Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the fintech industry. This time, you get to discover 5 hand-picked mutual funds startups.

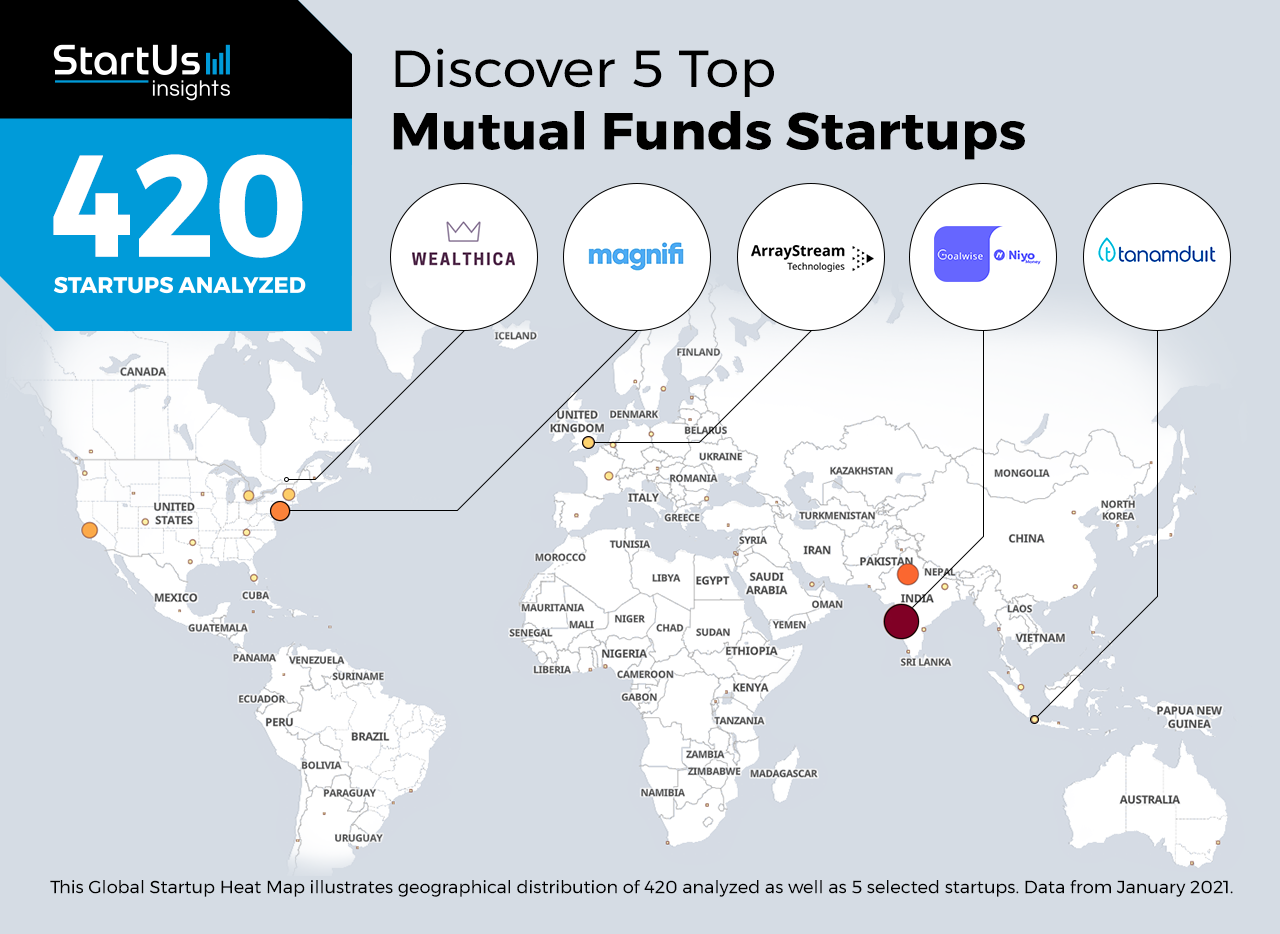

Global Startup Heat Map: 5 Top Mutual Funds Startups

The 5 mutual funds startups you will explore below are chosen based on our data-driven startup scouting approach, taking into account factors such as location, founding year, and relevance of technology, among others. This analysis is based on the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering over 1.3 million startups & scaleups globally.

