Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked startups developing alternative credit scoring solutions.

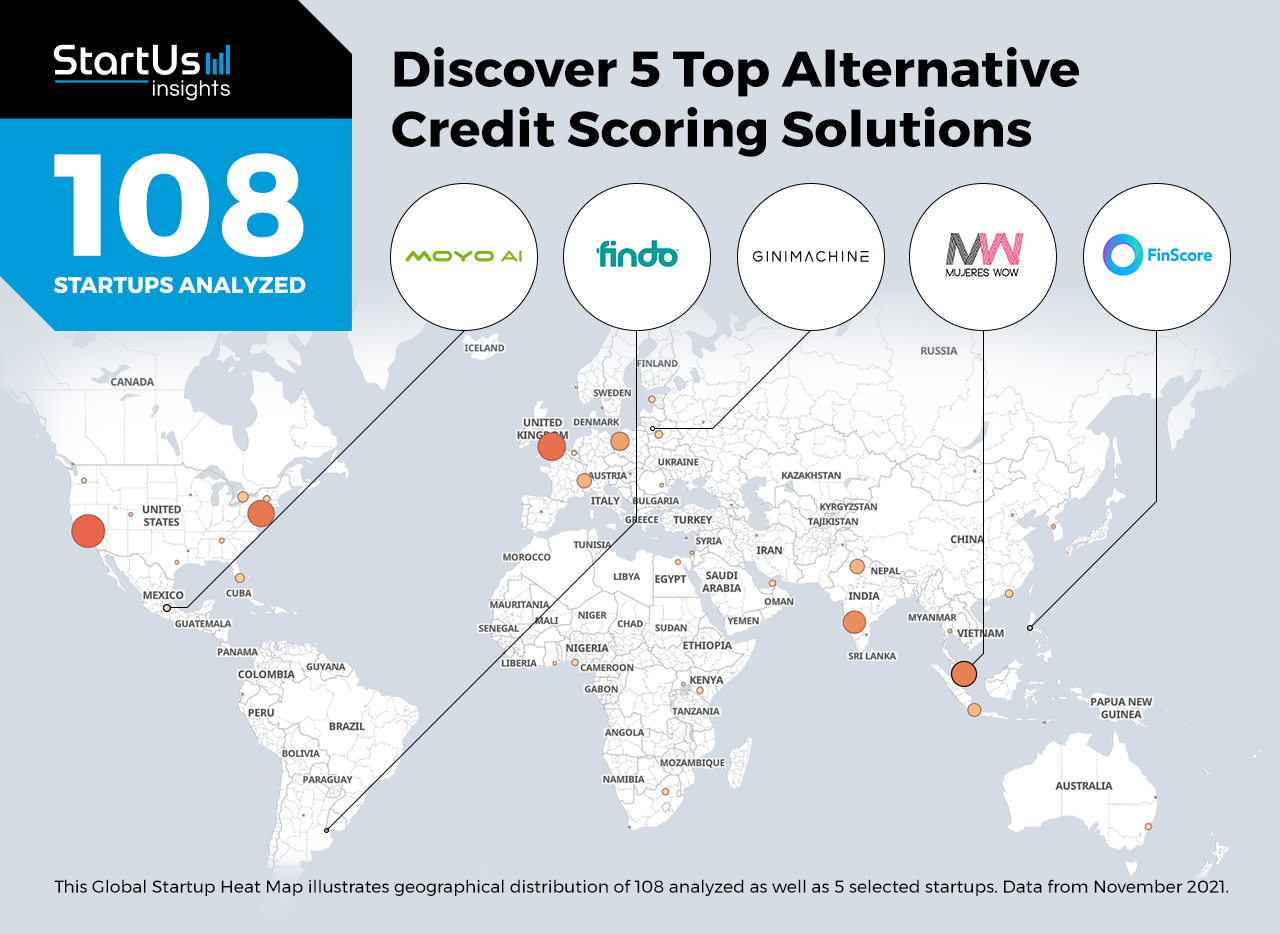

Out of 108, the Global Startup Heat Map highlights 5 Top Alternative Credit Scoring Solutions

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 108 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 103 alternative credit scoring solutions, get in touch.

GiniMachine offers an AI-based Credit Scoring Software

Founding Year: 2016

Location: Vilnius, Lithuania

Partner for: Credit Scoring Models

Lithuanian startup GiniMachine develops an AI-powered platform that builds credit scoring models. The startup’s software analyzes parameters such as age, occupation, and location to make credit scoring decisions. These parameters are typically ignored and result in poor experiences for thin-file applicants. The startup also provides detailed validation reports on each model and tracks the discriminant power of these models using advanced analytics. The startup’s AI credit scoring software enables telecom businesses and financial institutions to cater to a broader customer base that is generally disregarded by traditional credit simulations.

MoyoAI enables Behavior-Based Credit Scoring

Founding Year: 2017

Location: Mexico City, Mexico

Partner for: Behavioral Analytics-based Credit Scoring

Mexican startup MoyoAI develops a credit scoring tool that uses behavioral analytics. The tool uses a cognitive test to evaluate client metrics such as their values, attitudes, beliefs, culture, prejudices, and desires before quantifying their potential repayment behavior. It also analyzes different datasets of markets to identify changes in behavior for idea generation and business intelligence purposes. Credit institutions are able to use the startup’s tool to base their scoring on a person’s behavior in repayment rather than their portfolios or financial status. This not only allows higher credit scores to be issued to customers, such as students and young adults but also reduces the amount of arrears.

Mujeres WOW creates a Credit Scoring Platform

Founding Year: 2018

Location: Pajan, Ecuador

Partner for: Female-Friendly Credit Scoring, Gender Equal Credit Score Models

Mujeres WOW is an Ecuador-based startup that provides an end-to-end lending and credit scoring platform for female entrepreneurs. The platform utilizes AI and machine learning algorithms to analyze the social reputation of applicants including demographic factors, social media activity, and reviews of other successful female entrepreneur applicants, among others. It is then used to generate a credit score based on the loans requested. Statistically, women entrepreneurs are less likely to receive higher credit scores and larger loans. The startup’s fintech solution, on the other hand, promotes the financial inclusion of women among banking and lending institutions to empower women entrepreneurs, especially in developing economies.

FinScore provides Credit Scoring using Telecom Data

Founding Year: 2017

Location: Manila, Philippines

Partner for: Telecom-based Credit Scoring

Filipino startup FinScore provides a platform to predict customer credit scores using telecom data. The score is calculated based on information such as call duration, call origin location, call destinations, porting history, duration of SIM ownership, handsets used, missed calls, and more. This allows fintech companies to increase accessibility to underbanked and unbanked economies through telco data analysis, together with other consumer data, such as bill-paying history, number, and type of accounts. The startup’s solution allows financial institutions to accurately gauge customer credit scores in regions or countries where conventional models render inaccurate or impractical results. This also provides an alternative avenue for customers from such economies to build credit scores through the means that are easily accessible to them.

Findo develops a Mobile Credit Scoring System

Founding Year: 2017

Location: Caballito, Argentina

Partner for: Personal Credit

Findo is an Argentine startup that develops a digital platform and mobile app for credit scoring. The startup’s solution, Credit App, lets clients request credit through their mobile phones easily and securely. The app calculates users’ credit scores using thousands of data points obtained through cell phones. Credit App evaluates the users’ willingness and ability to pay, even if they lack credit history. This enables customers and financial institutions to access and assess credit scores when applicants have thin files, no access to banking facilities, or work in regions where wages are paid in cash or not irregular intervals.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on artificial intelligence, machine learning as well as personal credit solutions. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.