Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the FinTech industry. This time, you get to discover 5 hand-picked digital brokerage solutions.

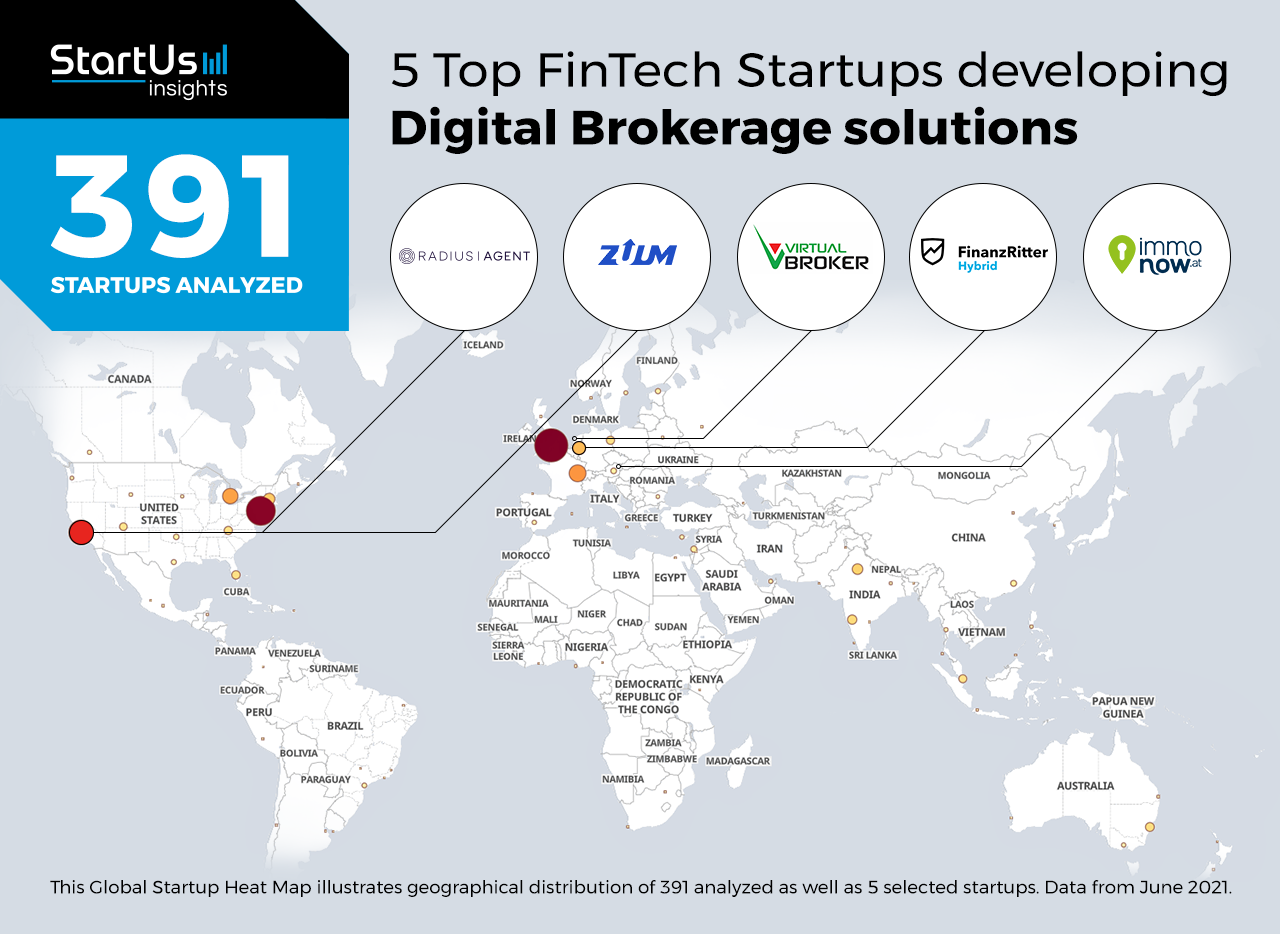

Global Startup Heat Map highlights 5 Top Digital Brokerage Solutions out of 391

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2.093.000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 391 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 digital brokerage startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 386 digital brokerage solutions, get in touch.