The Global Startup Heat Map below highlights the 5 startups our Innovation Researchers curated for this report. Moreover, you get insights into regions that observe a high startup activity and the global geographic distribution of the 420 companies we analyzed for this specific topic.

tanamduit enables Consolidation of Investment Operations

People and companies seek opportunities to invest in mutual funds to grow their idle funds. Even though diversification reduces the risk of such an investment is, investors still look for ways to further minimize risks. To help with that, startups develop digital solutions that simplify investment and withdrawal operations with mutual funds.

Indonesian startup tanamduit develops a financial platform for mutual fund investment for businesses and individuals. The startup’s app allows users to compare different types of investments and choose an investment manager. Additionally, tanamduit simplifies investment monitoring and permits anytime withdrawal, reducing investment risks.

Niyo Money provides Goal-Based Investments

People often invest in mutual funds to pursue certain goals, be it a retirement plan, vacation, or emergency reserve. Therefore, startups develop goal-based investment plans, letting investors choose the goals and suggest the most appropriate mutual funds for each goal. Such solutions are capable of generating a personalized plan based on investment preferences and objectives.

Indian startup Niyo Money offers a goal-based mutual fund investment platform for individuals. The startup’s proprietary software GoalSense suggests the best fitting mutual funds depending on each investor’s goals, targets, and time budget. Moreover, the startup offers portfolio rebalancing and accommodates asset allocation changes towards the end of the goal’s time budget to help users maximize income and minimize risks.

Magnifi leverages a Semantic Investment Platform

The specific language that financial institutions use is often confusing to investors without a degree in finance. To bridge the language gap and facilitate investing processes, startups develop semantic recognition platforms that give investment intelligence on mutual funds, exchange-traded funds (ETFs), and model portfolios. The solutions help portfolio managers, financial advisors, and investors receive actionable insights on investment opportunities.

Magnifi is a US-based startup developing a discovery and comparison platform for investment intelligence gathering. The platform leverages natural language recognition to find and compare investment opportunities, as well as allow users to invest in the most suitable mutual funds, ETFs, or stocks. Magnifi’s platform contains an extensive database of funds that helps investors and investment managers build, enhance, and evaluate portfolios.

Wealthica offers Portfolio Tracking

Different financial institutions provide reports and statements in different ways and formats, which complicates tracking investments and financial assets. To accommodate mutual fund tracking, startups develop solutions that offer a consolidated view of all assets. Such solutions give a clear aggregated picture of investment performance and net worth.

Canadian startup Wealthica develops a platform that connects investment and banking accounts, offering users a consolidated view of all finances within a single dashboard. The startup’s platform provides data analytics tools, allowing clients to compare different institutions keep a record of all transactions. Additionally, Wealthica’s advanced analytics solutions offer automated suggestions on mutual fund investment strategies. This helps individual investors efficiently track and invest their assets.

ArrayStream enables AI-Based Investment Management

The abundance of market signals that help portfolio managers determine whether to stay in the fund or sell the holdings calls for advanced signal interpretation and organization techniques. Startups develop AI-based solutions that improve fund diversification and extract more meaningful insights from available data. Such solutions help mutual fund managers outperform their benchmarks.

British startup ArrayStream develops AI solutions for market signal processing for mutual fund managers. The startup uses cloud computing to identify signals with high predictability and combine single signals into composite signals, seeking profit opportunities. It monitors signal strength to determine their relevance and reliability. Moreover, the startup develops polymorphic investment diversification solutions to help fund managers increase the value of their active funds.

Discover more FinTech startups

To keep you up-to-date on the latest technology and emerging solutions, we provide you with actionable innovation intelligence – quickly and exhaustively. You can download our free FinTech Innovation Report and discover new business opportunities or save your time & let us look into your areas of interest. We provide you with an exhaustive overview of new startups, scaleups & emerging technologies that matter to you.