Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the InsurTech industry. This time, you get to discover five hand-picked AI solutions impacting InsurTech companies.

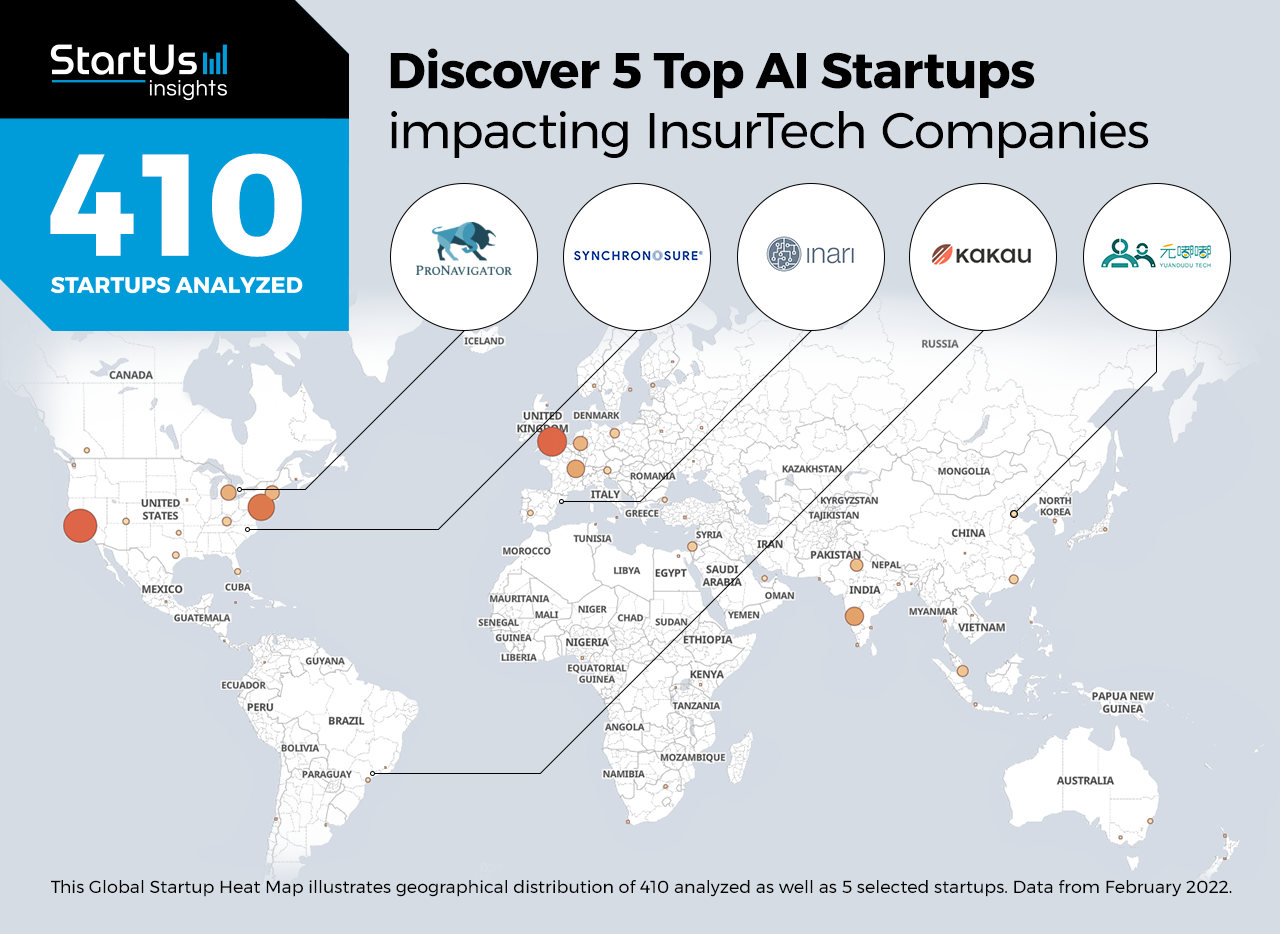

Out of 410, the Global Startup Heat Map highlights 5 Top AI Solutions impacting InsurTech

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 410 exemplary startups & scaleups we analyzed for this research. Further, it highlights five AI startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 405 AI solutions impacting InsurTech companies, get in touch with us.

Kakau provides Subscription-based Insurance

Founding Year: 2017

Location: Sao Paolo, Brazil

Partner for: Insurance Distribution Platform

Brazillian startup Kakau offers a digital insurance platform that uses AI and big data to provide subscription-based mobile phone and bicycle insurance. The startup partners with reliable insurance companies and list their insurance plans as subscriptions to its users. The platform’s AI-based virtual assistant Anna then suggests relevant plans and insurance brokers to users as well as assists in opening claims or clarifying doubts. In this way, Kakau accelerates insurance sales for brokers and provides freedom to pause and switch insurance plans for buyers.

INARI builds Blockchain Security Solutions for InsurTech

Founding Year: 2017

Location: Barcelona, Spain

Partner for: Insurance Management

Spanish startup INARI provides a cloud-based blockchain platform for end-to-end insurance management. The platform’s machine learning (ML) algorithms utilize a broad variety of insurance data to provide automated insurance operations – from quotation to portfolio management. The platform is integrable with small and legacy insurance businesses and offers brings blockchain-based security to detect portfolio risks. INARI streamlines operational efficiencies with its automated underwriting tool, real-time analytics of business data, and distributed ledger-powered risk events monitoring.

SynchronoSure enables Automated Underwriting

Founding Year: 2019

Location: Raleigh, USA

Funding: USD 3,8 M

Partner for: Insurance-as-a-Service Platform

SynchronoSure is a US-based startup that provides digital underwriting services for small businesses and nascent industries. The AI-powered platform provides underwriting services within minutes, requires no carrier appointments, and administers policies for the producers. The SynchronoSure platform empowers producers by providing curated lists of leads to grow their portfolio and commission earnings. The startup partners with insurance producers to market the its different insurance products.

Beijing Yuandudu Technology facilitates Fraud Detection

Founding Year: 2017

Location: Beijing, China

Funding: USD 3 M

Partner for: Auto Insurance Fraud Detection

Chinese startup Beijing Yuandudu Technology provides a digital platform solution for fraud detection in auto insurance claims. The startup’s AI algorithms continuously screen suspicious cases and detect false claims due to drunk driving, false reports, intentional accidents, or other crimes. The startup combines big data, cloud computing, and blockchain to automatically identify various risk scenarios. The platform also protects auto insurance providers by predicting insurance claim frauds and, in turn, minimizing their losses.

ProNavigator empowers Knowledge Management

Founding Year: 2016

Location: Kitchener, Canada

Funding: CAD 7,8 M

Partner for: Insurance Search Engine

ProNavigator is a Canadian startup that provides Sage Knowledge Management System (Sage), an insurance knowledge-sharing platform. Sage enables insurers to manage and access all their underwriting and process manuals, coverage options, as well as all bulletins and forms in one platform. In addition, its AI-powered search engine shows keyword-based information as well as contextual information based on the search intent and insurance acronyms. ProNavifator benefits insurers by reducing time spent on finding information, enabling faster customer service.

Discover more InsurTech Startups

InsurTech startups such as the examples highlighted in this report focus on insurance fraud detection, automated underwriting as well as digital insurance operations and management. While all of these technologies play a major role in advancing the insurance industry, they only represent the tip of the iceberg. To explore insurance technologies in more detail, let us look into your areas of interest. For a more general overview, download our free InsurTech Innovation Report to save your time and improve strategic decision-making.