Virtual Broker develops an Insurance Brokerage Platform

The insurance market is constantly growing along with the types of insurance products available. Insurance intermediaries act as a bridge between customers and insurance companies while facilitating the insurance purchasing process. However, the time and complexities of insurance sales lower customer satisfaction and revenues. To solve this, startups are developing digital platforms that optimize online insurance for efficiency and productivity.

Dutch startup Virtual Broker develops an insurance brokerage software platform. The platform automates the sales process by integrating backend administration, online sales systems, and mobile apps with the insurers’ systems. The platform also provides a price comparison feature that enables customers to make the best purchase decisions. The software reduces the effort required by insurance intermediaries. It also improves customer satisfaction, leading to higher insurance sales.

FinanzRitter Hybrid provides Self-Administered Insurance Cover

The increasing digitization of the finance industry reduces human interaction during transactions. However, the lack of human interaction also results in a more difficult experience for customers who require specific assistance. Startups are creating digital insurance platforms to assist customers while purchasing insurance. Such insurance coverage platforms focus on self-administration and also feature insurance experts to assist customers.

German InsurTech startup FinanzRitter Hybrid provides a digital insurance platform that prioritizes the anonymity and security of their customers’ data. Customers have access to expert advice via GDPR-compliant video chat servers located in Germany. The software helps customers safely and securely receive personalized insurance recommendations. It also promotes local, independent insurance brokers who are not tied to a single insurance provider.

Zuum Transportation builds a Freight Brokerage Platform

Delays in freight movement due to customs or other regulations create bottlenecks in transportation that result in significant monetary losses. For this reason, freight brokers are moving towards digital platforms to easily manage their documentation. To ease the transition, startups develop freight brokerage software that considers regulations and associated documentation that carriers and shippers must adhere to.

Zuum Transportation is a US-based startup that builds a digital logistics platform for freight brokers. The digital brokerage software reduces operational costs, automates back-office tasks, maximizes broker productivity, and increases customer satisfaction. The software also provides freight brokers with automated reporting and advanced freight intelligence solutions through advanced analytics.

Radius Agent offers a Real Estate Platform for Brokers

The real estate industry is constantly evolving, with digitization replacing conventional systems, in turn, leading to greater competition in the market. The digitization of the real estate industry also allows brokers to interact with a larger number of potential clients. However, the downside to this is that more effort is required by brokerage agents to follow up on leads and create positive results. Startups develop software platforms to improve the skills of brokers and achieve higher success rates while closing deals.

US-based startup Radius Agent provides an online real estate brokerage platform to assist brokerage agents. The startup offers Radius Assist, a lead scrubbing service for qualifying potential clients. The startup also offers webinars from real estate experts and access to Radius Academy, a curated library of training resources. The solutions enable brokerage agents and teams to close more deals in an effective manner without compromising on their commission.

Immonow develops Sales Distribution Software for Real Estate Brokerage

The real estate sector increasingly focuses on digital technologies since customers prefer using online services for purchasing decisions. These trends have been given a boost due to the COVID-19 pandemic since clients need to interact remotely. Startups are creating comprehensive software to optimize the real estate sales process for both brokers and their clients.

Austrian startup Immonow develops sales distribution software for the real estate sector. The web-based software includes modules for property management, customer resource management, communications, and commercialization, as well as an application programming interface (API) module. The software gives real estate professionals an edge in the digital market, helping them achieve higher sales targets more efficiently.

Discover more FinTech Startups

Digital brokerage startups, such as the 5 examples highlighted in this report, focus on software solutions for automating and training agents, as well as easing the insurance process for consumers. While all of these technologies play a major role in advancing the industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.