mentions, indicating its importance in industry discussions. This category also has the highest number of companies involved, at 22.6K. Estate property management follows, with 618 mentions, and 12.8K companies participating in this trend.

Explore Firmographic Data for All Property Management Industry Trends

- Rental management is a notable trend in the property management industry, with 4000+ companies operating in this area. Despite a slight annual trend decline of -0.73%, the sector maintains a workforce of over 200K employees and has added 16K new employees over the last year.

- Estate property management is another key area with over 12000 companies engaged. It has a workforce of more than 500K, having grown by 33K+ new employees in the past year. However, the trend’s growth rate has seen a decline of -1.36% annually.

- Commercial property management has a firmographic profile with 7000+ companies identified. The industry employs over 400K individuals and has seen an addition of 22K+ employees recently. The annual trend growth rate, however, is at -1.42%, indicating a consolidation phase within the sector.

These trends highlight the property management industry’s dynamic nature, facing shifts and embracing growth opportunities.

5 Top Examples from 3000+ Innovative Property Management Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a platform demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

SILQU offers Property Management Solution

Kenyan startup SILQU builds a property management solution to optimize tenant and landlord experiences. The platform offers a property manager portal that streamlines rent collection, payment processing, and tenant management. Whereas, its tenant portal provides an interface for rent payments, real-time complaints, and support queries.

Additionally, the system includes an inbuilt accounting platform. This offers control over financials, auto bank reconciliations, and detailed financial record maintenance. Further, SILQU provides reporting and analytics tools for insightful property and financial reports.

Relynk allows Real-Time Property Data Integration

Norwegian startup Relynk develops an integration platform that facilitates real-time data access from commercial buildings. It connects with building automation systems and IoT sensors to organize data and make it available to users via an API.

Proptech companies leverage the startup’s solution for proactive maintenance and cleaning, space utilization, and energy optimization. This streamlines operational efficiency and enhances tenant experiences.

Smartos provides Proptech SaaS

Vietnamese startup Smartos offers property management solutions to streamline operations across various leasing spaces. Its Smartos PMS (Property Management System) for real estate rental services reduces costs and improves management performance.

Its White Label Solutions allow customization for both the app and the web, enhancing brand identity. Further, the Smartos Marketplace serves as a network for expanding market reach and customer acquisition. Smartos also supports diverse rental spaces, including coworking and living spaces.

Alpaca Technology creates Virtual Tour of Properties

Colombian startup Alpaca Technology offers Digital Twin software and an advanced CMMS platform to streamline and automate facility management tasks. Its platform transforms maintenance and energy management by embedding physical information into property assets.

Alpaca Technology provides property managers with a comprehensive, real-time view of their facilities. Thus, it enables them to make more informed decisions and optimize real-estate operations.

STAN offers AI Assistant for Property Management

Canadian startup STAN provides various AI-driven tools to automate communication for property management. Its offerings include an AI assistant that manages inquiries across different platforms such as text and email, and a web chat feature for instant support.

The startup also provides an analytics dashboard for tracking interactions, a notice generator for community announcements, and a system for service requests and amenity bookings. Further, STAN’s integration capabilities ensure compatibility with various property management software systems, enhancing operational efficiency.

Looking for Comprehensive Insights into Property Management Trends, Startups, or Technologies?

The property management report presents a sector adopting digitalization, sustainability, and tenant-centric models post-pandemic. Trends like remote management, smart buildings, and AI integration suggest a shift towards a more agile and data-informed sector. Book a platform demo to explore all 3000+ startups and scaleups, as well as all industry data and trends impacting property management companies.